Aircraft Sensors Market Report Scope & Overview:

To get more information on Aircraft Sensors Market - Request Free Sample Report

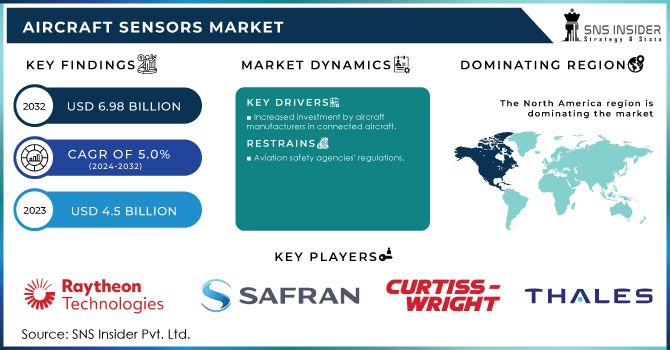

The Aircraft Sensors Market Size was valued at USD 4.5 billion in 2023 and is expected to reach USD 6.98 billion by 2032 with a growing CAGR of 5% over the forecast. period 2024-2032.

Technological advances in the aviation industry improve airline and airport operations. From recent years, services in the aviation industry are grown exponentially. The markets associated with this sector, which are proving to be the services in the aviation sector, are emerging around the world. Aviation market players are striving to improve their services and products so that they can be as efficient as possible in the industry. The Air Sensors Market is one of the airlines related to the airport, seeing the continued growth rate over the years. Sensors are devices that detect and measure visual features. The use of sensors in aircraft has been found to be effective for a variety of purposes.

Sensors in flight function play an important role in a variety of functions. The Air Sensors Market has grown significantly due to its important service and solutions in relation to the airport. The sensors used in the aircraft provide accurate flight time data, which enables passengers to remain alert during takeoff and landing. Aircraft sensors even provide response data for a variety of aircraft conditions, such as compression and temperature of the aircraft, to control the wings, wings, and other objectives. Thanks to these functional features, the Aircraft Sensory Market is gaining a lot of attention worldwide.

Increased demand for advanced sensors in aircraft to measure different body structures is driving a significant growth in the Aircraft sensor Market. The need for the aircraft aviation industry with improved features sets new opportunities for growth in the aviation sensory market. Key market players work on features and sensory development to provide advanced sensors according to market demand. The growing level of public interest in simultaneous air travel accelerates the growth of the Aircraft Market. People prefer to fly because it is considered a comfortable way to travel, and it takes less time to reach the right destination. Therefore, the wide selection of passengers to fly has improved Aircraft Sensors Market Trends. As the choice of air travel grows by the day today, the increasing demand for advanced aviation services is increasing, which encourages the use of sensors in the aircraft.

MARKET DYNAMICS

KEY DRIVERS

-

Global demand for new aircraft is increasing.

-

Increased investment by aircraft manufacturers in connected aircraft

RESTRAINTS

-

Aviation safety agencies' regulations

-

Small or new market participants find it difficult to meet the requirements set by these regulatory authorities, which acts as a barrier for market players, reducing market growth.

OPPORTUNITIES

-

Sensors for unmanned aerial vehicles are becoming increasingly popular.

-

The aviation sector is increasingly embracing the Internet of Aircraft Things.

CHALLENGES

-

Due to Digitalization and system interconnection risk of cyber attack are increases

-

ALIS acts as the F-35's information infrastructure, transmitting information about the aircraft to the relevant users via a globally spread network of technicians.

IMPACT OF COVID-19

The COVID-19 pandemic period was a nightmare for the aviation industry. During this time, the markets associated with the aviation sector have faced significant challenges. When travel and transportation were restricted due to the imposed lockdown, the Aircraft Sensors Market suffered massive financial losses. For an extended period of time, aviation services and aircraft operations were suspended. These factors influenced the Aircraft Sensors Market Value. However, the market will restore its growth rate in the coming years in order to achieve its goal.

MARKET ESTIMATION

Increased air passenger traffic, particularly from emerging economies, is expected to have a significant impact on the commercial aviation market. During the forecast period, the aircraft sensors market is expected to be driven by rising demand for fixed-wing aircraft, which are widely used for air travel. The wireless sensors segment is expected to grow at the fastest CAGR during the forecast period. The wired sensors segment dominates the global market, and the market size for wireless sensors for aircraft will grow due to increased demand for lightweight aircraft.

In the connectivity segment, the Aircraft Sensors Market is divided into wired and wireless sensors. The wired sensors have low maintenance costs and high reliability, which accelerates the segment's growth. The wireless segment has been identified as the dominant segment, and it is expected to grow at a faster rate during the evaluation period.

The Aircraft Sensors Market is divided into OEM and aftermarket segments based on end-use. During the forecast period, the OEM segment has the highest CAGR. This segment is critical because it is important to manufacturers of commercial aircraft, military aircraft, and business jets. The aftermarket segment is the end-use type's dominant segment. Among others, the sensor type segment is the most extensive. It is made up of Pressure Sensors, Force Sensors, Temperature Sensors, Speed Sensors, Torque Sensors, Position & Displacement Sensors, Level Sensors, Flow Sensors, Proximity Sensors, Gyroscopes, Global Positioning System (GPS) Sensors, Radar Sensors, Pitot Probes, Angle-Of-Attack (AOA) Sensors, Smoke Detection Sensors, Altimeter Sensors, Oxy All of these sensors have valuable applications, which will drive the global Aircraft Sensors Market forward. In recent years, altimeter sensors have dominated the market, and it is expected to register the highest CAGR during the review period.

KEY MARKET SEGMENTATION

By End Use

-

OEM

-

Aftermarket

By Connectivity

-

Wired

-

Wireless

By Platform

-

UAV

-

EVTOL

-

Fixed

-

Rotary

By Application

-

Engine

-

Door

-

Environmental Control

By Sensor

-

Pressure

-

Temperature

-

Speed

-

Proximity

-

Gyro

REGIONAL ANALYSIS

During the forecast period, the North American aircraft sensors market is expected to grow at the fastest CAGR. The aviation industry in North America is expanding rapidly, owing primarily to increased air passenger traffic. Increased disposable income and increased air passenger traffic have resulted in a growing demand for new aircraft deliveries in this region, which has increased demand for aircraft sensors.

Need any customization research on Aircraft Sensors Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Safran Electronic & Defense, Curtiss-Wright Corporation, The Raytheon Company, Zodiac Aerospace, Honeywell International Inc., Ametek Inc., Esterline Technologies Corporation., UTC Aerospace Systems, TE Connectivity Ltd., Thales group, Meggitt PLC and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 4.5 Billion |

| Market Size by 2032 | US$ 6.98 Billion |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (OEM, Aftermarket) • By Connectivity(Wired, Wireless), Platform (UAV, EVTOL, Fixed, Rotary) • By Application (Engine, Door, Environmental Control) • By Sensor (Pressure, Temperature, Speed, Proximity, Gyro) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Safran Electronic & Defense, Curtiss-Wright Corporation, The Raytheon Company, Zodiac Aerospace, Honeywell International Inc., Ametek Inc., Esterline Technologies Corporation., UTC Aerospace Systems, TE Connectivity Ltd., Thales group, Meggitt PLC. |

| DRIVERS | • Global demand for new aircraft is increasing. • Increased investment by aircraft manufacturers in connected aircraft |

| RESTRAINTS | • Aviation safety agencies' regulations • Small or new market participants find it difficult to meet the requirements set by these regulatory authorities, which acts as a barrier for market players, reducing market growth. |