Aircraft Leasing Market Report Scope & Overview:

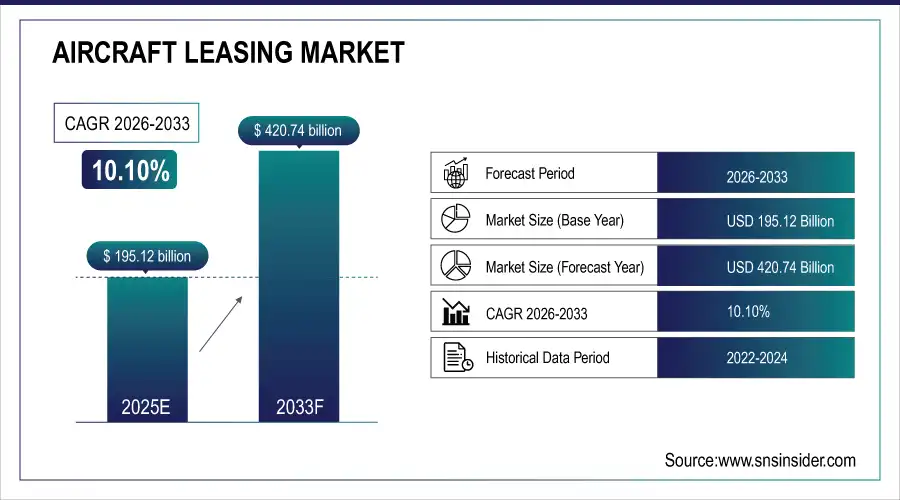

The Aircraft Leasing Market Size was valued at USD 195.12 Billion in 2025E and is expected to reach USD 420.74 Billion by 2033 and grow at a CAGR of 10.10% over the forecast period 2026-2033.

The Aircraft Leasing Market analysis growth, primarily due to the in increasing demand for air travel which has prompted the expansion and modernisation of airline fleets without incurring the substantial capital expenditure of buying aircraft. Leasing enables an airline to be flexible in its financial management as it balances cash flow and operational capability. In addition, the growing market trend for fuel-efficient and new-generation airplanes also helped in accelerating leasing activity as airlines practice to minimize their operating costs and comply with strict environmental regulations. According to study, Fuel-efficient aircraft adoption through leasing can help airlines cut operational costs by approximately 15–20% per flight hour.

Market Size and Forecast:

-

Market Size in 2025: USD 195.12 Billion

-

Market Size by 2033: USD 420.74 Billion

-

CAGR: 10.10% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Aircraft Leasing Market - Request Free Sample Report

Aircraft Leasing Market Trends

-

Airlines increasingly prefer leasing for fleet expansion to reduce upfront capital expenditure.

-

Adoption of fuel-efficient aircraft in leases improves operational cost savings significantly.

-

Short-term and flexible lease agreements gain popularity among low-cost carriers globally.

-

Emerging markets like Asia-Pacific and the Middle East drive leasing demand growth.

-

Cargo operations and e-commerce growth increase freighter leasing requirements worldwide.

-

Digital lease management platforms and predictive maintenance enhance operational efficiency for lessors.

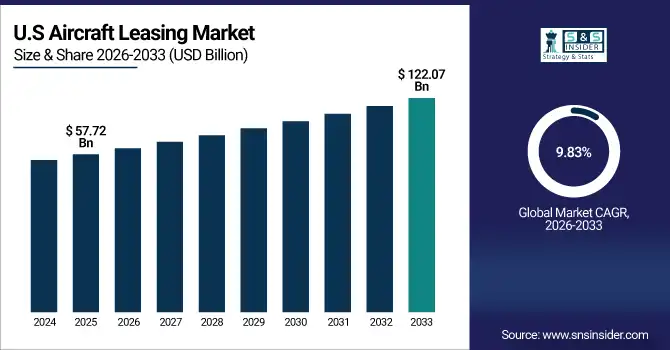

The U.S. Aircraft Leasing Market size was USD 57.72 Billion in 2025E and is expected to reach USD 122.07 Billion by 2033, growing at a CAGR of 9.83% over the forecast period of 2026-2033, driven by high air travel demand, mature airline networks, and fleet modernization needs. Leasing enables operational flexibility, cost efficiency, and access to next-generation fuel-efficient aircraft, supporting sustained market growth and strategic fleet expansion.

Aircraft Leasing Market Growth Drivers:

-

Rising Air Travel Boosts Aircraft Leasing Demand Globally and Rapidly

The Aircraft Leasing Market is growing driven by, increasing air travel around the world in particular around the emerging regions such as Asia-Pacific and the Middle East. With passenger and cargo demand back to pre-pandemic levels, airlines want to grow their fleets but cannot pay for new aircraft up front. Leasing provides airlines with the option of purchasing state-of-the-art jets with relatively less capital up front, preserving operational flexibility and the ability to respond to fluctuating market conditions with a quicker turnaround time in fleet size reacquisition. Moreover, leasing plays an important role by allowing airlines to obtain the more fuel-efficient and next-generation aircraft they need to lower operating costs, meet tighter environmental standards, and enhance profitability.

Leasing fuel-efficient aircraft helps airlines meet emission regulations, potentially reducing CO₂ emissions by 12–15% per aircraft.

Aircraft Leasing Market Restraints:

-

Market Vulnerable Due to Aircraft Valuation Fluctuations and Economic Risks

Despite its advantages, Aircraft Leasing Market faces challenges in High reliance of the leasing market on aircraft value and varying market conditions. Economic slowdowns, geopolitical uncertainties and hikes in fuel prices, or a sudden undemand for air travel can negatively affect aircraft values. Such variations raise dangers of defaults in the lease or depreciation of the asset, making it difficult for lessors to achieve revenue stability. Additionally, the residual value risk whereby leased planes could lose value at a greater rate than expected at lease-end dissuade investors and holds the market back from further growth. These risks require lessors to be judicious in managing lease lengths, aircraft, and cycle positioning.

Aircraft Leasing Market Opportunities:

-

Low-Cost Carriers Expansion Presents Lucrative Aircraft Leasing Opportunities Worldwide

A major opportunity lies in the rapid growth of low-cost carriers and regional airlines, particularly in Asia-Pacific, the Middle East, and Africa. With limited capital to invest in the business and the need to be able to expand and contract their fleets, these airlines tend to prefer leasing rather than purchasing. Lessors can access this growing customer segment by offering customized leasing solutions like short-term leases, wet leases, and sale-and-leaseback transactions. It said the accelerated demand for cargo tasks and logistics supporting e-commerce has driven thousands of freighter candidates, uncovering extra leasing selections within the industry. Digital lease management platforms and predictive maintenance to improve operational efficiency also make leasing attractive; thus, driving growth in the market.

Asia-Pacific, Middle East, and Africa together contribute nearly 42% of global aircraft leasing growth.

Aircraft Leasing Market Segmentation Analysis:

-

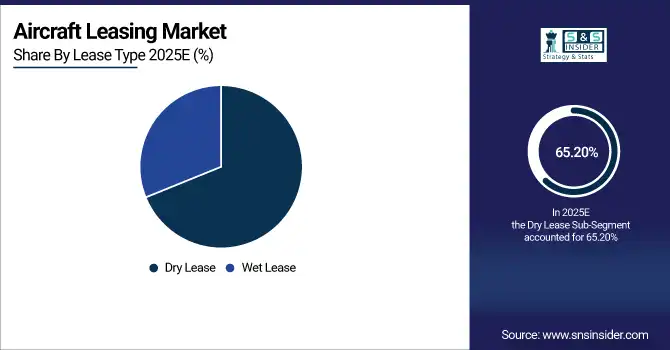

By Lease Type: In 2025, Dry Lease led the market with a share of 65.20%, while Wet Lease is the fastest-growing segment with a CAGR of 12.50%.

-

By Aircraft Type: In 2025, Narrow-body led the market with a share of 55.30%, while Wide-body is the fastest-growing segment with a CAGR of 11.20%.

-

By Lease Term: In 2025, Long-term Leases led the market with a share of 60.40%, while Short-term Leases is the fastest-growing segment with a CAGR of 13.10%.

-

By Lessee Type: In 2025, Commercial Airlines (Full-Service & LCCs) led the market with a share of 72.80%, while Cargo Operators is the fastest-growing segment with a CAGR of 14.60%.

By Lease Type, Dry Lease Leads Market and Wet Lease Fastest Growth

The Dry Lease lead in 2025, owing to its relatively lower operational cost and flexibility to operate the aircraft, which also helps airlines to expand their fleet without incurring the high fixed capital cost. Full-service and low-cost carriers prefer dry leases for long-term fleet planning and modernization. Meanwhile, Wet Lease is the fastest-growing component, as airlines are increasingly looking at options that operate with crew and for shorter-term contracts as they expand capacity faster to meet cyclical demand in passenger and cargo traffic. This emerging market, coupled with the increasing demand for seasonal routes and operational flexibility, are likely to remain the primary factors supporting the growth of wet leases over the upcoming years.

By Aircraft Type, Narrow-body Leads Market and Wide-body Fastest Growth

The Narrow-body lead in 2025, Due to their operational efficiency, economical capital outlay, and their proficiency to be used on short to medium-haul routes, which full-service and low-cost carriers prefer abundantly in the Aircraft Leasing Market. Narrow-bodies also allow airlines the ability to fly more frequent flights at the best load factor. Meanwhile, Wide-body aircraft is the fastest-growing segment driven by long-haul travel demand, international cargo grows, and airlines increasingly desiring economical next-generation aircraft for intercontinental operations. The increasing use of wide-body aircraft leases, whether they be wet or sale-and-leaseback, allows airlines to expand long-haul capacity quickly, facilitating a growing market and new fleet modernization.

By Lease Term, Long-term Leases Lead Market and Short-term Leases Fastest Growth

The Long-term Leases leads the market in 2025, due to their ability to provide airlines with stable fleet planning, predictable costs, and long-term operational efficiency. Full-service carriers and legacy airlines that aim to refresh fleets while keeping their financials predictable favour these types of leases. Meanwhile, Short-term leases represent the highest growth segment as airlines increasingly require flexibility to react to seasonal demand variations, test new routes or perform temporary capacity expansions. Although short-term leases, particularly wet leases, provide only a temporary solution for carriers, it is attractive to emerging markets, low-cost carriers and cargo operators as they present a way to rapidly scale operations with limited capital investment.

By Lessee Type, Commercial Airlines Lead Market and Cargo Operators Fastest Growth

The Commercial Airlines leads in 2025, supported by their massive fleet requirements, network, and avoidance of expensive fleet expansion strategies. This leasing model enables these airlines to obtain brand new, more fuel-efficient planes for less upfront capital expenditure, and still enjoy operational flexibility and scalability. Meanwhile, Cargo Operators comprise the fastest-growing segment, primarily attributed to the briskly surging e-commerce sector, logistical needs across the globe, and freight transport demands. Custom-engineered leasing agreements, such as short-term leases, wet leases, and sale-and-leaseback agreements allow cargo airlines to rapidly increase capacity, streamline operations, and fulfill volatile market demand which in-turn will drive the international cargo aircraft leasing market during the forecast period.

Aircraft Leasing Market Regional Analysis:

North America Aircraft Leasing Market Insights:

The North America dominated the Aircraft Leasing Market in 2025E, with over 41.06% revenue share, driven by an advanced aviation industry base with a mature airline market along with the presence of leading aircraft lessor companies in North America. Factors such as robust airline networks, high passenger volumes, and large cargo traffic in the region fuel stable demand for leased aircraft. Growing demand services benefits lessors including attractive economic conditions, modern infrastructure, and stable relationships with pillar carriers under long-term contracts North American airlines are also increasingly turning to dry leases to add capacity quickly, but at a controllable cost. The factors such as technological advancements, compliance to regulatory standards and surge in adoption of fuel-efficient aircraft will further boost the market growth, resulting North America as major global aircraft leasing hub.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Aircraft Leasing Market Insights

The U.S. Aircraft Leasing Market is dominated by dry leases, driven by mature airlines, high fleet modernization demand, and operational flexibility, with growing adoption of fuel-efficient aircraft and short-term leasing solutions.

Asia Pacific Aircraft Leasing Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 10.88%, driven by the rapid growth of low-cost carriers, demand for air travel, and an increase in cargo operations. Demand is especially seen for leasing as opposed to purchasing given the need for flexibility and cost management regarding fleet in the region. Just as wet leases have exploded in recent years, offering airlines the ability to flex quickly in response to changes in market demand, both short-term leases and sale-and-leaseback deals are becoming much more commonplace, allowing carriers to rapidly grow their fleets while remaining nimble. The rapid growth of demand for fuel efficient and next-generation aircraft and the potential for significant operational efficiency improvements through more digitalized lease management and predictive maintenance further underpin strong market growth and identify Asia-Pacific as a leading opportunity region.

-

China and India Aircraft Leasing Market Insights

The China and India Aircraft Leasing Market is rapidly growing, fueled by low-cost carriers, rising air travel demand, cargo operations, and increasing preference for flexible lease solutions and modern, fuel-efficient aircraft.

Europe Aircraft Leasing Market Insights

Europe accounts for a major part in the share of the Aircraft Leasing Market owing to its mature aviation market with established airlines and a developed air travel landscape. Leasing has played a crucial role for the region’s airlines as they modernize their fleets, seek cost efficiency, and enhance financial flexibility during uncertain market conditions. The bulk of the dry lease market allows carriers the benefit of long-term planning, whereas the short-term and wet version is starting to gain traction to serve seasonal and temporary demand. Furthermore, the rising emphasis on fuel efficiency next-generation aircraft and need for environmental and regulatory compliance stimulate the uptake of leasing. Together, these elements reinforce the importance of Europe on the global aircraft leasing map.

-

Germany and U.K. Aircraft Leasing Market Insights

The Germany and U.K. Aircraft Leasing Market is significant, driven by mature airlines, fleet modernization needs, operational efficiency, adoption of dry and short-term leases, and growing demand for fuel-efficient, next-generation aircraft.

Latin America (LATAM) and Middle East & Africa (MEA) Aircraft Leasing Market Insights

The Latin America and Middle East & Africa act a key growth region for the global Aircraft Leasing Market witnessing healthy growth on the back of rising passenger and cargo traffic. For the regions mentioned, airlines prefer leasing as there is not enough capital available to expand fleet and also, they need flexibility to operate. Dry leases prevail in long-term fleet planning; short-term and wet leases are being increasingly embraced to cater to seasonal fluctuations and market volatility. Increasing demand for modern and fuel-efficient aircraft, combined with the adoption of digital lease management & predictive maintenance, are improving operational efficiency. All these factors together provide attractive opportunities for lessors, making LATAM and MEA prominent growth regions.

Aircraft Leasing Market Competitive Landscape

BBAM Aircraft Leasing & Management enhances the market by offering passenger-to-freighter conversions, flexible lease structures, and comprehensive fleet management services. The company focuses on operational efficiency and strategic partnerships with airlines, addressing both passenger and cargo demand, thereby supporting fleet modernization and overall Aircraft Leasing Market growth globally.

-

In August 2025, BBAM announced the delivery of the first Airbus A321 Passenger-to-Freighter (P2F) aircraft on lease to Titan Airways. This marks a significant milestone in the passenger-to-freighter conversion program, highlighting BBAM's leadership in fleet modernization and expansion into the freighter segment

Avolon actively expands the Aircraft Leasing Market through strategic aircraft acquisitions and lease agreements, including narrowbody and widebody aircraft. The company focuses on providing flexible leasing solutions, supporting airlines’ fleet modernization and operational efficiency. Avolon’s partnerships with manufacturers like Airbus enhance market growth, particularly in emerging regions and cargo operations.

-

In January 2025, Avolon released its 2025 Outlook report, forecasting that the global airline industry will reach $1 trillion in revenue for the first time. The report highlights the Asia-Pacific region as a significant driver of this growth, with China expected to place 800 aircraft orders in 2025.

Air Lease Corporation (ALC) strengthens the Aircraft Leasing Market by delivering long-term lease agreements and modern fleet solutions. The company supports airlines with operational flexibility, fleet expansion, and access to next-generation fuel-efficient aircraft. ALC’s consistent order book and strategic partnerships help maintain steady market growth and meet rising global air travel demand.

-

In September 2025, Air Lease Corporation entered into a definitive agreement to be acquired by a newly established holding company based in Dublin, Ireland.

Aircraft Leasing Market Key Players:

Some of the Aircraft Leasing Market Companies are:

-

AerCap Holdings N.V.

-

Avolon

-

SMBC Aviation Capital

-

Air Lease Corporation (ALC)

-

BOC Aviation

-

BBAM Aircraft Leasing & Management

-

ICBC Leasing

-

DAE Capital

-

Nordic Aviation Capital (NAC)

-

Boeing Capital Corporation

-

CDB Aviation

-

AviLease

-

Avia Solutions Group

-

Aircastle

-

AerCap GECAS

-

Macquarie AirFinance

-

Genesis Lease

-

Elix Aviation Capital

-

Amedeo

-

ICBC Financial Leasing

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 195.12 Billion |

| Market Size by 2033 | USD 420.74 Billion |

| CAGR | CAGR of 10.10% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Lease Type (Dry Lease, Wet Lease) • By Aircraft Type (Narrow-body, Wide-body, Freighters) • By Lease Term (Long-term Leases, Medium-term Leases, Short-term Leases) • By Lessee Type (Commercial Airlines – Full-Service & LCCs, Cargo Operators) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AerCap Holdings N.V., Avolon, SMBC Aviation Capital, Air Lease Corporation (ALC), BOC Aviation, BBAM Aircraft Leasing & Management, ICBC Leasing, DAE Capital, Nordic Aviation Capital (NAC), Boeing Capital Corporation, CDB Aviation, AviLease, Avia Solutions Group, Aircastle, AerCap GECAS, Macquarie AirFinance, Genesis Lease, Elix Aviation Capital, Amedeo, ICBC Financial Leasing, and Others. |