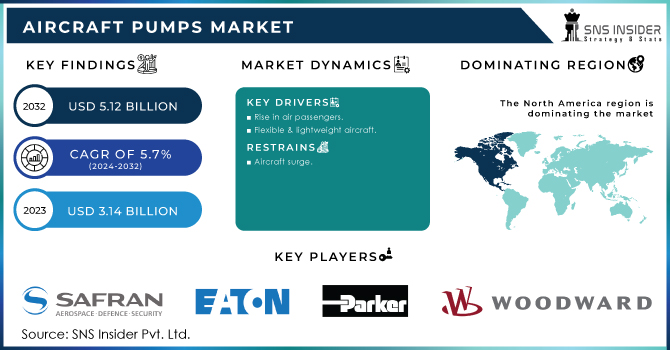

Aircraft Pumps Market Report Scope & Overview:

The Aircraft Pumps Market Size was valued at USD 3.14 billion in 2023, expected to reach USD 5.12 billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032. An aircraft is a complicated machine by design, relying on the mutual and coordinated operation of over 10000 components. Aircraft Pumps are one of such vital components. Aircraft Pumps are a type of pump that converts mechanical energy into hydraulic energy, which is then utilized to supply and circulate fuel in an engine at high altitude. Aircraft pumps are used to maintain the fuel supply, water supply, and air conditioning system for the engines and passengers on board. The crucial relevance of Aircraft Pumps in aircraft construction, combined with an increase in demand for air carriers for the movement of goods and people, has resulted in an increase in the Global Aircraft Pumps Market.

To get more information on Aircraft Pumps Market - Request Free Sample Report

Aircraft pumps are an important component of an aircraft's hydraulic system. These pumps are well-known for operating flaps, the flight control surface, landing gear, and brakes. They also give other aircraft components operating capabilities. To lower the overall weight of the aircraft, a range of lightweight pumps such as air-conditioning pumps, lubrication, fuel, and hydraulics are used. Thus, the use of these aircraft pumps is determined by the type and complexity of the aircraft. They have various advantages, including low maintenance needs, convenience of installation, simplified inspection, light weight, and operational power sources. They are particularly efficient since their employment results in negligible loss due to the low fluid friction of hydraulic activities.

MARKET DYNAMICS

KEY DRIVERS

- Rise in air passengers

- Flexible & lightweight aircraft

RESTRAINTS

- Aircraft surge

OPPORTUNITIES

- Advancement of technology

- IoT integrated pump systems

CHALLENGES

- Legal barrier

IMPACT OF COVID-19

Eaton Corporation plc, Safran, Woodward Inc., Parker-Hannifin Corporation, and Crane Co. are among the leading participants in the aircraft pump market. These companies have expanded their operations to North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. COVID-19 has also had an influence on their companies. According to industry experts, COVID-19 might reduce aviation pump production and services by 7–11% globally by 2020.

The COVID-19 epidemic has had a negative influence on the end-use sectors, resulting in a dramatic drop in 2020 aircraft sales and delivery. This is projected to have a short-term negative impact on the aircraft market, with a modest recovery expected in Q2 of 2021.

The growing popularity of human aviation and the increase in the number of pilot services have predicted a portion of the Fuel Pump that will dominate part of the Air Force Type in the coming years. An increase in demand for aircraft pumps that control the supply of fuel in Hydraulic processes has resulted in a 3.8% increase in demand for Hydraulic pumps.

The increase in demand for commercial airlines by public and defense airlines has resulted in a 3.6% increase in demand for Fixed Air Force Pumps. Increased use of two-winged aircraft carriers in the defense sector has led to a 2.5% increase in demand for Rotary Wing air pumps.

General air traffic control led to a 4.8% increase in demand for Engine Driven Technology as the second airline of this century by the aviation industry. Rising fuel prices and an increase in the popularity of low-impact aircraft carriers have predicted the Electric Motor Driven technology that will dominate the Global Aircraft Pumps market for years to come.

The popularity of heavy cargo carriers and the large number of passengers predicted more than 3000 psi The Pressure handling Aircraft Pump to control part of the Global Aviation Market pressure in the coming years. The growing demand for Jet Aircrafts has led to a 6.7% increase in demand for 1500 psi 3000 psi aircraft from 2020 to 2023 by medium-sized aircraft manufacturers in Europe.

Previous and next news: Previous and next news: The aviation industry is ready to be used by the defense and public aviation sector has predicted the OEM segment to dominate the End User Part of the International Aviation Market in the coming years. The increase in the number of commercial aviation services in developing and developing countries has resulted in a 1.7% increase in demand for Air Pumps through Aftersales in the second decade of this century.

KEY MARKET SEGMENTATION

By Technology

-

Air Driven

-

Engine Driven

-

Ram Air Turbine Driven

-

Electric Motor Driven

By Type

-

Fuel Pumps

-

Water & Waste System Pumps

-

Lubrication Pumps

-

Cooling Pumps

-

Hydraulic Pumps

By Application

-

Commercial Aviation

-

Military Aviation

-

Business & General Aviation

By End User

-

OEM

-

Aftermarket

By Pressure

-

10 psi to 500 psi

-

500 psi to 3000 psi

-

3000 psi to 5000 psi

-

5000 psi to 6500 psi

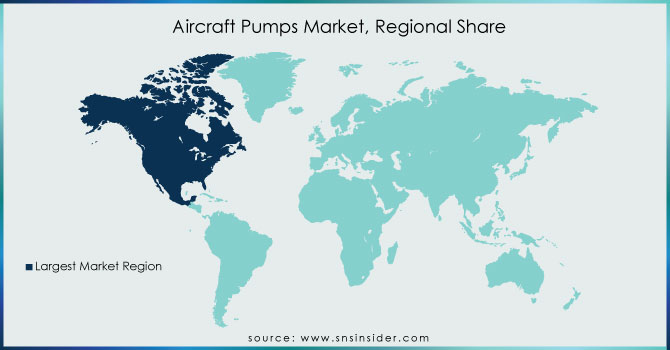

REGIONAL ANALYSIS:

During the forecast period, North America is expected to have the highest geographic share of the aviation pumps market. The primary element responsible for North America leading the aircraft pumps market is the region's rapid rise of technologically advanced pumps. The increase in aircraft orders and supplies in North America is pushing aircraft pump manufacturers to improve their sales year on year. The growing demand for commercial aircraft, as well as the presence of some of the market's major companies, including as Parker-Hannifin Corporation, Woodward, Inc, Crane Co, and Collins Aerospace, are projected to drive the aircraft pumps market in North America. These players are concentrating on R&D in order to expand their product lines and using technologically advanced systems, sub-systems, and other equipment for manufacturing aircraft pumps.

Need any customization research on Aircraft Pumps Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Safran, Eaton Corporation plc, Parker-Hannifin Corporation, Woodward, Inc, Crane Co. and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.14 Billion |

| Market Size by 2032 | US$ 5.12 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Air Driven, Engine Driven, Ram Air Turbine Driven, and Electric Motor Driven) • By Type (Fuel Pumps, Water & Waste System Pumps, Lubrication Pumps, Air Conditioning & Cooling Pumps, and Hydraulic Pumps) • By Application (Commercial Aviation, Military Aviation, and Business & General Aviation) • By End User (OEM and Aftermarket) • By Pressure (10 psi to 500 psi, 500 psi to 3000 psi, 3000 psi to 5000 psi, and 5000 psi to 6500 psi) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Safran, Eaton Corporation plc, Parker-Hannifin Corporation, Woodward, Inc, and Crane Co. |

| DRIVERS | • Rise in air passengers • Flexible & lightweight aircraft |

| RESTRAINTS | • Aircraft surge |