Military Embedded Systems Market Report Scope & Overview:

To get more information on Military Embedded Systems Market - Request Free Sample Report

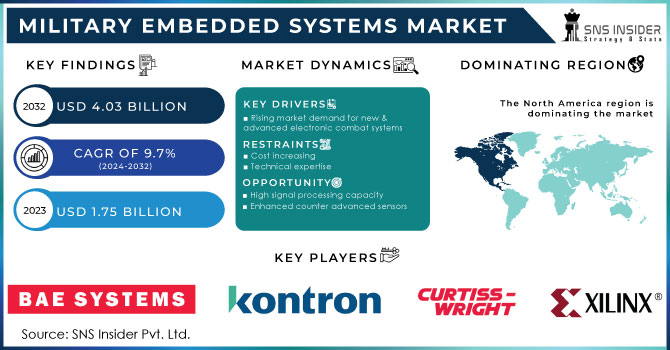

The Military Embedded Systems Market Size was valued at USD 1.75 billion in 2023 and is expected to reach USD 4.03 billion by 2032 with a growing CAGR of 9.7% over the forecast period 2024-2032.

Customs military system requirements promote significant growth in the embedded military systems industry worldwide. An embedded military system is a combination of computer hardware and software that integrates a specific program. Embedded computer systems are composed of components such as memory, CPUs, and input / output components that can work alone or as part of a larger system. Embedded military systems are also open architectural hardware used for electronic applications. Embedded systems, unlike standard purpose computers, microcontroller-based systems are designed to perform a specific function. Embedded military systems are used in a variety of applications such as communications equipment, command and control systems, data storage tools, and military computers.

The embedded military system is composed of embedded systems such as sensors and operating systems that perform relief operations and aid soldiers on the battlefield.. the main function of embedded military systems is to help military commanders analyze large amounts of data to make better decisions. Embedded systems are used to translate important data to protect them from attack. Embedded systems are also used for communication, monitoring, intelligence, and data analysis tools in real time. There are many factors that contribute to the growth of trends in the embedded system market.

A market designed for embedded military systems will see growing growth due to the growing demand for a fuel-efficient aircraft. Additionally, there has recently been a huge demand for cloud computing technology in the security sector. Also, the rise of portable devices with embedded systems, technological advances, electronic battles, and an increase in network-based wars, as well as wireless technology will increase the market demand for integrated military systems in the coming years. Now each country is trying to strengthen its defense and military by using advanced technology, and it will play a key role in the growth of embedded military systems of world market revenue.

MARKET DYNAMICS

KEY DRIVERS

-

Rising market demand for new & advanced electronic combat systems

-

Cloud computing and wireless Technologies

RESTRAINTS

-

Cost increasing

-

Technical expertise

OPPORTUNITIES

-

High signal processing capacity

-

Enhanced counter advanced sensors

CHALLENGES

-

Complexity in the electronic systems design

-

Changing demand

-

Technology development

IMPACT OF COVID-19

The covid-19 epidemic has had a significant impact on all large-scale businesses and countries around the world. Because the virus was spreading quickly, governments around the world proclaimed a state of emergency. As a result, the production and supply chain were interrupted. As a result, the production of military embedded systems was hampered. Because of the lockout, the embedded system manufacturers were obliged to halt operations. Furthermore, travel restrictions around the world hampered the supply of raw commodities. Another key element influencing the military embedded systems market negatively was a manpower shortage. After the post-covid situation, the situation is expected to return to normal, and the military embedded systems global market trends will rise again.

The blade server segment is expected to lead the military embedded systems market from 2023 to 2030, based on server architecture. This segment is expected to lead the market because adoption of modern blade servers is increasing, particularly in network-centric military and avionics applications that require high-end computing with more I/O than conventional servers and have more stringent environmental requirements than a normal data center. ATCA is now employed in network-centric military and avionics applications such as radar/sonar systems, C4ISR, electronic warfare, naval tactical combat systems, C2, communications, and data center consolidation.

The military embedded systems market is classified as Intelligence, Surveillance, and Reconnaissance, command and control, communication and navigation, electronic warfare, wearable, weapon and fire control, and others based on application. the command-and-control sector held the largest proportion of the military embedded systems market. Due to rising demand for military technology with ISR capabilities, the Intelligence, Surveillance, and Reconnaissance segment is predicted to be the fastest-growing segment in the military embedded systems global market forecast period.

According to the platform, the land segment is predicted to lead the industry and would continue to lead through 2030. The market has been divided into four sections: terrestrial, airborne, naval, and space. According to the forecast period, the land segment is expected to have the largest market share in the military embedded systems market. This segment's rise can be linked to the increased demand for surveillance activities as a result of geographical instability, as well as the development of complex electronic systems and mission-critical embedded technologies. The harsh-environment embedded computing systems will assist the Army in increasing the usage of low-cost open standards-based commercial off-the-shelf electronics in military ground vehicles. Curtiss-Wright provides components for command, control, communications, computers, intelligence, surveillance, and reconnaissance applications on armored combat vehicles. According to the region, North America is predicted to maintain its lead through 2030.

KEY MARKET SEGMENTATION

By Application

-

Intelligence, Surveillance and Reconnaissance

-

Command & Control

-

Communication & Navigation

-

Radar

-

Avionics & Vetronics

-

Cyber & amp

-

Networking

-

others

By Server Architecture

-

Blade Server

-

Rack-Mount Server

By Installation

-

New Installation

-

Upgradation

By Platform

-

Land

-

Airborne

-

Naval

-

Space

By Component

-

Hardware

-

Software

REGIONAL ANALYSIS

According to the area, North America is predicted to maintain its lead through 2028. This region is predicted to lead the market due to increased investments in defence equipment and warfare capabilities, as well as the adoption of network-centric infrastructure. The key countries in this region are the United States and Canada, with the United States leading the North American military embedded systems market. The United States is a technologically advanced country with enormous investment potential in military electronics.

North America is a major hub for innovative technical applications. The United States is a technologically advanced country with enormous investment potential in embedded system technologies. Investing more in next-generation communication technology and integrated fighting capabilities

Need any customization research on Military Embedded Systems Market - Enquiry Now

REGIONAL COVEREGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are BAE Systems, Intel Corporation, Kontron AG, Xilinx Inc., Curtiss-Wright Corporation, Radisys Corporation, General Micro Systems, Abaco Systems, Tele-phonics Corporation, Microsemi Corporation, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.75 Billion |

| Market Size by 2032 | US$ 4.03 Billion |

| CAGR | CAGR of 9.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Intelligence, Surveillance and Reconnaissance, Command & Control, Communication & Navigation, Radar, Avionics & Vetronics, Cyber & Networking and others) • By Server Architecture (Blade Server, Rack-Mount Server) • By Installation (New Installation, Upgradation) • By Platform (Land, Airborne, Naval, Space) • By Component (Hardware, Software) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BAE Systems, Intel Corporation, Kontron AG, Xilinx Inc., Curtiss-Wright Corporation, Radisys Corporation, General Micro Systems, Abaco Systems, Tele-phonics Corporation, Microsemi Corporation, and other players. |

| DRIVERS | • Rising market demand for new & advanced electronic combat systems • Cloud computing and wireless Technologies |

| RESTRAINTS | • Cost increasing • Technical expertise |