Aircraft Water and Waste Systems Market Report Scope & Overview:

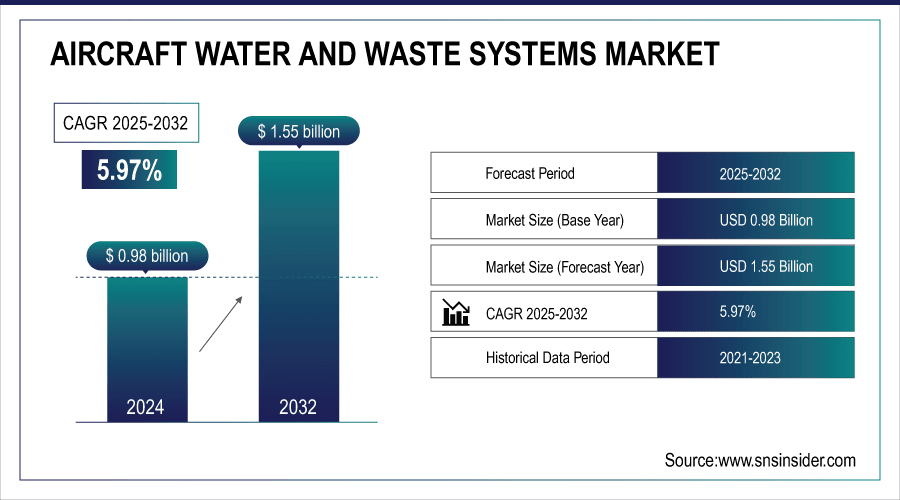

The Aircraft Water and Waste Systems Market size was valued at USD 0.98 Billion in 2024 and is projected to reach USD 1.55 Billion by 2032, growing at a CAGR of 5.97% during 2025-2032.

The Aircraft Water and Waste Systems Market is experiencing steady growth, driven by increasing air passenger traffic and stringent hygiene regulations. These critical systems ensure safe potable water supply and efficient waste management onboard, directly impacting passenger comfort and health. Advancements focus on lightweight materials to reduce fuel consumption, automation for improved maintenance, and antimicrobial technologies to enhance sanitation. The market is bolstered by fleet modernization programs and the introduction of new aircraft models requiring advanced, reliable, and efficient water and waste management solutions.

To Get More Information On Aircraft Water and Waste Systems Market - Request Free Sample Report

Key Aircraft Water and Waste Systems Market Trends:

-

Growing air passenger traffic is increasing demand for reliable and hygienic onboard sanitation systems.

-

Rising stringency of international health and sanitation regulations is driving system upgrades and replacements.

-

Advances in lightweight composite materials are reducing system weight and improving aircraft fuel efficiency.

-

Integration of IoT and smart sensors is enabling predictive maintenance and real-time system monitoring.

-

Increasing focus on water conservation is promoting the development of more efficient water management systems.

-

Expansion of long-haul and ultra-long-haul routes is necessitating more robust and higher-capacity systems.

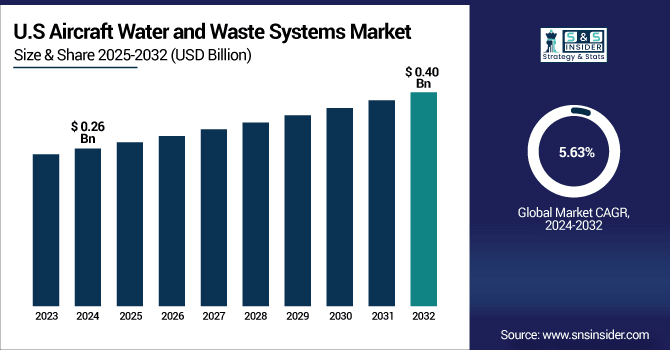

The U.S. Aircraft Water and Waste Systems Market size was valued at USD 0.26 Billion in 2024 and is projected to reach USD 0.40 Billion by 2032, growing at a CAGR of 5.63% during 2025-2032. The U.S. Aircraft Water and Waste Systems Market is driven by a 15% year-over-year increase in mandated health and safety inspections, compelling airlines to upgrade aging infrastructure. This regulatory push necessitates investments in advanced systems featuring automated disinfection, which can reduce maintenance downtime by up to 20%. Consequently, manufacturers are focusing on R&D for lighter, more efficient components to meet both operational and regulatory demands.

Aircraft Water and Waste Systems Market Driver:

-

Stringent International Health and Safety Regulations Mandate System Modernization and Compliance

The cause is the implementation of increasingly rigorous global health regulations by aviation authorities like the FAA and EASA, which set strict standards for water potability and waste handling to prevent contamination and disease spread. This regulatory pressure effects a compulsory need for airlines to modernize their existing fleets with compliant systems and for OEMs to integrate advanced technologies into new aircraft. As a result, there is a consistent, regulation-driven demand for upgraded water purification systems, automated flushing mechanisms, and leak-proof waste tanks, ensuring continuous market growth independent of economic cycles.

In response to updated FAA advisory circulars in April 2024, a major U.S. airline announced a fleet-wide retrofit program to install new-generation water filters and UV sterilization units across its narrow-body aircraft to ensure continuous compliance and enhance passenger safety.

Aircraft Water and Waste Systems Market Restraint:

-

High Installation and Maintenance Costs Limit Retrofit and Upgrade Initiatives

The market faces a significant restraint due to the substantial costs associated with installing new water and waste systems or retrofitting existing ones, which includes expenses for specialized components, engineering labor, and aircraft downtime during installation. This cause, significant financial investment, effects a cautious approach from airlines, particularly those with tight operating margins or older fleets, who may delay non-essential upgrades despite regulatory pressures. Consequently, the sales cycle for aftermarket solutions can be prolonged, and price sensitivity becomes a key factor, potentially slowing the overall pace of market adoption for the latest technologies.

A low-cost carrier deferred its planned lavatory system modernization for its A320 fleet in late 2023 after analysis showed the project would require an average of 3 days of downtime per aircraft, resulting in an unacceptable loss of revenue during a peak travel season.

Aircraft Water and Waste Systems Market Opportunity:

-

Development of Lightweight and Smart IoT-Enabled Systems Presents Growth Avenues

The cause is the aviation industry's relentless pursuit of fuel efficiency and operational excellence, coupled with the proliferation of IoT technology. This dual focus effects a significant opportunity for manufacturers to innovate and differentiate their products. As a result, there is growing demand for systems constructed from advanced composites that reduce weight and for smart components equipped with sensors that monitor water quality, tank levels, and potential faults in real-time. This allows airlines to transition from scheduled to predictive maintenance, minimizing downtime and reducing long-term operating costs, creating a high-value market segment.

In May 2024, a leading system manufacturer unveiled a new smart water tank module with integrated sensors that provide real-time data on water quality and consumption to ground crews via a cloud platform, enabling proactive maintenance and enhancing operational efficiency.

Aircraft Water and Waste Systems Market Segmentation Analysis:

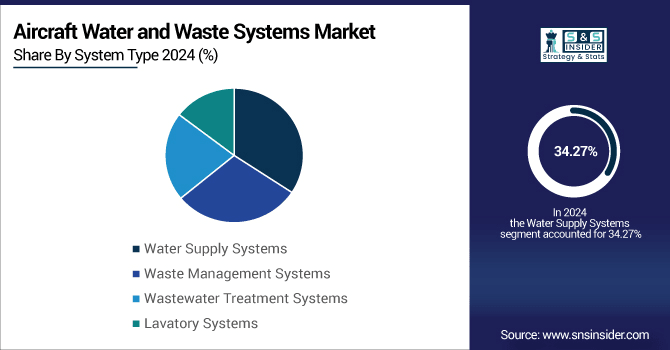

By System Type: Water Supply Systems Lead Market While Lavatory Systems Register Fastest Growth

The Water Supply Systems segment dominates the global Aircraft Water and Waste Systems Market, capturing a 35% revenue share in 2024. This dominance is caused by the critical and non-negotiable requirement for providing safe, potable water for drinking and sanitation on every flight, coupled with stringent and frequently updated health regulations. The effect is that these systems require regular maintenance, part replacements, and occasional upgrades to meet standards, generating consistent and recurring revenue streams for manufacturers and MRO providers, thus securing their leadership position. The Lavatory Systems segment is projected to grow at the fastest CAGR of 6.91%. This rapid growth is caused by increasing passenger expectations for hygiene and comfort, the introduction of higher-capacity aircraft, and the need for more efficient and reliable vacuum toilet technology. The effect is that airlines are investing in modern, touchless, and easier-to-service lavatory systems to improve the passenger experience and reduce turn-around times, driving accelerated growth in this segment.

By Aircraft Type: Commercial Aircraft Leads Market While Business & Private Jets Register Fastest Growth

The Commercial Aircraft segment dominates the global Aircraft Water and Waste Systems Market, accounting for a 55% revenue share in 2024. This leadership is caused by the vast size of the global commercial fleet, which includes thousands of aircraft each requiring multiple complex water and waste systems. The effect is that high-volume production for new aircraft deliveries, combined with a substantial aftermarket for maintenance and retrofits, creates a massive and steady demand base, ensuring the segment's revenue dominance. The Business & Private Jets segment is expected to grow at the fastest CAGR of 6.70%. This growth is caused by the increasing number of high-net-worth individuals and corporations utilizing private aviation, who demand luxurious and highly reliable amenities. The effect is that OEMs and completion centers are outfitting these aircraft with advanced, customized systems that offer greater comfort and convenience, supporting the segment's premium growth trajectory.

By Component: Tanks & Reservoirs Lead Market While Sensors & Control Units Register Fastest Growth

The Tanks & Reservoirs segment dominates the global Aircraft Water and Waste Systems Market, holding a 30% revenue share in 2024. This leadership is caused by the fundamental need for durable, lightweight, and corrosion-resistant containers to store fresh water and waste on every aircraft. The effect is that these are core, high-value components that are essential for any system and are subject to wear and tear, requiring periodic inspection and replacement, which generates consistent aftermarket revenue and secures the segment's leading share. The Sensors & Control Units segment is projected to grow at the fastest CAGR of 6.53%. This growth is caused by the accelerating trend towards digitalization and predictive maintenance in aviation, aimed at improving operational efficiency and reliability. The effect is that airlines are increasingly adopting smart systems equipped with sensors to monitor water quality, quantity, and system health in real-time, driving rapid investment in these advanced electronic components.

By End-User: Airlines & Commercial Operators Lead Market While Business Jet Operators Register Fastest Growth

In 2024, Airlines & Commercial Operators dominate the Aircraft Water and Waste Systems market with a 63.75% share, driven by high commercial flight volumes and stringent onboard hygiene standards. Meanwhile, Business Jet Operators are expected to register the fastest CAGR from 2025 to 2032, fueled by rising demand for luxury and private air travel, fleet expansion, and adoption of advanced, efficient water and waste management systems tailored for premium passenger comfort.

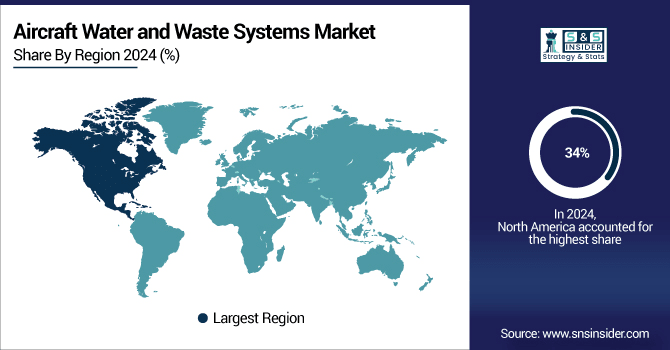

Aircraft Water and Waste Systems Market Regional Analysis:

North America Dominates the Aircraft Water and Waste Systems Market in 2024

North America is the dominant region, holding an estimated 34% market share in 2024. North America dominates the Aircraft Water and Waste Systems market due to its large commercial and military aircraft fleet. High regulatory standards, advanced aviation infrastructure, and continuous fleet modernization drive steady demand. The region’s focus on passenger comfort, safety, and sustainable water and waste management solutions makes it a mature and influential market for system manufacturers and service providers.

Get Customized Report as Per Your Business Requirement - Enquiry Now

United States Leads Aircraft Water and Waste Systems Market in North America

The U.S. dominates the regional market due to its concentration of major aircraft manufacturers (Boeing), leading system suppliers, and some of the world's largest airlines operating large and aging fleets. Stringent FAA regulations and a strong focus on maintenance, repair, and overhaul (MRO) activities ensure continuous demand for new installations, upgrades, and replacement parts, solidifying the country's position as the largest and most mature market globally.

Asia Pacific is the Fastest-Growing Region in Aircraft Water and Waste Systems Market in 2024

Asia Pacific is the fastest-growing region with an estimated CAGR of 6.43%. The Asia Pacific region is the fastest-growing market for Aircraft Water and Waste Systems in 2024, driven by rapid expansion in commercial aviation, increasing air travel demand, and fleet modernization initiatives. Rising investments in airport infrastructure, stringent hygiene regulations, and adoption of advanced water and waste management technologies are accelerating growth, making the region a key focus for manufacturers and service providers.

China Leads Aircraft Water and Waste Systems Market Growth in Asia Pacific

China dominates the regional market growth driven by its rapidly expanding commercial airline fleet to serve its growing middle class, the establishment of its own aerospace manufacturing capabilities (COMAC), and significant government investment in aviation infrastructure. This rapid fleet modernization and expansion create substantial demand for new aircraft outfitted with modern water and waste systems, making China the primary growth engine in the region.

Europe Aircraft Water and Waste Systems Market Insights

In 2024, Europe holds a significant share of the Aircraft Water and Waste Systems Market. Stringent EASA regulations and presence of Airbus drive a high standard for system innovation and safety. Germany is a key leader, supported by its strong aerospace manufacturing base, home to major system suppliers like Diehl, and a focus on engineering excellence and compliance with rigorous environmental and safety standards.

Middle East & Africa and Latin America Market Insights

The Aircraft Water and Waste Systems Market in Latin America and MEA is developing, driven by airline fleet expansions and modernization efforts. In Latin America, Brazil leads with its established aviation market. The MEA growth is centered around the Gulf carriers, which operate large, modern fleets and require advanced systems for their long-haul operations, though the market is smaller compared to other regions.

Aircraft Water and Waste Systems Market Competitive Landscape:

RTX Corporation

RTX Corporation (formerly Raytheon Technologies), through its Collins Aerospace business, is a U.S.-based global leader in aerospace and defense systems. The company provides a comprehensive range of water and waste management systems, including vacuum toilets, water heaters, and waste tanks, for both commercial and military aircraft. Its role is that of a tier-1 integrated systems supplier, leveraging its vast engineering resources and long-standing relationships with major airframers to develop advanced, reliable, and compliant solutions for next-generation aircraft platforms.

-

Collins Aerospace was selected in early 2024 to supply the integrated water and waste system for a new variant of a popular single-aisle aircraft, highlighting its continued innovation in lightweight and efficient design.

Safran SA

Safran SA is a French multinational aerospace and defense company and a key player in aircraft systems. Its Safran Cabin division specializes in interior solutions, including lavatories and water systems. Safran's role is that of a systems integrator, offering complete lavatory modules and advanced water treatment technologies that focus on passenger comfort, hygiene, and significant weight reduction. The company emphasizes innovation in water conservation and smart monitoring systems to enhance airline operations.

-

Safran introduced a new touchless lavatory control system in April 2024, focusing on enhanced hygiene and passenger peace of mind for post-pandemic travel.

Diehl Stiftung & Co. KG

Diehl Stiftung & Co. KG is a German diversified industrial group with a strong aerospace division, Diehl Aviation. The company is a renowned manufacturer of high-quality aircraft cabin interiors and systems, including water and waste components. Diehl's role is that of a precision manufacturer and reliable supplier, known for its engineering expertise and focus on producing durable, lightweight, and compliant tanks, valves, and control units for a wide range of aircraft programs.

-

Diehl Aviation extended a long-term contract with a major European airline in 2024 to supply spare parts and maintenance support for its water system components, underscoring its role in the aftermarket.

JAMCO Corporation

JAMCO Corporation is a Japan-based leading manufacturer of aircraft interior products and systems. The company specializes in the design, development, and production of lavatories, monuments, and water/waste system components. JAMCO's role is that of a specialized and trusted supplier, particularly strong in the Asia-Pacific region, known for its high manufacturing quality, efficiency, and ability to meet the stringent demands of both commercial airframers and airline operators.

-

JAMCO announced a new production line for composite waste tanks in March 2024, aiming to increase capacity and meet growing demand from aircraft manufacturers in the region.

Aircraft Water and Waste Systems Market Key Players:

Some of the Aircraft Water and Waste Systems Market Companies

-

RTX Corporation

-

Safran SA

-

Diehl Stiftung & Co. KG

-

JAMCO Corporation

-

AeroControlex Group Inc.

-

Collins Aerospace Inc.

-

Parker-Hannifin Corporation

-

Honeywell International Inc.

-

FACC AG

-

Stelia Aerospace SAS

-

General Electric Company

-

Eaton Corporation plc

-

Elbit Systems Ltd.

-

Smiths Group plc

-

T. Controls Ltd.

-

Zodiac Aerospace (now part of Safran)

-

Woodward, Inc.

-

Meggitt PLC

-

Yokohama Rubber Co., Ltd.

-

Geven S.p.A.

| Report Attributes | Details |

| Market Size in 2024 | USD 0.98 Billion |

| Market Size by 2032 | USD 1.55 Billion |

| CAGR | CAGR of 5.97% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Water Supply Systems, Lavatory Systems, Waste Management Systems) • By Aircraft Type (Commercial Aircraft, Business & Private Jets, Military Aircraft) • By Component (Tanks & Reservoirs, Valves & Pipes, Sensors & Control Units, Others) • By End-User (Airlines & Commercial Operators, Business Jet Operators, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | RTX Corporation, Safran SA, Diehl Stiftung & Co. KG, JAMCO Corporation, AeroControlex Group Inc., Collins Aerospace Inc., Parker-Hannifin Corporation, Honeywell International Inc., FACC AG, Stelia Aerospace SAS, General Electric Company, Eaton Corporation plc, Elbit Systems Ltd., Smiths Group plc, T. Controls Ltd., Zodiac Aerospace, Woodward, Inc., Meggitt PLC, Yokohama Rubber Co., Ltd., Geven S.p.A. |