Aircraft Electric Motors Market Key Insights:

To Get More Information on Aircraft Electric Motors Market - Request Sample Report

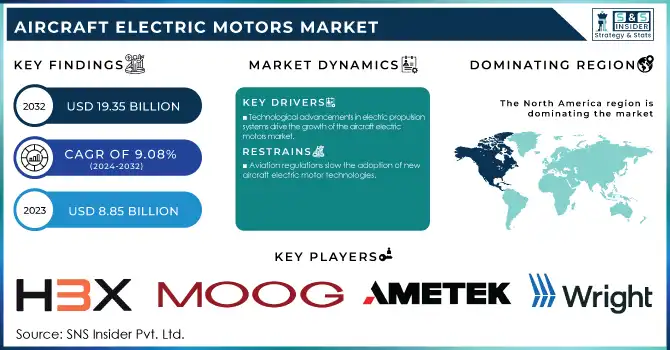

The Aircraft Electric Motors Market size was valued at USD 8.85 billion in 2023 and is expected to reach USD 19.35 billion by 2032 and grow at a CAGR of 9.08% over the forecast period 2024-2032.

The Aircraft Electric Motors Market is rapidly expanding due to the growing demand for sustainable aviation solutions. As airlines and aircraft manufacturers strive to reduce carbon emissions and align with global sustainability goals, electric propulsion systems are becoming a key focus. Innovations in electric aircraft technology, particularly hybrid-electric and fully electric aircraft, are expected to drive significant growth in this sector.

Governments are implementing stringent emissions regulations, pushing for cleaner technologies like electric propulsion. Technological advancements, particularly in electric motors, are essential to this transition. Companies such as Collins Aerospace, MagniX, and Rolls-Royce are leading the charge in developing more efficient and environmentally friendly electric propulsion systems, improving motor efficiency, power output, and reliability. Moreover, the development of high-density batteries and lightweight materials is enhancing the viability of electric motors for commercial aircraft.

Additionally, the rise of Urban Air Mobility (UAM), including electric vertical takeoff and landing (eVTOL) aircraft, is driving demand for electric motors. Companies like Joby Aviation and Vertical Aerospace are at the forefront of this revolution. The hybrid-electric aircraft segment is expected to grow faster, benefiting from government support and the demand for energy-efficient solutions. By 2032, the market is set to experience robust growth, with electric propulsion systems anticipated to play a pivotal role in decarbonizing aviation. Efficiency improvements, such as electric drivetrains achieving over 90% efficiency compared to just 55% for large turbofans, further highlight the critical role of electric motors in shaping the future of aviation.

Market Dynamics

Drivers

-

Technological advancements in electric propulsion systems are one of the primary drivers for the growth of the aircraft electric motors market.

The development of megawatt-class motors, such as MIT's megawatt motor for commercial aircraft, represents a groundbreaking innovation in electric aviation. These motors have the potential to significantly cut emissions and fuel consumption while enhancing overall performance. Hydrogen-electric propulsion systems are also emerging as a cleaner alternative to traditional jet engines. By generating electricity through a hydrogen-oxygen reaction, these systems produce only water as a byproduct, offering a sustainable way to reduce carbon emissions. Moreover, hydrogen-electric aircraft can mitigate contrail formation, responsible for up to 40% of aviation's climate impact, by eliminating harmful emissions like CO2 and NOx entirely.

Hybrid-electric propulsion systems are gaining momentum as well. GE Aerospace's successful demonstration of a hybrid system combining the CT7 turboshaft engine with electric power systems for the U.S. Army marks a significant step in optimizing this technology for commercial and military use. These systems promise extended ranges and increased payload capacities.

Ampaire’s hybrid-electric EEL demonstrator has set notable benchmarks, including covering 27,000 miles in flight and achieving a 50% reduction in fuel consumption. With their AMP-H570 hybrid powertrain, Ampaire demonstrated near-zero carbon emissions using 100% sustainable aviation fuel (SAF), achieving double the fuel efficiency while preserving 95-98% of the aircraft's capacity. Fully electric aircraft concepts are also advancing rapidly, further pushing the boundaries of sustainable aviation.

In 2023, Dutch startup Elysian Aircraft unveiled its E9X concept, a 90-passenger regional aircraft with a range of 500 miles (805 km), featuring distributed propulsion with eight electric propellers. Whisper Aero also introduced its Whisper Jetliner, designed for 100 passengers with a range of 769 miles (1,238 km). These developments, along with the hybrid-electric systems, are essential in propelling the aircraft electric motors market toward a more sustainable future.

Restraints

-

Aviation regulations slow the adoption of new aircraft electric motor technologies.

Electric propulsion systems, including advanced motors and batteries, require entirely new certification frameworks to meet safety, reliability, and environmental standards. Regulatory authorities like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) enforce rigorous airworthiness requirements, including performance under extreme conditions, durability, and fail-safe mechanisms. These processes often involve extensive documentation, testing, and multiple refinements, leading to certification timelines spanning years. Electric propulsion systems face additional scrutiny due to unique challenges like battery thermal management, motor redundancy, and integration with air traffic systems. The nascent stage of these technologies further complicates the process, as both manufacturers and regulators are navigating uncharted territory. This has resulted in delays in the commercialization of electric vertical take-off and landing (eVTOL) aircraft and hybrid-electric regional planes, stalling market expansion. The lack of globally harmonized standards adds to the complexity, with manufacturers needing to comply with varying certification criteria across jurisdictions, driving up costs and delaying market entry. Regions like Asia-Pacific, with evolving regulatory frameworks, amplify these challenges for companies seeking to establish a foothold. Addressing these barriers requires collaboration between regulators and industry stakeholders to streamline approval processes without compromising safety. Accelerated certifications are crucial for fostering innovation, enabling faster market growth, and aligning the aviation industry with its sustainability objectives.

Segmentation Analysis

By Type

The AC motor segment dominated the Aircraft Electric Motors Market, accounting for 65% of the revenue in 2023. AC motors are widely preferred in electric aircraft due to their high efficiency, durability, and ability to operate at variable speeds, which are crucial for aircraft propulsion systems. These motors are particularly well-suited for applications in both small and large aircraft, offering a high power-to-weight ratio, a key factor in aviation. Additionally, AC motors are more reliable and require less maintenance compared to other motor types, such as DC motors. The growth of this segment is driven by advancements in motor technology, which improve energy efficiency and reduce operational costs, further boosting their adoption in the aerospace industry.

By Output

The 10 to 200 kW output segment captured the largest share of the Aircraft Electric Motors Market, accounting for around 75% of the revenue in 2023. This range of output is ideal for small to medium-sized electric aircraft and hybrid-electric propulsion systems, which are increasingly being developed for short regional flights and urban air mobility applications. Motors in this range offer an optimal balance between power, weight, and efficiency, making them suitable for aircraft that require reliable performance without compromising fuel efficiency. As electric aviation continues to advance, the 10 to 200 kW motors are increasingly being adopted for various applications, from eVTOL aircraft to regional aircraft, owing to their scalability, cost-effectiveness, and ability to meet stringent aviation safety and performance standards. This segment’s growth is further fueled by innovations in battery technology and propulsion systems, which are enhancing the range and capabilities of electric aircraft.

Regional Analysis

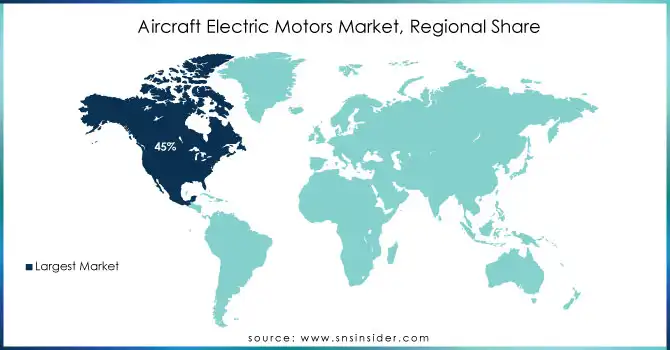

North America held the largest share of the Aircraft Electric Motors Market in 2023, capturing around 45% of the revenue. The region's dominance is attributed to significant investments in electric aviation technology, supported by government incentives and strong environmental policies. The U.S. leads with major players like Joby Aviation, Lilium, and Ampaire, advancing electric and hybrid-electric propulsion systems. The U.S. Department of Defense’s focus on hybrid-electric aircraft for military applications further accelerates innovation. Canada is also contributing with developments in electric vertical takeoff and landing (eVTOL) aircraft. North America’s well-established aerospace infrastructure, research and development efforts, and favorable regulatory environment make it the leading region in the electric aircraft market, positioning it for continued growth.

Asia-Pacific is the fastest-growing region in the Aircraft Electric Motors Market in 2023. This growth is driven by increasing investments in electric aviation technology, government initiatives to promote sustainable transportation, and expanding urban air mobility (UAM) projects. Countries like China, Japan, and India are at the forefront of developing electric aircraft technologies. China is actively investing in electric aviation, with companies like EHang leading in autonomous eVTOL aircraft development. Japan is focusing on hybrid-electric aircraft, with major players like SkyDrive and Terrafugia making significant strides in the eVTOL sector. India is also exploring electric aircraft for regional connectivity and urban mobility. The region benefits from a growing demand for greener alternatives, propelling rapid advancements in electric propulsion systems and infrastructure developments.

Do You Need any Customization Research on Aircraft Electric Motors Market - Inquire Now

Key Players

Some of the major key Players in Aircraft Electric Motors Market with their product:

-

H3X Technologies Inc. (Electric Propulsion Motors for Aircraft)

-

Moog Inc. (Electric Motor Systems for Aerospace)

-

Ametek, Inc. (Electric Propulsion Motors for Aircraft)

-

Wright Electric (Electric Propulsion Systems for Aircraft)

-

MagniX Corporation (Magni500)

-

Siemens AG (Shaft Power Electric Motors)

-

Honeywell International Inc. (Hybrid Electric Propulsion Systems)

-

Safran SA (E-Fan X Hybrid-Electric Motor)

-

Rolls-Royce Holdings plc (Electric Aircraft Motor System)

-

GE Aviation (Electric Propulsion Systems)

-

Raytheon Technologies Corporation (Electric Propulsion Systems)

-

YASA Limited (High-Power Density Electric Motors)

-

Pipistrel (Electric Aircraft Motors)

-

Joby Aviation (Electric Propulsion Motors for eVTOL)

-

Vertical Aerospace (VA-X4 Electric Propulsion)

-

Lilium (Lilium Jet Electric Motors)

-

Eviation Aircraft (Alice Electric Aircraft Motor)

-

AeroVironment (Electric Motors for UAVs)

-

Zunum Aero (Hybrid-Electric Aircraft Motors)

-

Harbour Air (Electric Propulsion Conversion)

List of 25 key suppliers of raw materials for the Aircraft Electric Motors Market, which includes manufacturers of materials used in electric motor production:

-

Alcoa Corporation – Aluminum and aluminum alloys

-

Rio Tinto – Aluminum and copper

-

Sumitomo Metal Mining Co. – Copper, nickel, and precious metals

-

BASF SE – Specialty chemicals and composite materials

-

Mitsubishi Materials Corporation – Copper and metal alloys

-

Glencore International AG – Copper, nickel, and cobalt

-

ArcelorMittal – Steel and metal alloys

-

Southwire Company, LLC – Copper and aluminum wire for motor windings

-

TE Connectivity – Electrical connectors and materials for aerospace motors

-

Thyssenkrupp AG – Steel and high-performance alloys

-

Aperam – Stainless steel and alloys

-

Sumitomo Electric Industries, Ltd. – Conductors and components for electric motors

-

Kobelco Steel – High-strength steel for motor components

-

Nippon Steel Corporation – Steel and alloys for electric motor cores

-

Magna International – Aluminum and metal casting for electric motors

-

Hitachi Metals Ltd. – Specialty alloys, including magnetic materials

-

Molybdenum Corp. of China – Molybdenum and high-performance materials for aerospace motors

-

Volkswagen Group of America – Battery components and rare-earth magnets

-

China Northern Rare Earth Group High-Tech Co. – Rare earth materials, including neodymium for permanent magnets

-

Toyota Tsusho Corporation – Cobalt, lithium, and other materials for electric vehicle motors

-

BASF Catalysts LLC – Rare earth materials and catalysts for magnets

-

Standard Motor Products, Inc. – Electrical components for aircraft motor manufacturing

-

Vermilion Energy Inc. – Cobalt and other critical minerals for electric motor manufacturing

-

Westlake Chemical Corporation – Plastics and polymers used in motor housings

-

Tronox Limited – Titanium dioxide and other specialty chemicals for insulation materials

Recent Developments

-

August 6, 2024 – H3X, a Denver-based manufacturer of high power density electric motors, secured 20M in Series A funding led by Infinite Capital, with participation from Lockheed Martin Ventures and others. The company plans to expand production of its next-generation integrated motor drives, including megawatt-class machines for electric aircraft, marine, and heavy industrial applications.

-

June 18, 2024 – Honeywell highlighted its vision for hydrogen-fueled aircraft, predicting the phasing out of conventional jet fuel within 20-30 years and emphasizing hydrogen's potential for zero-emission aviation systems.

-

September 17, 2024 – NASA and GE Aerospace advanced hybrid-electric propulsion under the HyTEC initiative, integrating electric motors with fuel-burning cores to enhance efficiency and reduce fuel consumption in next-generation airliners.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.85 Billion |

| Market Size by 2032 | USD 19.35 Billion |

| CAGR | CAGR of 9.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (AC Motor, DC Motor) • By Output (Up to 10 kW, 10 to 200 kW) • By Application (Propulsion System, Flight Control System, Engine Control System, Environmental Control System, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | H3X Technologies Inc., Moog Inc., Ametek, Inc., Wright Electric, MagniX Corporation, Siemens AG, Honeywell International Inc., Safran SA, Rolls-Royce Holdings plc, GE Aviation, Raytheon Technologies Corporation, YASA Limited, Pipistrel, Joby Aviation, Vertical Aerospace, Lilium, Eviation Aircraft, AeroVironment, Zunum Aero, and Harbour Air are key players in the Aircraft Electric Motors Market. |

| Key Drivers | • Technological advancements in electric propulsion systems are one of the primary drivers for the growth of the aircraft electric motors market. |

| Restraints | • Aviation regulations slow the adoption of new aircraft electric motor technologies. |