Military Battery Market Report Scope & Overview:

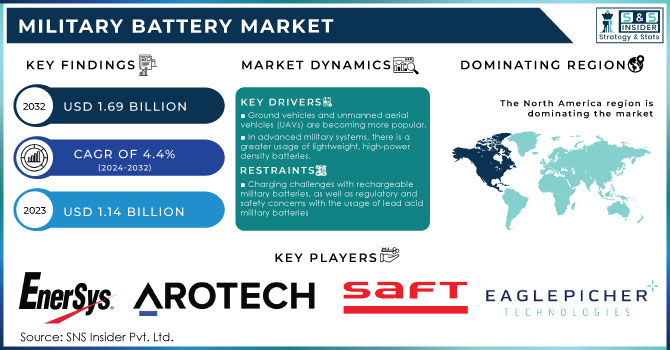

The Military Battery Market was valued at USD 1.14 billion in 2023 and is projected to reach USD 1.69 billion by 2032, growing at a CAGR of 4.4% over the forecast period of 2024-2032.

To get more information on Military Battery Market - Request Free Sample Report

The military uses batteries to deliver electrical energy to a wide range of devices, from powering tools to military portable equipment. Lithium-ion batteries have been identified as the greatest power source for portable military equipment on the battlefield. Because military lithium batteries are specifically developed to withstand rigorous military conditions, they are not widely available for commercial usage. The military battery serves as a backup in the event of a power loss.

Some of the key trends that will boost market expansion over the projected period include the need for contemporary combat systems based on advanced technologies, an increase in demand for drones for surveillance applications, and a decrease in the price of lithium-ion batteries. The growing preference for rechargeable batteries, as well as tight military rules and regulations for manufacturers of military batteries, are some of the industry trends that are likely to drive market expansion. Furthermore, an increase in various countries' military budgets as a result of increased occurrences of international disputes propels market expansion in the coming years.

In addition, in recent years, there has been a considerable demand for UAVs outfitted with extended endurance and high-power military batteries. Increasing development of various chemical compositions to boost power density has aided market expansion. Adoption of batteries as energy storage devices, as well as increased demand for solid-state batteries, all contribute to the industry. These factors are projected to boost the Military Battery market over the estimated period.

MARKET DYNAMICS

KEY DRIVERS

-

Ground vehicles and unmanned aerial vehicles (UAVs) are becoming more popular.

-

In advanced military systems, there is a greater usage of lightweight, high-power density batteries.

RESTRAINTS

-

Lithium battery regulations

-

Charging challenges with rechargeable military batteries, as well as regulatory and safety concerns with the usage of lead acid military batteries

OPPORTUNITIES

-

Smart battery technology advancements

-

Material science and battery technology advancements

CHALLENGES

-

Battery production presents design issues.

-

Recovering from the pandemic

IMPACT OF COVID-19

The COVID-19 pandemic has had a significant impact on the global battery sector, with COVID-19 lockdown having a negative impact on battery supply chains. Certain manufacturers are continually pursuing various techniques such as collaborations and joint ventures in order to establish a strong place in the overall market. Indian Oil Corporation developed a strategic partnership with Phinergy to apply breakthrough technologies in the development, manufacturing, assembly, and sales of Al-air batteries. Following the closure of COVID-19, Phinergy has continued to develop aluminum-air batteries in order to expand the company's portfolio in the Indian market. During an emergency, this component is predicted to promote market growth.

The military battery market is divided into OEM and aftermarket segments. OEMs design, develop, and manufacture military batteries for a variety of uses, integrating them into various platforms such as airborne, naval, and land-based systems. The defence market is inextricably related to the military battery market. Growing military spending has a direct impact on military market OEMs, who are producing more batteries for military uses.

As new batteries are required for evolving technologies, the OEM segment will be driven by the electrification of military equipment, automobiles, and aeroplanes. Nexans was awarded a contract by Airbus in January 2021 to develop new high voltage batteries for next-generation electric and hybrid aircraft.

The Marine Corps and the Army have shown a desire to use lithium iron phosphate batteries in micro grid and Forward Operating Base (FOB) camp applications. The military has typically used generators and/or lead-acid batteries to power these camps, but decision-makers are increasingly looking to lithium as a more efficient and lighter-weight battery. To limit the need of generators, the military must pair them with an energy-dense battery and a working solar array. Even when the generator is necessary, full power can be returned to the battery.

Furthermore, the solar cells can be utilised to charge the battery indefinitely. The generator will not be completely eliminated, but it can be hybridised by using inverters to charge the battery to continuously run, resulting in a generator with much greater efficiency using fuel for shorter periods of time, which is a huge advancement, and lithium-ion batteries play a significant role in that reduction.

Lithium-ion batteries have a substantially better power density and are much lighter than alkaline and carbon-zinc batteries. Rechargeable lithium-ion batteries are employed in military applications. This battery is used by the military for a variety of purposes, including radios, thermal imagers, and thermal cameras. The battery generates energy by transferring lithium ions from the negative electrode to the positive electrode during discharge and vice versa during charging. High power density military batteries are replacing standard batteries in a variety of military applications, including air defence systems and electronic warfare systems. Furthermore, unmanned aerial vehicles (UAVs) and man-portable devices have a significant demand for lightweight, high-capacity, long-duration batteries, resulting in a reduction in overall system size.

the massive D-sized lithium primary battery packs used by military UAVs to ensure safe landings during power outages are being replaced by tiny and powerful lithium AA batteries. These batteries not only reduce the overall size of UAVs, but they also boost the UAVs' endurance.

KEY MARKET SEGMENTATION

By Application

-

Propulsion Systems

-

Auxiliary Power Units

-

Backup Power

-

Ignition Systems

-

Fire Control Systems

-

Communication

-

Navigation Systems

By Platform

-

Aviation

-

Land

-

Marine

-

Space

-

Munition

By End User

-

OEM

-

Aftermarket

By Type

-

Rechargeable

-

Non-Rechargeable

Need any customization research on Military Battery Market - Enquiry Now

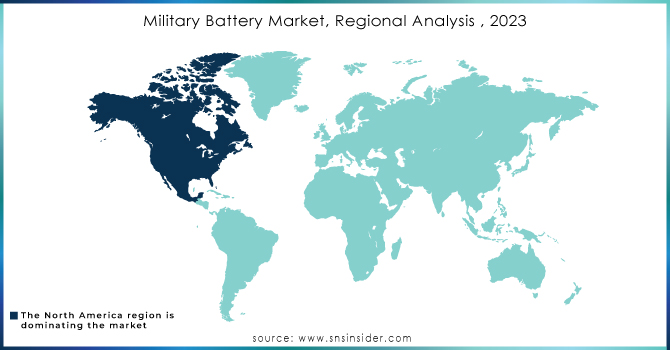

REGIONAL ANALYSIS

Because of increased investments, the North American region will lead the military battery market over the forecast period. This regional market is also growing as a result of the presence of key players such as Eaglepicher, Arotech Corporation, and Enersys in the region. Aside from this region, demand for military batteries is expanding in Europe.

The military in this region has a high adoption rate of modern systems such as UMVs, UAVs, and UGVs for reconnaissance, intelligence, and surveillance operations. Furthermore, the Asia-Pacific area is predicted to rise at a rapid CAGR during the assessment period.

Because of increased terrorist activity in nations such as Indonesia, India, Australia, and China, this area is driving worldwide military battery market demand. Another major factor driving the region's expansion is increased defence spending.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are EnerSys, Arotech Corporation, Saft Groupe, Mathews Associates, EaglePicher Technologies, Bren-Tronics, Inc., BST Systems, Inc., Teledyne Battery Products, Concorde, Denchi Power, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.14 Billion |

| Market Size by 2032 | US$ 1.69 Billion |

| CAGR | CAGR of 4.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Propulsion Systems, Auxiliary Power Units, Backup Power, Ignition Systems, Fire Control Systems, Communication and Navigation Systems) • By Platform (Aviation, Land, Marine, Space, and Munition) • By End User (OEM, and Aftermarket) • By Type (Rechargeable, and Non-Rechargeable) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | EnerSys, Arotech Corporation, Saft Groupe, Mathews Associates, EaglePicher Technologies, Bren-Tronics, Inc., BST Systems, Inc., Teledyne Battery Products, Concorde, Denchi Power, and other players. |

| DRIVERS | • Ground vehicles and unmanned aerial vehicles (UAVs) are becoming more popular. • In advanced military systems, there is a greater usage of lightweight, high-power density batteries. |

| RESTRAINTS | • Lithium battery regulations • Charging challenges with rechargeable military batteries, as well as regulatory and safety concerns with the usage of lead acid military batteries |