Airflow Management Market Report Scope & Overview:

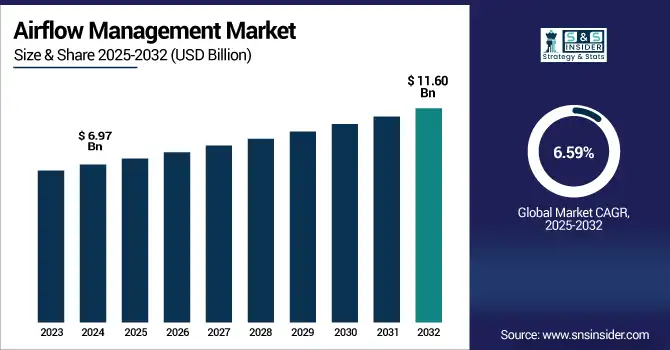

The Airflow Management Market size was valued at USD 6.97 billion in 2024 and is expected to reach USD 11.60 billion by 2032, expanding at a CAGR of 6.59% over the forecast period of 2025-2032.

To Get more information onAirflow Management Market - Request Free Sample Report

Airflow Management Market is growing rapidly owing to the increasing need for energy saving to cool data centers, commercial, and industrial facilities. It encompasses everything from blanking panels and containment systems to installation and maintenance services. Chilled water is usually the choice for a large facility, while direct expansion is for a smaller one. The fastest-growing segment is hyperscale data centers, powered by companies including AWS and Microsoft. North America dominates the market, while Asia Pacific is growing as the fastest on account of industrialization. Main applications implementing such solutions are IT & telecom, healthcare, BFSI, and manufacturing, together with the increasing focus on saving energy and sustainability across the globe.

According to the research, advanced Airflow Management solutions deployed in data centers save up to 30% energy on auxiliary cooling, resulting in substantial operational cost savings, as over 40% of new builds include IoT-based monitoring for real-time optimization of energy use and improved Resource Utilization Effectiveness.

The U.S Airflow Management Market size reached USD 1.87 billion in 2024 and is expected to reach USD 2.88 billion in 2032 at a CAGR of 5.56% over 2025-2032.

The U.S. is a leader in the market with the presence of advanced data center facilities, which have adopted the latest cooling technologies and strict energy efficiency mandates. With major cloud providers, such as AWS, so as Microsoft Azure, and Google Cloud continuing to drive the rapid expansion of hyperscale data centers, there will always be a need for our high-flow solutions. Furthermore, a rise in investments in healthcare, manufacturing, and IT sectors supplements the market growth. Focus on energy efficiency and cost efficiency, driven by efficient airflow management, continues to promote the market. Another contributing factor in the United States’ leading market status is the proactive support for green building and energy-efficient HVAC systems, introduced by the government.

Market Dynamics:

Drivers:

-

Increasing Demand for Energy-Efficient Cooling Solutions in Data Centers and Industrial Applications

Increasing demand for energy-efficient cooling solutions in data centers and enterprises is such demand for the airflow management market. Increased footprints of data centers and associated high power density, efficient airflow have become quite important in maintaining the temperature of equipment, and in turn for saving power. Advanced airflow management systems optimize cooling efficiency to reduce the cost of cooling infrastructure and improve the reliability of your most critical infrastructure. Latest trends in intelligent airflow solutions coordinate with building management systems to provide real-time status and predictive maintenance.

Restraints:

-

High Initial Investment and Maintenance Costs Associated with Advanced Airflow Management Systems

Advanced airflow management systems have high initial and maintenance costs, which is a major restraint in the market. Budget constraints may make it difficult for small- and medium-sized enterprises (SMEs) to afford the cost. Furthermore, integrating such systems into legacy infrastructures can be a difficult and expensive process, resulting in prolonged downtimes during the transition phase. Those financial and operational obstacles can impede wider usage of advanced airflow management solutions.

Opportunities:

-

Integration of IoT and AI Technologies to Enhance Airflow Management Efficiency

The collision of IoT and AI technology offers a strong promise for improved airflow management efficiency. IoT-equipped sensors can serve as real-time sources for airflow data, and AI systems can process this data to dynamically optimize the distribution of airflow. This combined functionality enables predictive maintenance, minimizing downtime and extending machine life. In recent years, AI-based airflow optimization technologies have been developed, which have proven to save a significant amount of energy with better indoor air quality for different applications.

Challenges:

-

Ensuring Compatibility and Integration with Existing Infrastructure in Retrofitting Projects

A challenge is to fit new advanced airflow management systems seamlessly into existing infrastructure, compatible with the networks of data center infrastructure components that have already been deployed. For retrofits, existing structures may not facilitate modern airflow solutions due to age and incompatible designs or systems. These problems can lead to extra expenses, elongated timeframes for projects, and business disruptions while integrating. To solve them, thoughtful planning, personalized solutions, and cooperation among the players are necessary to bring about successful delivery.

Segmentation Analysis:

By Offerings

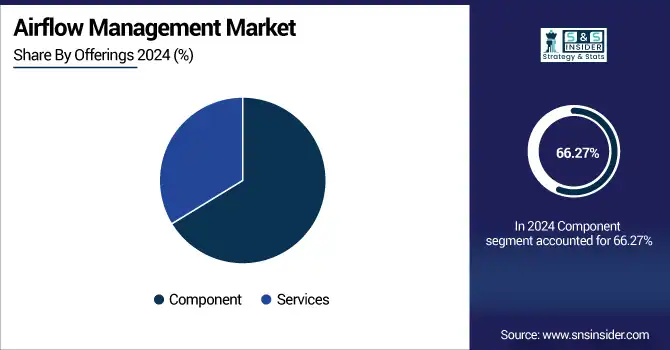

The Component segment is dominated by the largest share of revenue, with 66.27% in 2024. The dominance is attributed to the wide usage of airflow management products, including grommets, containment systems, and blanking panels in data centers and industrial facilities. These features ensure the best possible cooling performance to cool the card efficiently and then to dissipate heat and hot air effectively. The airflow management market companies, such as Upsite Technologies and Vertiv, have introduced modular solutions specifically geared toward making the retrofit process and scaling easier. Energy-efficient activities and sustainability are the two growing airflow management market trends.

The services segment is growing at the fastest CAGR of 7.32% over the forecasted period. The growth can be attributed to high demand for consulting, installation, optimization, and maintenance in airflow management. End-to-end solutions supported with intelligent technologies and services within the growing complexity of data centers are available from service providers. Schneider Electric and Siemens are two examples of companies that are adding AI-powered monitoring tools for airflow efficiency to their service portfolio. The increasing demand for predictive maintenance and tailor–made. One of the factors is the trend for outsourcing the competence for improving operational stability.

By Data Center

The Enterprise segment is dominated by the largest share of revenue, with 55.37% in 2024. Businesses will continue to invest in legacy on-premises data centers, both for control, governance, and latency of data-sensitive applications. This growth is pushing the use of sophisticated airflow management solutions to accommodate high-density computing and to keep energy costs in check. Rittal and Eaton have introduced adaptable containment and rack cooling solutions to enterprise sites. Fundamentally, it is the demand for 24/7 availability, data protection, and infrastructure robustness that drives larger organizations to fine-tune their on-premise data needs.

The hyperscale market is expected to register the fastest-growing CAGR of 7.16% during the forecast period. This growth is propelled by exponential data growth, the rise of cloud, and AI-driven workloads from the likes of Amazon, Microsoft, and Google. Hyper-scale operators value ultra-efficient cooling to control the elevated thermal loads. Recent advances involve the application of CFD modeling and real-time air-management optimization tools. The likes of Vertiv and Stulz have announced large-scale containment and monitoring systems custom-designed for hyperscale settings.

By Cooling System

The Chilled Water segment held the largest airflow management market share in 2024, accounting for 54.91% of the revenue. Cold water systems are popular for high heat density environments, such as large data centers and industrial applications, with efficient heat dissipation. They are very reliable and capable of being adapted to many different load profiles. Today’s heavy hitters, such as Trane Technologies and Johnson Controls, have introduced high-performance chilled water offerings with variable speed technology and smart controls. One of the key factors driving growth in this area is the need for reliable, central cooling solutions that deliver long-term cost and sustainability savings.

Direct Expansion is projected to grow at the fastest CAGR of 7.20% during the forecast period. This development is driven by the increasing number of small and mid-sized data centers, which use direct expansion systems because of lower capital costs and easier installation. Innovations have ranged from environmentally friendly coolants to energy-saving compressor technologies from the likes of Mitsubishi Electric and LG Electronics. The primary driver is the demand for compact, self-sufficient cooling systems that deliver high efficiency and require minimal maintenance in edge and remote data center environments.

By Industry Vertical

The IT & Telecom market is projected to hold the largest revenue share of 16.37% during the forecast period due to it relying heavily on high-performance computing (HPC) infrastructure and on real-time data processing. Efficient air flow is a must for optimal operation and the prevention of expensive downtime. Venture-funded competitors are working on this problem, the biggest of which are Dell Technologies and Huawei, building integrated air flow solutions for telco infrastructure. The primary drivers are the sector demand for business and service continuity, energy efficiency green data center initiatives.

Healthcare is expected to be the fastest-growing segment at a CAGR of 6.39% during the projected period. This airflow management market growth is propelled by escalating concern for indoor air quality, patient safety and infection control in healthcare establishments and laboratories. Companies, including Johnson Controls and Honeywell have launched HEPA air flow and filtration units for healthcare facilities. The primary driver is the increasing demand from healthcare for accurate flow control to ensure sterile conditions and controlled temperature conditions that are critical for both patient outcomes and compliance with health and safety standards.

Regional Analysis:

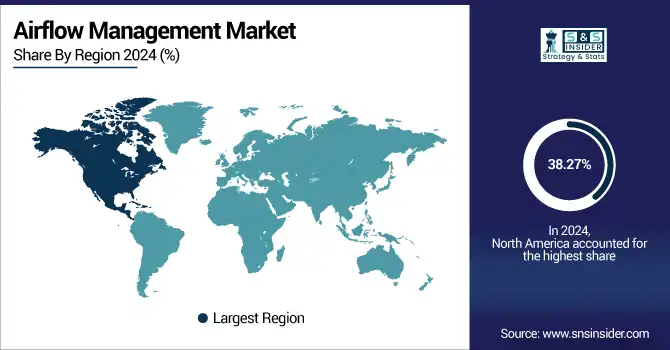

North America dominates with the largest market during the forecast period and accounts for 38.27% revenue share in 2024, followed by Asia Pacific and Europe, mainly due to the presence of strong and established players and the expansion of business in the region. Its growth is driven by strict energy efficiency regulations and strong demand from hyperscale data centers, reinforcing its market leadership.

The U.S. is the leading country in the North American market due to the presence of a large number of hyperscale and enterprise data centers, early adoption of advanced airflow management solutions, and government policies favoring energy-efficient IT infrastructure.

Europe is expected to grow at a good pace in the market, spurred by the EU regulations concerning energy consumption, increasing deployment of cloud and high-performance computing systems, and a rise in green IT initiatives. Sustainable data centers are also being preferred in countries, such as Germany, the U.K., and France, triggering the need for airflow solutions.

Germany is taking the lead in Europe with its support infrastructure, focus on carbon-neutral data centers, and high adoption of the conversion of traditional cooling to AFT cooling technology.

Asia Pacific is the fastest-growing region, with a CAGR of 7.87%, in the market, which can be attributed to the growing digital transformation, high cloud adoption, and increase in hyperscale data centers. Large investments toward AI, IoT, and data infrastructure in countries, such as China, India, and Japan are driving the demand for high-end airflow solutions.

China is the largest Asia Pacific market due to its aggressive expansion of data centers, government support for digital infrastructure projects, and the demand for scalable, energy-efficient cooling solutions to accommodate next-generation technologies.

The Middle East & Africa and Latin America are projected to register a good growth in the Airflow Management Market due to the rise of smart cities, digital transformation, and rising IT infrastructure, and the growing adoption of energy-saving data centers in the UAE, Saudi Arabia, Brazil, and Mexico.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key players of the Airflow Management Market are Schneider Electric, Eaton Corporation, Kingspan Group, Upsite Technologies, Subzero Engineering, Polargy, Inc., AdaptivCOOL, Conteg, 42U by DirectNET, Data Clean Corporation, and others.

Key Developments:

-

In October 2024, Schneider Electric purchased a 75% interest in US-based Motivair Corp for USD 850 million. The acquisition bolsters Schneider's data center cooling offering by combining Motivair's innovation in liquid cooling systems specifically designed for high-performance computing, especially to address the growing needs of AI and large language model workloads.

-

In March 2024, Subzero Engineering introduced its groundbreaking Composite AisleFrame (CAF) System, which provides a 50% weight reduction over conventional steel structures. This technology allows for faster shipping, easier installation, and significant CO₂ emission savings per frame, facilitating eco-friendly data center operations.

-

In October 2024, Kingspan launched its Green Finance Framework, restating its commitment to the financing of sustainable operations. The framework focuses on investing in energy-saving technologies, such as innovation in airflow management systems for data centers, supporting Kingspan's overall environmental and decarbonization objectives.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.97 Billion |

| Market Size by 2032 | USD 11.60 Billion |

| CAGR | CAGR of 6.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Offerings (Component, Services) •By Cooling System (Chilled Water, Direct Expansion) •By Data Center (Enterprise, Hyperscale) •By Industry Vertical (BFSI, IT & Telecom, Research & Academic, Government & Defense, Retail, Energy, Manufacturing, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Eaton Corporation, Kingspan Group, Upsite Technologies, Subzero Engineering, Polargy, Inc., AdaptivCOOL, Conteg, 42U by DirectNET, Data Clean Corporation. |