Peer-to-Peer Lending Market Report Scope & Overview:

Get More Information on Peer to peer lending Market - Request Sample Report

Peer to peer lending Market was valued at USD 5.94 billion in 2023 and is expected to grow to USD 30.54 billion by 2032 and grow at a CAGR of 20% over the forecast period of 2024-2032.

Rising need for alternative financing options is fuelling the growth of peer 2peer (P2p) lending market. P2P lending platforms are an appealing alternative for people and small businesses, as traditional sources of loans or investments like banks may not always be accessible. These digital platforms create an ecosystem for soft credit, providing access to a larger market of loans and enabling borrowers with poor establish ability-to-pay credentials to borrow money. This growth has been driven by technological innovation. thanks to online platforms and digital infrastructure that fuel peer-to-peer communication between borrowers and lenders. No intermediaries and machine learning algorithms increased efficiency in the credit risk assessment; lending decisions are now quicker as compared to traditional methods. Investors have recorded average returns of between 5% and 7% per year from P2P lending platforms. In 2024, many countries have announced a series of new rules or amendments to help safeguard the interests of investors and increase transparency in P2P lending. The European Union, for example has begun new disclosure obligations of P2P-platforms to make sure that all investors can rate risks better.

However, the possibility of higher returns than traditional investment opportunities is also driven the peer-to-peer lending market. P2Ps enable individuals to lend money directly into loans, offering an alternative form of risk and reward that could beat standard returns by a savings account or other financially savvy alternatives. What more, the heightened transparency and easy-to-understand processes of these platforms have only added to their appeal. This allows borrowers to compare loan terms, rates and fees so they can make an educated decision and without all the extensive paperwork. Moreover, the rapid expansion of fintech companies in the U.S. and increased integration P2P lending across BFSI domain is driving market growth. Use of advanced technologies, like AI and ML is growing on P2P lending platforms. Close to 40% of platforms are using these technologies for credit scoring and risk management. Investor returns for US based P2P lending platforms have traditionally averaged about 6%-8% per year, give or take a little surrounding loan level credit risk and platform performance. About 70% of US P2P platforms´ borrowers are individuals needing personal loans. The remaining 30 percent are small businesses looking for a loan. State of AI and Machine Learning: Around 50% of P2P lending platforms in the US are now augmenting their practices with artificial intelligence, primarily to help improve credit scoring models as well new fraud detection.

Drivers

-

Growing need for alternative financing options, especially for individuals and small businesses that find it challenging to secure loans from traditional banks.

-

Innovations in digital platforms, advanced algorithms, and data analytics streamline the lending process, making P2P lending more efficient and accessible.

-

P2P lending offers potentially higher returns compared to traditional savings or investment options, attracting more investors to the market.

-

P2P platforms provide borrowers with clear loan terms and flexible repayment options, making them an attractive choice for personal and business loans.

The growing demand for alternative financing options, especially from individuals and small businesses that have difficulty obtaining loans through traditional banking services is acting as the major driver of global Peer-to-Peer (P2P) Lending market. Traditional banks tend to have stricter lending criteria making it difficult for those with low credit scores or small businesses just getting started access the loans they need. P2P lending platforms bridge the gap by making borrowing much easier and streamlined. A TransUnion survey from 2023, for example, found that approximately 60% of small business owners felt they couldn't readily get loans through traditional banks and turned to alternative financing avenues such as P2P lending instead. This demand is only further driven by the flexibility and convenience provided through P2P lending platforms. Lending Club, for example, international survey across 24 banks in early 2024 that said borrowers have indicated a faster approval process as one of the key reasons 70% of consumers decided to get loans from Lending Club as compared to traditional banks. 65% percent also valued adjusting the loan amount and payback time to be more personalized, per a release.

Restraints

-

Inconsistent or evolving regulations in different regions can pose challenges to the growth and operations of P2P lending platforms.

-

Higher risk of default, especially with borrowers who have limited credit history or are considered high-risk, can deter potential lenders.

-

Potential risks related to data security and fraud can undermine trust in P2P lending platforms, affecting user adoption.

One of the major challenges for the peer-to-peer (P2P) lending market is regulatory uncertainties, which differ case by case based on regions. Because P2P lending is such a new financial model, many governments and financial regulators are still working on putting good frameworks in place to control how it works. Some examples include India's Reserve Bank of India (RBI) proposed guidelines back in 2017 and there have been changes to the P2P market since that time, raising potential hurdles for these platform operators working hard to comply with new demands. In the U.S. for example, there is federal oversight by way of the Securities and Exchange Commission (SEC) but each state has its own set of laws making it fairly complex to operate a P2P platform everywhere in America. Such regulatory uncertainty can directly translate into higher compliance costs, market entry delays and the threat of sudden changes in operations should new rules nationwide. Greater than 40% of P2P platforms had listed regulatory challenges as a leading impediment towards growth in the year-2023 survey.

Segment Analysis

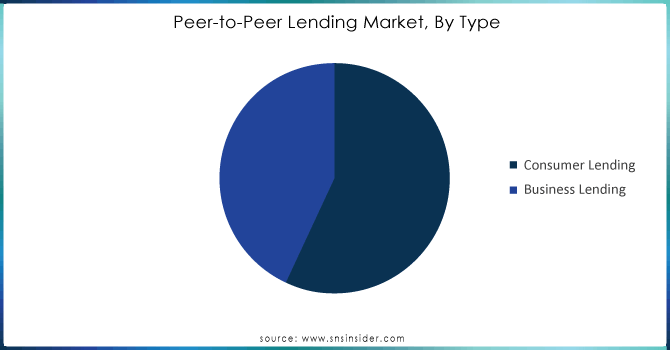

By type

The P2P lending market was led by the consumer lending segment, which generated more than 58% of revenue share in 2023. P2P lending also appeals to consumers looking for loans at lower interest rates than most traditional banks or credit unions. P2P lenders are able to offer more competitive rates because they provide their services on far lower margins than traditional banks who allocate large overhead costs. Moreover, the automated underwriting process at P2P platforms helps both in lowering the cost of lending and thus is an attractive option for anyone seeking to borrow money cheaply.

The vertical of business lending is anticipated to undergo the highest growth, registering a CAGR in excess of 21.8% during the forecast period, For P2P most of the businesses started opting since it helps to avoid so many formalities and hard procedures for loan approval on bank traditional loans. Since P2P loans are also digital in nature, the application process is faster and more convenient for many small businesses. In addition, P2P loans are especially popular for startups and small businesses because they generally come with lower funding caps thus, making them an attractive financing option to these types of enterprises.

Need any customization research on Peer-to-Peer Lending Market - Enquiry Now

By End-use

Non-business loans segment led the P2P lending market in 2023, representing over 73% of revenue share. Individuals use personal loans to cover numerous financial needs like debt consolidation, home repair and renovation projects a or remodel homes again for cheap medical expenses education & funeral expenses etc. And with the flexibility of loan sizes and tenures, P2P lending platforms are a perfect choice for personal loans with smaller amounts and shorter repayment plans.

Business loans are estimated to be the fastest growing segment at 22.1% CAGR during forecast period of2024-2032, small- and medium-sized enterprises (SMEs) find it difficult to secure a traditional bank loan when they are in the early stages or times of financial uncertainty. P2P lending platforms provide another avenue, enabling these kinds of businesses access to more suitable financial options that can allow them seek out the capital they need for expansion and growth. In addition, businesses looking for quicker access to capital in order take advantage of opportunities or meet short-term finance requirements find the quick and efficient loan application processes on P2P platforms appealing.

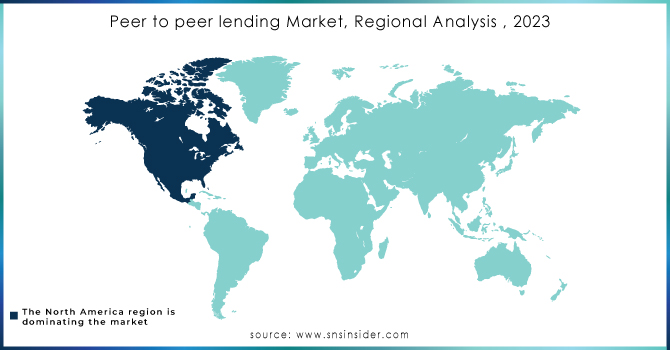

Regional Analysis

North America emerged as a leading region with more than 33% of revenue share in the year, 2023. As a result of the region already having an established financial ecosystem that was innovative and technology focused has allowed P2P lending portals to grow in popularity with both borrowers seeking funding solutions as well investors looking for higher returns. The widespread use of digital platforms in North America also means there is a large population comfortable with applying for loans and transferring money online, making P2P lending particularly popular. The region has been arguing for a relatively emerging regulatory framework, laying down the foundation needed for P2P lending platform growth.

On the other hand, Asia Pacific is anticipated to grow at a highest CAGR of 22% throughout the forecast period. The region is home to a large number of unbanked or underbanked, people with limited access to traditional financial services. With an alternative funding source available through P2P lending, the demand for credit has increased throughout the region. In addition, Asia Pacific is the world's fastest-growing economic region and a driving force for entrepreneurship as well small business development. With P2P lending platforms being another avenue that these businesses are using to access capital, the growth of P2P lending in turn is driven by business across this region.

KEY PLAYERS:

The major key players are Avant, LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree, LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance, Inc, Zopa Bank Limited.

Recent Developments

| Report Attributes | Details |

| Market Size in 2023 | USD 5.94 Bn |

| Market Size by 2032 | USD 30.54 Bn |

| CAGR | CAGR of 20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Consumer Lending, Business Lending) • By Loan Type (Secured, Unsecured) • By Purpose Type (Repaying Bank Debt, Family Celebration, Credit Card Recycling, Buying Car, Education, Home Renovation, Others) • By End-user (Non Business Loans, Business Loans) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avant, LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree, LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance, Inc, Zopa Bank Limited. |

| Key Drivers | • Growing need for alternative financing options, especially for individuals and small businesses that find it challenging to secure loans from traditional banks. • Innovations in digital platforms, advanced algorithms, and data analytics streamline the lending process, making P2P lending more efficient and accessible. |

| Market Opportunities | • Inconsistent or evolving regulations in different regions can pose challenges to the growth and operations of P2P lending platforms. |