Ammunition Handling Systems Market Report Scope & Overview:

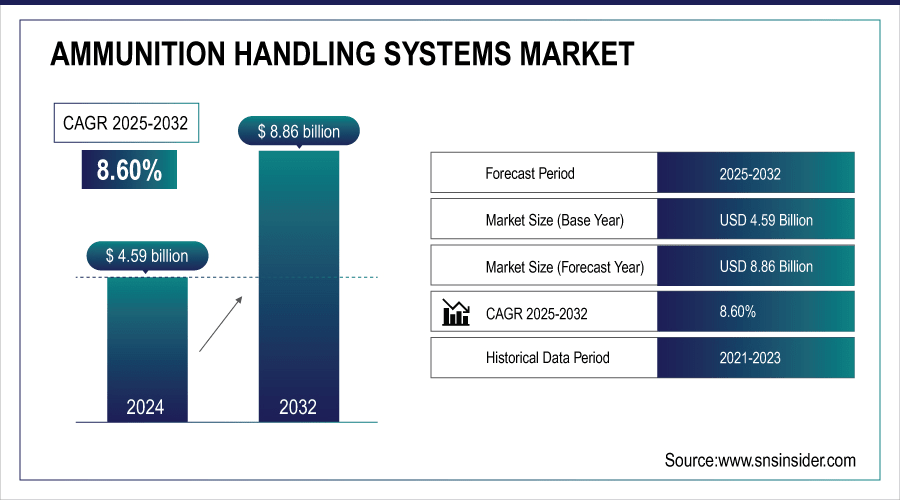

The Ammunition Handling Systems Market size was valued at USD 4.59 Billion in 2024 and is projected to reach USD 8.86 Billion by 2032, growing at a CAGR of 8.60% during 2025-2032.

The Ammunition Handling Systems (AHS) market is growing due to rising defense modernization programs, increasing demand for automation in military operations, and the need for rapid, safe, and efficient ammunition handling. Expansion of armored vehicles, artillery, naval, and airborne platforms, coupled with technological advancements in robotics, storage systems, and automated loaders, is further driving market adoption globally.

Rheinmetall inaugurated Europe's largest ammunition plant in Unterlüß, Germany, with an investment of EURO 500 million. The facility aims to produce 25,000 rounds in 2025, scaling up to 350,000 annually by 2027

To Get More Information On Ammunition Handling Systems Market - Request Free Sample Report

Key Ammunition Handling Systems Market Trends

-

Increasing defense modernization initiatives across land, naval, and airborne platforms.

-

Rising need for efficient, safe, and rapid ammunition handling.

-

Heightened defense spending due to geopolitical tensions in key regions.

-

Adoption of advanced automated and semi-automated handling systems.

-

Integration of AI and predictive maintenance technologies for innovation and cost reduction.

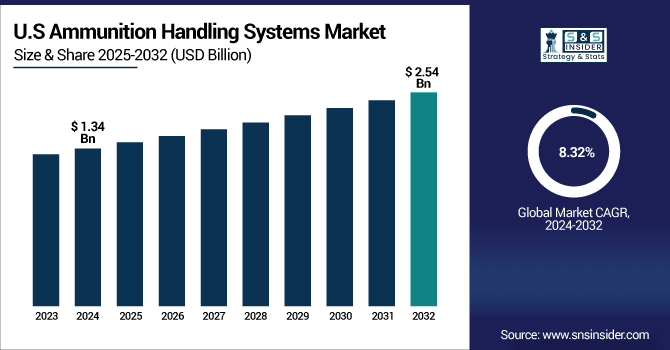

The U.S. Ammunition Handling Systems Market size was valued at USD 1.34 Billion in 2024 and is projected to reach USD 2.54 Billion by 2032, growing at a CAGR of 8.32% during 2025-2032. The U.S. Ammunition Handling Systems market is growing due to increased defense modernization programs, rising demand for automated and efficient ammunition handling, expansion of armored and airborne platforms, and strategic investments in advanced storage, loading, and robotic systems.

Ammunition Handling Systems Market Growth Drivers:

-

Defense Modernization and Advanced Technologies Propel Global Ammunition Handling Systems Market Growth and Adoption

The global Ammunition Handling Systems (AHS) market is primarily driven by increasing defense modernization initiatives and the rising need for efficient, safe, and rapid ammunition handling across land, naval, and airborne platforms. Growing geopolitical tensions and heightened defense spending in regions such as North America, Europe, and Asia Pacific are accelerating investments in advanced automated and semi-automated handling systems. Technological advancements in robotics, storage solutions, and loader mechanisms further enhance operational efficiency, reliability, and safety, making AHS indispensable for modern military applications.

Czechoslovak Group (CSG) reported revenues of EURO 2.8 billion in the first half of 2025, with an order backlog valued at €14 billion. The company attributes 68% of its sales to NATO countries, reflecting the heightened demand for ammunition

Ammunition Handling Systems Market Restraints:

-

Complex Integration and Regulatory Challenges Restrain Global Ammunition Handling Systems Market Growth and Deployment

The global Ammunition Handling Systems (AHS) market faces restraints due to complex integration requirements with existing military platforms, stringent safety and regulatory standards, and the need for highly skilled personnel to operate and maintain advanced automated systems. Additionally, challenges such as limited infrastructure in emerging regions, long development and testing cycles, and the risk of system malfunctions under combat conditions can slow adoption and deployment of new AHS technologies worldwide.

Ammunition Handling Systems Market Opportunities:

-

Emerging Economies and AI Integration Drive Ammunition Handling Systems Market Opportunities and Innovation Globally

Significant market opportunities exist in emerging economies where defense modernization is underway, as well as in developing automated solutions for legacy systems. The integration of AI and predictive maintenance technologies presents avenues for innovation, cost reduction, and improved system lifecycle management, attracting global defense contractors and technology providers.

In February 2024, Adani Defence & Aerospace announced a USD 362 million investment to establish two major ammunition and missile production facilities in Uttar Pradesh

Ammunition Handling Systems Market Segment Analysis

-

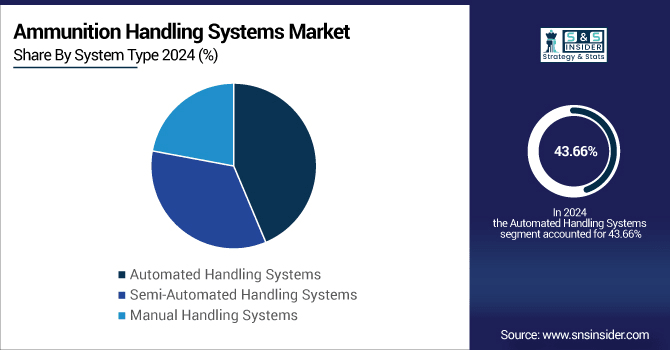

By System Type, Automated Handling Systems dominated the market in 2024 with a 43.66% share and is expected to register the fastest growth from 2025 to 2032.

-

By Component Type, Storage Systems dominated the market in 2024 with a 29.28% share, while Feeder is expected to achieve the fastest growth, registering a CAGR of 9.04% from 2025 to 2032.

-

By Weapon Type, Cannons dominated the market with a 29.76% share, while Main Guns are expected to register the fastest growth, with a CAGR of 9.20% from 2025 to 2032.

-

By Platform, Land Platforms dominated the market with a 51.52% share and are expected to achieve the fastest growth, registering a CAGR of 8.93% from 2025 to 2032.

By System Type, Automated Handling Systems Dominate Ammunition Handling Market While Advanced Robotics and AI Drive Rapid Growth

Automated Handling Systems dominated the Ammunition Handling Systems market in 2024 and are expected to grow at the fastest CAGR from 2025 to 2032. The market growth is driven by increasing defense modernization programs, rising demand for efficient and safe ammunition logistics, and the adoption of advanced technologies such as robotics and AI for handling operations. Growing defense budgets and the need for faster ammunition deployment are further fueling market expansion globally.

By Component Type, Storage Systems Lead Ammunition Handling Systems Market While Feeder Systems Achieve Fastest Growth Globally

Storage Systems dominated the Ammunition Handling Systems market with a 29.28% share in 2024, while Feeder systems, holding 9.04%, are expected to grow at the fastest CAGR from 2025 to 2032. The growth is driven by increasing demand for efficient ammunition storage and distribution solutions, advancements in automated handling technologies, and rising defense modernization programs. Enhanced safety, faster deployment, and streamlined logistics are further fueling adoption across global defense forces.

By Weapon Type, Cannons Dominate Ammunition Handling Systems Market While Main Guns Drive Rapid Growth and Advanced Innovation

Cannons dominated the Ammunition Handling Systems market with a 29.76% share in 2024, while Main Guns are expected to grow at the fastest CAGR of 9.20% from 2025 to 2032. The market growth is driven by increasing defense modernization programs, rising demand for advanced artillery systems, and technological innovations in firepower and accuracy. Growing military expenditure and the need for enhanced combat efficiency are further boosting adoption globally.

By Platform, Land Platforms Lead Ammunition Handling Systems Market with Rapid Growth and Advanced Technology Adoption

Land Platforms dominated the Ammunition Handling Systems market with a 51.52% share in 2024 and are expected to grow at the fastest CAGR of 8.93% from 2025 to 2032. The growth is driven by increasing investments in modern armored vehicles, rising defense modernization programs, and the adoption of advanced ammunition handling technologies. Enhanced operational efficiency, improved safety, and the need for rapid deployment are further fueling market expansion globally.

Ammunition Handling Systems Market Report Analysis

North America Ammunition Handling Systems Market Insights

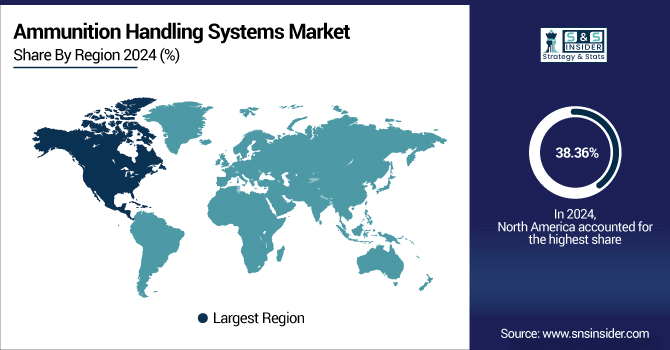

North America dominated the Ammunition Handling Systems market with a 38.36% share in 2024, driven by high defense spending, modernization of military equipment, and the adoption of advanced automated handling systems. The region’s focus on upgrading land, naval, and artillery platforms, coupled with technological innovations in storage, feeder, and cannon systems, is fueling market growth. Rising investments in defense infrastructure and strategic military programs further support the market expansion.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. America Ammunition Handling Systems Market Insights

The U.S. dominated the North American Ammunition Handling Systems market in 2024, owing to its largest defense budget, advanced military technology adoption, and extensive modernization programs across armed forces.

Asia Pacific Ammunition Handling Systems Market Insights

The Asia Pacific Ammunition Handling Systems market is expected to grow at the fastest CAGR of 9.31% from 2025 to 2032, driven by increasing defense modernization programs, rising military expenditure, and the adoption of advanced automated handling and storage technologies. Growing geopolitical tensions, expansion of armed forces, and investments in modern artillery, land, and naval platforms are further fueling market growth across the region.

China Ammunition Handling Systems Market Insights

China dominated the Asia Pacific Ammunition Handling Systems market in 2024, supported by its rapidly expanding defense budget, modernization of military platforms, and strategic initiatives to strengthen national defense capabilities.

Europe Ammunition Handling Systems Market Insights

The Europe Ammunition Handling Systems market is witnessing steady growth, driven by defense modernization initiatives, increasing adoption of automated handling technologies, and investments in advanced artillery, land, and naval platforms. Rising focus on improving operational efficiency, safety, and rapid ammunition deployment is boosting market demand. Technological advancements, coupled with growing defense budgets in key countries, are supporting the expansion of ammunition handling solutions across the European region.

Germany Ammunition Handling Systems Market Insights

The United Kingdom dominated the Europe Ammunition Handling Systems market in 2024, driven by substantial defense spending, modernization of military platforms, and adoption of advanced automated ammunition handling technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Ammunition Handling Systems Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Ammunition Handling Systems market is witnessing moderate growth, driven by increasing defense modernization programs, rising military expenditure, and the adoption of automated handling and storage solutions. Geopolitical tensions, investments in upgrading land, naval, and artillery platforms, and the focus on enhancing operational efficiency and safety are fueling demand. Growing procurement of advanced ammunition systems supports market expansion across these regions.

Competitive Landscape for Ammunition Handling Systems Market:

BAE Systems is a leading global defense contractor specializing in advanced ammunition handling systems. The company produces a full range of high-quality explosive and propellant products for the U.S. Department of Defense, Department of Energy, and commercial customers . Notably, BAE Systems has developed the Mk 45 Maritime Indirect Fire System, integrating a 5-inch, 62-caliber naval gun with a fully automated ammunition handling system, enhancing operational efficiency and safety for naval platforms

-

In September 2024, BAE Systems began integrating the Mk 45 naval gun system onto the HMS Glasgow, the first of eight Type 26 frigates being constructed for the UK Royal Navy.

General Dynamics Corporation is a prominent aerospace and defense conglomerate specializing in ammunition handling systems through its subsidiary, General Dynamics Ordnance and Tactical Systems (GD-OTS). GD-OTS designs and manufactures advanced munitions, weapon systems, and ammunition handling solutions for land, sea, and air platforms. The company is integral to modernizing defense capabilities, providing cutting-edge technologies to enhance operational efficiency and safety in military operations.

-

In September 2024, GD-OTS completed the divestiture of its EBV Munitions Services subsidiary, focusing on its core ammunition handling systems and related capabilities.

Ammunition Handling Systems Market Key Players:

Some of the Ammunition Handling Systems Market Companies

-

BAE Systems

-

General Dynamics Corporation

-

Curtiss-Wright Corporation

-

Dillon Aero, Inc.

-

Meggitt Defense Systems

-

Moog Inc.

-

Thales Group

-

GSI International, Inc.

-

McNally Industries

-

Nobles Worldwide, Inc.

-

Standard Armament Inc.

-

Calzoni S.p.A.

-

Lockheed Martin Corporation

-

Boeing Company

-

Raytheon Technologies Corporation

-

Northrop Grumman Corporation

-

Airbus Group

-

Leonardo S.p.A.

-

Rheinmetall AG

-

Hanwha Defense Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.59 Billion |

| Market Size by 2032 | USD 8.86 Billion |

| CAGR | CAGR of 8.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Automated Handling Systems, Semi-Automated Handling Systems, and Manual Handling Systems) • By Component Type (Feeder, Loader, Storage Systems, Drive Assembly, and Auxiliary Power Units (APU)) • By Weapon Type (Cannons, Gatling Guns, Machine Guns, Main Guns, and Launchers) • By Platform (Land Platforms, Naval Platforms, and Airborne Platforms) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BAE Systems, General Dynamics Corporation, Curtiss-Wright Corporation, Dillon Aero, Meggitt Defense Systems, Moog Inc., Thales Group, GSI International, McNally Industries, Nobles Worldwide, Standard Armament Inc., Calzoni S.p.A., Lockheed Martin Corporation, Boeing Company, Raytheon Technologies Corporation, Northrop Grumman Corporation, Airbus Group, Leonardo S.p.A., Rheinmetall AG, Hanwha Defense Corporation. |