INTEGRATED MARINE AUTOMATION SYSTEM MARKET REPORT SCOPE & OVERVIEW

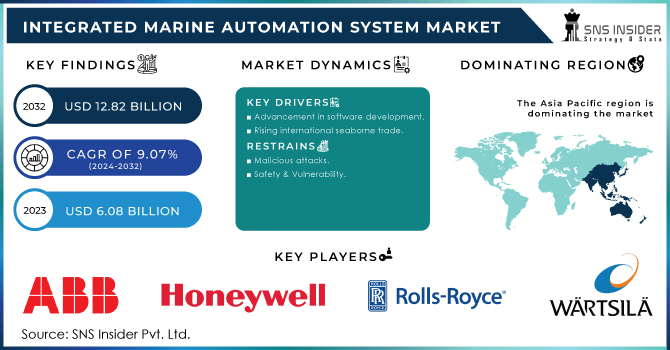

The Integrated Marine Automation System Market Size was valued at USD 5.55 Billion in 2023 and is expected to reach USD 12.24 Billion by 2032 and grow at a CAGR of 9.2% over the forecast period 2024-2032.

The Integrated Marine Automation System Market, is witnessing considerable growth due to advances in maritime technologies, the increased demand for operation efficiency, and the urgent necessity to upgrade safety standards for marine operations. IMAS encompasses a suite of technologies and systems designed to automate various functions onboard vessels, such as navigation, propulsion control, power management, and auxiliary machinery monitoring. This market is positioned for significant growth based on global economic recovery, increases in trade volumes, and the maritime industry's shift to greener, more efficient solutions.

The U.S. Government Accountability Office report offers valuable insights into automation trends in the maritime sector and has direct relevance to the IMAS market. Automation technologies are implemented in all top 10 U.S. container ports, with certain terminals reporting up to 30% improvements in operational efficiency. In addition, automated systems have contributed to a 15% reduction in emissions, aligning with global environmental goals. These statistics show the massive influence of automation on port operations and the demand for integrated systems that are both efficient and sustainable. Based on the survey, investment in terminal automation per facility ranges from USD 500 million to USD 1 billion on port automation. Operating costs are reduced by 25-55% with the help of these systems. Automated ports, however, experience productivity that is 7-15% lower than the traditional ones. The number of workplace incidents has also declined significantly with automation. Ports implementing new technologies like automated cranes and guided vehicles have become more efficient and scalable.

To get more information on Integrated Marine Automation System Market - Request Free Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Growing Need for Energy-Efficient Solutions Enhances Integrated Marine Automation System Market Growth

The increasing use of energy efficiency in the maritime industry is driving the application of Integrated Marine Automation Systems significantly. These systems help streamline vessel operations, reducing consumption of fuel and complying with global environmental regulations. They allow for real-time monitoring of energy and adaptive management, ensuring seamlessness in the integration of sustainable practices. This move to greener operations positions IMAS as a critical technology, enabling shipping companies to minimize ecological impacts while improving overall operation efficiency.

The research points out how artificial intelligence can be a factor in improving vessel operations, such as optimizing speed and fuel efficiency. Integrated Marine Automation Systems (IMAS) has been tested over 40,000 trips, spanning 450,000 nautical miles, demonstrating the ability to adapt to real-time environmental conditions. The AI-based solutions can mitigate the maritime industry's contribution of around 3% to global greenhouse gas emissions. Optimization of fuel consumption makes IMAS significant toward making the industry sustainable, thereby being a growth driver for the market.

-

Rapid Technological Advancements in Maritime Automation Drive Integrated Marine Automation System Market Expansion

Technological innovation is a critical driver in the growth of IMAS. These include AI, IoT, and robotics, which transform maritime automation by improving vessel performance and safety. Automation systems now support remote diagnostics, predictive maintenance, and autonomous navigation, thus ensuring efficiency and operational reliability. These innovations position IMAS as a transformative solution in modern shipping, responding to industry needs for intelligent, data-driven automation to streamline marine operations.

The article points out that with the advancement of AI and automation in maritime operations, there could be a reduction in the cost of operation by as much as 30%. Autonomous vessels, that is, vessels using these technologies are likely to reduce carbon emissions by 20% by taking efficient routes and consumption of fuel. The adoption of AI-powered technologies in shipping will also increase by 15% annually in the next five years. These innovations are driving the growth in Integrated Marine Automation Systems market as maritime companies strive to improve efficiency and meet environmental goals.

Need any customization research on Integrated Marine Automation System Market - Enquiry Now

RESTRAIN:

-

High Initial Investment Costs Restrain Integrated Marine Automation System Market Growth

Despite its advantages, the IMAS market is restricted owing to the high capital outlay for deployment. Capital outlay for equipment deployment is very high for any automation system, which again presents a challenge for budget-restricted operators. Consequently, this cost barrier directly hampers smaller enterprises from adopting the technology thereby impeding the growth of its market. This may probably require innovative pricing models or may require government-backed financial support toward greater implementation and growth for the IMAS technologies in question.

For instance, the IMAS system has supported more than 34,000 voyages with savings of around 2 million liters of fuel annually, but the lack of money remains the main barrier to entry. The smaller operators do not have the capital to invest in such kind of technology. Innovative funding solutions or government support plans may be needed to reach a higher level of financial accessibility to promote broader mass market adoption.

KEY MARKET SEGMENTS

BY SOLUTION

The Vessel Management System segment is anticipated to lead the IMAS market in terms of revenue share at 37% in 2023. It is primarily driven by increased investment in vessel performance monitoring, fuel efficiency, and safety management. For example, Wärtsilä and Kongsberg recently launched new solutions integrated into VMS platforms to facilitate real-time monitoring and predictive maintenance, thus further optimizing operations. An instance of this is Wärtsilä launching Smart Marine Ecosystem which offers more intelligent automation in managing a vessel, optimizing fuel usage while its service schedule.

The Power Management System segment in the IMAS market is expected to have the highest CAGR of 11.05% throughout the forecasted period, which is due to the increased necessity of optimized energy use and lowered operational costs for maritime vessels. Companies like ABB and Siemens have been able to leapfrog the industry by launching superior PMS solutions that would interface with automation systems that will help improve fuel efficiency and reduce emissions. Onboard DC Grid by ABB and energy management solutions of Siemens enable real-time power optimization, predictive maintenance, and general improvement in vessel performance.

BY SHIP TYPE

The Commercial segment is projected to lead the IMAS market, accounting for a revenue share of 45% in 2023. This is driven by the growing need for commercial vessels to introduce automated systems to optimize their operations, improve safety, and minimize fuel consumption. Such companies as Rolls-Royce and Wärtsilä are at the forefront of innovation in commercial vessel automation systems. For instance, Rolls-Royce's "Intelligent Awareness" system, integrates with existing vessel systems, enhancing navigation and operational efficiency.

The Defense segment of the IMAS market is expected to grow at the highest CAGR of 10.31% during the forecasted period, driven by the increasing need for advanced automation systems in military vessels. Companies such as Lockheed Martin and Thales are developing cutting-edge technologies for defense applications, including autonomous navigation systems and real-time monitoring solutions. These innovations improve operational efficiency, mission success, and security.

REGIONAL ANALYSIS

The Asia Pacific region dominated the market share of 38% for Integrated Marine Automation Systems in the year 2023 with significant maritime trade, high technological advancement, and rising trends of automation of shipping. China, Japan, and South Korea are countries where demand for energy efficiency and self-governed vessels has increased, leading to growth in shipbuilding industries in these regions. The region's estimated market share for IMAS will continue to be dominated because of the continued investment in maritime technologies, digitalization, and sustainability initiatives.

North America is expected to remain the highest-growing IMAS market in the next forecasted period 2024-2032 at a CAGR of 11.27%. Significant investments in advanced technology and regulations are followed mainly in such developed maritime industry countries, which include countries like the United States and Canada. As market demand for automation technologies offering efficiency, fuel savings, and environmental compliance in shipping continues to grow rapidly, the growth of IMAS solutions in North America accelerates with a focus on sustainability and the development of smart, energy-efficient vessels.

KEY PLAYERS

Some of the major players in the Integrated Marine Automation System Market are:

-

ABB (ABB Marine Control Systems, ABB Integrated Vessel Automation Systems)

-

Blue Ctrl AS (BlueBox Control System, BlueCtrl Automation System)

-

Emerson Electric Co. (DeltaV Distributed Control System, Marine Integrated Control Systems)

-

Wärtsilä (Wärtsilä Marine Automation System, Wärtsilä Integrated Power Management System)

-

Høglund AS (Høglund Integrated Automation System (IAS), Høglund Power Management System (PMS))

-

Honeywell International Inc. (Honeywell Marine Automation System, Honeywell Process Control Systems)

-

INGETEAM, S.A. (INGESYS Control System, INGETEAM PMS (Power Management System))

-

Jason Marine Group (JMC (Jason Marine Control) Automation Systems, JMC Vessel Monitoring System)

-

Kongsberg Gruppen ASA (Kongsberg Maritime Automation Systems, Kongsberg Vessel Performance and Energy Management System)

-

L3Harris Technologies, Inc. (L3Harris Integrated Navigation Systems, L3Harris Marine Automation and Control Solutions)

-

Moxa Inc. (Moxa Marine Automation Gateway, Moxa Industrial Networking Solutions for Marine Automation)

-

SEAM AS (SEAM Vessel Automation System, SEAM Energy Management Solutions)

-

Siemens AG (Siemens Marine Automation Systems, Siemens Ship Power Management System)

-

Thales Group (Thales Integrated Navigation Systems, Thales Marine Automation Control Solutions)

-

Ulstein Group ASA (Ulstein Integrated Control System, Ulstein Bridge System)

-

Rockwell Automation, Inc. (Rockwell Automation Marine Control Systems, Rockwell Process Automation Solutions for Marine)

-

General Electric Company (GE) (GE Marine Automation System, GE Digital Power Management Solutions)

-

Navis LLC (Navis N4 Terminal Operating System, Navis MACS3 Load Planning System)

-

Samsung Heavy Industries Co., Ltd. (Samsung Integrated Control Systems, Samsung Automation & Monitoring System)

-

Daewoo Shipbuilding & Marine Engineering Co., Ltd. (DSME) (DSME Integrated Ship Automation System, DSME Energy Management System)

RECENT TRENDS

-

In April 2024, ABB upgraded the Oranjeborg cargo vessel with integrated automation systems customized for efficiency, robust to future-proof for decades. This upgrade provides advanced control and automation, ensuring the vessel's operational reliability and environmental performance while protecting it from future regulations.

-

In December 2023, Wärtsilä supplied a full scope of automation and control systems for the new Chinese cruise Adora Magic City. These systems, such as navigation and engine control, improved efficiency and safety. This collaboration was a milestone in China's increasingly independent shipbuilding capabilities.

-

In July 2024, Emerson A development in marine automation, the use of advanced control systems enables significant safety, efficiency, and operational performance improvements across the maritime industry. This is part of a wider trend of moving towards smarter technologies to satisfy changing global standards.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 5.55 Billion |

|

Market Size by 2032 |

US$ 12.24 Billion |

|

CAGR |

CAGR of 9.2 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Ship Type (Commercial, Defense, Unmanned) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

ABB, Blue Ctrl AS, Emerson Electric Co., Høglund AS, Honeywell International Inc., INGETEAM, S.A., Jason Marine Group, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Moxa Inc., SEAM AS, Siemens AG, Thales Group, Ulstein Group ASA, Wärtsilä, Rockwell Automation, Inc., General Electric Company (GE), Navis LLC, Samsung Heavy Industries Co., Ltd., Daewoo Shipbuilding & Marine Engineering Co., Ltd. |

|

Key Drivers |

• Growing Need for Energy-Efficient Solutions Enhances Integrated Marine Automation System (IMAS) Market Growth |

|

Restraints |

• High Initial Investment Costs Restrain Integrated Marine Automation System (IMAS) Market Growth |