Anatomic Pathology Market Size & Trends:

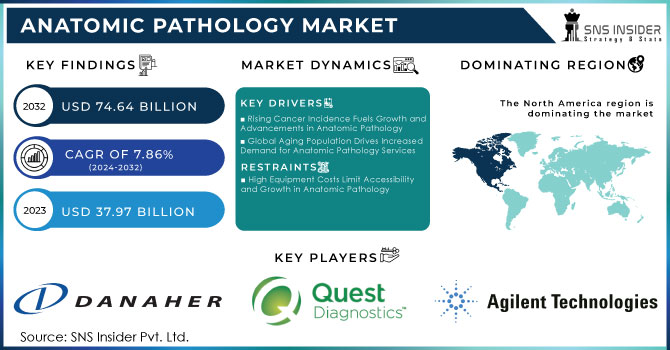

The Anatomic Pathology Market Size was valued at USD 37.97 billion in 2023 and is expected to reach USD 74.64 billion by 2032, growing at a CAGR of 7.86% from 2024-2032.

Get More Information on Anatomic Pathology Market - Request Sample Report

Anatomic pathology is growing rapidly because of the rising demand for advanced diagnostic techniques involving molecular pathology and personalized medicine. With 95% of clinical pathways being dependent upon access to pathology services, it becomes obvious how tissue analysis plays a critical role, especially when it is becoming progressively surmised that pathology will become more and more predominant in personalized treatments. This is again gigantic-500 million biochemistry and 130 million hematology tests per annum. As health care continues to shift to patient-centered care and an approach based on individual care, the increase in pathology is essential to maintain such advanced medical practices.

AI tools are speeding up diagnostics by boosting the accuracy of cancer cases and other complex diseases. More than 300,000 tests are conducted daily in the UK, and digital innovations are helping combat the volume. The global digital pathology market is expected to grow to USD 2.03 billion by 2027, and AI is greatly assisting in increasing accuracy while minimizing human error and optimizing workflow efficiency. This integration also leads to faster turnaround times and supports both healthcare providers and patients as 50 million lab reports are dispatched to GPs every year in the UK.

International efforts ensure that pathology services are enhanced in emerging markets and contribute to growth in this field. Another initiative that the CAP Foundation offers is the Global Pathology Development Grant. These grants are as much as USD 10,000 in funding for impactful global efforts. Another way improving global health is pushing pathology forward is in the increasing demand for advanced diagnostic services as healthcare systems in developing regions build. As many as 14 tests per year can be handled for the average citizen of England and Wales, and thus these expanded services underscore the important role pathology plays in contemporary healthcare locally and around the world.

Anatomic Pathology Market Dynamics

DRIVERS

-

Rising Cancer Incidence Fuels Growth and Advancements in Anatomic Pathology

The primary source of expansion for the anatomic pathology lab is the upsurge in cancer cases. In 2022, there were approximately 20 million new instances of cancer, and by 2050, it is expected to surpass 35 million due to population growth. The highest number of cases are accounted for by lung cancer at 2.5 million, followed by female breast cancer at 2.3 million cases, and colorectal cancer at 1.9 million cases. This increased diagnosis of cancer necessitates more pathology labs to service the early detection and personalized treatment provisions. The anatomic pathology labs transform with advancements in technologies as they handle complex, larger volumes of tests for rapid and accurate diagnoses. Increasingly important, this growth is precisely aimed at bringing down the rising healthcare burden of cancer and other critical diseases across the globe.

-

Global Aging Population Drives Increased Demand for Anatomic Pathology Services

The worldwide aging population is a major demand driver of anatomic pathology services because of the rise in the related diseases to age, which includes: cancer, cardiovascular conditions, and neurological disorders. The proportion of those 65 and older will increase more than double, from around 761 million in 2021 to nearly 1.6 billion in 2050. Most of that growth will take place in regions such as Northern Africa, Western Asia, and sub-Saharan Africa. The demographic transition is further accelerating the prevalence of chronic diseases, such as cardiovascular diseases, which contributed to 19.8 million deaths in 2022. Anatomic pathology, therefore, plays an important role in early diagnosis and management of these diseases. As the elderly population increases, pathology labs are expanding to meet increased demand for precise diagnostic services more so in age-related diseases. This is an important trend, with advanced diagnostic tools now being very much the basis for how health is managed for an aging global population.

RESTRAINTS

-

High Equipment Costs Limit Accessibility and Growth in Anatomic Pathology

Advanced technology and equipment pose an important constraint on the anatomic pathology market. Diagnostic tools such as digital pathology systems, molecular diagnostics, and AI-driven solutions require significant investment. For instance, a digital pathology scanner can vary from USD 12,000 to USD 72,000; a biochemistry analyzer can cost anywhere in the range of USD 4,800 to USD 30,000. With a microscope and histopathology instruments costing great amounts of money too, these are huge upfront costs for most labs, which makes things even worse. Therefore, they cannot afford to buy these cutting-edge diagnostic facilities, thereby increasing the disparity between resource-rich and resource-poor labs.

Anatomic Pathology Market Segmentation Analysis

BY APPLICATION

Disease diagnosis generated 58% of anatomic pathology market revenue in 2023, mainly due to the increasing demand to detect diseases early, which includes cancers, cardiovascular diseases, and infectious diseases. Such diseases need a microscopic view of tissues and biopsies that are mainly essential in diagnosing correctly. Increasing chronic disease prevalence has also made this the most important and massive segment of the pathology industry.

Drug discovery and development is anticipated to be growth-oriented with a CAGR of 8.88% in the forecast period from 2024 to 2032, led by the rising adoption of molecular pathology and genetic analysis which is a crucial part of drug target discovery, advancing precision medicine, and improving drug development processes. Such developments are furthering personalized and efficient therapeutic procedures, hence experiencing significant growth in this aspect.

BY PRODUCT

The consumables dominate in the anatomic pathology, which accounted for 69% of the market share in 2023 mainly due to a repeated requirement of reagents, slides, and staining kits. The consumables are required for regular day-to-day lab routines, making them sustain their demand in the pathology test. They are much less expensive than equipment and require repeated usage; hence, their percentage is very significant in the market.

Instruments are expected to grow at the highest CAGR of 8.98% from 2024 to 2032. Advancements in diagnostic technology such as digital pathology systems and high-throughput analyzers will be the driving factor in this segment. With an increasing demand for preciseness and automation by more pathology labs, the adoption of advanced instruments will be expedited and drive growth in the segment.

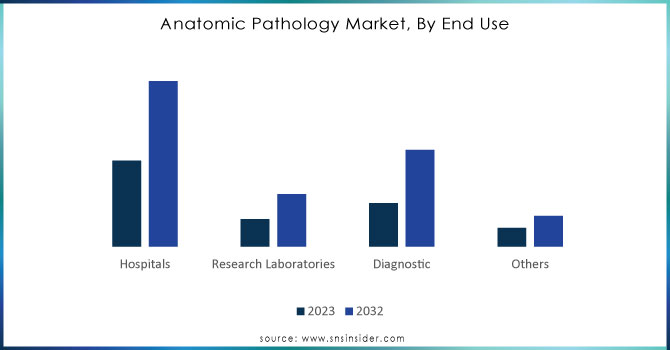

BY END USE

The anatomic pathology market was led by hospitals, with a share of 49% in 2023. The demand for high-volume procedure services is increasingly rising, especially in cancer diagnosis and complex disease management. It is primarily the hospitals that provide integrated diagnostic and treatment services, hence making them the core center for the pathology market.

The Diagnostic Laboratories segment is expected to witness the highest CAGR during the forecast period at 9.36%, with its growth being contributed by the increasing specialized diagnostic testing, growth in the laboratories services, and also increasing outpatient testing. Operational costs concerning diagnostic labs are lower when compared to hospitals. Therefore, several patients flocked to these diagnostic labs for precise and cost-effective diagnostic solutions.

Need Any Customization Research On Anatomic Pathology Market - Inquiry Now

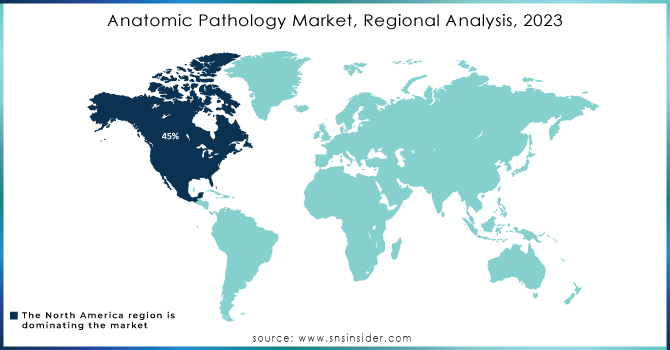

Anatomic Pathology Market Regional Insights

North America dominated the anatomic pathology market with 45% of revenue share in 2023, mainly due to its advanced healthcare system, high spending, and increasing necessity for diagnostic services. The requirement for proper diagnostic solution is critical as 1,958,310 new cancer cases and 609,820 cancer deaths are expected to occur in the U.S in 2023. The advanced medical infrastructure along with a high prevalence of diseases further cements its position in the pathology market.

Asia Pacific is likely to hold the highest CAGR of 8.52% during the forecast period from 2024 to 2032. The regional digital health market that touches a billion lives is on track to reach USD 100 billion by 2025 from USD 37 billion in 2020. Even so, its average Asian governments allocate only 4.5% of GDP to healthcare, much lower than the OECD average of 12%, thus capping the upside potential of healthcare growth. These factors combined with an aging population and growing awareness of disease contribute to the demand for anatomic pathology market in the region.

LATEST NEWS-

-

NYU Langone Health launched a digital pathology program in 2024, and it has phased out the old microscopes with high-definition images. This allows immediate sharing of these images across the hospital network, enhancing efficiency in the diseased diagnosis process.

-

In 2024, the Head of Pathology at Roche Diagnostics reported that the mission of Roche Diagnostics was to revolutionize cancer research by marrying their know-how in tissue diagnostics with cutting-edge AI innovations that will bring innovation to the field and shape the course of future cancer diagnostics and research.

Anatomic Pathology Market Key Players

-

Danaher Corporation (Leica Biosystems - Automated Slide Scanners, Tissue Stainers)

-

PHC Holdings Corporation (Epredia - Pathology Imaging Systems, Tissue Microarray Processors)

-

Quest Diagnostics (Ameripath - Molecular Diagnostic Kits, Cytology Reagents)

-

Laboratory Corporation of America Holdings (LabCorp Pathology - Immunohistochemistry Kits, Digital Pathology Software)

-

F. Hoffmann-La Roche AG (Ventana - Immunohistochemistry Stains, Automated Slide Stainers)

-

Agilent Technologies (SureScan - Digital Pathology Imaging, Nucleic Acid Extraction Kits)

-

Cardinal Health (Histology Lab Equipment, Diagnostic Reagents)

-

Sakura Finetek USA (Tissue Embedding Systems, Automated Slide Scanners)

-

NeoGenomics Laboratories (Genomic Testing Kits, Oncology Pathology Services)

-

BioGenex (Immunohistochemistry Reagents, Diagnostic Antibodies)

-

Mylan N.V. (Molecular Diagnostics Kits, Pathology Reagents)

-

Teva Pharmaceutical Industries (Oncology Pathology Services, Immunohistochemistry Reagents)

-

Sanofi (Cancer Diagnostic Kits, Pathology Testing Reagents)

-

Pfizer Inc. (Oncology Diagnostics, Biomarker Testing Reagents)

-

GlaxoSmithKline (Pathology Testing Kits, Cancer Biomarkers)

-

Novartis AG (Gene Expression Testing, Tumor Pathology Kits)

-

Bayer AG (Pathology Diagnostic Kits, Tumor Marker Assays)

-

Eli Lilly (Cancer Biomarker Testing, Molecular Diagnostics)

-

Merck & Co. (Pathology Testing Services, Genetic Testing Kits)

-

llergan (Cancer Diagnostics, Histology Staining Kits)

-

AstraZeneca (Oncology Pathology Kits, Diagnostic Antibodies)

-

Johnson & Johnson (Histology Lab Equipment, Molecular Diagnostic Solutions)

-

Cipla Inc. (Molecular Pathology Reagents, Cancer Diagnostics)

-

Bausch Health Companies (Histology Diagnostic Kits, Digital Pathology Solutions)

-

Abbott (Molecular Diagnostics, Cancer Detection Kits)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.97 Billion |

| Market Size by 2032 | USD 76.64 Billion |

| CAGR | CAGR of 7.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Services (Instruments, Consumables, Services) • By Application (Disease Diagnosis, Drug Discovery and Development, Others) • By End-use (Hospitals, Research Laboratories, Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher Corporation, PHC Holdings Corporation, Quest Diagnostics, Laboratory Corporation of America Holdings, F. Hoffmann-La Roche AG, Agilent Technologies, Cardinal Health, Sakura Finetek USA, NeoGenomics Laboratories, BioGenex, Mylan N.V., Teva Pharmaceutical Industries, Sanofi, Pfizer Inc., GlaxoSmithKline, Novartis AG, Bayer AG, Eli Lilly, Merck & Co., Allergan, AstraZeneca, Johnson & Johnson, Cipla Inc., Bausch Health Companies, Abbott |

| Key Drivers | • Rising Cancer Incidence Fuels Growth and Advancements in Anatomic Pathology • Global Aging Population Drives Increased Demand for Anatomic Pathology Services |

| RESTRAINTS | • High Equipment Costs Limit Accessibility and Growth in Anatomic Pathology |