Pathology Laboratories Market Report Scope & Overview:

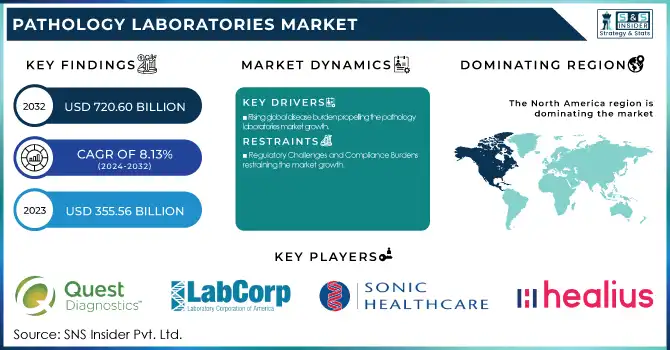

The Pathology Laboratories Market was valued at USD 355.56 billion in 2023 and is expected to reach USD 720.60 billion by 2032, growing at a CAGR of 8.13% from 2024-2032.

To Get more information on Pathology Laboratories Market - Request Free Sample Report

Pathology Laboratories Market report provides valuable insights into utilization rates, examining the diagnostic tests conducted in 2023 and their availability across healthcare facilities. It offers a regional segmentation of test type trends, emphasizing differences in demand for general, imaging, and esoteric tests. The report root into growth in laboratory volumes between 2020 and 2032, highlighting trends in hospital-based, freestanding, and diagnostic chain laboratories. The report also provides an in-depth examination of healthcare expenditures on diagnostic testing, dividing spending into government, commercial, private, and out-of-pocket sources, providing a broad perspective on financial dynamics within the industry.

Pathology Laboratories Market dynamics

Drivers

-

Rising global disease burden propelling the pathology laboratories market growth.

The rising incidence of chronic conditions like cancer, infectious diseases, and metabolic disorders is a major growth driver for the pathology laboratories market. With these health conditions increasing in prevalence, the need for efficient and accurate diagnostic services increases, and this, in turn, increases the utilization of pathology laboratories. The growth captures the growing demand for diagnostic services to control the upsurge in the incidence of chronic diseases. Recent additions, including the inauguration of new laboratories by Redcliffe Labs in New Delhi in August 2024, further illustrate the sector's reaction to such growing demand. Moreover, technological advancements in molecular diagnostics and biomarker-based tests are enhancing the detection of diseases at an early stage, boosting patient outcomes, and propelling further growth in pathology services.

-

Technological advancements in diagnostic services accelerated the pathology laboratory market.

Progress in diagnostic technologies, most notably the convergence of artificial intelligence (AI) and digital pathology, is driving the pathology laboratories market. These technologies improve the accuracy, efficiency, and pace of disease diagnosis. For instance, in May 2024, Quest Diagnostics joined forces with PathAI to expand the adoption of AI-assisted digital pathology solutions to enhance diagnostic accuracy and operational effectiveness. In the same vein, Sonic Healthcare's PathologyWatch launched an integrated digital pathology platform in March 2024, transforming dermatopathology reporting with AI-powered tools. These advances not only enhance patient outcomes but also overcome issues like the worldwide shortage of pathologists by boosting productivity and diagnostic capacity.

Restraint

-

Regulatory Challenges and Compliance Burdens restraining the market growth.

The pathology laboratories market is confronted with major challenges in the form of strict regulatory norms and changing compliance standards. Laboratories have to comply with numerous national and international regulations, including CLIA (Clinical Laboratory Improvement Amendments) in the United States and ISO 15189 accreditation for medical laboratories across the globe. Compliance with these regulations requires huge investments in quality assurance, infrastructure, and training of personnel, which raises the cost of operations. The U.S. Food and Drug Administration (FDA) has been imposing more stringent regulations on laboratory-developed tests (LDTs) recently, creating industry concerns. In August 2024, a large American medical association filed a lawsuit against the FDA to prevent new regulations for LDTs, citing mounting tensions between regulators and laboratories. Such compliance obstacles can hamper innovation and stifle market expansion, especially for small diagnostic laboratories.

Opportunities

-

The growing adoption of personalized and precision medicine presents a significant opportunity for the pathology laboratories market.

The increasing uptake of precision and personalized medicine creates a major opportunity for the pathology laboratories industry. Improvements in genomic and molecular diagnostics are making it possible to treat, more specifically, pushing demand for specialized pathology services. As healthcare moves more towards individualized therapy regimens, pathology laboratories are at the forefront of genetic marker analysis, disease progression prediction, and therapy choice guidance. For example, the greater adoption of next-generation sequencing (NGS) in cancer oncology has augmented early cancer diagnosis and personalized therapy. Furthermore, partnerships between pharma and diagnostics companies are fueling the evolution of companion diagnostics, further fueling market opportunities. As there is ongoing advancement in biomarker discovery and AI-driven pathology, laboratories stand ready to leverage this emerging healthcare trend.

Challenges

-

A critical challenge facing the pathology laboratories market is the global shortage of skilled pathologists and laboratory technicians.

A key challenge to the pathology laboratories market is the worldwide shortage of skilled pathologists and laboratory technicians. An increasing need for diagnostic testing, combined with an aging workforce, has created staffing shortages that affect laboratory efficiency and turnaround time. It has been reported that in certain areas, a single pathologist may review thousands of cases in a year, which could create possible delays in diagnosis and added pressure on workload. This problem is especially common in rural and underserved communities where specialized diagnostic services are not readily available. Although digital pathology and AI-based diagnostics are alleviating this problem, the demand for highly skilled professionals is still critical. To solve this shortage, more investment needs to be made in education, training initiatives, and workforce retention.

Pathology Laboratories Market Segmentation Insights

By Type

The hospital-based segment dominated the pathology laboratories market in 2023 with a 53.65% market share because of the extensive diagnostic services provided in hospitals, providing fast and precise disease diagnosis for inpatients and outpatients. Hospitals possess well-equipped pathology laboratories combined with sophisticated imaging and molecular diagnostic technologies, which facilitate smooth workflow between clinicians and laboratory staff. Further, hospital laboratories perform large volumes of significant tests, such as emergency and specialty diagnostic services, which are required in disease management and treatment planning. Skilled pathologists on board, reduced turnaround times, and the capability to carry out intricate testing procedures also enhanced the segment's leadership. Further, hospitals are supported with government funding and insurance reimbursement, thereby making pathology services highly accessible across the country and upholding their market leadership.

The diagnostic chains segment will experience the fastest growth in forecast years with growing demand for high-quality and cost-efficient specialist diagnostic services away from hospital locations. Diagnostic chains like Quest Diagnostics and Sonic Healthcare are growing their networks with several collection centers and regional labs, thus offering pathology services to patients. The increasing need for home-based sample collection and integration of digital health is also propelling the growth of the segment. Moreover, diagnostic chains utilize sophisticated automation, AI-based diagnostics, and centralized processing centers, which provide high efficiency and standardized testing across geographies. The increasing incidence of chronic diseases, growing awareness of preventive healthcare, and strategic collaborations with healthcare providers are likely to drive the aggressive growth of diagnostic chains in the future.

By Testing Services

The General Physiological & Clinical Tests segment dominated the pathology laboratories market with a 38.15% market share in 2023 because of the increased demand for routine diagnostic tests employed for disease screening, monitoring, and preventive care. Tests such as blood tests, urine tests, liver function tests, and complete blood count (CBC) are commonly prescribed by doctors to examine overall health and identify prevalent diseases like diabetes, anemia, and infections. The mounting incidence of chronic diseases and the increasing focus on early disease diagnosis have further increased the demand for these tests. Moreover, these diagnostic services are easily accessible through hospitals, diagnostic chains, and independent labs, covering a huge patient base. Government schemes focusing on routine health check-ups and preventive care have also fueled the dominance of the segment.

The Esoteric Tests segment is anticipated to witness the fastest growth in the forecast period with a 9.73% CAGR on account of the increasing uptake of specialized and sophisticated diagnostic methods for rare and complex diseases. Such tests, such as genetic testing, molecular diagnostics, and biomarker analysis, are becoming increasingly popular as precision medicine and targeted therapies gain traction. The growing prevalence of cancer, autoimmune diseases, and infectious illnesses has contributed to the demand for high-complexity testing capable of yielding greater insight into disease processes. Moreover, developments in next-generation sequencing (NGS) and liquid biopsy technologies are transforming personalized diagnostics, contributing significantly to market expansion. The growth of reference laboratories with expertise in esoteric testing and partnerships among biotech companies and pathology labs are likely to drive the use of these high-value diagnostic services in the future.

By End-Use

The Physician Referrals segment dominated the pathology laboratories market with a 53.41% market share in 2023 because physicians ordered a very large number of diagnostic tests to diagnose diseases, monitor treatment, and provide preventive care. Doctors are important guides for patients on the way toward required laboratory exams, allowing appropriate and timely diagnostics of many sicknesses as the majority of pathology tests are ordered based on clinical assessment, hospitals and private clinics partner with pathology labs to ensure smooth testing services. Moreover, the growing incidence of chronic conditions like diabetes, cardiovascular diseases, and cancer has also fueled the demand for physician-referred diagnostic tests. Insurance claims and medical policies covering physician-ordered tests have also bolstered this segment's leadership by enhancing patient access to critical diagnostic services.

The Corporate segment is expected to witness the fastest growth in the forecast period with a 9.15% CAGR as a result of increasing focus on employee health and wellness programs. Companies are investing in preventive healthcare programs by collaborating with diagnostic laboratories to provide routine health checks, such as blood tests, cardiovascular evaluation, and cancer screening. Growing corporate knowledge of workplace health and the economic payback of early disease diagnosis has motivated companies to add pathology testing as part of employee benefit programs. Tax incentives and government legislation encouraging occupational health are also propelling companies to adopt diagnostic services. The increasing trend of corporate alliances with diagnostic chains and the incorporation of digital health solutions for remote screening is likely to further drive the growth of this segment during the forecast years.

Pathology Laboratories Market Regional Analysis

North America dominated the pathology laboratories market with a 38.25% market share in 2023 by its well-developed healthcare infrastructure, high rate of uptake of sophisticated diagnostic technologies, and high density of leading market players. The region is characterized by a high incidence of chronic diseases like cancer, cardiovascular diseases, and infectious diseases, and this boosts the requirement for diagnostic testing. Moreover, government programs and healthcare policies, including Medicare and Medicaid reimbursement schemes, facilitate mass access to pathology services. The presence of prominent diagnostic firms, including Quest Diagnostics, Laboratory Corporation of America (LabCorp), and Thermo Fisher Scientific, also consolidates North America's market leadership. Furthermore, continuous developments in digital pathology, AI-driven diagnostics, and automation have enhanced efficiency and precision in laboratory work, solidifying the region's dominance.

Asia Pacific is the fastest-growing region in the pathology laboratories market throughout the forecast period, with a 9.28% CAGR, supported by rising healthcare expenditure, expanding disease burden, and enhanced diagnostic facilities. Urbanization, aging demographics, and growing awareness of detecting diseases at early stages have triggered demand for pathology services in markets such as China, India, and Japan. Government programs that aim to expand healthcare access, including India's Ayushman Bharat program and China's health reforms, are also propelling market growth. Moreover, growth in private diagnostic labs and high uptake of AI-based digital pathology solutions are redefining the diagnostic landscape in the region. The increasing numbers of international lab service providers and partnerships with domestic healthcare organizations are also driving fast growth in pathology services in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Pathology Laboratories Market

-

Quest Diagnostics (Comprehensive Metabolic Panel, QuestDirect COVID-19 Active Infection Test)

-

Laboratory Corporation of America (LabCorp) (Pixel by LabCorp At-Home Kits, Oncology Diagnostic Services)

-

Sonic Healthcare (Clinical Laboratory Testing Services, Anatomical Pathology Services)

-

Healius Limited (Pathology Testing Services, Genomic Diagnostics)

-

Australian Clinical Labs (Routine Blood Tests, Histopathology Services)

-

Abbott Laboratories (ARCHITECT c4000 Clinical Chemistry Analyzer, Alinity m Molecular Diagnostics System)

-

Siemens Healthineers (ADVIA Centaur XP Immunoassay System, Atellica Solution Immunoassay & Clinical Chemistry Analyzers)

-

Roche Diagnostics (cobas 8000 Modular Analyzer Series, Ventana BenchMark ULTRA IHC/ISH System)

-

Thermo Fisher Scientific (Phadia 250 Allergy Testing System, Ion Torrent Genexus System)

-

Danaher Corporation (Leica Biosystems Pathology Imaging Solutions, Beckman Coulter DxH 900 Hematology Analyzer)

-

PerkinElmer Inc. (Vectra Polaris Automated Quantitative Pathology Imaging System, EnVision Multimode Plate Reader)

-

Sysmex Corporation (XN-Series Hematology Analyzers, DI-60 Digital Image Analyzer)

-

Bio-Rad Laboratories, Inc. (QX200 Droplet Digital PCR System, BioPlex 2200 Multiplex Immunoassay System)

-

Beckman Coulter (AU5800 Series Clinical Chemistry Analyzers, DxI 800 Immunoassay System)

-

Applied Spectral Imaging (HiPath Pro, PathFusion)

-

Clarapath (Automated Microtomy Solutions, Digital Pathology Platforms)

-

HistoWiz (Automated Histology Services, Digital Slide Scanning)

-

Babson Diagnostics (Small-Volume Blood Collection Device, Sample Handling Machine)

-

Truvian Health (Easy Check COVID-19 Test Kit, Point-of-Care Blood Testing System)

-

INHECO Industrial Heating & Cooling GmbH (Thermoshake AC, Thermoshake Classic)

Suppliers (These suppliers provide a range of products and services essential for the efficient operation of pathology laboratories, contributing to advancements in diagnostic capabilities and patient care.)

-

Medline Industries

-

USA Lab Equipment

-

MFI Medical

-

Naugra Export

-

Hospital Laboratory India

-

S.V. Scientific Centre

-

Leica Biosystems

-

Ventana Medical Systems

-

Midland Scientific

-

Antylia Scientific

Recent Development

-

In May 2024, Quest Diagnostics, a healthcare testing company providing diagnostic information services, introduced a strategic alliance with PathAI, a renowned world leader in pathology technology backed by artificial intelligence. The new collaboration is established with the target to speed up digital and AI technology adoption within pathology, providing increased quality, efficiency, and faster diagnosis of cancer and other illnesses.

-

March 2024 – Sonic Healthcare's PathologyWatch has launched an advanced, fully integrated digital pathology platform dedicated to skin pathology. Utilizing its proprietary 'dot.' (dermatopathology optimization tool), the platform combines a laboratory information system, digital pathology viewer, image storage, and AI-driven algorithms. This new system improves dermatopathology reporting, offering an optimized experience for both pathologists and referring physicians.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 355.56 Billion |

| Market Size by 2032 | US$ 720.60 Billion |

| CAGR | CAGR of 8.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hospital-based, Standalone Labs, Diagnostic Chains) • By Testing Services (General Physiological & Clinical Tests, Imaging & Radiology Tests, Esoteric Tests, COVID-19 Tests) • By End-Use (Physician Referrals, Walk-ins, Corporate) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quest Diagnostics, Laboratory Corporation of America (LabCorp), Sonic Healthcare, Healius Limited, Australian Clinical Labs, Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Thermo Fisher Scientific, Danaher Corporation, PerkinElmer Inc., Sysmex Corporation, Bio-Rad Laboratories, Beckman Coulter, Applied Spectral Imaging, Clarapath, HistoWiz, Babson Diagnostics, Truvian Health, INHECO Industrial Heating & Cooling GmbH, and other players. |