Animal Wound Care Market Report Scope & Overview:

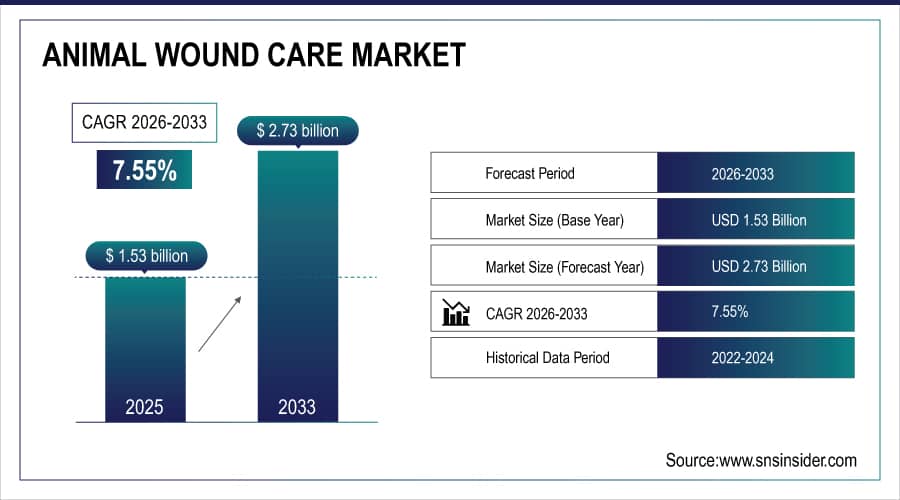

The Animal Wound Care Market size is estimated at USD 1.53 billion in 2025 and is expected to reach USD 2.73 billion by 2033, growing at a CAGR of 7.55% over the forecast period of 2026-2033.

The global animal wound care market trend is rising prevalence of animal injuries, surgical procedures, and chronic wounds across companion and livestock animals, driven by increasing pet ownership, advanced veterinary care, and growing awareness about animal health management. Innovations in advanced wound dressings, tissue adhesives, and therapy devices are transforming treatment protocols, while the expansion of veterinary infrastructure and e-commerce platforms is improving accessibility to specialized wound care products globally.

For instance, in April 2024, increased pet ownership and veterinary surgical procedures drove a 12% increase in demand for advanced wound care products in North America, accelerating adoption of foam dressings and tissue adhesives.

Animal Wound Care Market Size and Forecast:

-

Market Size in 2025E: USD 1.53 billion

-

Market Size by 2033: USD 2.73 billion

-

CAGR: 7.55% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Animal Wound Care Market - Request Free Sample Report

Animal Wound Care Market Trends:

-

Growing incidence of traumatic injuries, post-surgical wounds, and chronic conditions in companion and livestock animals is driving demand for effective wound management solutions.

-

Development of species-specific wound care products tailored to dogs, cats, horses, and livestock based on wound type, size, and healing requirements for optimal outcomes.

-

Introduction of antimicrobial dressings, bioactive materials, negative pressure wound therapy, and regenerative medicine to accelerate healing and reduce infection rates.

-

Use of telemedicine platforms, mobile apps, and AI-based diagnostic tools for remote wound assessment, treatment planning, and monitoring by veterinary professionals.

-

Growth in demand for easy-to-apply dressings, bandages, and therapy devices suitable for home administration, enhancing convenience for pet owners and livestock managers.

-

Partnerships between veterinary product manufacturers, research institutions, and animal health companies to develop innovative wound care technologies and expand clinical applications.

-

FDA, EMA, and veterinary regulatory bodies promoting standardized guidelines for product safety, efficacy testing, and quality control while encouraging education on proper wound management practices.

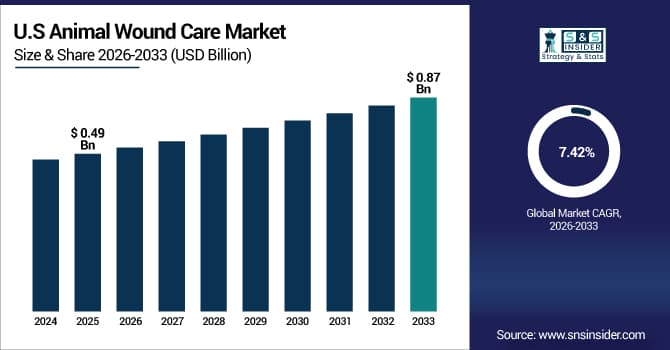

The U.S. Animal Wound Care Market is estimated at USD 0.49 billion in 2025 and is expected to reach USD 0.87 billion by 2033, growing at a CAGR of 7.42% from 2026-2033.

The U.S. has the biggest market share due to increasing pet ownership, the veterinary healthcare system is so advanced, and people spend a lot of money on pet care. The market is growing as surgical and sophisticated wound care products are widely available, more people are going to veterinary hospitals, and new therapeutic devices are being used more and more. The U.S. is also the largest regional market globally due to regulatory support and the early use of digital veterinary platforms.

Animal Wound Care Market Growth Drivers:

-

Rising Pet Ownership and Veterinary Spending is Driving the Animal Wound Care Market Growth

Increasing pet ownership and veterinary healthcare expenditure serve as primary growth drivers for the animal wound care market share, fueled by humanization of pets, growing awareness of animal welfare, and willingness to invest in advanced medical treatments. This trend is expanding demand for surgical wound care products, advanced dressings, and therapy devices across veterinary hospitals, clinics, and homecare settings, thereby strengthening overall market penetration and revenue generation worldwide.

For instance, in May 2025, companion animal wound care products accounted for ~64% of total the U.S. veterinary wound management sales, reflecting strong pet owner engagement and expanding market share.

Animal Wound Care Market Restraints:

-

High Treatment Costs and Limited Veterinary Access are Hampering the Animal Wound Care Market Growth

The animal wound care industry is not growing as fast as it should since modern wound care products and therapy devices are expensive and there aren't many specialized veterinary facilities in rural and developing areas. Many people who own livestock or pets in places that don't have enough services use traditional wound care methods or put off getting expert help because they can't afford it. This leads to poor wound care, more complications, and slower market growth in areas where prices are sensitive and infrastructure is inadequate.

Animal Wound Care Market Opportunities:

-

E-commerce and Telehealth Expansion Drive Future Growth Opportunities for the Animal Wound Care Market

Online veterinarian consultation platforms, mobile health apps, and direct-to-consumer distribution channels are all ways that e-commerce and telehealth might work together in the animal wound care sector. These tools make it possible to analyze wounds from a distance, suggest specific products, and easily distribute wound care supplies to homes. These technologies can improve healing outcomes, lower problems, and greatly expand market reach by making treatments more accessible, speeding up treatment times, and making owners more likely to follow through, especially in rural and underserved locations.

For instance, in June 2024, the American Veterinary Medical Association reported that 38% of U.S. households owned dogs requiring post-surgical or injury-related wound care, highlighting growing demand and market potential.

Animal Wound Care Market Segment Analysis:

-

By product, advanced wound care products held the largest share of around 41.28% in 2025E, and is expected to register the highest growth with a CAGR of 7.89%.

-

By animal type, companion animal segment dominated the market with approximately 67.32% share in 2025E, while livestock animal is expected to register strong growth with a CAGR of 7.21%.

-

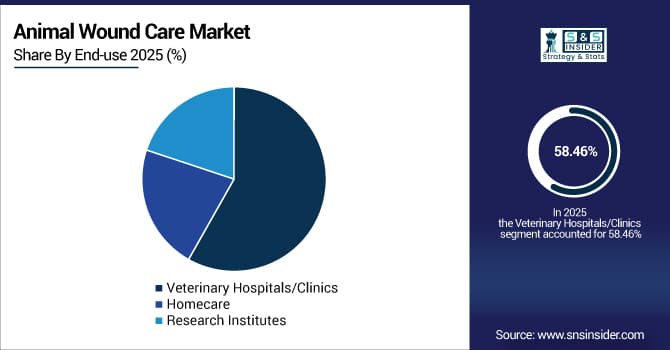

By end use, veterinary hospitals/clinics accounted for the leading share of nearly 58.46% in 2025E, and homecare is expected to register the highest growth with a CAGR of 8.12%.

-

By distribution channel, veterinary hospitals/clinics led the market with about 52.37% share in 2025E, while e-commerce segment is forecasted to grow the fastest at a CAGR of 8.64%.

By Product, Advanced Wound Care Products Lead the Market and Register Fastest Growth

The advanced wound care products segment accounted for the highest revenue share of approximately 41.28% in 2025, owing to superior healing properties, infection control capabilities, and suitability for complex and chronic wounds in companion and livestock animals. Growing adoption is driven by increasing surgical procedures, traumatic injuries, and veterinarian preference for foam dressings, hydrocolloid dressings, and hydrogel formulations.

Furthermore, this segment is anticipated to achieve the highest CAGR of nearly 7.89% during the 2026–2033 period, driven by continuous innovation in antimicrobial materials, moisture management technologies, and bioactive wound healing solutions that reduce recovery time and improve clinical outcomes.

By Animal Type, Companion Animal Segment Dominates, while Livestock Animal Shows Steady Growth

The companion animal segment held the largest revenue share of approximately 67.32% in 2025, owing to high pet ownership rates, increased veterinary care utilization, and strong emotional bonding between owners and pets driving willingness to invest in advanced wound management. Key factors include rising surgical interventions in dogs, cats, and horses, alongside growing awareness of proper wound care protocols among pet owners and veterinary professionals.

The livestock animal segment is predicted to grow at a solid CAGR of approximately 7.21% during 2026–2033, driven by increasing focus on animal productivity, welfare standards in commercial farming, and prevention of infection-related losses. Contributing factors include expansion of livestock populations, modernization of farm management practices, and growing recognition of economic benefits from proper wound care in cattle, poultry, and swine.

By End-Use, Veterinary Hospitals/Clinics Lead, While Homecare Registers Fastest Growth

Veterinary hospitals/clinics accounted for the largest share of the animal wound care market with about 58.46% in 2025, owing to their role as primary providers of surgical procedures, emergency trauma care, and professional wound management services. Growth drivers include increasing veterinary facility infrastructure, availability of advanced wound care products and therapy devices, and pet owner preference for professional medical supervision during critical healing phases.

The homecare segment is slated to grow at the fastest rate with a CAGR of around 8.12% throughout the forecast period of 2026–2033, as pet owners increasingly manage post-operative care and minor wound treatment at home using easy-to-apply dressings and bandages. Rising veterinary guidance for at-home wound monitoring, cost considerations, and availability of user-friendly products through retail and e-commerce channels are accelerating adoption of homecare wound management solutions.

By Distribution Channel, Veterinary Hospitals/Clinics Lead, While E-commerce Segment Grows the Fastest

Veterinary hospitals/clinics held the largest revenue share of around 52.37% in the animal wound care market in 2025, as they serve as trusted sources for prescription wound care products, professional-grade dressings, and therapy devices. Key drivers include direct veterinarian recommendations, immediate product availability during treatment, and integrated care delivery that ensures proper wound management protocols.

The e-commerce segment, however, is projected to register the highest CAGR of around 8.64% during the forecast period of 2026-2033, owing to increasing online shopping convenience, competitive pricing, and expanding product selection for pet owners and livestock managers. Factors include growing digital literacy among consumers, subscription-based delivery services for recurring wound care needs, and improved logistics networks enabling faster product delivery to remote and rural areas.

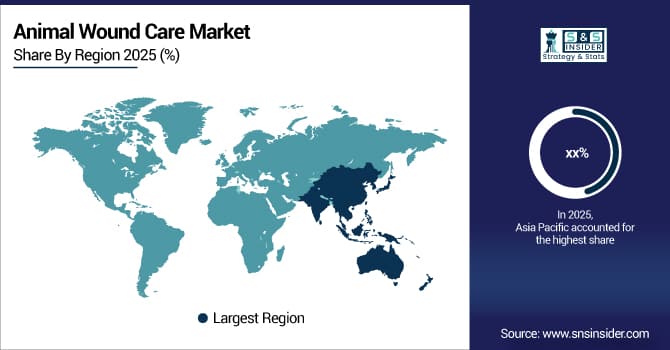

Animal Wound Care Market Regional Highlights:

Asia Pacific Animal Wound Care Market Insights:

Asia Pacific is the fastest-growing region of the animal wound care market, with a CAGR of 8.23%. This is because more people are becoming aware of the health of their pets, veterinary services, and how to care for livestock wounds. Market growth is being driven by things like more people living in cities, more people owning pets, the use of both new and old wound care products, and the growth of online shopping and telemedicine platforms. Government programs, campaigns to educate veterinarians, and reduced treatment costs compared to Western markets all help with early detection and treatment, as well as making surgical and sophisticated wound care options more available in the area.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Animal Wound Care Market Insights:

In 2025, North America had the largest animal wound care market share of around 38.52% due to a high number of pet owners, improved veterinary infrastructure, and a great awareness of animal health. Easy access to surgical and advanced wound care products, high diagnostic rates, strong pet insurance, and the use of new foam dressings and antimicrobial medicines all help the market thrive. The region's market dominance is also strengthened by government programs, early intervention programs, and increased spending on pet health care.

Europe Animal Wound Care Market Insights:

Europe is the second-largest market for animal wound care after North America as more pets are getting hurt, more surgeries are being done, there is a strong veterinary infrastructure, and pet owners are becoming more aware of the issue. The industry is also growing because of more usage of both traditional and sophisticated therapies, better diagnostics, better reimbursements, and government programs to help animals.

Latin America (LATAM) and Middle East & Africa (MEA) Animal Wound Care Market Insights:

In Latin America and the Middle East & Africa, rising animal injuries, greater veterinary awareness, and access to wound care products are driving the animal wound care market. Growing use of traditional and advanced products, telemedicine services, urban pet ownership, and higher disposable incomes further support market growth.

Animal Wound Care Market Competitive Landscape:

3M Company (est. 1902) is a global diversified technology and healthcare leader that focuses on developing innovative solutions for veterinary wound management. It uses its R&D capabilities and material science expertise to produce cutting-edge animal wound care products with enhanced healing outcomes.

-

In January 2025, it expanded its veterinary product portfolio with a new antimicrobial foam dressing specifically designed for companion animals, featuring rapid absorption and extended wear time for improved healing and reduced infection rates.

Zoetis Inc. (est. 2013) is a well-known global animal health company focused on veterinary medicines, vaccines, and diagnostics. It invests in advanced wound care technologies and surgical products with the hopes of revolutionizing the treatment of animal injuries with effective, safe, and species-specific therapies.

-

In March 2024, launched a comprehensive wound care kit for equine injuries in North America, combining advanced hydrocolloid dressings with antimicrobial agents, enhancing accessibility, treatment efficacy, and veterinarian confidence in managing complex horse wounds.

Virbac (est. 1968) is a global veterinary pharmaceutical enterprise specializing in animal health solutions. The company's wound care product portfolio focuses on companion and livestock animals, particularly surgical and advanced wound management, and features a strong R&D innovation pipeline to complement the strong market presence in both emerging and developed markets.

-

In November 2024, received European regulatory approval for a new bioactive hydrogel dressing targeting chronic wounds in dogs and cats, strengthening its companion animal portfolio and expanding treatment availability across European veterinary markets.

Animal Wound Care Market Key Players:

-

3M Company

-

B. Braun Melsungen AG

-

Ethicon Inc. (Johnson & Johnson)

-

Medtronic plc

-

Virbac

-

Zoetis Inc.

-

Neogen Corporation

-

Jorgen Kruuse A/S

-

Sonoma Pharmaceuticals Inc.

-

Acelity L.P. Inc. (KCI)

-

Advancis Veterinary Ltd

-

Animal Medics

-

Bayer AG (Animal Health Division)

-

Bioseal Inc.

-

Boehringer Ingelheim Animal Health

-

Coloplast A/S

-

Dermavet Pty Ltd

-

Elanco Animal Health

-

Indian Immunologicals Ltd

-

Innovacyn Inc.

-

McCue Veterinary Supply

-

Millpledge Veterinary

-

Puracyn Animal Health

-

Robinson Healthcare Ltd

-

Vetoquinol S.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.53 Billion |

| Market Size by 2033 | USD 2.73 Billion |

| CAGR | CAGR of 7.55% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Surgical Wound Care Products, Advanced Wound Care Products, Traditional Wound Care Products, Therapy Devices) • By Animal Type (Companion Animal, Livestock Animal) • By End Use (Veterinary Hospitals/Clinics, Homecare, Research Institutes) • By Distribution Channel (Retail, E-commerce, Veterinary Hospitals/Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, B. Braun Melsungen AG, Ethicon Inc. (Johnson & Johnson), Medtronic plc, Virbac, Zoetis Inc., Neogen Corporation, Jorgen Kruuse A/S, Sonoma Pharmaceuticals Inc., Acelity L.P. Inc. (KCI), Advancis Veterinary Ltd, Animal Medics, Bayer AG (Animal Health Division), Bioseal Inc., Boehringer Ingelheim Animal Health, Coloplast A/S, Dermavet Pty Ltd, Elanco Animal Health, Indian Immunologicals Ltd, Innovacyn Inc., McCue Veterinary Supply, Millpledge Veterinary, Puracyn Animal Health, Robinson Healthcare Ltd, Vetoquinol S.A. |