Antihistamine Drugs Market Report Scope & Overview:

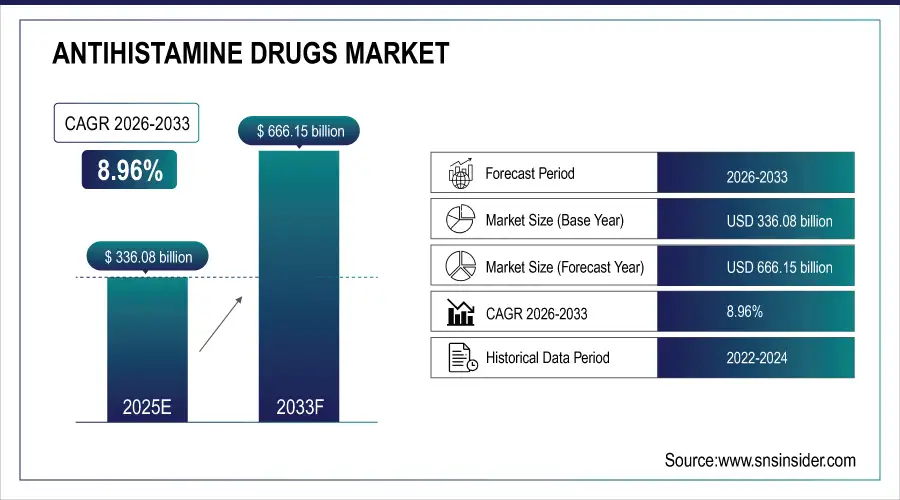

The Antihistamine Drugs Market Size is valued at USD 336.08 Billion in 2025E and is projected to reach USD 666.15 Billion by 2033, growing at a CAGR of 8.96% during the forecast period 2026–2033.

The Antihistamine Drugs Market analysis report offers a detailed coverage which includes industry chain structure, definitions, applications, and classifications of the industry. Growing incidence of allergic conditions, and growing use of advanced antihistamine solutions are anticipated to contribute significantly toward the growth and expansion of the market over the coming years.

Antihistamine drug consumption reached 5.4 billion doses in 2025, driven by rising allergy cases and growing use of second-generation formulations.

Market Size and Forecast:

-

Market Size in 2025: USD 336.08 Billion

-

Market Size by 2033: USD 666.15 Billion

-

CAGR: 8.96% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Antihistamine Drugs Market - Request Free Sample Report

Antihistamine Drugs Market Trends:

-

Increasing preference toward second-generation antihistamine with higher efficacy and less sedation is restructuring prescription trends.

-

A growing trend toward combination drugs for multiple allergic indications is increasing the size of product portfolios among leading competitors.

-

Rising contribution of new dosage forms such as nasal sprays and eye drops are making the patients more compliant and convenient.

-

Rising incidence of allergies caused by pollution and lifestyle habits will increase the OTC (over-the-counter) antihistamines sales.

-

Increasing penetration of the digital health platforms and e-pharmacy distribution is changing the accessibility and consumer reach in antihistamine market.

U.S. Antihistamine Drugs Market Insights:

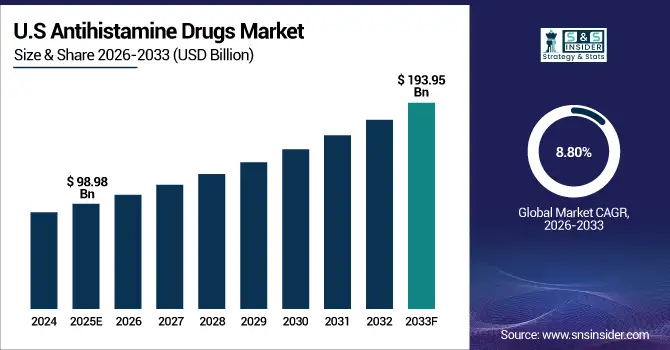

The U.S. Antihistamine Drugs Market is projected to grow from USD 98.98 Billion in 2025E to USD 193.95 Billion by 2033, at a CAGR of 8.80%. Growth is fueled by high levels of allergic and related disorders, with expanding OTC drug needs, latest innovations in non-sedative, long-acting antihistamines formulas.

Antihistamine Drugs Market Growth Drivers:

-

Rising prevalence of allergic disorders is driving demand for advanced, long-acting second-generation antihistamine drugs.

Rising prevalence of allergic disorders is a key driver of Antihistamine Drugs Market growth. Growing numbers of airborne pollutants, lifestyle changes and heightened immune sensitivity have been fueling cases of allergy and immunological dysfunction at all ages. This trend is driving demand for more advanced, sustained-action second-generation antihistamines that deliver powerful symptomatic relief with very low drowsiness. R&D continued in this area on better formulations and wider OTC availability, is also constantly redefining accessibility, treatment norms and the marketplace.

Second-generation antihistamine drug sales grew 9.4% in 2025, driven by the rising incidence of allergic rhinitis and increasing preference for non-sedative formulations.

Antihistamine Drugs Market Restraints:

-

Patent expirations, generic competition, and potential side effects are restraining large-scale growth of the Antihistamine Drugs Market.

Patent expirations, generic competition, and potential side effects are major restraints for the Antihistamine Drugs Market. Expiration of patent exclusivity of top brands have led to increased price competition and declining profit margins for most players. Also, with generics widely available cheaply, there's not much of an incentive to innovate. Undesirable side effects, such as drowsiness and impaired motor coordination or drug-drug interactions also limit patient acceptance, imposing difficulties on manufacturers who are looking to balance the tripod of efficacy, affordability and safety in product innovation.

Antihistamine Drugs Market Opportunities:

-

Growing demand for novel, non-sedative antihistamine formulations offer opportunities for innovation in targeted allergy treatment and drug delivery.

Growing demand for novel, non-sedative antihistamine formulations present a major opportunity for market expansion. Rising patient demand for long-acting, fast-acting and side-effect-light drugs is supporting R&D spend on novel molecules and advanced drug delivery methods. Drug manufactures are coming up with fine-tuned formulations including intranasal sprays and extended-release tablets, enhancing drug efficacy and patient compliance. This revolution driven change improves treatment productivity, improves market penetration and enhances brand coverage in the Antihistamine Drugs Market.

Non-sedative antihistamines accounted for 38% of new product launches in 2025, driven by growing demand for safer and longer-acting allergy treatments.

Antihistamine Drugs Market Segmentation Analysis:

-

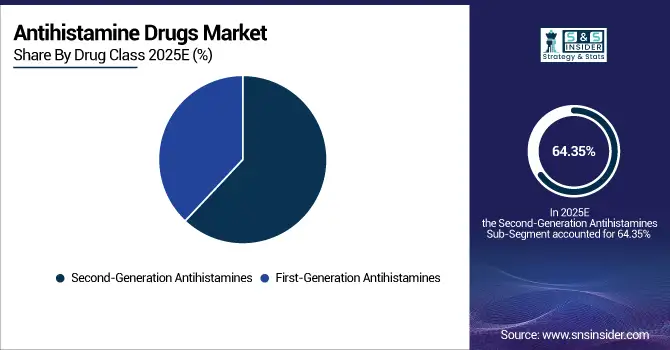

By Drug Class, Second-Generation Antihistamines held the largest market share of 64.35% in 2025, while they are also expected to grow at the fastest CAGR of 9.12% during 2026–2033.

-

By Dosage Form, Tablets & Capsules dominated with a 41.78% share in 2025, while Nasal Sprays are projected to expand at the fastest CAGR of 10.37% during the forecast period.

-

By Indication, Allergic Rhinitis accounted for the highest market share of 48.92% in 2025, while Dermatitis is anticipated to record the fastest CAGR of 9.58% through 2026–2033.

-

By Route of Administration, Oral formulations held the largest share of 56.24% in 2025, while Topical routes are expected to grow at the fastest CAGR of 9.41% during 2026–2033.

-

By Distribution Channel, Retail Pharmacies led the market with a 52.67% share in 2025, while Online Pharmacies are projected to grow at the fastest CAGR of 10.24% over the forecast period.

By Drug Class, Second-Generation Antihistamines Dominate and They Expand Rapidly:

The Second-Generation Antihistamines segment dominated the market and is also anticipated to be the fastest-growing segment as these agents offer better efficacy, longer duration of action, and less sedation compared with first-generation drugs. These agents now serve as the benchmark drugs for treatment of allergic rhinitis and chronic urticaria. Due to their great convenience and outstanding safety, these agents are much favored by both patients and physicians. In 2025, over 72 approved brands globally reflected this segment’s strong dominance and accelerated growth momentum.

By Dosage Form, Tablets & Capsules Dominate While Nasal Sprays Expand Rapidly:

Tablets & Capsules segment dominated the market based on first dosage form due to ease of administration, wide spread availability and low cost. They are still the preferred form for antihistamine products both prescription and over-the-counter. Nasal Sprays are the fastest growing segment promoted by its fast onset and localized action for allergic rhinitis. In 2025, over 180 million nasal spray units were sold, reflecting the accelerating shift toward convenient and fast-acting formulations.

By Indication, Allergic Rhinitis Dominates While Dermatitis Expands Rapidly:

Allergic Rhinitis segment dominated the market it is also one among most prevalent allergic conditions all around the world which impacts millions from children to aged people and adults. Secondary med demand gains come from increasing exposure to poor air and climate-driven allergens. Dermatitis is the fastest growing segment, with a surge in skin sensitivity and allergies. In 2025, around 410 million people were estimated to suffer from allergic rhinitis, reinforcing its leading position in the market.

By Route of Administration, Oral Dominate While Topical Expand Rapidly:

Oral segment dominated the market as it is convenient and absorbed rapidly, providing systemic relief for allergy. Tablets and capsules are still the most frequently prescribed dosage forms in all therapeutic segments. Topicals are the fastest growing segment, providing localized relief while minimizing systemic side effects. In 2025, nearly 60% of antihistamine prescriptions were filled in oral form, demonstrating their established dominance and reliability.

By Distribution Channel, Retail Pharmacies Dominate While Online Pharmacies Expand Rapidly:

Retail Pharmacies segment dominated the market due to these being the major selling point for both prescription and OTC antihistamines, providing both convenience and expert advice. Online Pharmacies is the fastest growing segment with digital adoption, telemedicine growth and convenience in home delivery all contributing. In 2025, over 28% of antihistamine purchases were made through e-pharmacy platforms, showcasing a major shift in consumer buying behavior toward digital healthcare access.

Antihistamine Drugs Market Regional Analysis:

North America Antihistamine Drugs Market Insights:

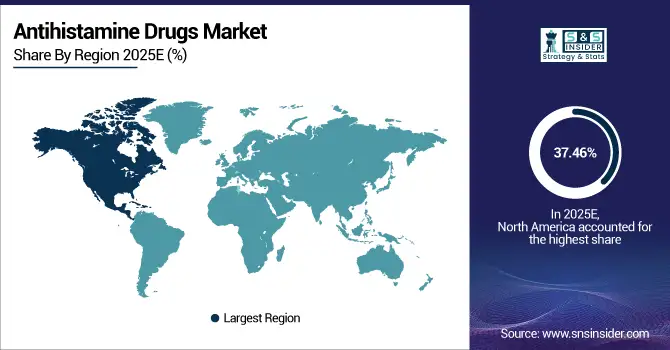

North America dominated the Antihistamine Drugs Market with a 37.46% share in 2025, owing to high prevalence of allergies, high healthcare facilities and number of OTC drugs availability. This region is favoured by ongoing R&D spending and the rapid launch of later-generation second-generation antihistamines with long-lasting effect and few adverse reactions. Growing consumer education, along with strong pharmaceutical distribution and prescription volume, are enabling North America to maintain its place as a leader in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Antihistamine Drugs Market Insights:

The U.S. Antihistamine Drugs Industry is mainly propelled by the accelerating allergy incidence, expanding OTC category of products and robust drug development. Increase of more second-generation drugs with better side effect profiles are improving the treatment outcomes. The stable market growth is driven by persistent R&D pipeline investment, proliferation of digital retail pharmacies across India and increasing patient awareness.

Asia-Pacific Antihistamine Drugs Market Insights:

The Asia-Pacific Antihistamine Drugs Market is the fastest growing region, projected to expand at a CAGR of 9.99% during 2026–2033. Expanding on rising allergy prevalence in China, India, Japan and South Korea spurred by pollution and urbanization. Segments such as developing healthcare infrastructure, rise in OTC sales and surging demand for 2-generation antihistamines are driving the market growth. High pharmaceutical manufacturing capacities and e-pharmacy proliferation adds to Asia-Pacific’s dominant role in the international competitive landscape.

China Antihistamine Drugs Market Insights:

China Antihistamine Drugs market to witness robust growth due to high prevalence of allergy, increasing urbanization and rising pollution level in air. Robust market penetration on account of growing healthcare infrastructure and OTC medication availability. Increasing domestic pharma innovation and large-scale production & export base makes China one of the major growth drivers in APAC antihistamine drugs market.

Europe Antihistamine Drugs Market Insights:

The Europe Antihistamine Drugs Market is witnessing steady growth owing to increasing incidence of allergy, robust pharmaceutical R&D spending and growing acceptance for non-sedative variants. Growing demand for over-the-counter antihistamines and regulators focus on safety and efficacy is driving market progression. Germany, the UK, France and Italy are also among the early adopters, driven by established healthcare systems, increasing self-medication practices and ongoing innovation in fast-acting long-lasting antihistamine products across the region.

Germany Antihistamine Drugs Market Insights:

Germany Antihistamine Drugs Market is also one of the significant markets in Europe owing to specialized healthcare infrastructure and robust drugs manufacturing. Growth is also steady with both rising incidence of allergies and the demand for non-sedative antihistamines on the increase. Strategic R&D investment, patient awareness, and high acceptance of OTC drugs also consolidate Germany as a leading player in antihistamine space across Europe.

Latin America Antihistamine Drugs Market Insights:

The Latin America Antihistamine Drugs Market is growing along with the increasing incidence of allergy, and accessibility to healthcare and its infrastructure is expanding in recent years. Brazil, Mexico and Argentina among high OTC demand on back of rising availability of OTC drugs and allergy awareness. Market growth is facilitated by an increase in generic drug production and the availability of non-sedative, affordably priced preparations.

Middle East and Africa Antihistamine Drugs Market Insights:

The Middle East & Africa Antihistamine Drugs Market is growing owing to increasing the prevalence of allergies, better healthcare facilities and rising popularity about OTC drugs. Market expansion will be supported by continued increases in pharmaceutical access, greater investments in healthcare modernization and rising demand for second-generation antihistamines in major markets including Saudi Arabia, United Arab Emirates and South Africa.

Antihistamine Drugs Market Competitive Landscape:

Pfizer Inc., headquartered in the U.S., is a leader in pharmaceuticals with a strong presence in allergy and respiratory therapeutics. The company’s leadership position in antihistamine drugs is underpinned by solid R&D, a wealth of clinical trials and strong brand names such as Zyrtec and Xyzal (co-marketed with partners). Pfizer’s commitment to leading edge formulation technologies, patient access, and expanding prescription-to-OTC switch translations has made it the world leader in antihistamine drug development and commercialization.

-

In August 2025, Pfizer Inc. expanded its allergy portfolio with a next-generation antihistamine featuring faster onset and 24-hour efficacy. This launch strengthens Pfizer’s respiratory and allergy therapeutics presence, targeting seasonal allergic rhinitis and chronic urticaria patients.

Johnson & Johnson, based in the U.S., is one of the largest healthcare conglomerates globally, with a diversified portfolio across pharmaceuticals, medical devices, and consumer health. The company is in a solid position in the antihistamine market, thanks to popular over-the-counter products sold under the Zyrtec and Benadryl brands. J&J has a competitive advantage through its constant innovation, brand equity and large retail distribution networks. Providing a more consumer-friendly experience and advancing its evidence-based allergy relief portfolio extends its leadership in this space.

-

In July 2025, Johnson & Johnson introduced a reformulated Zyrtec antihistamine for faster absorption and reduced drowsiness. The product leverages advanced delivery technology to enhance convenience and reinforce J&J’s leadership in non-prescription allergy relief solutions.

GlaxoSmithKline plc (GSK), headquartered in the UK, is a major player in the antihistamine drugs market, leveraging its deep expertise in respiratory and allergy therapies. The company’s products, with popular brands such as Piriton and Clarityn, enjoy good levels of customer loyalty. GSK leads through cutting-edge R&D, a presence, and investments in next-generation antihistamine cocktails. Its focus on non-sedating, long-acting allergy drugs and the push to secure markets in developing nations reduce its reliance on over-the-counter and prescription antihistamines.

-

In March 2025, GlaxoSmithKline plc (GSK) launched an upgraded Claritin-equivalent antihistamine across Asia-Pacific markets. The new formulation delivers longer symptom control and improved tolerability, aligning with GSK’s focus on innovation and accessibility in allergy and respiratory healthcare.

Antihistamine Drugs Market Key Players:

Some of the Antihistamine Drugs Market Companies are:

-

Pfizer Inc.

-

Johnson & Johnson

-

GlaxoSmithKline plc (GSK)

-

Sanofi S.A.

-

Bayer AG

-

Novartis AG

-

Merck & Co., Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Mylan N.V. (now Viatris Inc.)

-

AstraZeneca plc

-

Boehringer Ingelheim International GmbH

-

Sun Pharmaceutical Industries Ltd.

-

Dr. Reddy’s Laboratories Ltd.

-

Cipla Ltd.

-

Aurobindo Pharma Ltd.

-

Almirall S.A.

-

Akorn Operation Company LLC

-

Cadila Pharmaceuticals Ltd.

-

Prestige Consumer Healthcare Inc.

-

Glenmark Pharmaceuticals Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 336.08 Billion |

| Market Size by 2033 | USD 666.15 Billion |

| CAGR | CAGR of 8.96% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (First-Generation Antihistamines, Second-Generation Antihistamines) • By Dosage Form (Tablets & Capsules, Syrups, Nasal Sprays, Eye Drops, Injectables, Others) • By Indication (Allergic Rhinitis, Urticaria, Conjunctivitis, Dermatitis, Others) • By Route of Administration (Oral, Parenteral, Topical, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Pfizer Inc., Johnson & Johnson, GlaxoSmithKline plc (GSK), Sanofi S.A., Bayer AG, Novartis AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., AstraZeneca plc, Boehringer Ingelheim International GmbH, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Mylan N.V. (Viatris), Takeda Pharmaceutical Company Ltd., AbbVie Inc., Almirall S.A., Glenmark Pharmaceuticals Ltd., Hikma Pharmaceuticals PLC, Torrent Pharmaceuticals Ltd. |