Immunology Market Size Analysis:

Get more information on Immunology Market - Request Free Sample Report

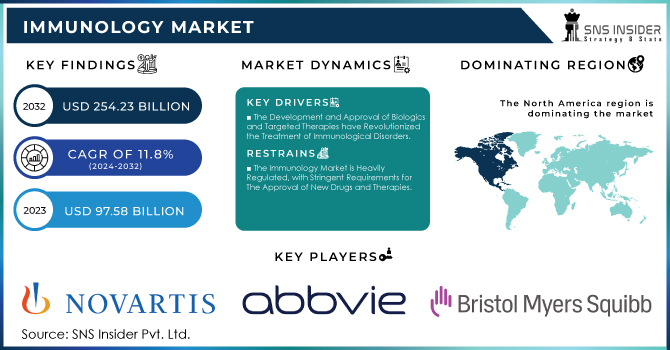

The Immunology Market Size was valued at USD 97.58 Billion in 2023, and is expected to reach USD 254.23 Billion by 2032, and grow at a CAGR of 11.8%.

Exposure to toxic chemicals, stress, dietary components, gut dysbiosis, and infections among various other environmental factors lead to a substantial number of patients affected by autoimmune diseases. Currently, autoimmune diseases are the third leading chronic illness in the U.S., and approximately 50 million people in the country have at least one form of autoimmune disease. For example, UK data, published by the University of Oxford in May 2023, population-based study that included 22.0 million individuals indicates that one in ten people is suffering from the autoimmune disorders.

Moreover, the demand for these medications among the patient population are encouraging market players to develop and launch their new medication in the global immunology market. The market growth is also encouraged by the rising regulatory approvals of new medications for the treatment of autoimmune diseases. For example, as of February 2023, Regeneron Pharmaceuticals, Inc. and Sanofi announced that the U.S. Food and Drug Administration approved KEVZARA to treat polymyalgia rheumatica, an inflammatory rheumatic disease. The growth of the market is expected to be accelerated over the forecast period, owing to the increasing awareness of autoimmune diseases in developed and developing countries, as well as on the potential pipeline candidates.

MARKET DYNAMICS:

Key Drivers:

-

The Rising Prevalence of Autoimmune Diseases, Such as Rheumatoid Arthritis, Multiple Sclerosis, and Type 1 Diabetes, is A Significant Driver of the Immunology Market.

-

The Development and Approval of Biologics and Targeted Therapies have Revolutionized the Treatment of Immunological Disorders.

Restraints:

-

One of the Primary Challenges in the Immunology Market is the High Cost Associated with Biologic Therapies and Advanced Immunological Treatments.

-

The Immunology Market is Heavily Regulated, with Stringent Requirements for The Approval of New Drugs and Therapies.

Opportunity:

-

Immunotherapy Is Gaining Traction as a Promising Approach in Oncology, offering Opportunities for Market Expansion Beyond Traditional Immunological Disorders.

-

The Increasing Emphasis on Precision Medicine Presents a Significant Opportunity in the Immunology Market.

SEGMENTATION ANALYSIS:

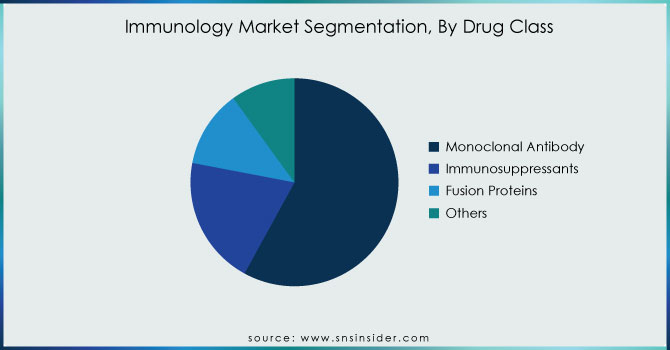

By Drug Class

The monoclonal antibody segment held the largest share of 58% in 2023. The increasing efficacy associated with monoclonal antibodies for treating chronic and rare diseases including autoimmune diseases is contributing to segment growth. The antibodies include, infliximab, rituximab, adalimumab among others. Moreover, a higher number of approvals for mAbs for treating different diseases is further supporting segment growth. For example, In January 2023, Gilead Sciences, Inc. entered into a collaboration with EVOQ Therapeutics, Inc., to leverage EVOQ’s NanoDisc technology for developing a treatment for Rheumatoid Arthritis and lupus.

Get Customized Report as per your Business Requirement - Request For Customized Report

The immunosuppressants segment is expected to grow at the highest CAGR during the forecast period. The rapid growth of the segment is attributed to a strong focus on R&D by prime market players to establish a higher number of regulatory approvals. Moreover, higher efficacy of immunosuppressants is contributing to the fast growth resulting in an over rush in their utilization in developing markets thereby propelling a higher CAGR.

By Indication

The rheumatoid arthritis segment held a dominant share that was 43% by 2023. An increasing number of patients seeking treatment and the growing prevalence of rheumatoid arthritis will result in a growing demand for drugs from the rheumatoid arthritis segment. For instance, according to the Australian Bureau of Statistics that published the statistics in 2023, in Australia, there were an estimated 3.7 million people with arthritis, and about 13.9% are suffering from rheumatoid arthritis.

On the other hand, limited drug approvals for conditions such as ankylosing spondylitis, inflammatory bowel disease, and others, and the high cost of currently marketed drugs, are hindering their adoption by the patient population, especially in the emerging countries.

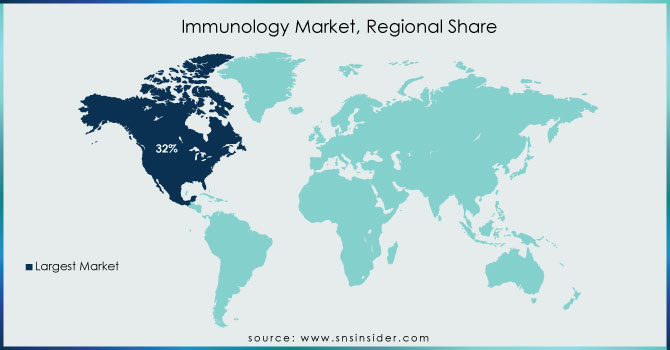

REGIONAL ANALYSIS:

North America, and more specifically the U.S., continues to dominate immunology market share with 32% share in 2023 as it provides significant healthcare expenditure, excellent R&D infrastructure, and the high uptake of advanced therapeutics. Europe is next with significant investment in biotechnology and innovative immunology therapies, primarily in Germany, France, and the U.K.

Asia-Pacific is growing the fastest due to the number of patients, expansion in healthcare expenditure in countries such as China and India, and improved resources making advanced therapies more readily available. In 2022, the Victorian Government in Australia has provided a $100,000 grant to the Hudson Institute of Medical Research to explore affordable and more accessible RNA-based treatments for autoimmune diseases. This clearly showcases the advances in RNA predictive sciences and immunology and, overall, the ability of RNA therapeutics to revolutionize the medication of autoimmune conditions.

In February 2022, NIH provided a webinar on the purpose of autoimmune diseases and women’s health. Mostly affecting women, with 8 out of 10 people with a chronic autoimmune condition in the U.S. being female, the phenomenon was presented during the event. Finally, the World Health Organization is looking to better extend the access to care for RA in a number of ways, with two of the examples including the aim of Rehabilitation 2030 and the UN Decade of Healthy Ageing to promote healthy ageing and improve the satisfaction of older people with RA in all their specific and diverse needs.

KEY PLAYERS:

The key market players are Novartis AG, AbbVie, Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Amgen Inc., F. Hoffmann-La Roche Ltd., Astellas Pharma Inc., Pfizer Inc., Janssen Global Services, LLC, Merck Sharp, Dohme Corp. & other players.

RECENT DEVELOPMENTS

-

In June 2023- Sandoz launched Hyrimoz injection, a high-concentration formulated used to treat rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, and other immunological diseases

-

In March 2023 – Eli Lilly and Company received approval from the Indian regulatory agency Directorate General of Commercial Intelligence and Statistics allowing it to launch its drug, Copellor, for the treatment of moderate-to-severe plaque psoriasis as well as treatment of psoriatic arthritis.

-

In June 2022 – Eli Lilly and Company U.S. Food and Drug Administration approved OLUMIANT as a first-in-disease systemic treatment for adults suffering from severe alopecia areata (Auto-immune disorder).

| Report Attributes | Details |

| Market Size in 2023 | US$ 97.58 Billion |

| Market Size by 2032 | US$ 254.23 Billion |

| CAGR | CAGR of 11.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Drug Class (Monoclonal Antibody (mAb), Fusion Proteins, Immunosuppressants, and Others) •By Indication (Rheumatoid Arthritis, Psoriatic Arthritis, Plaque Psoriasis, Ankylosing Spondylitis, Inflammatory Bowel Disease, Prophylaxis of Organ Rejection, and Others) •By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis AG, AbbVie, Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Amgen Inc., F. Hoffmann-La Roche Ltd., Astellas Pharma Inc., Pfizer Inc., Janssen Global Services, LLC, Merck Sharp, Dohme Corp. & other players |

| Key Drivers | •The Rising Prevalence of Autoimmune Diseases, Such as Rheumatoid Arthritis, Multiple Sclerosis, and Type 1 Diabetes, is A Significant Driver of the Immunology Market. •The Development and Approval of Biologics and Targeted Therapies have Revolutionized the Treatment of Immunological Disorders. |

| RESTRAINTS | •One of the Primary Challenges in the Immunology Market is the High Cost Associated with Biologic Therapies and Advanced Immunological Treatments. •The Immunology Market is Heavily Regulated, with Stringent Requirements for The Approval of New Drugs and Therapies. |