Armored Vehicle Fire Suppression Systems Market Key Insights:

To get more information on Armored Vehicle Fire Suppression Systems Market - Request Sample Report

The Armored Vehicle Fire Suppression Systems Market size was valued at USD 21.2 million in 2023 and is expected to reach USD 29.15 million by 2032, growing at a CAGR of 3.6% over the forecast period of 2024-2032.

The armored vehicle fire suppression systems market is poised for steady growth driven by the paramount need for crew safety, rising defense budgets, and advancements in eco-friendly technologies. Crew safety remains paramount for militaries worldwide. Fire suppression systems are a frontline defense against fires caused by accidents, enemy attacks, or malfunctions. A 2023 study by the Stockholm International Peace Research Institute (SIPRI) revealed a concerning rise in military personnel casualties due to vehicle fires during conflicts. This has intensified the focus on implementing robust fire suppression systems, propelling market growth. also, Geopolitical tensions and ongoing conflicts are leading to a significant rise in global defense spending. A 2024 report forecasts a 12% increase in North American defense spending alone, with a portion allocated to armored vehicle upgrades, including fire suppression systems. This surge in defense budgets translates to increased investment in crew safety technologies, creating significant opportunities for fire suppression system manufacturers.

Furthermore, The market is witnessing exciting advancements in fire suppression technology. Companies like Marotta Controls and Oshkosh Corporation are developing more efficient and faster-reacting systems using lighter materials and targeted suppression agents. Additionally, environmental concerns surrounding traditional fire suppression agents like Halon are pushing the industry towards eco-friendly alternatives. For instance, Chemguard Inc. offers a fluorine-free fire suppression agent specifically designed for military applications. This focus on eco-friendly solutions is expected to be a major growth driver in the coming years.

MARKET DYNAMICS:

KEY DRIVERS:

-

Heightened Focus on Crew Safety

-

Technological Advancements like GFE and Kidde Fire Systems are developing more efficient and faster-reacting fire suppression systems, using lighter materials and more targeted suppression agents.

-

The Rising Defense Expenditure drive the market growth.

Increased geopolitical tensions and ongoing conflicts are leading to a rise in global defense spending. This leads to increased budgets for military vehicle modernization, including fire suppression systems. For instance, the United States requested a record-breaking $813.3 billion for its 2024 defense budget, with a portion allocated to armored vehicle upgrades.

RESTRAINTS:

-

Traditional fire suppressants like Halon harm the ozone layer, prompting regulations and a drive for eco-friendly alternatives in armored vehicles.

-

High Integration Costs

Integrating advanced fire suppression systems into existing armored vehicles can be a complex and expensive process. This can be a hurdle for some militaries with limited budgets.

OPPORTUNITIES:

-

Focus on Regional Production, creates an opportunity for local fire suppression system manufacturers to partner with defense contractors.

-

The Growing Demand for Modernized Fleets

Many countries are looking to modernize their aging armored vehicle fleets. This presents an opportunity for manufacturers to supply new vehicles equipped with advanced fire suppression systems.

CHALLENGES:

-

The battlefield landscape is constantly evolving, with new threats emerging like improvised explosive devices (IEDs).

-

The Integration of Stringent Testing and Certification

Military fire suppression systems undergo rigorous testing and certification procedures to ensure their effectiveness and reliability in harsh environments. This can be a lengthy and costly process for manufacturers.

IMPACT OF RUSSIA-UKRAINE WAR

The war highlighted the critical role of armored vehicles in modern warfare. But this could led to the depletion of stocks of these vehicles in some countries supporting Ukraine. This creates an urgent need for new armor, many of which require the integration of advanced fire suppression systems. A report by the Center for Strategic and International Studies (CSIS) estimates that Ukraine and its allies have lost or disabled more than 8,000 armored vehicles since the start of the war, creating a significant need for replacement vehicles. This increase in demand is expected to drive market growth. The war also disrupted the global supply chains and affected the availability of raw materials and components for firefighting systems. This may cause production delays and possible price fluctuations for these systems. For example, a recent report by McKinsey and Company indicates that raw material costs for defense equipment could rise by 20% due to the impact of the war on global supply chains. Manufacturers must adapt their supply strategies and localize production where possible to mitigate these disruptions. The war triggered a reassessment of the defense capabilities of several countries, especially in Europe. In the long term, this may lead to an increase in defense spending, part of which will be directed to the modernization and purchase of armor. This long-term market expansion will benefit fire suppression system manufacturers who can provide reliable and customization solutions.

IMPACT OF ECONOMIC SLOWDOWN

A economic slowdown could lead to tightened government budgets, potentially impacting defense spending. This could result in cuts to military vehicle procurement programs, including those for armored vehicles. Reduced demand for new armored vehicles would leads to a decrease in the demand for integrated fire suppression systems. An economic slowdown may lead to militaries extending the lifespan of their existing armored vehicles. This would create a larger market for spare parts and maintenance of fire suppression systems, presenting an opportunity for companies specializing in the aftermarket. also, During economic downturns, a focus on cost-efficiency becomes paramount. Fire suppression system manufacturers who can offer reliable and effective systems at competitive prices are likely to see increased demand. This could lead to a rise in competition and potentially drive innovation in cost-effective fire suppression technologies.

KEY MARKET SEGMENTS:

By Vehicle Type

-

Combat Vehicles

-

Troop Transport Vehicles

-

Others Vehicles Type

Based on Vehicle Type, Combat vehicles dominate the armored vehicle fire suppression systems market with approx more than 70 % market share in the forecasted period, due to the critical need for crew safety in high-risk environments. Combat vehicles, including main battle tanks, infantry fighting vehicles, and armored personnel carriers, form the backbone of modern ground forces. These vehicles operate in high-risk environments where fire hazards are prevalent due to enemy attacks, accidents, or malfunctions. However, the Other Vehicle Types segment is expected to witness the fastest growth driven by the expanding use of specialized armored vehicles and a growing emphasis on crew safety across all armored platforms.

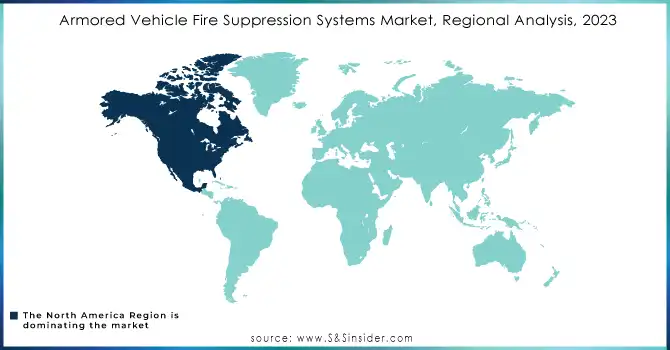

REGIONAL ANALYSES

North America has traditionally been the dominant region in the armored vehicle fire suppression systems market due to High defense spending by the United States, a major global military power. and the Focus on advanced technology and crew safety in US armored vehicles. for eg, The US Army awarded a $25 million contract to General Dynamics Ordnance and Tactical Systems for the development and supply of next-generation fire suppression systems for its new AbramsX main battle tank program. This signifies the US military's continued commitment to cutting-edge technology in crew safety. While North America remains a leader, the market might face a period of maturation due to A large existing fleet of armored vehicles, potentially leading to a saturation in demand for new systems for these platforms. Stringent regulations and focus on aftermarket solutions could create opportunities despite slower growth in new vehicle procurement.

In the Asia-Pacific region, the market for armored fire fighting systems has seen significant growth due to the rapid military modernization program implemented in countries such as China and India. and an increasing focus on regional security and potential geopolitical tensions. Also, expanding the production capacity of domestic fire extinguishing system manufacturers. For example, in May 2024, China introduced its newest main battle tank, the ZTQ-17, Defense Expo. This advanced tank is expected to be equipped with advanced fire suppression systems, reflecting the modernization of China's armored vehicle fleet.

To Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Fire Protection Technologies Pty Ltd., Spectrex Inc., Halma plc, N2 Towers Inc., Marotta Controls Inc., Nero Industries, ExploSpot Systems Pty Ltd, Mikro-Pulssi Oy, Bulldog Direct Protective Systems, Kidde-Deugra Brandschutzsysteme GmbH, and other key players.

RECENT DEVELOPMENT

In May 19, 2024, Oshkosh Corporation unveils its new ATLAS Next Generation Combat Vehicle (NGCV) at a military expo. This advanced combat vehicle features an integrated fire suppression system designed for superior performance and crew protection. Oshkosh emphasizes the system's lightweight design and faster response time compared to traditional fire suppression systems.

In May 10, 2024, BAE Systems successfully completes live-fire testing of its new fire suppression system for armored personnel carriers (APCs). This test demonstrates the system's effectiveness in extinguishing fires caused by enemy attacks or internal malfunctions, showcasing advancements in real-world performance of fire suppression technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.2 Million |

| Market Size by 2031 | US$ 28.1 Million |

| CAGR | CAGR of 3.6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Combat Vehicles, Troop Transport Vehicles, Other Vehicle Types) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fire Protection Technologies Pty Ltd., Spectrex Inc., Halma plc, N2 Towers Inc., Marotta Controls Inc., Nero Industries, ExploSpot Systems Pty Ltd, Mikro-Pulssi Oy, Bulldog Direct Protective Systems, Kidde-Deugra Brandschutzsysteme GmbH |

| Key Drivers | • Heightened Focus on Crew Safety • Technological Advancements like GFE and Kidde Fire Systems are developing more efficient and faster-reacting fire suppression systems, using lighter materials and more targeted suppression agents. • The Rising Defense Expenditure drive the market growth. |

| Restraints | • Traditional fire suppressants like Halon harm the ozone layer, prompting regulations and a drive for eco-friendly alternatives in armored vehicles. • High Integration Costs |