Air Freight Software Market Report Scope & Overview:

To get more information on Air Freight Software Market - Request Free Sample Report

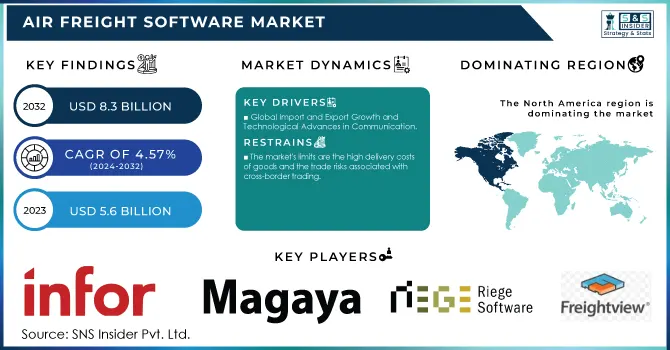

The Air Freight Software Market Size was valued at USD 5.6 billion in 2023 and is expected to reach USD 8.3 billion by 2032 with an emerging CAGR of 4.57% over the forecast period 2024-2032.

Rising communication technologies paired with an expanding range of IoT devices. Developing freight visibility arrangements and advancements, managing time-in-transit, advancements in freight security, wellness, and transportation arrangements are also predicted to promote market expansion. Organizations are increasingly turning to innovations that help them track, follow, secure, and control their in-transit freight. Big data analytics appears to be the most promising possibility in freight software. The criteria that determine the success of a freight business are speed, productivity, and consistent quality.

Organizations now generate massive volumes of data, but struggle to maximise the benefits from it as innovation pushes and digitization expands. Massive data analysis can convey accurate information estimation to increase freight operational efficiencies and consumer loyalty at a reasonable cost. The rapid rise of massive information applications has necessitated the development of more recent improvements to improve cost productivity. As a result, these issues must be the driving force behind the development of new analytics platforms and information storage focuses in the freight software market.

MARKET DYNAMICS

KEY DRIVERS

-

Global Import and Export Growth and Technological Advances in Communication

-

Growing Demand for Supply Chain Visibility

RESTRAINTS

-

The market's limits are the high delivery costs of goods and the trade risks associated with cross-border trading.

-

Software for Air Freight Market participants implement measures to address this factor and allow the market to progress.

OPPORTUNITY

-

Cloud Computing and Big Data Analytics

-

The Use of Blockchain in Air Freight Management

CHALLENGES

-

The pandemic was a difficult scenario for the market, but it is working hard to overcome it in order to resume its development rate.

-

The Air Freight Software Market Outlook is characterized by operational progress for small companies as well as cost sensitivity.

IMPACT OF COVID-19

The COVID-19 period harmed both the aviation industry and the aviation-related market. Due to different travel and transportation enforced lockdown limitations, the aviation sector saw a significant drop in growth. This aspect has also had an impact on the Air Freight Software Market Share, as it is related to the aviation industry. Shipments of products and services were stalled, and customers delayed delivery. However, the Air Freight Software Market Analysis is expected to resume its growth pace in the post-pandemic period and compete on a worldwide scale. Air freight services are gradually becoming more creative. This element will recoup the market's losses suffered during the pandemic.

Within the research period, the Air Freight Software Market Forecast is predicted to reach its USD value.

The market is divided into four types: web-based, cloud-based, SaaS, on-premises, and mobile-installed. Cloud-based software is hosted on the vendor's server and can be accessed via a web browser; it may be utilised by all stockholders in that supply chain, resulting in the expansion of cloud-based software. On-premises software is typically installed and run on a company's computers and servers, and it is widely utilised by brokers.

The Air Freight Software Market is classified into two types: on-premise and cloud-based. The on-premise section is where the company's servers are installed. Because of its broad use, the Air Freight Software Market increased steadily during the predicted period. The vendor's server, which may be accessed via a browser, hosts the cloud-based parts. The rising use of these sectors in recent years has led to the market achieving the greatest CAGR throughout the projection period.

The market is divided into four applications: rail freight, road freight, ocean freight, and air freight. Rail freight is the use of railroads and trains to convey cargo. Road freight is the physical process of delivering cargo by cars utilising roads, and it is a traditional mode of freight transportation. In general, ocean freight refers to the transportation of products by sea. The transportation of air freight is done through the use of an air carrier.

In the end-user category, the Air Freight Software Market Size is divided into third-party logistics, forwarders, brokers, and shippers. Because of its widespread use, third-party logistics is seen as the dominant segment among them. Because of the increased use of forwarders to minimise delivery time, they are considered the fastest expanding segment. During the evaluation period, the broker segment was the second-largest segment with the highest CAGR.

KEY MARKET SEGMENTATION

By Type

-

On-Premise

-

Cloud-based

-

SaaS

-

Mobile-Installed

By End-User

-

Third-Party Logistics

-

Forwarders

-

Brokers

-

Shippers

By Application

-

Rail Freight

-

Road Freight

-

Ocean Freight

-

Air Freight

REGIONAL ANALYSIS

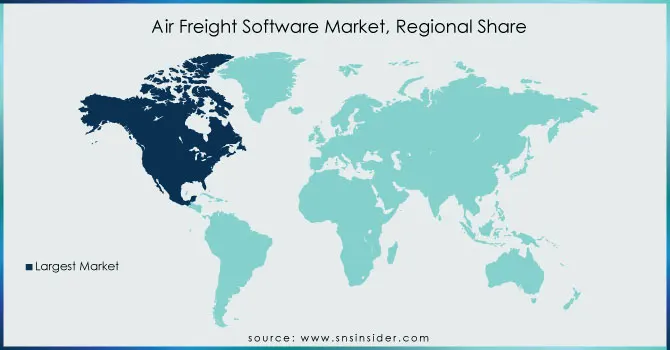

North America, Europe, Asia Pacific, and the Rest of the World comprise the Global Freight Software Market. Because of the region's significant adoption of freight management software, North America is the largest market with high growth. Because of the widespread implementation of the programme, Asia Pacific is also experiencing growth.

Need any customization research on Air Freight Software Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Freight data 2000, Infor, Magaya, Riege Software International GmbH, Sprocket, The Descartes Systems Group Inc, Freightos, FreightPOP, Freightview, Hard Core Technology Corp and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.62 Billion |

| Market Size by 2032 | US$ 8.39 Billion |

| CAGR | CAGR of 4.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (On-Premise, Cloud-based, Web-based, SaaS, Mobile-Installed) • By End-User (Third-Party Logistics, Forwarders, Brokers, Shippers) • By Application (Rail Freight, Road Freight, Ocean Freight, Air Freight) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Freight data 2000, Infor, Magaya, Riege Software International GmbH, Sprocket, The Descartes Systems Group Inc, Freightos, FreightPOP, Freightview, Hard Core Technology Corp. |

| DRIVERS | • Global Import and Export Growth and Technological Advances in Communication • Growing Demand for Supply Chain Visibility |

| RESTRAINTS | • The market's limits are the high delivery costs of goods and the trade risks associated with cross-border trading. • Software for Air Freight Market participants implement measures to address this factor and allow the market to progress. |