Aroma Chemicals Market Size & Overview

The Aroma Chemicals Market Size was valued at USD 5.59 Billion in 2023 and is expected to reach USD 8.66 Billion by 2032, growing at a CAGR of 4.99% over the forecast period of 2024-2032.

Get More Information on Aroma Chemicals Market - Request Sample Report

The Aroma Chemicals Market is witnessing dynamic growth, fueled by rising demand in fine fragrances, personal care, and food applications. Investment and expansion activities by key players are driving innovation, enhancing production capacities, and strengthening global footprints. Market dynamics are shaped by raw material price trends, where fluctuations in petrochemical and natural ingredient costs influence profitability. Shifting price trends of aroma chemicals reflect evolving consumer preferences, supply chain challenges, and advancements in synthetic production. Sustainability is a key focus, with eco-friendly initiatives promoting bio-based alternatives and green chemistry solutions. Meanwhile, stringent regulatory compliance and restrictions, including IFRA and REACH guidelines, continue to impact product formulations. Our report provides exclusive insights into these market forces, highlighting key opportunities and future growth trajectories.

Aroma Chemicals Market Dynamics

Drivers

-

Increasing Consumer Preference for Natural and Sustainable Fragrances Fuels Growth in the Aroma Chemicals Market

As consumers become more aware of environmental sustainability, there is a noticeable shift towards natural and eco-friendly fragrances in various applications, including fine fragrances, personal care products, and food flavorings. This increasing preference for clean, green, and sustainable ingredients is driving demand for natural aroma chemicals. Manufacturers are investing heavily in the development of bio-based aroma chemicals, often derived from renewable plant sources. These natural alternatives are not only seen as environmentally friendly but also cater to the growing consumer trend towards transparency in product ingredients. This shift towards sustainability is supported by innovations in extraction and production methods, making natural ingredients more affordable and accessible. Moreover, the rising focus on sustainability in industries such as cosmetics and food further accelerate the adoption of natural aroma chemicals. This trend is expected to drive continued growth in the market, with natural aroma chemicals increasingly replacing synthetic variants, thus contributing to the expansion of market share for sustainable ingredients.

Restraints

-

High Raw Material Costs and Supply Chain Disruptions Affect Aroma Chemicals Market Growth

The aroma chemicals market is often impacted by fluctuations in the prices of raw materials, particularly those derived from petrochemicals and natural sources. The price volatility of key raw materials such as benzene, terpenes, and essential oils can lead to increased production costs, thereby affecting the overall pricing structure of aroma chemicals. Additionally, supply chain disruptions caused by geopolitical tensions, natural disasters, or the COVID-19 pandemic can exacerbate these issues. These disruptions can lead to shortages, delays, and higher costs for sourcing raw materials, which in turn may result in production delays and reduced profitability for manufacturers. The reliance on both natural and synthetic raw materials from different regions introduces complexities in securing a stable supply chain. As a result, manufacturers in the aroma chemicals industry face challenges in maintaining stable pricing and meeting consumer demand without compromising on product quality or production timelines.

Opportunities

-

Growing Trend for Sustainable and Natural Aroma Chemicals Creates New Product Development Opportunities

The global shift towards sustainability and eco-consciousness offers manufacturers a unique opportunity to develop and market sustainable aroma chemicals. With increasing consumer awareness of environmental impact and ethical sourcing, there is a growing demand for natural aroma chemicals derived from renewable resources, such as plant-based terpenes and essential oils. This trend is driving innovations in bio-based fragrance ingredients, allowing manufacturers to tap into the growing niche of clean, green, and cruelty-free products. Companies can focus on creating sustainable products that align with the clean label movement and cater to consumers seeking environmentally friendly alternatives. Additionally, advancements in green chemistry and fermentation technologies present new opportunities to develop aroma chemicals that are not only natural but also affordable and scalable for mass-market applications. By focusing on sustainability, companies can gain a competitive edge and differentiate themselves in a crowded market.

Challenge

-

Navigating the Volatile Regulatory Landscape and Its Impact on Aroma Chemicals Production

The volatile and evolving regulatory landscape presents a significant challenge for the aroma chemicals industry. Regulatory bodies continuously update safety standards, ingredient restrictions, and environmental guidelines, which can disrupt production processes and force manufacturers to reformulate their products. Compliance with various regional regulations, such as REACH in Europe or IFRA in the fragrance industry, requires constant vigilance and adaptation to ensure product formulations meet the latest safety requirements. Regulatory changes can also affect the availability of certain chemicals, which can result in supply shortages or the need to invest in alternative raw materials, further increasing production costs. Manufacturers must remain agile and invest in research and development to stay ahead of regulatory changes, ensuring compliance without compromising on product quality or profitability. This dynamic and unpredictable regulatory environment continues to challenge the industry, requiring manufacturers to invest in both legal expertise and product innovation.

Aroma Chemicals Market Segmental Analysis

By Source

In 2023, the synthetic segment dominated the Aroma Chemicals Market with a market share of 57.2%. This dominance can be attributed to the cost-effectiveness and scalability of synthetic aroma chemicals compared to their natural counterparts. Synthetic chemicals can be produced in large quantities at lower costs, making them the preferred choice for mass-market applications across various industries like personal care, food, and beverages. Organizations such as the International Fragrance Association (IFRA) and the American Chemical Society (ACS) continue to emphasize the importance of synthetic aroma chemicals, especially in regions where cost and availability of raw materials for natural alternatives are limitations. For instance, synthetic musks and benzenoids are widely used in the production of perfumes, and fragrance formulations for household products. The ability to replicate complex natural scents at a fraction of the cost positions synthetic aroma chemicals as the dominant source in the market.

By Product

The Terpenes/Terpenoids segment dominated the Aroma Chemicals Market in 2023, with a market share of 32.5%. Terpenes and terpenoids, primarily sourced from plants and flowers, are known for their versatile applications in fragrances, flavors, and personal care products. The demand for these natural aroma chemicals has been growing due to their safe, non-toxic properties and eco-friendly characteristics. Leading fragrance companies like Givaudan and Firmenich use terpenes for developing high-quality perfumes and aromatic products. Additionally, the growing consumer preference for natural ingredients in cosmetics and fragrances, spurred by organizations like the Global Sustainability Institute, supports the increasing market share of terpenes and terpenoids. The eco-conscious trend towards plant-based, sustainable ingredients continues to fuel the adoption of this segment, providing a competitive edge in the Aroma Chemicals Market.

By Application

Fine fragrances held the largest share of the Aroma Chemicals Market in 2023, with an estimated market share of 24.1%. The fine fragrances segment benefits from the growing demand for luxury and premium perfume products, which consistently use high-quality aroma chemicals. The rise in disposable income, particularly in emerging markets like Asia-Pacific, has led to an increased demand for branded perfumes, which significantly contributes to the growth of this segment. Renowned fragrance houses such as Chanel and Dior are known to incorporate premium aroma chemicals, including rare essential oils and synthetics, in their formulations. Associations such as the Fragrance Foundation play a pivotal role in promoting and advocating for high standards in the fine fragrances market, further boosting its dominance. Additionally, the fine fragrances sector has capitalized on consumer trends toward personalization and exclusivity, which continues to drive the segment's strong market performance.

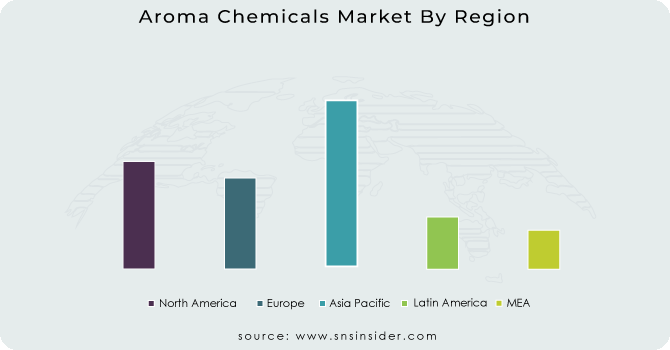

Aroma Chemicals Market Regional Outlook

The Asia Pacific region dominated the Aroma Chemicals Market in 2023 with a market share of 35.9%. This dominance can be attributed to the region’s rapidly growing consumer base, particularly in countries like China, India, and Japan. China’s booming personal care industry, along with its strong manufacturing capabilities, supports the significant demand for both natural and synthetic aroma chemicals. India, with its growing middle class, has seen increased demand for fragrances in food, beverages, and cosmetics, propelling the need for aroma chemicals. Japan remains a strong player in the fragrance sector, leveraging its expertise in both high-quality natural and synthetic aroma chemicals. According to the International Trade Administration (ITA), China and India are expected to continue their robust growth, driving the demand for aroma chemicals, with China being one of the largest consumers globally. This market dominance is further fueled by the region’s large-scale manufacturing facilities, which are crucial for meeting global demand.

The North America region is the fastest-growing area in the Aroma Chemicals Market during the forecast period, with a significant growth rate. This growth is largely driven by the increasing demand for high-quality fragrance chemicals in the food, beverages, and personal care industries. The United States, in particular, is witnessing a surge in demand for eco-friendly and sustainable aroma chemicals, as consumers become more conscious of the ingredients used in their daily products. Companies like International Flavors & Fragrances Inc. (IFF) and Firmenich, both headquartered in the region, are spearheading the market growth with innovative product offerings, catering to the growing consumer demand for natural, organic, and sustainable fragrance solutions. Additionally, the ongoing expansion of fragrance production capabilities in Canada is expected to bolster regional market growth further. With advancements in research and development and growing consumer preference for premium fragrance products, North America is expected to witness rapid growth in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

A.C.S. International (Cinnamyl Alcohol, Phenyl Ethyl Alcohol)

-

BASF SE (Vanillin, Citral, Linalool)

-

Bedoukian Research, Inc. (Methyl Dihydrojasmonate, Ethyl Maltol, Hexyl Acetate)

-

Borregaard (Vanillin, Ethyl Vanillin, Guaiacol)

-

DSM (Canthaxanthin, Vanillin, Carotenoids)

-

Eternis Fine Chemicals Ltd. (Cashmeran, Iso E Super, Dihydromyrcenol)

-

Hindustan Mint & Agro Products Pvt. Ltd. (Menthol, Eugenol, Anethole)

-

Kalpsutra Chemicals Pvt. Ltd. (Anethole, Linalool, Citronellal)

-

Kao Corporation (Methyl Dihydrojasmonate, Hedione, Jasmine Lactone)

-

Lanxess AG (Dihydromyrcenol, Linalool, Terpineol)

-

Privi Organics India Limited (Dihydromyrcenol, Camphor, Acetophenone)

-

Robertet Group (Linalool, Geraniol, Beta-Ionone)

-

S H Kelkar and Company Limited (Keva) (Alpha-Ionone, Beta-Ionone, Gamma-Nonalactone)

-

Sensient Technologies Corporation (Methyl Anthranilate, Benzyl Acetate, Coumarin)

-

Silverline Chemicals (Linalool, Eugenol, Menthone)

-

Solvay (Vanillin, Eugenol, Guaiacol)

-

Symrise (Helional, Iso Bornyl Acetate, Acetophenone)

-

Takasago International Corporation (Galaxolide, Florhydral, Exaltone)

-

Treatt Plc (Lemon Oil Terpenes, Orange Oil Terpenes, Lime Oil Distillates)

-

Yingyang Aroma Chemical Group (Musk Xylene, Methyl Cedryl Ketone, Camphor)

Recent Highlights

-

May 2024: LANXESS presented its portfolio of sustainable aroma chemicals, including renewable-materials-based “Ultrapure Scopeblue” and Kalama benzyl benzoate, at SIMPPAR in France, targeting eco-conscious fragrance and cosmetics industries.

-

February 2023: International Flavors & Fragrances (IFF) announced the sale of its aroma chemicals business to a private equity firm for approximately $2 billion as part of a strategic restructuring to focus on its core fragrance and flavor operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.59 Billion |

| Market Size by 2032 | USD 8.66 Billion |

| CAGR | CAGR of 4.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Natural, Synthetic) •By Product (Benzenoids, Terpenes/Terpenoids, Musk Chemicals, Others) •By Application (Food & Beverages, Fine Fragrances, Cosmetics, Toiletries, Soaps & Detergents, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Solvay, Takasago International Corporation, Kao Corporation, Robertet Group, Privi Organics India Limited, S H Kelkar and Company Limited (Keva), DSM, Eternis Fine Chemicals Ltd., Kalpsutra Chemicals Pvt. Ltd. and other key players |