Artificial Heart Market Report Scope & Overview

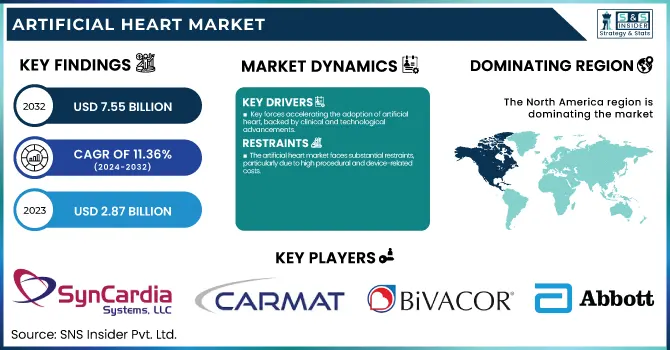

The Artificial Heart Market size was valued at USD 2.87 billion in 2023 and is expected to reach USD 7.55 billion by 2032, growing at a CAGR of 11.36% over the forecast period of 2024-2032.

To Get more information on Artificial Heart Market - Request Free Sample Report

This report emphasizes the increasing incidence and prevalence of end-stage heart failure throughout geographies, driving demand for sophisticated cardiac support solutions. The research analyzes waitlist and transplant gap data, showing an expanding need for other therapies, such as artificial hearts, owing to shortages in donors. Healthcare expenditure trends for mechanical circulatory support devices are evaluated by type of payer, with both public and private payers making major contributions to market growth. The study also examines the rate of technological adoption and innovations in the R&D pipeline, such as fully implantable systems and biocompatible materials, as well as rehospitalization and mortality reduction trends, which highlight the clinical benefit of artificial heart technologies.

The U.S. Artificial Heart Market was valued at USD 1.43 billion in 2023 and is expected to reach USD 3.46 billion by 2032, growing at a CAGR of 10.34% over the forecast period of 2024-2032. In the United States, the market is growing strongly because of the heavy cardiovascular disease burden, strong investment in the development of cardiac devices, and positive reimbursement policies favoring the use of life-supporting artificial heart devices.

Artificial Heart Market Dynamics

Drivers

-

Key forces accelerating the adoption of artificial heart, backed by clinical and technological advancements.

The artificial heart market is mainly fueled by the increasing global incidence of end-stage heart failure and the chronic lack of donor organs. The American Heart Association estimates that more than 6.5 million adults in the U.S. have heart failure, with a considerable percentage needing mechanical circulatory support. Artificial hearts, especially LVADs and Total Artificial Hearts (TAHs), provide life-saving interventions for patients who are not candidates for or waiting for transplants. Technological advances have driven adoption further—new devices are nowadays miniaturized, more resistant, and have better biocompatibility, making infection and thrombosis risk lower. Additionally, supportive reimbursement policies and growing FDA approvals are driving the market favorably. For instance, SynCardia TAH approval and the emergence of newer, completely implantable LVADs have broadened the horizon of treatment. As clinical trials persist in announcing improved survival and quality-of-life results, faith in artificial hearts as both destination and bridge-to-transplant therapies grows. This, combined with growing awareness among patients and doctors, is greatly accelerating growth in the market.

Restraints

-

The artificial heart market faces substantial restraints, particularly due to high procedural and device-related costs.

Artificial heart implantation usually costs more than USD 100,000, not including pre-operative evaluation and post-operative management. This creates a major obstacle in nations with scarce healthcare budgets or without full insurance coverage. Additionally, the invasive nature of implantation procedures requires highly trained surgical teams and cutting-edge facilities, rendering these devices available mainly in tertiary care facilities. Post-operative complications like hemorrhage, infection, hemolysis, and device failure continue to be the order of the day and necessitate extended hospital stays or device replacement, thus escalating the total cost burden. These risks also discourage adoption by patients and physicians in marginal clinical instances. Furthermore, most developing countries lack the adequate infrastructure and training required to facilitate the artificial heart ecosystem, thus limiting penetration in the emerging markets. In addition, rigorous regulatory procedures and long periods of approval can decelerate the introduction of new devices into the marketplace. Consequently, even with technological advancement and growing need, the actual application of artificial hearts is limited by budgetary and infrastructural factors, especially beyond high-income healthcare systems.

Opportunities

-

The artificial hearts market holds substantial untapped opportunities, particularly in the realm of miniaturized, fully implantable, and smart cardiac assist systems.

Technologies like magnetically levitated pumps, wireless power delivery, and flow controllers with integrated sensors are defining the future of artificial hearts with improved durability, energy consumption, and physiological sensitivity. Businesses committing to wearable monitoring devices and AI-powered predictive maintenance solutions have the potential to disrupt patient care after implantation. In addition, broadening clinical applications, like pediatric or congenital heart defect patients, offers fertile ground for growth. Another major opportunity is in the worldwide unmet need—although North America and Europe are at the forefront of adoption, other areas such as Asia-Pacific and Latin America, where cardiovascular disease is increasing at a fast pace, are still underpenetrated because of cost and access barriers. Public-private initiatives and strategic alliances between worldwide manufacturers and regional healthcare providers can fill this gap. Also, continuous clinical trials with long-term survival benefits and enhanced quality of life are bound to spur regulatory endorsement and physician acceptance. As healthcare systems around the world continue to embrace value-based models, artificial hearts, especially for destination therapy, may prove to be cost-effective in the long run, creating new avenues of reimbursement and adoption.

Challenges

-

The artificial heart market faces critical challenges that extend beyond cost and access, including technological complexity, patient compatibility, and long-term management issues.

Among the major challenges is device longevity despite advancements; artificial hearts continue to be at risk of wear and tear from continuous mechanical function, often requiring replacement or revision within 5–7 years. Biocompatibility is another issue, as blood-contact surfaces lead to thrombosis, necessitating lifelong anticoagulation with attendant risks of bleeding. These clinical complications have a profound impact on patient outcome and satisfaction. Also, the production of artificial hearts involves sophisticated precision engineering and regulation compliance, rendering production time-consuming, expensive, and scale-resistant. Individualization to accommodate varied patient anatomy, particularly in female and pediatric patients, contributes to development challenges. Also, long-term follow-up and care of patients with artificial hearts are often via telehealth, advanced follow-up care, and multidisciplinary teams, which are not available in all healthcare systems. Device-related psychological effects like fear, restricted mobility, and way of life also contribute to a lower quality of life in certain patients. Collectively, these problems highlight the demand for increased innovation in materials technology, remote monitoring, and medical infrastructure to make wider and longer-term implementation of artificial hearts available globally.

Artificial Heart Market Segmentation Insights

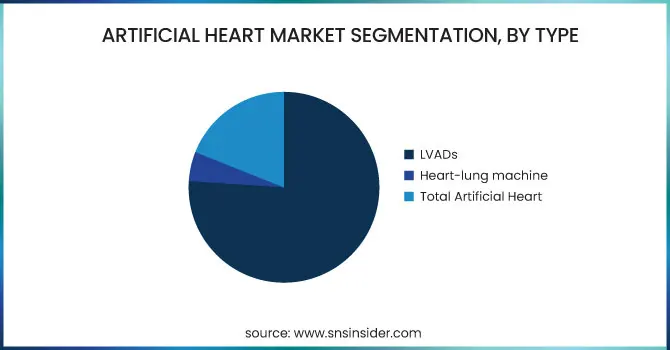

By Type

In 2023, the Left Ventricular Assist Devices (LVADs) segment held the largest share of the market, with a hefty 76.2% share. This is because LVADs have become universally accepted by clinicians as a standard of care for end-stage heart failure, specifically as a bridge to transplant or destination therapy. Their proven history of enhancing survival and quality of life, along with technology improvements in miniaturization and durability, have entrenched their hold in the market.

At the same time, the Total Artificial Heart (TAH) segment is expected to record the highest growth during the forecast period. This is fueled by increasing demand for full heart replacement therapy in the event of failure of both ventricles and the growing number of patients who are not eligible for heart transplantation. Technological advancements, better biocompatibility, and enhanced clinical trial success have also further spurred TAH's increasing uptake.

By Therapy

The Destination Therapy segment was the highest revenue generator in 2023, with the largest market share. This is indicative of a change in treatment trends, wherein artificial heart devices are being employed more and more as a long-term therapy instead of a short-term bridge to transplant. The increasing aged population, combined with shortages of donor hearts, has increased the demand for destination therapy as a final treatment option.

Of all the therapy segments, Destination Therapy is also likely to witness the fastest growth in the future. This trend is driven by positive regulatory support, technological advancements in device longevity, and the growing patient population who are not transplant candidates but need permanent circulatory support.

North America Artificial Heart Market Trends

North America was the largest holder of the artificial hearts market in 2023, backed by advanced medical infrastructure, a high prevalence of end-stage heart failure, and favorable reimbursement policies. The United States is at the forefront of the use of LVADs and TAHs due to the availability of key players such as Abbott, SynCardia Systems, and Medtronic, along with robust clinical research infrastructure.

Europe Artificial Heart Market Trends

Europe is the most rapidly expanding region within the artificial heart market. Europeans are growing because of the expanding prevalence of heart failure, greater use of destination therapy, and increasing clinical trials in nations such as Germany, France, and the U.K. The European market also has great cardiac centers, government-funded healthcare, and fast CE approvals for new devices. For instance, Germany is among the region's biggest LVAD implant markets, with growing patient volumes year by year. Strategic partnerships among European research institutions and medical device firms are also driving the take-up of next-generation artificial heart technologies. With growing awareness and improving clinical results, Europe will see tremendous growth in the artificial hearts market, and it becomes a critical focus area for both manufacturers and healthcare providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

SynCardia Systems, LLC – SynCardia Temporary Total Artificial Heart (TAH)

-

CARMAT – Aeson Total Artificial Heart

-

BiVACOR Inc. – BiVACOR Total Artificial Heart

-

RealHeart – RealHeart TAH

-

Abbott – HeartMate 3 LVAD

-

ABIOMED (Johnson & Johnson Services Inc.) – Impella Heart Pump

-

Jarvik Heart, Inc. – Jarvik 2000 LVAD

-

LivaNova PLC – Heart-Lung Machine HL 20

-

Getinge – Cardiohelp System

-

Terumo Corporation – Capiox Cardiopulmonary Bypass System

Recent Development

-

In February 2025, CARMAT announced having completed over 100 implants of its Aeson Total Artificial Heart. This achievement marks a significant advancement in the clinical adoption of artificial hearts for patients with advanced biventricular heart failure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.87 billion |

| Market Size by 2032 | USD 7.55 billion |

| CAGR | CAGR of 11.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [LVADs, Heart-lung Machine, Total Artificial Heart] • By Therapy [Bridge to transplant, Destination therapy, Bridge to decision, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SynCardia Systems, LLC, CARMAT, BiVACOR Inc., RealHeart, Abbott, ABIOMED (Johnson & Johnson Services Inc.), Jarvik Heart, Inc., LivaNova PLC, Getinge, Terumo Corporation. |