Wearable Medical Devices Market Report Scope & Overview:

Get more information on Wearable Medical Devices Market - Request Sample Report

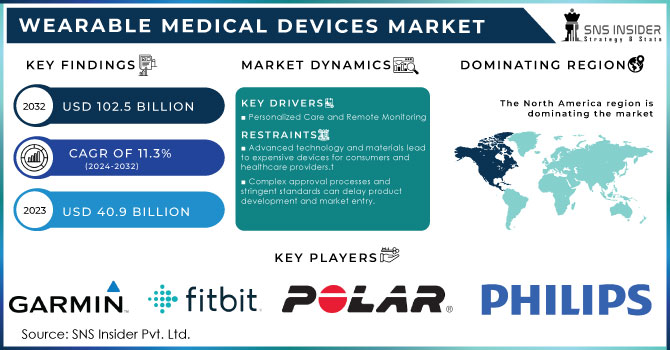

The Wearable Medical Devices Market size was valued at USD 40.9 Billion in 2023 and is expected to reach USD 102.5 Billion by 2032 and grow at a CAGR of 11.3% over the forecast period 2024-2032.

Wearable Medical Device Market: Dynamic Growth Driven by Technology and Health Trends

Expanding Horizons of Wearable Medical Devices: Key Drivers and Market Trends

The wearable medical device market is experiencing robust growth driven by technological advancements, the rising prevalence of chronic diseases, and a heightened focus on personalized healthcare. The expansion is further fueled by the surge in remote patient monitoring and home healthcare, alongside a growing emphasis on fitness and health-conscious lifestyles. Innovations in technology, strategic mergers and acquisitions, and increased clinical trials are creating significant opportunities for market growth. The prevalence of lifestyle-related disorders, such as diabetes and hypertension, linked to sedentary lifestyles, underscores the need for continuous physiological monitoring. Portable medical devices, increasingly integrated into healthcare systems, offer real-time data to physicians, reducing errors.

The COVID-19 pandemic has accelerated the adoption of wearable medical devices, showcasing their utility in diverse healthcare applications. For instance, devices like the Ava Bracelet, initially designed for fertility tracking, have been repurposed to detect early signs of viral infections by monitoring parameters such as heart rate variability and skin temperature. This shift highlights the versatility of wearable devices in addressing urgent health concerns. The rise in chronic diseases and associated mortality rates has intensified the need for personalized and continuous remote patient monitoring. Wearable medical devices, worn 24/7 without disrupting daily routines, are becoming increasingly popular due to their convenience and effectiveness. This trend is particularly evident in the cardiovascular device market, where wearables offer real-time health tracking, early detection of cardiovascular issues, and personalized care, reflecting a significant shift towards preventive healthcare.

The market is marked by rapid technological advancements and intense competition, with a wide range of innovative products and strategic collaborations. Companies are pursuing new product launches, regulatory approvals, acquisitions, and partnerships to enhance their offerings and gain a competitive edge. A notable example is Cloud DX’s January 2024 contract to develop a wrist-based wearable for tracking ECG and vital signs, underscoring the industry's focus on advancing remote patient monitoring solutions. The wearable medical device sector is highly fragmented, with numerous players contributing to a diverse and competitive market landscape. This fragmentation is driven by continuous technological progress and the introduction of various wearable solutions. Companies are engaging in strategic expansions and partnerships to broaden their geographic reach and cater to emerging market opportunities, highlighting the industry's commitment to making wearable medical devices more accessible and addressing global healthcare needs. As the market evolves, companies are navigating stringent regulatory environments to ensure device safety and efficacy. Securing regulatory approvals remains crucial for bringing innovative products to market and maintaining industry trust. Overall, the wearable medical device sector is characterized by dynamic growth, technological innovation, and a strong emphasis on personalized healthcare solutions, reflecting its transformative impact on patient care and health management.

Market Dynamics

Drivers

-

Personalized Care and Remote Monitoring:

The rise in chronic diseases, such as diabetes and hypertension, exacerbated by sedentary lifestyles, has created significant demand for continuous health monitoring. Portable devices enable real-time tracking of vital parameters, enhancing disease management and patient outcomes. The growing emphasis on personalized healthcare and remote patient monitoring fuels market growth, as wearable devices offer convenient, non-invasive solutions for continuous health assessment. Technological advancements, including advanced sensors and connectivity features, enhance the functionality and appeal of these devices. The COVID-19 pandemic has further accelerated adoption, demonstrating the utility of wearables in tracking and managing health conditions related to viral infections. Additionally, increasing health awareness and a shift towards health-oriented lifestyles drive consumer demand for wearable health solutions. Strategic industry developments, such as mergers, acquisitions, and new product launches, contribute to market growth, reflecting the industry's commitment to advancing technology and expanding product portfolios.

Restraints

-

Advanced technology and materials lead to expensive devices for consumers and healthcare providers.

-

Increased scrutiny over the handling and security of sensitive health information.

-

Complex approval processes and stringent standards can delay product development and market entry.

-

Limited battery life and connectivity problems can affect device performance.

Market Segmentation:

By Product

In 2023, the diagnostic devices segment led the market with a substantial revenue share of 61.6%, driven by the rising prevalence of neurological disorders. According to the World Federation of Neurology (October 2023), neurological disorders are the second leading cause of death and the foremost cause of disability globally. Over 40% of the global population is affected by neurological conditions, with this figure expected to nearly double by 2050. The top ten neurological conditions, including Stroke, Neonatal Encephalopathy, Migraine, Dementia, Meningitis, Epilepsy, Neurological Complications from Preterm Birth, Nervous System Cancers, Autism Spectrum Disorders, and Parkinson’s Disease, represent about 90% of neurological Disability-Adjusted Life Years (DALYs). Increased awareness of the benefits of neurological wearables for continuous cognitive assessment is expected to drive growth in this segment. Conversely, the therapeutic device segment is projected to grow the fastest, driven by innovations such as intelligent asthma management tools, wearable pain relief devices, and insulin management solutions.

By Site

In 2023, the strap/clip/bracelet segment led the market with the largest revenue share 32.2%, projected to maintain dominance throughout the forecast period. This growth is attributed to the increasing use of smartwatches that monitor parameters like mobility, respiratory rate, and pulse rate, featuring Bluetooth and cloud connectivity. Innovations in wrist-worn devices, such as the Fitbit Ace 3 Next Generation Activity and Sleep Tracker for kids, enhance fitness tracking by measuring heart rate, skin temperature, and activity levels. Major brands like Samsung and Apple are boosting market growth by introducing compatible mobile apps for wearable medical devices, encouraging routine health monitoring.

By Application

In 2023, the home healthcare segment led the wearable medical devices market with the largest revenue share of 27.5%. This segment’s dominance is driven by factors such as the increasing elderly population, higher prevalence rates of target diseases, and the need for more cost-effective healthcare management. The remote patient monitoring segment is expected to experience the highest CAGR during the forecast period, driven by the expanding global geriatric population and the rising incidence of chronic conditions.

By Grade Type

In 2023, the consumer-grade wearable medical devices segment led the market, capturing the largest revenue share 53.8% due to user-friendly features and rising health awareness. Factors such as convenience and affordability have bolstered this segment’s performance. Conversely, the clinical-grade wearable medical devices segment is expected to grow the fastest, driven by the need for sophisticated monitoring solutions within clinical environments. The increasing use of these devices for continuous patient monitoring and remote healthcare management is driving rapid expansion in this segment.

By Distribution Channel

In 2023, the pharmacy segment led the wearable medical devices market with the largest revenue share 37.8%, attributed to the widespread accessibility of pharmacies and their role as health and wellness centers. The online channel segment is projected to experience the highest CAGR during the forecast period, driven by the increasing consumer shift towards online shopping and the convenience offered by e-commerce platforms.

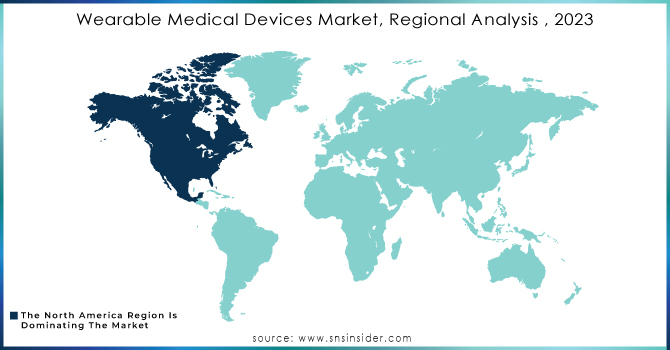

Regional Analysis

In 2023, North America led the market for wearable medical devices, capturing the largest revenue share 46.3% due to the high prevalence of cardiovascular disorders, diabetes, and cancer. The widespread adoption of remote patient monitoring and home care devices is expected to drive market growth throughout the forecast period. The Asia Pacific region is anticipated to experience significant growth, driven by supportive government initiatives, a growing elderly population, and increased healthcare spending. Japan, in particular, dominates the remote patient monitoring devices market within the Asia Pacific and is expected to retain its leadership due to rapid technological advancements and rising demand for home care devices.

Need any customization research on Wearable Medical Devices Market - Enquiry Now

Key Players

-

Koninklijke Philips N.V. (Philips Wearable Biosensor, Philips SmartSleep)

-

Fitbit (Fitbit Charge 5, Fitbit Sense)

-

Basis Science (now part of Intel) (Basis Peak)

-

Garmin (Garmin Forerunner 945, Garmin Vivosmart 4)

-

Covidien (Medtronic) (Covidien Guardant)

-

Omron Corp. (Omron HeartGuide, Omron Connect)

-

Withings (Withings ScanWatch, Withings Pulse HR)

-

Vital Connect (VitalPatch)

-

Polar Electro (Polar Vantage V2, Polar H10)

-

Intelesens Ltd. (Intelesens Wireless Vital Signs Monitor)

-

Apple (Apple Watch Series 8, Apple Watch Ultra)

-

Dexcom Inc. (Dexcom G6)

-

Masimo Corporation (Masimo Rad-97, Masimo MightySat)

-

Abbott Laboratories (FreeStyle Libre)

-

GE Healthcare (GE CARESCAPE V100)

Recent Developments

-

Fitbit Charge 6: In September 2023, Fitbit launched the Charge 6, featuring enhanced health tracking capabilities and integration with Fitbit’s updated health metrics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 40.9 Billion |

| Market Size by 2032 | US$ 102.5 Billion |

| CAGR | CAGR of 11.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

•By Product [Diagnostic Devices (Vital Sign Monitoring Devices, Sleep Monitoring Devices, Electrocardiographs Fetal and Obstetric Devices, Neuromonitoring Devices), Therapeutic Devices (Rehabilitation Devices, Respiratory Therapy Devices) •By Site [Handheld, Headband, Strap/Clip/Bracelet, Shoe Sensors, Others] •By Application [Sports and Fitness, Remote Patient Monitoring, Home Healthcare] •By Grade Type [Consumer-Grade Wearable Medical Devices, Clinical Wearable Medical Devices] •By Distribution Channel [Pharmacies, Online Channel, Hypermarkets] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Garmin Ltd., Fitbit, Inc, Kokinkliji Philips N.V., Polar Electro, Basis Science, Sotera Wireless, Withings, Vital Connect, Covidien (Medtronic), Omron Corp., Intelesens Ltd. and others. |

| DRIVERS | • Personalized Care and Remote Monitoring |

| RESTRAINTS | • • Advanced technology and materials lead to expensive devices for consumers and healthcare providers. • Increased scrutiny over the handling and security of sensitive health information. • Complex approval processes and stringent standards can delay product development and market entry. • Limited battery life and connectivity problems can affect device performance. |