Artificial Intelligence Toolkit Market Report Scope & Overview:

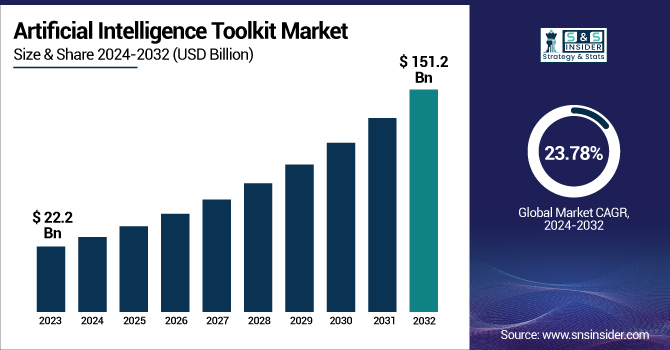

The Artificial Intelligence Toolkit Market was valued at USD 22.2 billion in 2023 and is expected to reach USD 151.2 billion by 2032, growing at a CAGR of 23.78% from 2024-2032.

To Get more information on Artificial Intelligence Toolkit Market - Request Free Sample Report

In the Artificial Intelligence Toolkit Market, adoption rates are highest in industries like healthcare, finance, retail, and manufacturing, driven by the need for intelligent automation and data-driven decision-making. Open-source AI toolkits are gaining popularity for their flexibility and community support, while proprietary solutions remain favored for enterprise-grade security and technical backing. Regionally, North America and Asia Pacific lead the market in revenue contribution, followed by steady growth in Europe. Cloud-based deployment dominates due to its scalability, ease of integration, and cost efficiency, though on-premise options continue to appeal in security-sensitive environments. The report could also explore integration trends with low-code/no-code platforms, AI toolkit marketplaces, and embedded AI functionalities within enterprise applications.

In the U.S. AI toolkit market, the market size was approximately USD 6.7 billion in 2023 and is projected to reach over USD 44.2 billion by 2032, reflecting a compound annual growth rate (CAGR) of around 23.42%. Growth factors include robust technological infrastructure, significant investments in AI research, and the presence of leading AI companies such as Google, Microsoft, and NVIDIA. The high adoption rates of AI in industries like healthcare, finance, retail, and automotive further propel market growth.

Artificial Intelligence Toolkit Market Dynamics

Driver

-

Rising demand for AI-driven business intelligence is accelerating the adoption of AI toolkits across key industries.

As a major driver of the Artificial Intelligence Toolkit Market, the ever-increasing demand for smart data analytical and decision-making capability. Companies from different verticals, such as healthcare, BFSI, retail, and logistics, are now using AI toolkits to extract useful intelligence from the growing amount of data, enhance personalization, and automate workflows involving complex processes. AI toolkits can make it easy to build, deploy, and manage AI models, saving time and money when it comes to implementation. Himanshu Varshney, Senior Director — AI & Data Analytics, Veritas Technologies: The widespread adoption of digital transformation initiatives among enterprises makes AI-powered business intelligence core to competitive advantage, thus propelling demand for AI toolkits featuring advanced machine learning, natural language processing, and computer vision capabilities.

Restraint

-

Technical complexities in AI model development and integration limit market accessibility for smaller enterprises.

However, the technical complexities involved in the development, training, and deployment of AI Models are a major restraint towards the adoption of this market despite the growth of the market. Artificial intelligence tool kits frequently need competencies in information science, machine learning, and infrastructure management, presenting a barrier for small and mid-sized enterprises that don’t have the talent in residence to capitalize on the opportunity. But the challenges of adoption are manifold — integrating AI solutions with existing IT systems, ensuring that the models you buy or build are correct, respecting privacy laws, and preventing AI systems from being hacked are just some of them. Furthermore, poor data quality and limitations with data infrastructures can affect AI toolkits’ performance. Such challenges restrict the accessibility of the market, especially for organizations in emerging economies or those with high regulatory requirements and legacy systems.

Opportunity

-

Integration with low-code/no-code platforms is enabling wider, faster, and more democratized AI adoption.

However, there is a large market opportunity available for bringing AI toolkits together with no or low-code AI development platforms. Such tools enable business analysts and other non-technical users to build, deploy, and manage AI options through visual interfaces with minimum coding expertise. Organizations can democratize AI adoption and bring AI projects to several organizational departments by lowering the technical barrier. AI toolkits are also the wave for them and vendors that offer these toolkits ail to be supported on low-code/no-code platforms to look more competitive as they counter talent shortage, though lowering the total cost of AI deployment. This trend of integration is especially beneficial for SMEs and modern industries that are new to AI implementation, and further drives the growth of the market in the coming years.

Challenge:

-

Growing concerns around data security, privacy, and AI ethics pose operational and compliance hurdles for providers.

Concerns regarding data security, privacy, and ethical use have become a major challenge for AI toolkit providers and users as more organizations adopt AI. As AI models are trained on sensitive personal, financial, and operational data, this reliance highlights the risk of breaches and unauthorized access to sensitive personal and business data. Also, AI algorithm biases can lead to biased decisions, scrutiny from regulators, and damaged reputations. Now ensure transparency, accountability, and compliance with GDPR, CCPA, and other laws and regulations, and you make one more set of operational complexities. To overcome these trust and compliance-related challenges in the market, toolkit providers will need to embed deep security protocols, model explainability, and bias mitigation within the solution.

Artificial Intelligence Toolkit Market Segmentation Analysis

By Type

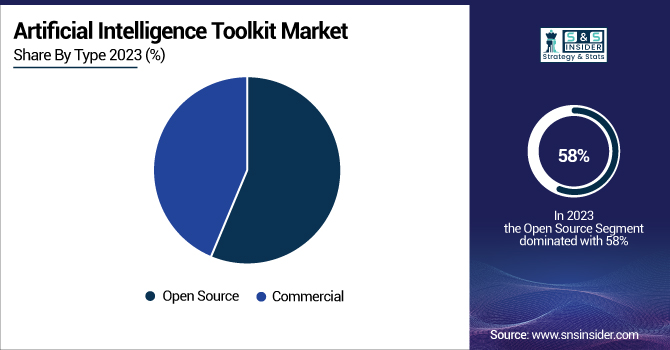

The open-source segment dominated the market and accounted for 58% of revenue share in 2023 and due to advantages like quick experimentation as well as customization of AI models by businesses and developers, flexibility for developing use cases, cost savings, and large community support. These AI toolkits like TensorFlow, PyTorch, and Scikit-learn, being open-source, contain tonnes of libraries and even frequent updates to hot plug into and hence are preferred in academia, start-up enterprises. This is especially so as the need for AI in research and innovation evolves, where the ability to have transparent and customizable solutions is increasingly vital.

The commercial segment is expected to register the fastest CAGR during the forecast period, as enterprises that place a higher demand on security, scalability, and enterprise-grade support for AI deployments. Commercial AI toolkits tend to include a suite of advanced features, including integrated analytics dashboards, model management, and regulatory compliance tools, making them more attractive for industries with complicated operational requirements. Moreover, increasing investments across enterprise-level solutions built on AI platforms, mostly in healthcare, finance, and manufacturing, are boosting the demand.

By Component

In 2023, the software segment dominated the market and accounted for 49% of revenue share, driven by the increasing demand for solutions for enterprise-wide development, deployment, and management of AI models. AI software toolkits make it easy to manipulate huge datasets, construct predictive models, and funnel AI into business workflows. The deployment of open-source and commercial AI software, meanwhile, along with ongoing updates and innovations with machine learning, computer vision, and NLP, drove market leadership.

The services segment is expected to record the fastest CAGR during the period ranging from 2024 to 2032, owing to the growing need for AI consulting, implementation support, integration, and managed services from enterprises. Companies are finding themselves more open to nostalgia-driven solutions to the tools they need to patch together, and so they want help in modifying the AI toolkit to their needs, getting even a few paid training models up and running, and meeting compliance in a more scalable manner. Enterprises that lack a tech background are also looking for AI model maintenance, performance tuning, and cloud migration services.

By Application

In 2023, the machine learning segment dominated the market and accounted for a significant revenue share, due to its extensive use in industries such as predictive analytics, recommendation systems, and anomaly detection in sectors like finance, healthcare, retail, and automotive. AI toolkits providing powerful machine learning frameworks enable organizations to discover meaningful insights from large data sets, automate decision-making, and enhance operational performance.

The natural language processing segment is projected to grow at the fastest CAGR between 2024 and 2032 as these solutions are increasingly used in AI-based chatbots, virtual assistants, and language translation tools. Today, enterprises leverage a plethora of NLP applications to automate customer communication channels, facilitate sentiment analysis, and build real-time language interpretive assistants, all to positively impact customer experience and improve operational efficiency. Increased NLP adoption across industries is augmented by generative AI models and conversational AI capabilities.

By End-Use

The IT & telecom segment dominated the market and accounted for a significant revenue share in 2023, due to early AI adoption, advanced digital infrastructure, and ongoing investments in intelligent network management and customer experience solutions. AI can automate many aspects of telecom operations, such as network optimisation, predictive maintenance, fraud detection, and personalized service delivery. Achieving this requires AI toolkits. Growing data traffic, pandemic-driven demand for AI-infused cybersecurity solutions, and rollouts of 5G network infrastructure bolstered the adoption.

The retail & e-commerce segment is expected to witness the fastest CAGR growth from 2024 to 2032 as it is driven by increasing demand for AI-powered personalization, dynamic pricing, inventory forecasting, and intelligent customer service tools. Retailers can leverage real-time customer data using AI toolkits, optimize recommendations on merchandise, automate logistics, and deploy conversational AI for conversational interaction with consumers.

Regional Landscape

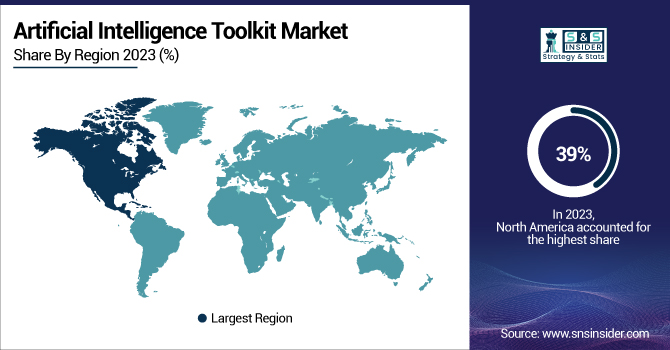

North America was the largest market in 2023 and accounted for 39% of revenue share, With well-established digital infrastructure, higher adoption rates than other regions, and the presence of the main AI toolkit providers such as Google, IBM, Microsoft, and NVIDIA. Enterprise investments in AI-driven analytics, cybersecurity, and automation tools across sectors such as healthcare, BFSI, and IT & telecom drive the state of AI in the region.

The Asia Pacific is expected to exhibit the highest CAGR during 2024 and 2032, due to rapid digitalization coupled with the increasing deployment of AI across industries, as well as lucrative governmental investments and the enhancing AI talent pool in countries such as India, China, Japan, and South Korea. Rapid increase in demand from e-commerce, smart manufacturing, fintech, and public service sectors expands AI toolkits use Government-led AI innovation projects, along with the growing penetration of cloud architecture, are creating conducive space for this technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players, along with their products, are

-

Google LLC – TensorFlow

-

Microsoft Corporation – Azure Machine Learning

-

IBM Corporation – IBM Watson Studio

-

Amazon Web Services, Inc. (AWS) – Amazon SageMaker

-

NVIDIA Corporation – NVIDIA AI Enterprise

-

Meta Platforms, Inc. – PyTorch

-

SAP SE – SAP AI Core

-

Oracle Corporation – Oracle AI Services

-

H2O.ai, Inc. – H2O Driverless AI

-

DataRobot, Inc. – DataRobot AI Platform

-

C3.ai, Inc. – C3 AI Suite

-

Salesforce, Inc. – Einstein AI

-

Anaconda, Inc. – Anaconda Distribution

-

MathWorks, Inc. – MATLAB AI Toolbox

-

RapidMiner, Inc. – RapidMiner Studio

Recent Developments

-

In March 2025, Oracle expanded its distributed cloud capabilities by integrating NVIDIA AI Enterprise into Oracle Cloud Infrastructure (OCI), facilitating accelerated AI solution deployment.

-

In January 2025, DataRobot integrated Azure OpenAI’s GPT-4o mini into its platform, enhancing its generative AI capabilities for text and image processing tasks.

-

In December 2024, AWS unveiled the next generation of Amazon SageMaker, introducing features like SageMaker Unified Studio, SageMaker Lakehouse, and enhanced data and AI governance tools.

-

In September 2024, Salesforce introduced an AI benchmark for customer relationship management, aiming to assist businesses in selecting optimal large language models for their needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.2 Billion |

| Market Size by 2032 | US$ 151.2 Billion |

| CAGR | CAGR of 23.78 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Open source, Commercial) • By Component (Hardware, Software, Services) • By Application (Natural language processing, Machine learning, Computer vision, Others) • By End-Use (IT & telecom, Retail and e-commerce, BFSI, Manufacturing, Energy and utility, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc. (AWS), NVIDIA Corporation, Meta Platforms, Inc., SAP SE, Oracle Corporation, H2O.ai, Inc., DataRobot, Inc., C3.ai, Inc., Salesforce, Inc., Anaconda, Inc., MathWorks, Inc. |