Wearable Fitness Technology Market Report Scope & Overview:

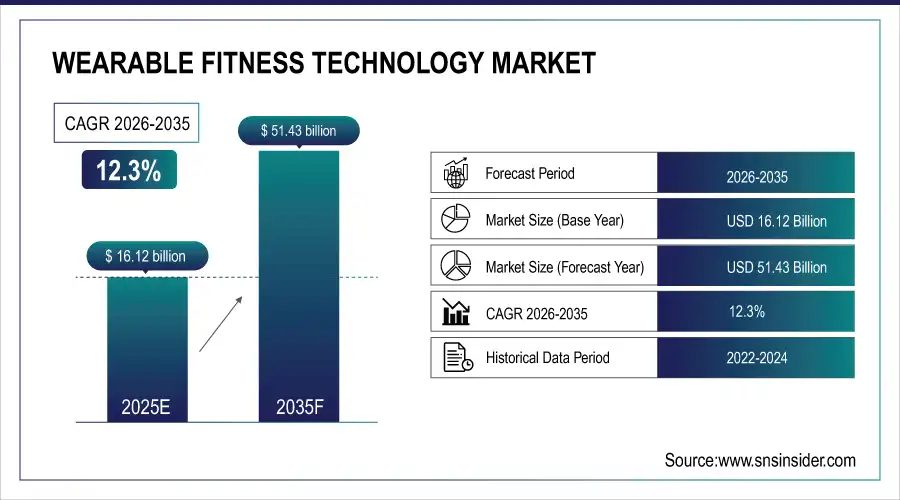

The Wearable Fitness Technology Market was valued at USD 16.12 billion in 2025 and is expected to reach USD 51.43 billion by 2035, growing at a CAGR of 12.3% from 2026-2035.

Wearable Fitness Technology Market is the innovation of newer technologies that enable people to keep an eye on health and fitness using sensor technology, AI, connectivity, etc., and is in a constant state of evolution. Wearable technology encompasses a wide range of devices smartwatches, fitness bands, and even smart clothing, to give you immediate information about heart rate, sleep, and activity levels. The growing health consciousness, the increasing adoption of fitness apps, and a rising demand for personalized wellness solutions are fuelling the market growth.

According to research, in 2023, smartwatches became the favorite wearable devices among 75% of users due to their multi-functional facilities such as fitness tracking, health monitoring, etc. Coming in second place were fitness tracker watches with a 34% share.

Wearable Fitness Technology Market Size and Forecast

-

Market Size in 2025: USD 16.12 Billion

-

Market Size by 2035: USD 51.43 Billion

-

CAGR: 12.3% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Wearable Fitness Technology Market - Request Free Sample Report

Wearable Fitness Technology Market Trends

-

Rising health consciousness and increasing focus on fitness tracking are driving demand for wearable fitness technologies.

-

Growing adoption of smartwatches, fitness bands, and smart clothing for real-time activity and health monitoring is boosting market growth.

-

Integration of advanced sensors, AI-driven analytics, and biometric monitoring is enhancing product functionality and user experience.

-

Increasing use of wearable fitness devices in preventive healthcare and remote patient monitoring is expanding application scope.

-

Advancements in battery life, miniaturization, and wireless connectivity are shaping product innovation trends.

-

Growing popularity of connected fitness ecosystems and mobile health applications is supporting sustained adoption.

-

Strategic partnerships between wearable device manufacturers, software developers, and healthcare providers are accelerating innovation and global market expansion.

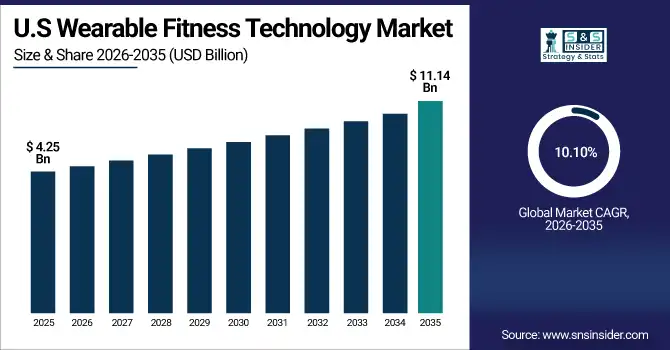

The U.S. Wearable Fitness Technology Market was valued at USD 4.25 billion in 2025 and is expected to reach USD 11.14 billion by 2035, growing at a CAGR of 10.10% from 2026-2035. The U.S. wearable fitness technology market analysis is expected to the increase in health consciousness and fitness awareness among consumers, high smartphone penetration, and the rapid integration of advanced sensors and artificial intelligence (AI).

Wearable Fitness Technology Market Growth Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Wearable Fitness Technology Market Growth

The growing demand for eco-friendly products among consumers in various industries is driving the growth of the wearable fitness technology industry. With sustainability taking center stage in 2024, manufacturers are investing in design principles that employ recycled materials and components that consume energy efficiently to help reduce their carbon footprints. For Instance, Garmin's "Venu 2S Eco Edition" smartwatch is made from recycled materials and can charge with sunlight, which matches consumers' environmental identity. Not only does this transition align with what we want out of an environmental perspective, but it also caters to the preferences of environmentally active purchasers, which leads to further market growth. With sensitivity about the environment increasing, we expect the designs of wearables utilizing eco-friendly practices to be a major influencer on the future direction of the market.

Wearable Fitness Technology Market Restraints:

-

Data Privacy and Security Concerns Hinder Wearable Fitness Technology Market Expansion

Widespread concerns regarding data privacy and security pose major impediments to the expansion of the wearable fitness technology market. In 2024, a study found that 80 percent of fitness apps convey user information to third parties, invoking sensitive data, including health metrics and personally identifiable information. Highly publicized sharing of data has consumers concerned that their personal information will be misused. Moreover, inadequate regulation on data privacy within wearable tech can create even more fear and apprehension, leading more people to refuse to adapt to these devices. Manufacturers need to deploy stringent data protection practices and transparent data management to restore consumer confidence and contribute to market expansion.

Wearable Fitness Technology Market Opportunities:

-

Integration of AI and Machine Learning Enhances Personalization in Wearable Fitness Technology

Artificial Intelligence (AI) and Machine Learning (ML) integration: AI and machine learning (ML) have massive prospects in the wearable fitness technology market. Digital physical therapy company Hinge Health announced in May 2025 that it is using AI to automate care delivery and improve patient outcomes. The company is focused on reducing clinician hours and scaling into other areas of care using AI-powered motion tracking and care coordination tools. The news highlights the ability of AI and ML to offer personalized user experiences, deliver timely health information, and boost general health. The incorporation of AI and ML technology will pave the way for innovation in wearable fitness devices, as anticipated by the expansion in the wearable fitness devices market.

Wearable Fitness Technology Market Challenges:

-

Limited Battery Life Impedes Continuous Usage of Wearable Fitness Devices

The wearable fitness technology market trend is the limitation of battery life in devices. Despite notable advancements in power-efficient components and smarter energy management systems, many fitness wearables still require daily or frequent charging. This affects the user experience, particularly for those relying on continuous health monitoring features like sleep tracking or 24/7 heart rate analysis. For active users or individuals with medical monitoring needs, interruptions due to battery constraints can be frustrating and disruptive. Moreover, the inclusion of more advanced sensors and connectivity features such as GPS, Wi-Fi, and LTE further strains battery performance. Addressing this challenge requires a holistic approach combining hardware innovation, software optimization, and perhaps user education on power-saving modes. Until a breakthrough in battery technology is achieved, limited battery life remains a persistent hurdle in ensuring a seamless and uninterrupted wearable experience.

Wearable Fitness Technology Market Segmentation Analysis:

By Component

Sensors led the wearable fitness technology market with a 22% revenue share in 2025, as these devices primarily determine physiological metrics, such as heart rate, movement, and temperature. The latest smartwatches launched by companies like Apple and Garmin bring in new sensors with better accuracy, thereby improving health monitoring. This ever-increasing demand for near-real-time data and accuracy has led to sensor innovation through the continuous introduction of new sensors, making them ubiquitous in wearable fitness products, and exploiting their use in personal health and medical applications.

Power management components, which are among the fastest growing components, in fitness wearables as manufacturers try to improve battery life and efficiency. This is also highlighted by the recent moves from Sony and Xiaomi with their low-power chipsets and smart battery optimization systems. Wearables are being packed with features but using them adds to the energy consumption and that needs to be lifetime provisioned with usage.

By Product

In 2025, smartwatches account for 47% of the market, as multifunctionality, eye-catching designs, and health-oriented capabilities are crucial. The past year has seen Apple, Fitbit, and Samsung update their respective smartwatch lines with ECG monitoring, sleep analysis, and personalized coaching. Smartwatches have gained more popularity with the growing fitness awareness among people, and smart tracking of health remotely, seamless integration with smartphones is increasing their usability.

The demand for smartshirts and jackets is growing at a high rate, CAGR of 15.24%, due to increasing interest in wearable textiles used to provide biometric tracking without the discomfort associated with wearing non-flexible devices against the skin. Sensor-embedded garments are coming from companies like Hexoskin and Ralph Lauren that provide ECG, respiration, and movement data. Such products are now finding traction with athletes and healthcare practitioners for near-real-time analytics on the human body.

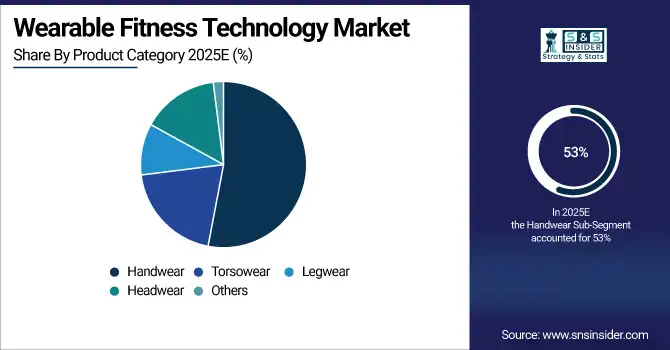

By Product Category

Handwear dominates product category share at 53% in 2025, largely due to the popularity of wrist-worn devices like smartwatches and fitness bands. Such instruments have a simple interface, continuous health monitoring, and mobile connectivity as well. Driven by the launch of high-end models with built-in GPS and health analytics from companies like Garmin and Huawei, the segment continues to grow. With the evolution of functional capabilities, strong market preferences secure handwear as the current dominating form factor for the wearable fitness tech ecosystem, with its convenience of usage.

Legwear wearables are experiencing the fastest growth with a 15.51% CAGR, powered by innovations in the form of smart leggings and socks that can detect muscle activity, posture, and step quality. With startups and fitness brands launching runner-focused products, as well as physical therapy and back pain posture ranges. Such devices provide biomechanical feedback to help with athletic training and injury prevention. With an emphasis on lower-body fit and recovery assistance, this legwear sets the stage for legwear to be the next great category in the wearable fitness technology market.

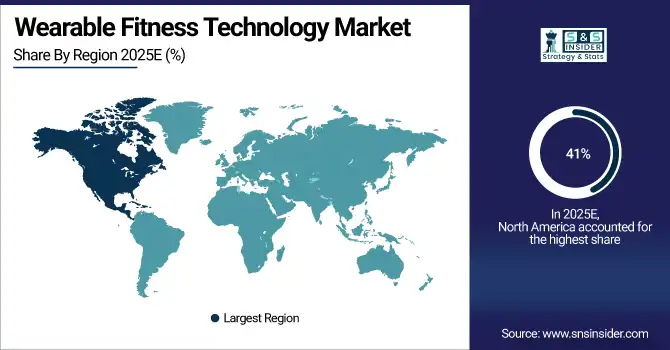

Wearable Fitness Technology Market Regional Outlook:

North America Wearable Fitness Technology Market Insights

The North America Region accounted for a Wearable Fitness Technology Market Share of 41% in 2025. Regional markets are led by high consumer health awareness, early technology adoption, and the incorporation of wearables in fitness, insurance, and healthcare. The North American market is further segmented into the U.S., Canada, and Mexico. U.S. consumers are utilizing smartwatches and fitness bands more than before to monitor their health proactively. Market expansion is enhanced by ongoing innovations from domestic technology giants and increasing collaborations with healthcare providers, cementing the U.S. as the regional engine of growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Wearable Fitness Technology Market Insights

Asia Pacific Fastest the fastest-growing region and the CAGR is 15.17%. Wearable adoption in Asian economies with high populations is being expedited by rapid digitalization, coupled with an expanding middle class and growing fitness trend. India, as the fastest-growing market in Asia, has seen a good tech environment, where health-conscious behaviour is developing. Foreign brands are introducing affordable, innovative wearables specifically for local consumers. Increased consumer dependence on fitness technologies complements the country’s increasing attention towards AI and data-driven healthcare. Due to high rates of smartphone penetration and a growing fitness culture amongst younger age groups, China is the regional leader in wearable technology market uptake.

Europe Wearable Fitness Technology Market Insights

In 2025, Europe’s market is steadily expanding, led by Germany, which dominates due to its advanced healthcare system and strong focus on preventive health. Europe’s Market is steadily expanding, led by Germany, which dominates due to its advanced healthcare system and strong focus on preventive health. Government healthcare digitization efforts and rising preventive health awareness are driving wearable fitness technology adoption across key European markets. German consumers increasingly adopt wearable devices for fitness tracking and chronic disease management. The country’s robust manufacturing base and innovation in sensor technologies further bolster market growth. Increasing government initiatives to promote digital health and rising health awareness across Europe are also contributing to the wider adoption of wearable fitness technologies throughout the region.

Middle East & Africa and Latin America Wearable Fitness Technology Market Insights

The MEA has seen a rise in awareness of health and fitness, and with urban centers seeing a surge in the popularity of smartwatches, this market is also expected to grow considerably. Gulf countries are also spending on digital health infrastructure, as well as initiatives aimed at health and wellness. Other contributors include South Africa and the UAE, with fitness culture and personal tracking interests accordingly. In Latin America (LA) is expanding, primarily thanks to Brazil and Mexico. Adoption is being driven by increased smartphone usage, fitness trends from social media, and the launch of smart bands at low price points. Wearables for lifestyle and wellness improvement have been embraced by urban consumers.

Wearable Fitness Technology Market Competitive Landscape:

Apple Inc.

Apple Inc. is a global technology leader known for integrating hardware, software, and services into a seamless ecosystem. In wearable fitness, Apple Watch plays a central role, combining health monitoring, activity tracking, and personalized insights. Apple emphasizes user privacy, advanced sensors, and AI-driven analytics to support fitness, wellness, and preventive healthcare. Continuous watchOS innovation allows Apple to enhance fitness experiences without relying solely on frequent hardware redesigns.

-

2024: Apple introduced watchOS 11, adding advanced health and fitness insights such as the Vitals app and training load metrics, helping users better understand workout impact and recovery.

-

2025: Apple launched Apple Watch Series 11, featuring hypertension notifications, sleep scoring, and Apple Intelligence integration to deliver more personalized, proactive fitness and lifestyle guidance.

Fitbit (Google LLC)

Fitbit, part of Google LLC, is a pioneer in consumer fitness tracking, offering wearables and software focused on activity, sleep, and health analytics. Fitbit’s platform increasingly leverages Google’s AI and cloud ecosystem to deliver smarter, data-driven insights. The brand continues transitioning from standalone hardware to a service-led health platform, emphasizing long-term behavior tracking, personalized coaching, and integration with Google devices and services.

-

2023: Fitbit advanced its integration into Google’s ecosystem by requiring Google Account login, consolidating user fitness data, services, and analytics under Google’s unified platform infrastructure.

-

2025: Google announced an AI-powered Personal Health Coach for the Fitbit app, delivering contextual workout and wellness guidance based on users’ long-term activity, sleep, and recovery patterns.

Samsung Electronics Co., Ltd.

Samsung Electronics is a global technology company delivering advanced consumer electronics, including a rapidly expanding wearable fitness portfolio. Samsung integrates biometric sensors, AI-powered analytics, and ecosystem connectivity across Galaxy devices. Its wearables emphasize holistic health, combining fitness tracking, sleep analysis, and wellness coaching. With Galaxy AI, Samsung continues enhancing personalization, positioning its wearables as intelligent companions supporting daily health and performance goals.

-

2023: Samsung expanded its wearables lineup with the Galaxy Ring, a biometric smart ring featuring PPG sensors, skin temperature monitoring, and continuous activity tracking for health insights.

-

2024: Samsung showcased its expanded Galaxy wearables portfolio, including Galaxy Ring and Galaxy Watch series, delivering intelligent health experiences powered by Galaxy AI and advanced fitness tracking.

-

2025: Samsung highlighted sleep and wellness innovations at World Sleep 2025, introducing antioxidant index tracking and AI-driven Running Coach features within the Galaxy Watch8 series.

Garmin Ltd.

Garmin Ltd. specializes in GPS-enabled wearable technology, with a strong focus on fitness, sports performance, and outdoor activities. Garmin devices are widely used by athletes and health researchers for precise metrics, long battery life, and advanced training analytics. The company combines hardware excellence with data-driven software insights, supporting endurance sports, wellness programs, and large-scale health research initiatives worldwide.

-

2025: Garmin partnered with King’s College London on a major health research initiative, collecting smartwatch data from up to 40,000 participants to study long-term health patterns.

-

2025: Garmin won five CES 2026 Innovation Awards for smartwatches including fēnix 8 Pro-MicroLED, Venu 4, and Forerunner 970, reinforcing leadership in fitness technology.

Key Players

Some of the Wearable Fitness Technology Market Companies

-

Apple Inc.

-

Fitbit

-

Garmin Ltd.

-

Samsung Electronics Co., Ltd.

-

Huawei Technologies Co., Ltd.

-

Xiaomi Corporation

-

Polar Electro Oy

-

Amazfit

-

Fossil Group, Inc.

-

Sony Corporation

-

Suunto

-

Withings

-

TomTom International BV

-

Whoop

-

Coros Wearables, Inc.

-

Oppo

-

Noise

-

boAt Lifestyle

-

Zephyr Technology Corporation

-

Fullpower Technologies, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 16.12 Billion |

| Market Size by 2035 | USD 51.43 Billion |

| CAGR | CAGR of 12.3% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Displays, Processors, Memory Chips, Power Management Components, Networking Components, User Interface Components, Sensors, Mechanical Components, Others) •By Product (Smartwatch, Wristband, Smartshoe, Smartshirt/Jacket, Headband/Smartcap, Others) •By Product Category (Handwear, Torsowear, Legwear, Headwear, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Apple Inc., Fitbit (Google), Garmin Ltd., Samsung Electronics, Huawei Technologies Co., Xiaomi Corporation, Whoop, Inc., Amazfit (Zepp Health Corporation), Polar Electro Oy, Oura Health Ltd., and Others. |