Astaxanthin Market Report Scope & Overview:

Get More Information on Astaxanthin Market - Request Sample Report

The Astaxanthin Market size was USD 2248.15 million in 2023 and is expected to Reach USD 9236.32 million by 2032 and grow at a CAGR of 17% over the forecast period of 2024-2032.

Astaxanthin is a naturally occurring red-colored ketocarotenoid that exists in microalgae and yeast. It is mostly found in the algae Haematococcus pluvialis and the yeast Xanthophyllomyces dendrorhous. Astaxanthin has a wide range of applications, in dietary supplements, aquaculture feed additives, and the cosmetic sector.

Based on Application, the animal feed & aquaculture segment dominated the astaxanthin market, and it is growing at a CAGR of 46% over the forecast period. Aquaculture and animal feed have the largest market share due to the widespread usage of astaxanthin as an animal feed. When compared to current food supplements, natural astaxanthin has superior antioxidant effects. The demand for these products is increasing in the aquaculture sector and improving seafood quality drives the growth of the astaxanthin market.

MARKET DYNAMICS

KEY DRIVERS

-

Health Benefits of Astaxanthin

Astaxanthin contains strong UV-blocking characteristics, which help protect our skin from sun damage. It also helps to reduce wrinkles and improve skin moisture levels. Natural forms of astaxanthin assist in blocking inflammatory COX2 enzymes while also decreasing serum levels of interleukin 1B, C Reactive Protein, nitric oxide, TNF-alpha (tumor necrosis factor-alpha), and prostaglandin E2. Astaxanthin is used to treat breast cancer by reducing the proliferation of breast cancer cells. Astaxanthin can improve endurance and fatigue levels after exercise, as well as increase the body's fatty acid consumption, which helps prevent muscular and skeletal damage. The rising awareness of the health benefits of astaxanthin drives the growth.

-

Increased demand for the cosmetics industry

RESTRAIN

-

Lack of research and development activity

Astaxanthin is a relatively new substance, and many health advantages are not known yet. More research activities are required to confirm current findings and to investigate other areas of possible benefit. Also, further research is required to discover new and innovative methods of producing and delivering astaxanthin to consumers. A dearth of R&D effort in the astaxanthin market is also impeding its entry into new markets.

OPPORTUNITY

-

Government support for aquaculture

Aquaculture is the main industry expected to drive the astaxanthin market forward. This initiative gives producers the flexibility and support they need to build the aqua feed sector and expand globally. The aquaculture market is expanding as a result of government initiatives in developing countries around the world. In India, the Ministry of Agriculture is in charge of funding, planning, and monitoring aquacultures and fisheries across the country through government development plans. It allows the aquaculture market to focus on the expansion of aquaculture sectors, to increase production. It employs a distributed strategy to assist the double farmer's income.

CHALLENGES

-

Adulteration of astaxanthin

Astaxanthin is frequently contaminated because it is an expensive component. Products containing astaxanthin that have been tampered with substances may include synthetic astaxanthin, which is less bioavailable than genuine astaxanthin. Clean-label rules are intended to stop businesses from labeling their products misleadingly or deceptively. As part of this, a product must list all of its contents, including any artificial colors, flavors, or preservatives. Customers are seeking transparency from astaxanthin producers as they become more aware of the issue of adulteration in the astaxanthin industry.

-

Stringent government rules

IMPACT OF RUSSIAN-UKRAINE WAR

The Russian-Ukraine war had a significant impact on the astaxanthin market. A significant portion of the world's astaxanthin supply, or roughly 40%, is produced in Russia and Ukraine. Due to the war's disruption of the astaxanthin supply coming from Russia and Ukraine, prices have increased and there are now shortages. Since the start of the war, astaxanthin prices have increased by 30% to 50% due to shortages of the supplements in some markets. Some astaxanthin producers were compelled to scale back or stop their operations completely. The war is predicted to result in a 10%–20% decrease in the astaxanthin supply worldwide.

IMPACT OF ONGOING RECESSION

The COVID-19 pandemic and the Russian-Ukraine war have impacted the astaxanthin supply chain, resulting in higher pricing and shortages. Astaxanthin is a rather expensive ingredient, and during a recession, consumers may be less likely to spend money on astaxanthin products. According to a Consumer Goods Industry Association survey, consumer expenditure on expensive items like nutritional supplements tends to fall in recession. Astaxanthin is an expensive item, and demand for astaxanthin products is expected to fall. In some markets, sales of astaxanthin supplements fell by 10% to 20%. This is most likely owing to a combination of circumstances, including a lack of conclusive evidence of its health advantages and the expensive cost of astaxanthin products.

MARKET SEGMENTATION

by Form

-

Liquid

-

Dry

by Source

-

Natural

-

Synthetic

by Method of Production

-

Fermentation

-

Chemical Synthesis

-

Extraction

-

Microalgae Cultivation

by Application

-

Dietary Supplement

-

Food and Beverages

-

Cosmetics

-

Nutraceuticals

-

Aquaculture & Animal Feed

-

other

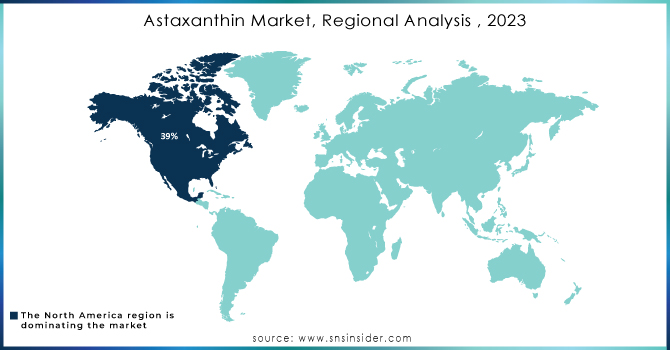

REGIONAL ANALYSIS

North America dominated the market in 2022, accounting for 39% of total revenue. One of the major causes driving astaxanthin demand in food products is the rising prevalence of nutrition and skin-related disorders in this region. Furthermore, a significant number of health-conscious consumers, an increase in nutraceutical use, and a well-established cosmetic sector are some of the primary factors fueling market expansion in the region.

The Asia Pacific region is the fastest-growing region for the astaxanthin market at the highest CAGR. New projects of aquaculture development and cosmetic industries in countries such as China, India, and others are driving the market growth. The aquaculture industry is growing rapidly, and astaxanthin is used as a feed additive to improve the health and well-being of farmed fish and seafood. The cosmetics industry in Asia Pacific is also growing rapidly, and astaxanthin is used in a variety of skincare products due to its antioxidant and anti-aging properties.

Europe held a market revenue share of 33% in 2022. The increased demand for astaxanthin in the aquaculture industries and nutraceuticals drives growth in the European area and is likely to develop at a moderate rate. Although Europe's aquaculture industry is growing slowly, astaxanthin is still utilized as a feed ingredient to boost the health and well-being of farmed fish and shellfish. The European nutraceutical business is expanding rapidly, and astaxanthin is used in a range of dietary supplements owing to its alleged health benefits.

Need any customization research on Astaxanthin Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Astaxanthin Market are Algatech Ltd, Algorigin, MicroA, Cyanotech Corporation, Algalíf Iceland ehf, Beijing Gingko Group (BGG), ENEOS Corporation, Fuji Chemical Industries Co., Ltd, Cardax, Inc., Solgar Inc., Atacama Bio Natural Products S.A., PIVEG, Inc., E.I.D. – Parry Ltd, and other key players.

RECENT DEVELOPMENTS

In 2023, Solabia-Algatech Nutrition Ltd. unveiled two new delivery forms utilizing its AstaPure astaxanthin components at the Vitafoods Europe trade event in Geneva, Switzerland. A vegan gummy and a powder that dissolves in cold water are the two new forms.

In 2022, Solabia-Algatech introduced Astaxanthin Gummies made with Vitamin C, a natural and preservative-free alternative. These candies provide a robust 4 mg dose of astaxanthin algal complexes per serving, making it easy and fun for customers to include this important element into their daily routine.

In 2022, Divi's Nutraceuticals and Algalif announced a collaboration to bring high-concentration astaxanthin beadlets to market. This collaboration combines the expertise of both firms to create a game-changing solution that provides a concentrated convenient version of astaxanthin.

| Report Attributes | Details |

| Market Size in 2023 | USD 2248.15 Million |

| Market Size by 2032 | USD 9236.32 Million |

| CAGR | CAGR of 17 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Liquid and Dry) • By Source (Natural and Synthetic) • By Method of Production (Fermentation, Chemical Synthesis, Extraction, and Microalgae Cultivation) • By Application (Dietary Supplement, Food and Beverages, Cosmetics, Nutraceuticals, Aquaculture & Animal Feed, and other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Algatech Ltd, Algorigin, MicroA, Cyanotech Corporation, Algalíf Iceland ehf, Beijing Gingko Group (BGG), ENEOS Corporation, Fuji Chemical Industries Co., Ltd, Cardax, Inc., Solgar Inc., Atacama Bio Natural Products S.A., PIVEG, Inc., E.I.D. – Parry Ltd |

| Key Drivers | • Health Benefits of Astaxanthin • Increased demand for the cosmetics industry |

| Market Restrain | • Lack of research and development activity |