De-Oiled Lecithin Market Report Scope & Overview:

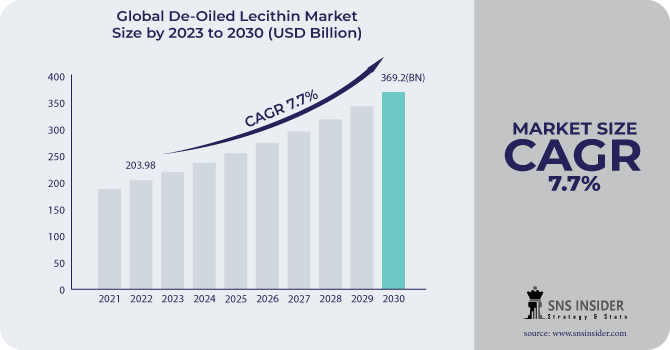

The De-Oiled Lecithin Market size was USD 203.98 billion in 2022 and is expected to Reach USD 369.2 billion by 2030 and grow at a CAGR of 7.7 % over the forecast period of 2023-2030.

De-oiled lecithin contains a high concentration of phospholipids, which are important nutrients for human health. It is also an emulsifier, wetting agent, antioxidant, and surfactant in nature.

Based on the Source, the market is segmented into Sunflower, Soybean, Canola seeds, Rapeseed, and Eggs. In 2022, the soybean segment led the market, accounting for around 51% of the total. Soybean lecithin is frequently utilized because soybeans are generally available and have a wide range of applications. Soy-based de-oiled lecithin is widely utilized in the food and beverage industries to create bread, confections, and dairy replacements due to its remarkable emulsifying properties.

Based on Type, the market is segmented as non-GMO and GMO. The non-GMO segment dominates the growth of global de-oiled lecithin. Non-GMO de-oiled lecithin is derived from species that didn't undergo genetic modification, ensuring the purity of the raw materials used in manufacture. This market has seen significant expansion as customers increasingly want natural and clean-label components. With a market share of roughly 44%, the food and beverages segment dominated the industry.

MARKET DYNAMICS

KEY DRIVERS

-

Rising demand for emulsifiers

-

The increasing demand for Food & Beverages products

Consumers are becoming more and more interested in healthy and natural food products. De-oiled lecithin is a natural ingredient that is frequently used to enhance the texture and shelf life of convenience meals. Many bakery and confectionery products must be produced using lecithin which aids in binding water and oil together. Lecithin is also utilized in a wide range of foods, such as ice cream, baked goods, salad dressings, and mayonnaise. Some functional meals, such as energy bars, and dietary supplements, contain lecithin.

RESTRAIN

-

Fluctuation in prices of raw materials

Lecithin is derived from soybeans, a commodity crop whose production is affected by factors such as weather, and crop yield. This can make it difficult for de-oiled lecithin producers to keep their prices consistent. Sunflower lecithin prices are also affected by the supply-demand balance. Another factor is the scarcity of sunflower seeds. Weather conditions, pests, disease outbreaks, and political uncertainty can all have an impact on the availability of sunflower lecithin, leading the price to rise.

OPPORTUNITY

-

Increasing applications of lecithin

De-oiled lecithin is currently widely utilized in medicines, personal care, food processing, drinks, bread, and confectionery items as a result of expanded research and development. The increasing expansion of healthcare infrastructure would increase demand for de-oiled lecithin in the pharmaceutical industries, creating attractive prospects for the lecithin market. With the expanding influence of Western culinary culture in Asia, the Middle East, and Africa, the food processing industry will drive up demand for de-oiled lecithin. Increased disposable income has led to the consistent growth of the cosmetics sector, which will provide profitable ventures for the de-oiled lecithin market.

-

Expansion of usage of lecithin in untapped market

CHALLENGES

-

Strict government regulations on lecithin use

Some nations have prohibited the use of lecithin in food products. These limitations are frequently based on worries about lecithin's safety or its possible usage as a food additive. The Food and Drug Administration in the United States has not prohibited the use of lecithin in food products. The European Union has prohibited the use of lecithin in some food products, including infant formula. This rule has the potential to create uncertainty about the future of the lecithin market, making it difficult for enterprises to invest in lecithin production.

IMPACT OF RUSSIAN-UKRAINE WAR

The two countries that produce the most sunflower seeds globally are Russia and Ukraine, and the disruption to their combined 50%+ of the global supply has led to sharp price rises for sunflower lecithin. Ukraine and Russia produce over 70% of the world's sunflower lecithin. As a result, the war in Ukraine had a significant impact on the sector. When agricultural activities are disrupted by weather or war, this lack of component diversity results in an increased risk of rising inflation and ingredient price volatility. In 2022, the confectionery sector will run out of sunflower lecithin, an emulsifier critical to their goods.

IMPACT OF ONGOING RECESSION

Since the war, the cost of liquid sunflower lecithin and de-oiled sunflower lecithin powder has increased by 3 to 4 times and is still rising. Uncertainty will hang large over the world's output of sunflowers for the foreseeable future, and it may last longer. Price pressures may also last for years. Smaller regional companies like Slovakia, Poland, Czechia, etc. have resumed serving the market as the largest, least expensive producers are no longer doing so, although their production only accounts for a small portion of the current market. Spain, several nations in Eastern Europe, and South America are examples of additional regional producers. Typically, South American production stays on the continent. As a result, prices have increased by 3 to 4 times from their pre-war level. The next cleanest alternative to sunflower lecithin is non-GM canola or rapeseed products.

MARKET SEGMENTATION

By Source

-

Soybean

-

Rapeseeds

-

Sunflower

-

Egg

-

Canola Seeds

By Form

-

Powdered

-

Granulated

By Type

-

GMO

-

Non-GMO

By Applications

-

Feed

-

Industrial

-

Health Care Products

-

Food & Beverages

.png)

REGIONAL ANALYSIS

Asia Pacific established as the largest de-oiled lecithin market with a market share of roughly 41% and 79.8 million market revenue in 2022. The huge agricultural sectors of India, and China, which offer sources such as soybean and sunflower for lecithin manufacturing, drive the Asia Pacific market for de-oiled lecithin. As a supplemental source of income consumers raise a large number of animals. The feed sector will thrive as animal numbers increase. For instance, the existing and rising beauty and cosmetics industries in South Korea and Japan will support the expansion of the de-oiled lecithin industry. The pharmaceutical industry in China and India would similarly be responsible for driving the need for de-oiled lecithin in the area.

North America has the second-largest market growth. The growth of the market in North America is driven by the increasing demand for processed foods, bakery & confectionery. The growing popularity of natural and organic products, and the rising awareness about the health benefits of lecithin.

Europe is expected to grow at a fast CAGR in the global market. The growth of the market in Europe is driven by similar factors as in North America, as well as the increasing demand for lecithin in the pharmaceutical and cosmetics industries in the U.K. and Germany.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the De-Oiled Lecithin Market are National Lecithin Inc, American Lecithin Company, Archer Daniels Midland, Cargill, Amitex Agro Product Pvt. Ltd., Bunge Limited, Clarkson Grain Company, LECICO GmbH, DowDuPont, Giiava, Stern-Wywiol Gruppe, and other key players.

National Lecithin Inc-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 Cargill acquired the Owensboro Grain Company, a Kentucky refinery and soybean processing plant owned by a fifth-generation family.

In 2023 National Lecithin, Inc., a New Jersey-based has purchased the commercial assets of Soya International LLC, a food ingredients supplier situated in New York.

In 2022 The Louis Dreyfus Company Agricultural Industries announced the official opening of its new soy liquid lecithin factory in Claypool, US, positioned this plant as the country's largest, incorporating biodiesel production, soybean processing, glycerine, and lecithin refining processes in addition to food-grade packaging line and canola oil distribution terminal.

| Report Attributes | Details |

| Market Size in 2022 | US$ 203.98 Billion |

| Market Size by 2030 | US$ 369.2 Billion |

| CAGR | CAGR of 7.7 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Soybean, Rapeseeds, Sunflower, Egg, and Canola Seeds) • By Form (Powdered and Granulated) • By Type (GMO, Non-GMO) • By Applications (Feed, Industrial, Food & Beverages, Health Care Products) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | National Lecithin Inc, American Lecithin Company, Archer Daniels Midland, Cargill, Amitex Agro Product Pvt. Ltd., Bunge Limited, Clarkson Grain Company, LECICO GmbH, DowDuPont, Giiava, Stern-Wywiol Gruppe |

| Key Drivers | • Rising demand for emulsifiers • The increasing demand for Food & Beverages products |

| Market Restrain | • Fluctuation in prices of raw materials |