Chocolate Confectionery Market Report Scope & Overview:

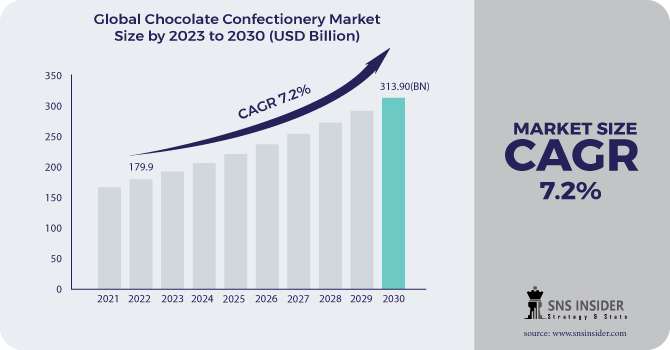

The Chocolate Confectionery Market Size was esteemed at USD 206.74 billion in 2024 and is expected to reach at USD 360.56 billion by 2032, at a CAGR of 7.2% over the forecast period 2025-2032.

The chocolate confectionery market is experiencing strong growth, driven by rising consumer demand for premium, indulgent, and innovative products. Europe dominates the market due to high per capita consumption and a strong preference for artisanal and luxury chocolates, while the Asia Pacific region is rapidly expanding, fueled by increasing incomes, urbanization, and evolving lifestyles. Key trends include growing popularity of milk and dark chocolates, the rise of online retail channels, and increasing demand for convenient, snackable, and gifting chocolate formats. Manufacturers are focusing on product innovation, unique flavors, sustainable sourcing, and premium packaging to cater to changing consumer preferences and strengthen brand loyalty in a competitive and dynamic market.

Chocolate Confectionery Market Size and Forecast:

-

Market Size in 2024: USD 206.74 Billion

-

Market Size by 2032: USD 360.56 Billion

-

CAGR (2025–2032): 7.2%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Chocolate Confectionery Market Highlights:

-

Evolving consumer preferences with increasing demand for quality, health-conscious, sustainable, and ethically sourced chocolate products, influencing innovation and product offerings

-

Product innovation with functional ingredients, natural fillings, exotic flavors, and nut-based or tropical products to cater to changing tastes

-

Gifting trends driving consumption of chocolates, candies, and bakery items during festivals, celebrations, and corporate events

-

Impulse purchases and branding prompting innovative packaging, promotions, and personalized marketing strategies

-

Raw material volatility due to fluctuating sugar and cocoa costs from climate, supply, and geopolitical factors challenging pricing, margins, and supply chains

-

Opportunities for premium and customized products with growing demand for artisanal and unique confectionery offerings

Buyer propensities, tastes, and inclinations are continually advancing. This has prompted advancement in the field of sweet shops that drive market development. Makers are expanding their item range by including useful fixings, natural homegrown fillings, tropical organic products, and nut-based and outlandish flavors in item definitions to satisfy changing buyer needs. Besides, the pattern of giving dessert shop items, like treats, chocolates, bread kitchen things, and others, has empowered to drive the market development in the new year’s. Brands are continually laying out special connections with methods to look for purchaser consideration as candy store items are fundamentally bought because of motivation purchasing. These elements have aggregately empowered to drive the market for dessert shop items. Nonetheless, the unpredictable idea of natural substance costs of sugar and cocoa can hamper the development of the market.

Chocolate Confectionery Market Drivers:

-

Purchaser propensities, tastes, and inclinations are continually advancing.

Purchaser propensities, tastes, and inclinations are continuously evolving due to changes in lifestyle, cultural influences, technological advancements, and exposure to global trends. Consumers today seek not only quality products but also experiences that align with their personal values, such as sustainability, ethical sourcing, and health-conscious choices. Brand loyalty is increasingly influenced by digital engagement, social media, and personalized marketing. Additionally, convenience, affordability, and innovation play a critical role in shaping purchasing decisions. Companies must constantly monitor these shifting preferences, adapt their offerings, and develop targeted strategies to meet consumer expectations while maintaining competitive advantage in a dynamic marketplace.

Chocolate Confectionery Market Restraints:

-

The unpredictable idea of unrefined substance costs of sugar and cocoa.

The unpredictable nature of raw material costs for sugar and cocoa significantly impacts the chocolate confectionery market. Prices for these essential ingredients fluctuate due to factors such as climate change, crop yields, geopolitical tensions, labor shortages, and global demand-supply imbalances. Poor harvests caused by droughts or excessive rainfall, coupled with rising transportation and energy costs, can drive prices upward, affecting production expenses. Conversely, favorable weather and increased supply can lead to temporary price drops. Such volatility challenges manufacturers in pricing strategies, profit margins, and supply chain planning, compelling companies to adopt risk management measures like futures contracts, hedging, and strategic sourcing to maintain stability.

Chocolate Confectionery Market Opportunities:

-

The pattern of giving candy parlor items, like treats, chocolates, pastry shop things, and others.

The pattern of gifting confectionery items, including chocolates, candies, bakery products, and other sweet treats, has become an integral part of social and cultural practices worldwide. Gifting such items is associated with celebrations, festivals, personal milestones, and corporate events, reflecting affection, appreciation, and goodwill. Consumer preferences have evolved, with an increased demand for premium, artisanal, and customized products that offer a unique and memorable experience. Seasonal trends, packaging innovations, and themed assortments further influence purchasing behavior. As lifestyles change, the gifting of confectionery has expanded beyond traditional occasions, becoming a popular choice for expressing emotions, building relationships, and enhancing personal and professional connections.

Chocolate Confectionery Market Segment Analysis:

By Product Type

In 2024, the molded bars segment led the chocolate confectionery market, holding a dominant share of 36.5%. This category includes popular products like M&M’s, Snickers, and Twix, which are widely consumed across various demographics. The chips & bites segment, encompassing products such as Maltesers and chocolate-covered nuts, is projected to experience the fastest growth, driven by increasing demand for convenient, shareable, and snackable formats. These bite-sized treats cater to on-the-go lifestyles and are gaining popularity among younger consumers seeking indulgent yet portion-controlled options.

By Type

In 2024, the milk chocolate segment dominated the chocolate confectionery market, accounting for approximately 52% of the total share, due to its widespread consumer preference and smooth, creamy taste. The dark chocolate segment is projected to experience the fastest growth, driven by rising health-conscious trends and demand for higher cocoa content and antioxidant benefits. The white chocolate segment holds a smaller share but continues to grow steadily, supported by premium and specialty product launches catering to niche consumer preferences

By Distribution Channel

In 2024, supermarkets & hypermarkets dominated the chocolate confectionery market, capturing around 45% of the total share, due to wide product availability and promotional campaigns. The online segment is projected to experience the fastest growth, fueled by increasing e-commerce adoption, digital marketing, and consumer preference for convenient home delivery. Convenience stores maintain a steady share by catering to impulse purchases, while others (including specialty stores and vending machines) hold a smaller portion but continue to grow gradually with niche offerings

.png)

Chocolate Confectionery Market Regional Analysis:

Europe Chocolate Confectionery Market Trends:

Europe continues to dominate the global chocolate confectionery market, holding the largest revenue share of approximately 39.2% in 2024. This leadership is primarily driven by high per capita consumption in countries such as Switzerland, France, Germany, Italy, and the Netherlands. Consumers in the region show a strong preference for premium, organic, and artisanal chocolate products, which has encouraged manufacturers to innovate with high-quality ingredients, unique flavors, and luxury packaging. Well-established retail networks, including supermarkets, hypermarkets, and specialty stores, ensure widespread availability. Seasonal events, gifting culture, and strong brand loyalty further strengthen Europe’s dominant position.

Asia-Pacific Chocolate Confectionery Market Trends:

The Asia Pacific region is the fastest-growing market for chocolate confectionery, fueled by a combination of demographic and economic factors. A large youth population, rising disposable incomes, and increasing urbanization have led to higher demand for premium, indulgent, and innovative chocolate products. Countries such as China, India, and Japan are witnessing a surge in consumption due to changing lifestyles, greater exposure to global trends, and growing adoption of western confectionery brands. Online retail channels and modern trade outlets are expanding rapidly, making chocolate more accessible to diverse consumer segments. The region also shows strong potential for new product launches targeting flavor innovation and health-conscious options.

North America Chocolate Confectionery Market Trends:

North America remains a steady and mature market for chocolate confectionery, supported by high chocolate consumption and the presence of leading global brands like Mars, Hershey, and Mondelez. The region benefits from advanced distribution channels across supermarkets, convenience stores, and online platforms, ensuring product accessibility. Consumers in North America increasingly seek premium and innovative products, including organic, sugar-reduced, and ethically sourced chocolates. Seasonal occasions, gifting trends, and indulgence-driven purchases continue to drive demand, while marketing campaigns and brand loyalty reinforce market stability.

Latin America Chocolate Confectionery Market Trends:

Latin America’s chocolate confectionery market is gradually expanding, driven by urbanization, a growing middle class, and increased exposure to global chocolate brands. Countries such as Brazil and Mexico are witnessing rising demand for both premium and mass-market chocolate products. Retail expansion, including supermarkets and e-commerce, has improved accessibility, while consumer awareness of gifting and indulgence continues to grow. Economic fluctuations may pose occasional challenges, but overall, the region presents significant opportunities for growth, particularly in flavored and innovative confectionery offerings.

Middle East & Africa Chocolate Confectionery Market Trends:

The MEA region shows steady growth in chocolate confectionery consumption, driven by increasing urban populations, higher disposable incomes, and a rising appetite for premium and imported chocolates. Countries such as the UAE, Saudi Arabia, and South Africa are key markets, where gifting culture and seasonal celebrations promote demand for chocolates. Expansion of modern retail formats, including hypermarkets and e-commerce, enhances accessibility. Additionally, growing awareness of international chocolate brands, along with tailored product innovations for regional tastes, supports market development across the region.

Chocolate Confectionery Market Key Players:

-

Mars, Incorporated

-

Mondelez International, Inc.

-

Nestlé S.A.

-

Ferrero Group

-

The Hershey Company

-

Chocoladefabriken Lindt & Sprüngli AG

-

Ezaki Glico Co., Ltd.

-

Haribo GmbH & Co. K.G.

-

Pladis

-

Barry Callebaut

-

CEMOI Group

-

Lake Champlain Chocolates

-

LOTTE Confectionery

-

Tony’s Chocolonely

-

Godiva Chocolatier

-

Russell Stover Chocolates

-

Ghirardelli Chocolate Company

-

Fazer Group

-

Whittaker’s

-

Trapa

Chocolate Confectionery Market Competitive Landscape:

Mars, Incorporated is a U.S.-based global confectionery and food company, founded in 1911 and headquartered in McLean, Virginia. Known for iconic brands like M&M’s, Snickers, and Twix, Mars operates across chocolate, gum, and petcare segments, emphasizing innovation, quality, and sustainability in its products worldwide.

-

In July 2024, Mars Wrigley will introduce U.S. products made without FD&C colors, including M&M’s Chocolate, Skittles Original, Extra Gum Spearmint, and Starburst Original, available nationwide online. This initiative continues Mars Wrigley’s innovation journey and commitment to consumer choice, safety, and industry leadership through efforts like the NCA “Always A Treat” initiative.

Nestlé S.A. is a Swiss multinational food and beverage company, founded in 1866 and headquartered in Vevey, Switzerland. It is a global leader in chocolate, coffee, dairy, and nutrition products, known for brands like KitKat, Nescafé, and Smarties, emphasizing quality, innovation, and sustainability across its diverse product portfolio.

-

In Sept. 2025 – Nestlé has developed a groundbreaking process to boost cocoa production by using up to 30% more of the cocoa fruit, including pulp, placenta, and pod husk, reducing waste and increasing farmer income. This pilot-stage innovation addresses climate-related yield reductions while supporting sustainable chocolate production worldwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 206.74 Billion |

| Market Size by 2032 | USD 360.56 Billion |

| CAGR | CAGR 7.2% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mars, Incorporated, Mondelez International, Inc., Nestlé S.A., Ferrero Group, The Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Ezaki Glico Co., Ltd., Haribo GmbH & Co. K.G., Pladis, Barry Callebaut, CEMOI Group, Lake Champlain Chocolates, LOTTE Confectionery, Tony’s Chocolonely, Godiva Chocolatier, Russell Stover Chocolates, Ghirardelli Chocolate Company, Fazer Group, Whittaker’s, Trapa |