Attitude and Heading Reference Systems (AHRS) Market Size:

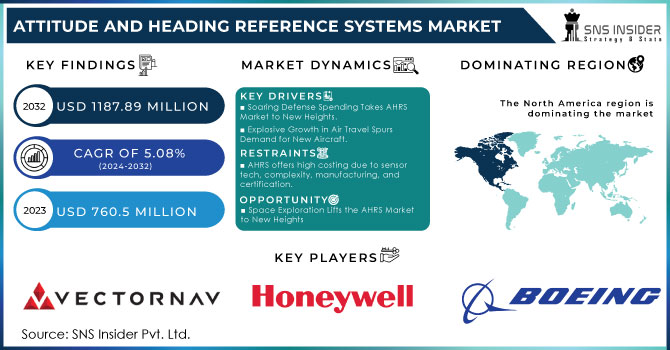

The Attitude and Heading Reference Systems Market Size was valued at US$ 760.5 million in 2023 and is expected to reach USD 1187.89 million by 2032 with an emerging CAGR of 5.08% over the forecast period 2024-2032. The Attitude and Heading Reference Systems (AHRS) fueled by the rise of aviation industry rising towards a future to enhanced safety and efficiency. These compact marvels replace bulky traditional gyroscopic instruments, offering a multi-sensor solution for superior navigation and flight stability. AHRS combines gyroscopes, accelerometer, and magnetometers to provide ultra-accurate data on an aircraft's position, orientation, and movement in all directions. This results to smoother flight, improved navigation, and a significant boost in pilot situational awareness. AHRS boasts a compact design, minimizing weight and space requirements. This translates to not only a sleeker aircraft but also increased fuel efficiency and improved payload capacity. Additionally, the solid-state or MEMS technology within AHRS offers superior reliability and lower maintenance needs compared to older systems, reducing operating costs for airlines.

To get more information on Attitude and Heading Reference Systems (AHRS) Market - Request Free Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Soaring Defense Spending Takes AHRS Market to New Heights.

-

Explosive Growth in Air Travel Spurs Demand for New Aircraft.

The rise in military might, with defense spending flexing its muscles. A recent report by the Stockholm International Peace Research Institute (SIPRI) revealed a 2.6% increase in global military expenditure, reaching a staggering $1.82 trillion. This surge in spending is predicted to ignite a firestorm of demand for technologically advanced aircraft think fighter jets, unmanned aerial vehicles (UAVs), and helicopters. As these high-tech machines take to the skies, the need for sophisticated navigation systems like Attitude and Heading Reference Systems (AHRS) is expected to skyrocket in parallel. This translates to a potential windfall for the AHRS market in the coming years, with the industry poised to take flight alongside the rise of modern military aviation.

RESTRAIN:

-

AHRS offers high costing due to sensor tech, complexity, manufacturing, and certification.

Attitude and Heading Reference Systems (AHRS) can come with a hefty price tag. This might seem counterintuitive considering the advancements in AHRS technology. The manufacturers have found ways to reduce production costs through miniaturization and improved sensor technology, several factors contribute to the overall expense of AHRS. The complexity of the system itself plays a role. AHRS goes beyond just gyroscopes. It integrates multiple sensors like accelerometers and magnetometers along with sophisticated processing algorithms to deliver accurate orientation data. This intricate design adds to the manufacturing cost. certification is a crucial aspect for AHRS used in critical applications like aviation and aerospace. These certifications ensure the system meets stringent safety and reliability standards. The rigorous testing procedures involved significantly increase the overall cost.

OPPORTUNITY:

-

Rising global defense budgets could boost demand for AHRS in advanced military aircraft.

-

Space Exploration Lifts the AHRS Market to New Heights.

The countries allocate more resources to military modernization, they prioritize upgrading existing aircraft fleets and procuring new ones. These advanced military aircraft, including fighter jets, unmanned aerial vehicles (UAVs), and helicopters, heavily rely on sophisticated AHRS. AHRS provide precise orientation and positioning data, crucial for effective navigation in complex environments and precision targeting of enemy positions. Advanced AHRS contribute to superior flight control capabilities, especially for high-performance military aircraft that require exceptional maneuverability. Increased defense spending fosters investment in next-generation military technologies like autonomous weapons systems and hypersonic missiles. These advanced systems necessitate highly accurate and reliable AHRS for precise positioning and guidance in dynamic operational scenarios.

CHALLENGES:

-

Defense budgets of several developed countries have been cut.

Several developed nations are witnessing reductions in their defense budgets. This trend can be attributed to a confluence of factors. The conclusion of the Cold War, a period marked by heightened East-West tensions, With the perceived threat of a large-scale conventional war diminished, some countries feel less compelled to maintain vast military forces. This allows them to re-evaluate spending priorities and potentially channel resources towards social welfare programs, education, or infrastructure development. Economic realities also play a significant role. Budgetary constraints, driven by factors like national debt or deficits, often necessitate cuts across government spending, with defense not immune. Governments may find it difficult to justify high military expenditure when other areas like healthcare or education demand significant investment.

IMPACT OF RUSSIA UKRAINE WAR

The impact of Russia-Ukraine has slowed the AHRS market. Supply chains are snarled, making it difficult and expensive to get key materials like semiconductors. This translates to production delays and potential shortages. War-induced inflation also pushes up raw material costs, further increasing the price of AHRS units. Economic uncertainty might also lead companies to reduce their expenses, delaying investments in new AHRS technology and upgrades, potentially slowing market growth. European markets could be hit particularly hard if they relied on components or finished products from the war zone. Increased defense spending by some countries could boost demand for military AHRS applications.

IMPACT OF ECONOMIC SLOWDOWN

The impact of economic downturn has majorly affected the AHRS market. Reduces their expenses and investment delays across industries could lead to decreased demand for new units and upgrades. Price sensitivity might also rise as companies seek cost-effective options. However, AHRS in essential sectors like aviation and defense might see stable demand, and there could be a shift towards advanced, efficiency-enhancing AHRS solutions as companies look to optimize costs during challenging times.

KEY MARKET SEGMENTS

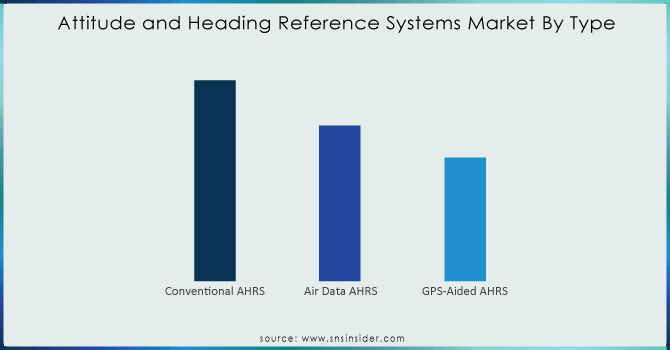

By Type

-

Conventional AHRS

-

Air Data AHRS

-

GPS-Aided AHRS

The Conventional AHRS sub-segment is leading the Attitude and Heading Reference Systems (AHRS), capturing over 45% Market Share in 2023 by type. These offer a cost-effective balance of functionality and affordability, making them popular in commercial aircraft, general aviation, and various industrial applications. GPS-Aided AHRS Integrating GPS technology for enhanced performance, these AHRS are becoming increasingly popular for their precision navigation, especially in environments with limited satellite signal availability. Growing demand for precision navigation in UAVs and high-performance military aircraft fuels this segment's rise.

Need any customization research on Attitude and Heading Reference Systems (AHRS) Market - Enquiry Now

By Component

-

Inertial Sensing Unit

-

Magnetic Sensing Unit

-

Digital Processing Unit

The Inertial Sensing Unit (ISU) sub-segment is dominating is the Attitude and Heading Reference Systems market in 2023 by component, housing accelerometers, gyroscopes, and sometimes magnetometers to measure motion and orientation. Advancements in sensor miniaturization and performance are driving growth in this segment. The Digital Processing Unit (DPU) processes sensor data and calculates the AHRS output. As AHRS functionalities become more complex, requiring advanced data processing algorithms, the DPU segment is witnessing growth.

By End-User

-

Civil Aviation

-

Military Aviation

-

Unmanned Vehicles

-

Marine

Civil Aviation sub-segment is dominating in the Attitude and Heading Reference Systems by capturing 40% market share in 2023 by end-user. Commercial airlines remain the biggest consumers of AHRS due to the sheer volume of passenger and cargo aircraft needing reliable navigation systems. Strict safety regulations also mandate advanced AHRS in civil aviation. Military aviatiom budgets and the need for sophisticated military aircraft equipped with advanced navigation and control systems are driving the AHRS market in defense. Integration of AHRS in military UAVs further fuels segment growth.

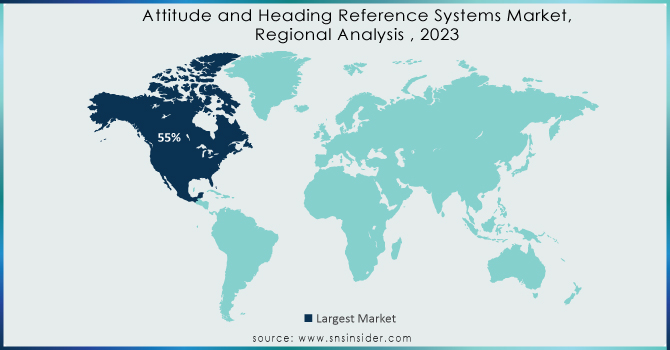

REGIONAL ANALYSIS

The North America leading the Attitude and Heading Reference Systems (AHRS) market in 2023, capturing over 55% of the market share. This region reigns supreme due to the presence of major players like Honeywell, Northrop Grumman, Raytheon Technologies, and Moog Inc. These industry giants heavily invest in AHRS research and development, solidifying North America's position. Additionally, a strong and established aerospace and defense sector in the region fuels demand for advanced AHRS technology. Europe is the second dominating aviation industry with a presence of leading airlines and aircraft manufacturers like Airbus. Stringent safety regulations in the region also necessitate the use of high-precision AHRS in various aviation applications. Additionally, government initiatives promoting unmanned aerial vehicle (UAV) technology further contribute to market growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the attitude and heading reference systems (AHRS) market are Boeing (U.S.), Honeywell International Inc. (US), Vectornav Technologies, LLC (US), Ixblue, Inc. (US), Sparton Navigation and Exploration, LLC (US), Lord Microstrain (US), Safran SA (France), Lord Microstrain (US), Raytheon Technologies Corporation (US), Meggitt PLC (UK), Northrop Grumman Corporation (US), Moog, Inc. (US), and other players.

RECENT DEVELOPMENTS

-

In April 2024: Exail, a leading navigation company, has secured a contract to supply its Octans AHRS units to Bourbon, a French maritime services provider. These AHRS systems will be installed on Bourbon's Evolution 800 Series MPSVs, designed for deep-sea operations (up to 3,000 meters). Exail's Octans, boasting IMO-HSC certification, enhances the efficiency of Bourbon's vessels for oil and gas, and offshore wind operations. This survey-grade system provides precise roll, pitch, and heave measurements, integrating seamlessly with the vessels' DP3 system.

-

In June 2023: Airbus Helicopters equipped their upgraded Tiger attack helicopters with cutting-edge navigation and flight control systems from Safran Electronics & Defense. This advanced technology empowers crews from France and Spain to dominate any mission, even in the toughest environments.

-

In January 2024: Honeywell International joined forces with Boeing to develop the next-generation Attitude and Heading Reference System (AHRS) specifically designed for the 737 MAX 10 aircraft. This collaboration signifies Safran's expertise in critical flight control technology and positions them as a partner for Boeing's future endeavors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 760.5 Million |

| Market Size by 2032 | US$ 1187.89 Million |

| CAGR | CAGR of 5.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User (Civil Aviation, Military Aviation, Unmanned Vehicles, & Marine) • By Component (Inertial Sensors, Magnetic Sensors, & Processor, Gyroscopes, Magnetometer, Accelerometers, and Digital Processing Unit) • By Type (Conventional AHRS, Air Data AHRS and GPS-Aided AHRS) • By Platform (Fixed Wing, Rotary Wing, and UAV)) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Moog Inc., Sparton Navigation and Exploration LLC, Lord MicroStrain, iXBLUE Inc., Honeywell International Inc., Safran S.A, Rockwell Collins Inc, Meggitt Plc, VectorNav Technologies LLC, Northrop Grumman, and other players. |

| DRIVERS | • Increasing Passenger Traffic And Important Demand For New Aircraft. • Increasing Interest in AHRS for Use in UAVs |

| RESTRAINTS | • Several developed countries' defence budgets have been reducedy |