Gunshot Detection System Market Report Scope & Overview:

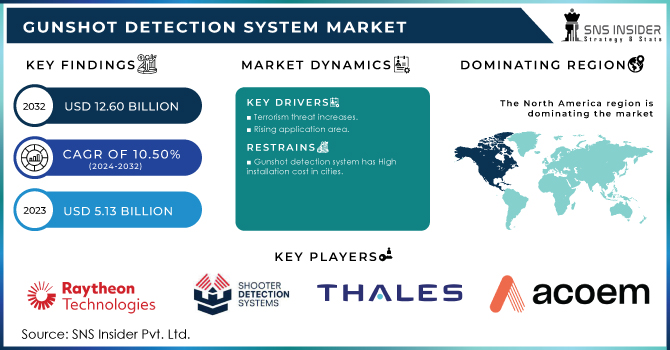

The Gunshot Detection System Market Size was valued at US$ 5.13 billion in 2023, expected to reach USD 12.60 billion by 2032 and grow at a CAGR of 10.50% over the forecast period 2024-2032.

To get more information on Gunshot Detection System Market - Request Free Sample Report

The Gunshot Detection System Market has been expanding recently as countries prepare to make modifications to their defensive and offensive systems. Despite the fact that the market is a narrow section of individuals, the systems employed for the market have witnessed high demand in recent years. These devices enable law enforcement and defence personnel to pinpoint the source of gunfire. Gunshot Detection Systems aid in boosting situational awareness between two parties during a conflict or weapon engagement. Although there have been no major wars on a global scale, guerrilla warfare and local battles have been common.

MARKET DYNAMICS

KEY DRIVERS

-

Terrorism threat increases

-

Rising application area

RESTRAINTS

-

Gunshot detection system has High installation cost in cities

-

These systems are costly because they necessitate the installation of a large number of spatially distributed sensors over a vast area. The upkeep of these systems is an added cost.

OPPORTUNITIES

-

Gunshot detection systems are becoming increasingly important in smart cities.

-

Gunshot detectors use digital microphones put on buildings and streets to record gunshot evidence, offer near-instantaneous warning, and triangulate the location of shooters and the direction of a shot.

CHALLENGES

-

The aviation industry is facing economic issues as a result of COVID-19.

-

New installations for GDS systems have been badly impacted and are experiencing a slowdown.

IMPACT OF COVID-19

The outbreak of COVID-19 has led to significant economic challenges in the detection industry in both the commercial and military sectors. The military sector has seen a reduction in government spending on equipment, while the introduction of a firearms identification system for new projects and the addition of new miles to existing projects has been significantly reduced.

The commercialization of the GDS is the most affected compared to military applications. There have been extensive travel restrictions, affecting the suspension of all project management activities and the implementation of GDS programs. New installations of GDS systems have been severely affected and are subject to decline. New areas added i.e the addition of new miles under existing contracts and new GDS installation contracts has dropped significantly. COVID19 and restrictions such as roadblocks and restrictions imposed by it, regional authorities of various municipalities and governments have significantly reduced customer engagement which has affected Q2 profits for most GDS commercial suppliers. There is expected to be a slight decrease in the implementation of the commercial GDS, and these conditions will apply until the end of 2020.

During the forecast period, the commercial market share of the gun acquisition program is estimated to grow rapidly. The need for greater security in future smart cities is driving the market for gun acquisition programs. Large-scale deployments of gunshot detection systems have occurred in cities across North America and parts of Europe in the previous three to five years. Gunshot detection systems are installed on armoured vehicles, soldier wearable, border crossings, and military facilities in buildings and bases, among other places. Defense systems are designed to pinpoint the source of a gunshot and provide information for counter-offensive plans. the static portion is expected to grow at the highest CAGR at the time of forecasting. The global market is dominated by the automotive component and the market size of GDS programs in automotive applications will grow with the increasing demand for armed vehicles from military countries.

Due to the presence of numerous sensor manufacturers and accompanying software providers, the market for gunshot detection systems is slightly fragmented. ACOEM Group, Shot Spotter Inc., Raytheon Technologies Corporation, Rheinmetall AG, and Thales Group are some of the key participants in the gunshot detection systems industry. Raytheon Technologies Corporation is a major provider of gunfire detection systems to the United States military, whereas Shot Spotter Inc. is a prominent distributor of gunshot detection systems to the civilian sector. Shot Spotter develops and sells licence civilian versions of Raytheon's gunshot detecting systems. In addition, the companies are working on new and sophisticated gunshot detection systems that can identify rounds fired at cheaper costs and with greater efficiency.

KEY MARKET SEGMENTATION

By Installation Type

-

Fixed System

-

Soldier Mounted System

-

Vehicle Mounted System

By Application

-

Indoor

-

Outdoor

By End-User

-

Commercial

-

Defense & Government

By Solution

-

Systems

-

Subscription based Services

REGIONAL ANALYSIS

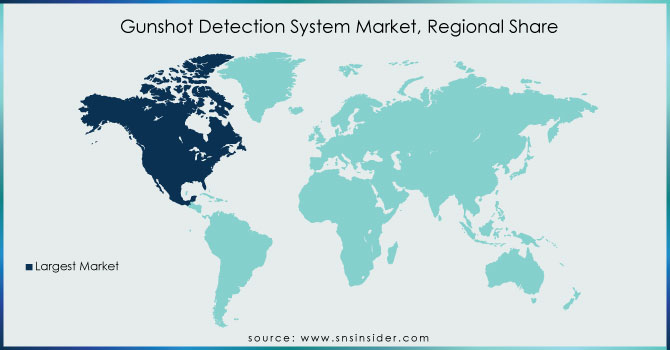

During the projection period, the US gunshot detection system market is expected to develop at the fastest CAGR. Increased gun ownership in the United States, as well as illegal arms sales, have increased to the threat of gunfire-related incidents. The rise in gun-related deaths and homicides is a major source of concern. The North American gunshot detection system market is predicted to expand due to the high number of firearm-related deaths in the region, particularly in the United States, where the rate of death from firearms is 25 times higher than in other countries Over the next ten years, major US cities plan to deploy indoor gunshot detection systems at universities, business offices, and financial institutions, among other areas.

Need any customization research on Gunshot Detection System Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The key players are Raytheon Company, Shooter Detection Systems LLC., Thales Group, ACOEM Group, ELTA Systems Ltd., Tracer Technology Systems, Inc., Safety Dynamics, LLC., ShotSpotter Inc., Battelle Memorial Institute, Louroe Electronics, and Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.13 Billion |

| Market Size by 2032 | US$ 12.60 Billion |

| CAGR | CAGR of 10.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Raytheon Company, Shooter Detection Systems LLC., Thales Group, ACOEM Group, ELTA Systems Ltd., Tracer Technology Systems, Inc., Safety Dynamics, LLC., ShotSpotter Inc., Battelle Memorial Institute, Louroe Electronics |

| DRIVERS | • Terrorism threat increases • Rising application area |

| OPPORTUNITIES | • Gunshot detection system has High installation cost in cities • These systems are costly because they necessitate the installation of a large number of spatially distributed sensors over a vast area. The upkeep of these systems is an added cost. |