Authentication Solution Market Report Scope & Overview:

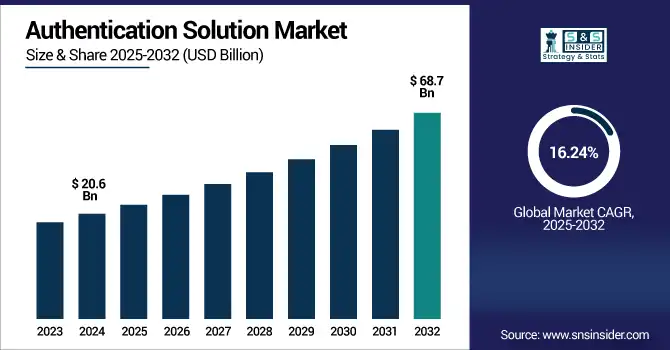

The Authentication Solution Market size was valued at USD 20.6 billion in 2024 and is expected to reach USD 68.7 billion by 2032, growing at a CAGR of 16.24% during 2025-2032.

To Get more information on Authentication Solution Market - Request Free Sample Report

The Authentication Solution Market is experiencing significant growth, driven by digital transformation, increased cyber threats seek and regulatory mandates for secure access. Businesses in different sectors are getting increasingly supportive of multi-factor authentication (MFA), biometrics, and other identity-based remedies to shield digital assets and effectively identify users. This demand for strong authentication mechanisms has been further magnified by the growing proliferation of mobile devices and cloud services. Moreover, AI and behavioral analytics are playing a fundamental role in improving these solutions and providing the ability to detect and respond to threats in real time. Sectors like BFSI, healthcare, and IT & telecom are primary adopters because they have significant security requirements.

The U.S. Authentication Solution Market trend is driven by a Rise in Incidents of Identity Fraud, and Data Protection laws such as the CCPA. In 2024, the market size was valued at USD 6.0 billion and is projected to reach USD 19.5 billion by 2032, growing at a CAGR of 16%. Advancements in biometric and AI-powered authentication are accelerating secure digital transformation across industries.

Market Dynamics:

Drivers:

-

Rising Cyberattacks and Identity Theft, Fuel Demand for Robust Multi-Factor and Biometric Authentication Solutions

As digital transactions and cloud-based systems increase, cyberattacks on user identities, credentials, and proprietary data have increased. Conventional authentication methods are no longer sufficient to protect organizations against threats like phishing, credential stuffing, and identity theft, and hence, organizations are constantly looking to implement secure authentication methods. Media coverage of high-profile breaches and financial losses in key sectors such as BFSI, healthcare, and government compounds this demand. Also, remote work and BYOD (Bring Your Device) have expanded the attack surface, making proper authentication more critical than ever. The market is projected to grow due to companies implementing zero-trust security models, which require authentication solutions, particularly multi-factor and biometric systems, to be used extensively to ensure only authorized users are allowed to access mission-critical systems.

A 25% year-over-year increase in reported fraud losses underscores the urgent need for stronger authentication defenses.

Restraints:

-

High Implementation Costs and Integration Challenges, Limit Adoption Among SMEs and Legacy System-Dependent Enterprises

However, the huge initial investment needed to deploy advanced authentication solutions is the principal challenge faced by all end users and the sole restraint of the market, particularly among small and medium-sized enterprises. Biometric systems, hardware tokens, and secure access platforms typically require expensive infrastructure upgrades, software licensing, and employee retraining. Moreover, technical integration of authentication systems with legacy IT environments itself carries the risks of such a service disruption, productivity losses. The need to manage multiple layers of authentication and to balance convenience makes adoption even more difficult. These costs and integration overheads stifle scalability and extend the decision horizon for organizations with insufficient IT budgets or skills, especially in emerging economies or smaller enterprises.

For instance, over half of small businesses report they’re not “very aware” of MFA’s benefits, and accordingly, 54% haven’t adopted it, often citing cost and complexity as the main barriers.

Opportunities:

-

Advancements in AI and Behavioral Biometrics, Enable Seamless, Adaptive Authentication Experiences and Open New Market Avenues

AI and machine learning for authentication are generating attractive potential growth opportunities. Behavioral biometrics powered by AI examines patterns like keystroke dynamics, navigation behavior, and even device utilization to continuously authenticate identity in real time. Technologies like these provide frictionless authentication, which minimizes the reliance on passwords and physical tokens while increasing security against the ever-changing threat landscape. Companies are also seeking adaptive authentication approaches that can add or eliminate security based on risk-level calculations. Given the need for seamless user experience and service as well as security compliance, AI-driven solutions would gain traction in the near term across banking, e-commerce, and public sector services, thus creating new avenues for vendors to offer intelligent, scalable authentication platforms.

Challenges:

-

Increasing Privacy Concerns and Strict Data Regulations Complicate Deployment and Slow Down Solution Adoption in Sensitive Sectors

The ubiquity of biometrics and persistent individual surveillance opens up serious privacy and ethical issues. With such rapid growth, however, users are becoming more cautious about the acquisition, retention, and usage of their biometric and behavioral data. Any mismanagement or breach of such sensitive data will cripple the trust his customers might have in him and lead to legal consequences too. As a consequence, tightened data protection regulations such as GDPR, CCPA, and HIPAA have placed extreme requirements on consent, data minimisation, and transparency. This requires improving data governance, encryption, and auditability, while also ensuring compliance, making operations more complex. The combination of these privacy and compliance obligations presents unique challenges for those designing solutions to meet these standards in an authentication system that is secure but does not override the rights of users, which in turn, slows the pace of adoption in more sensitive markets.

Segment Analysis:

By Authentication Type:

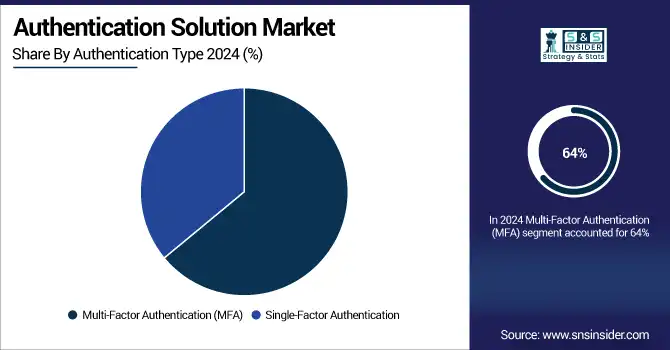

Multi-Factor Authentication (MFA) dominated the market in 2024 and accounted for 64% of the authentication solution market share, due to the limited security that passwords can offer, enterprises are putting their priority forward to MFA. Digital signatures: Digital signatures help communicate that a system or party is trustworthy and authentic. MFA will continue to be the cornerstone of secure access, with AI-driven adaptive authentication and biometric integration on the rise. Due to the increasing digital identity theft threat, the segment is expected to continue its dominance through 2032.

Single-Factor Authentication is expected to register the fastest CAGR during the forecast period. Due to its low cost, straightforward implementation, and minimal infrastructure requirements. This is still prevalent in non-mission-critical applications. As businesses migrate to MFA over the coming years, regions and industries without the budget for or ability to migrate entirely to MFA will require an improved password-only or password-like system that offers the most security, with the least complexity, until a full upgrade is possible.

By Organization Size:

Large enterprises dominated the authentication solution market in 2024 and accounted for 83% of revenue share, owing to larger IT budgets, complex digital infrastructures, and stringent compliance. By proactively investing in tools like biometrics and AI-powered MFA, they secure access to their worldwide business. This segment will retain its dominance due to increased digital transformation, cloud adoption, and the requirement to protect huge amounts of sensitive organizational and customer data.

SMEs are expected to register the fastest CAGR as cyber threats are increasingly targeting smaller targets, which typically lack sophisticated defences. A growing awareness, cost-effective SaaS-based authentication, and compliance pressure. Solutions developed/pitched to SME will have their penetration fast-tracked if offered as scalable or as plug-and-play solutions by vendors. To close security gaps for this high-potential, cost-sensitive segment, cloud-native authentication tools are key.

By Industry:

The BFSI segment dominated the authentication solution market in 2024 and accounted for a significant revenue share 2024, due to its critical need for securing financial transactions, preventing identity theft, and meeting strict compliance mandates like PCI-DSS and FFIEC. With rising digital banking, fintech growth, and increasing fraud cases, BFSI will continue leading the adoption of multi-layered authentication. Biometric and AI-driven solutions will further solidify their position through 2032.

Healthcare is expected to register the fastest CAGR due to increasing demand for telehealth services, the need for protection of sensitive patient data, and compliance with HIPAA. Ransomware attacks on hospitals have been endemic, driving the need for such investments in systems that provide strong authentication. The digital healthcare ecosystem is evolving with the need to make security a priority, with rapid adoption of biometric and MFA to secure access to EHR and connected medical devices.

Regional Analysis:

North America dominated the authentication solution market in 2024 and accounted for 38% of revenue share, which is attributed to early adoption of advanced authentication technologies, the growing incidence of cybercrime, and stringent regulatory frameworks, such as HIPAA, CCPA, and SOX, already being in place. Growing demand for cloud adoption at a large scale, digital banking, and enterprise security modernisation. Ongoing investments in AI-based authentication, along with high adoption in BFSI, healthcare, and government sectors, will help it maintain its lead until 2032.

Over 89% of bank and government IT leaders in North America identified multi-factor authentication (MFA) as a “key trend” in 2024.

Asia Pacific is expected to register the fastest CAGR during the forecast period, owing to the rapid digitalization, the initiatives taken by the government regarding cybersecurity, and the rising data breach cases. Smartphone penetration is ever-increasing, and with the transition to a cashless economy, mobile & biometrics authentication is expected to gain a boost. Secure identity management is also a top priority in Asia, with markets such as India, China, and even a larger area of Southeast Asia turning into a high-growth authentication technology market.

Europe’s authentication solution market is driven by GDPR enforcement, rapid digital banking, and rising identity fraud. Growth is being fueled by rising enterprise cloud adoption and increasing demand for password less authentication. From there, the region will continue to grow steadily for the rest of the decade, with AI-backed authentication gaining significant traction across major verticals through 2032.

Germany leads the European authentication solution market due to the presence of strong cybersecurity and Industry 4.0, along with quite a few banking and manufacturing enterprises. The demand for multi-factor and biometric-based authentication is supported by government-backed digital identity programs and growing cyber threats. Ongoing digital trust investment sustains leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major authentication solution market companies are IBM Corporation, Microsoft Corporation, Cisco Systems, Okta Inc., RSA Security, HID Global, Duo Security, Thales Group, Ping Identity, OneLogin, and others.

Recent Developments:

-

On May 14, 2024, Microsoft added native authentication, passkey support in Microsoft Authenticator, and released custom authentication extensions in Entra to enable more flexible, passwordless identity verification.

-

On February 5, 2025, Microsoft enforced new Conditional Access policies in Azure Entra to block device-code and legacy authentication protocols, strengthening identity protection for enterprise cloud environments.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 20.6 Billion |

|

Market Size by 2032 |

US$ 68.7 Billion |

|

CAGR |

CAGR of 16.24% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Authentication Type (Single Factor Authentication, Multi Factor Authentication) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

IBM Corporation, Microsoft Corporation, Cisco Systems, Okta Inc., RSA Security, HID Global, Duo Security, Thales Group, Ping Identity, OneLogin and others in the report |