ATM Managed Services Market Report Scope & Overview:

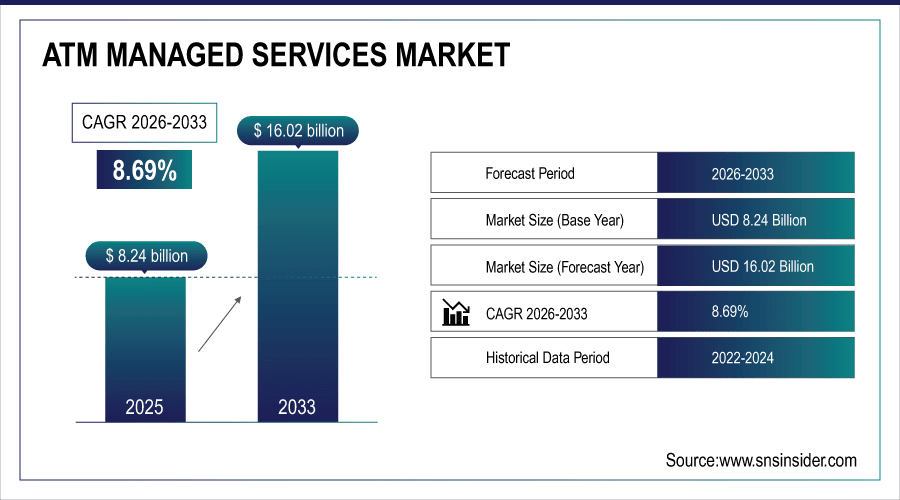

The ATM Managed Services Market Size was valued at USD 8.24 Billion in 2025E and is expected to reach USD 16.02 Billion by 2033 and grow at a CAGR of 8.69% over the forecast period 2026-2033.

The ATM Managed Services Market analysis driven by Lack of automation in ATM management along with rising demand from financial institutions for network optimization and improving operational efficiency. Several banks and credit unions are outsourcing ATM management services owing to reduced operational overhead, guaranteed uptime, and efficiency in cash replenishment and monitoring. Increasing use of cloud-based systems and advanced monitoring technologies, including artificial intelligence (AI) and IoT for predictive maintenance, helps to reduce downtime and provide a better experience for their customers. Also, the growing focus on security and compliance with a number of regulatory standards is encouraging organizations to turn to managed services specialists. According to study, around 50–55% of financial institutions are leveraging cloud-based ATM management solutions to enhance scalability and reduce IT infrastructure costs.

To Get More Information On ATM Managed Services Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 8.24 Billion

-

Market Size by 2033: USD 16.02 Billion

-

CAGR: 8.69% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

ATM Managed Services Market Trends

-

Banks increasingly outsource ATM management to specialized providers for operational efficiency.

-

Predictive maintenance using AI and IoT minimizes downtime across ATM networks.

-

Outsourcing allows financial institutions to focus more on core banking operations.

-

Managed services optimize cash replenishment cycles and reduce operational costs significantly.

-

Adoption of cloud-based ATM monitoring enhances scalability and real-time issue detection.

-

Financial institutions prioritize security compliance by leveraging specialized managed service providers.

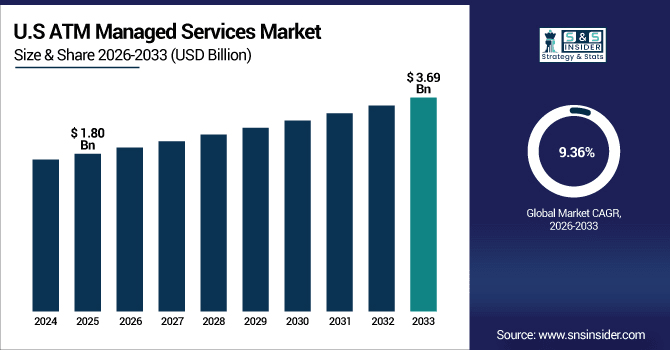

The U.S. ATM Managed Services Market size was USD 1.80 Billion in 2025E and is expected to reach USD 3.69 Billion by 2033, growing at a CAGR of 9.36% over the forecast period of 2026-2033, driven by advanced technological adoption, including AI and IoT-enabled ATMs, cloud-based management, and predictive maintenance, helping financial institutions optimize operations, reduce costs, enhance security, and improve customer experience nationwide.

ATM Managed Services Market Growth Drivers:

-

Banks Outsourcing ATM Operations Drive Efficiency, Reduce Costs, And Boost Productivity

The ATM management is increasingly outsourced by financial institutions to ATM management service provider to minimize operational costs and enhance efficiency. Operating an ATM network in-house can result in high costs associated with maintenance, cash-replenishment, monitoring, and security compliance. Using a managed service helps a bank secure uptime, increase cash optimization and even remove machines performing predictive maintenance with the help of AI and IoT. This not just improves customer experience by means of reducing downtime, but also aids banks to focus on core banking activities as opposed to operational aspects of ATM networks.

Banks outsourcing ATM operations can reallocate 20–25% of operational staff to strategic banking functions.

ATM Managed Services Market Restraints:

-

High Implementation Costs And Operational Challenges Limit Market Adoption Growth

Despite the benefits, the downside lies in high one-time costs associated with deployment, integration, and technology upgrades when converting to managed ATM services. The high price tags associated with enterprise solutions leave small to medium sized financial institutions with few options when it comes to gaining market presence on a national level. Moreover, upgrading to cloud-based monitoring, AI powered predictive maintenance and advanced security features take both hardware and software as well as staff training. Such economic and operational barriers can hinder the adoption and act to restrain the overall growth of this market, especially in developing markets.

ATM Managed Services Market Opportunities:

-

Digital And Cashless Payment Integration Creates Significant Market Growth Potential

The growing transition to digital banking and cashless transactions presents a valuable opportunity for managed ATM service providers. Modern ATMs are being equipped with integrated mobile wallets, QR code payments, cardless withdrawal, and more digital solutions allowing the financial institutions to serve more versatile and convenient services. This change in operational mode creates an opportunity for managed service providers to sell technology upgrades, real-time monitoring, and value-added services that increase ATM network functionality. In turn, this increases the volume of market transactions while creating additional revenue streams for service providers, making the market highly lucrative for innovation and investment.

Cashless transactions at ATMs have increased by 20–25% annually in regions with high digital banking penetration.

ATM Managed Services Market Segmentation Analysis:

-

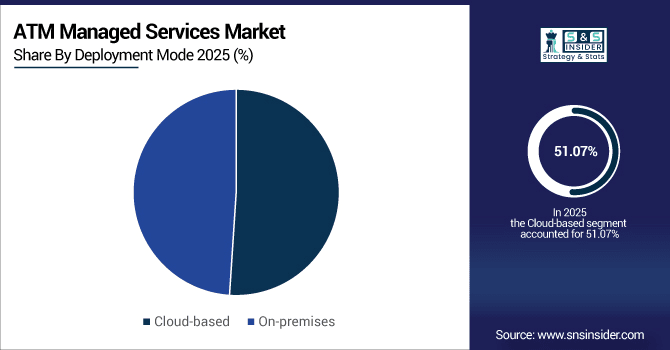

By Deployment Mode: In 2025, Cloud-based led the market with a share of 51.07%, while On-premises is the fastest-growing segment with a CAGR of 10.20%.

-

By Service Type: In 2025, Cash Management Services led the market with a share of 45.40%, while ATM Monitoring Services is the fastest-growing segment with a CAGR of 9.80%.

-

By ATM Location: In 2025, Offsite ATM led the market with a share of 45.30%, while Mobile ATM is the fastest-growing segment with a CAGR of 11.04.

-

By End User: In 2025, Banks led the market with a share of 64.20%, while Retailers is the fastest-growing segment with a CAGR of 8.80%.

By Deployment Mode, Cloud-based Leads Market and On-premises Fastest Growth

In the ATM Managed Services Market, Cloud-based deployment dominated the market in 2025, accounting for significant share owing its scalable, economical nature and its capacity to enable real-time monitoring and centralized management of ATM networks. More financial institutions are embracing the cloud and using it for operations while moving towards higher availability systems to help cut down infrastructure and maintenance costs. Conversely, The On-premises deployment segment is growing at the fastest rate, as banks and credit unions that are most concerned with the security of consumer data and regulatory compliance want more control over ATM operations. Increased interest in hybrid solutions offering the trade-offs of cloud flexibility and on-premises control, along with advances in monitoring and automation, are driving growth in both deployment modes worldwide.

By Service Type, Cash Management Services Leads Market and ATM Monitoring Services Fastest Growth

In the ATM Managed Services Market, Cash Management Services dominated the market in 2025, leading with a significant share owing to the high demand for streamlined cash handling and optimized cash replenishment cycles, which reduce operational costs for banks/Financial Institutions. Such services will help ensure high uptime and improve customer satisfaction and operational efficiency overall as ATMs are up and running. On the other hand, ATM Monitoring Services are expected to grow at the highest rate, attributed to rising adoption of AI, IoT, and cloud technologies to facilitate real-time monitoring, predictive maintenance, and improved security. This rise, globally, of managed ATM services is driven by a unique combination of operational efficiencies, hues of technological maturity and increased need for secure and reliable ATM networks.

By ATM Location, Offsite ATM Leads Market and Mobile ATM Fastest Growth

In the ATM Managed Services Market, Offsite ATMs led the market in 2025, holding the largest share due to their widespread adoption in high volume locations such as shopping malls, transport hubs, and urban areas. this ATM helps in financial institutions also provide easier access to cash to customers, while saving operational costs, improving customer satisfaction. Simultaneously, Mobile ATMs are beginning to establish themselves as the fastest-growing segment, with expanding demand for on-the-move solutions, music festivals and similar events, and rural or underserved regions. Mobile ATMs are a fast-growing and highly lucrative segment in the global ATM managed services market due to the pairing of advanced monitoring, predictive maintenance and cashless transaction capabilities to drive operational efficiency.

By End User, Banks Leads Market and Retailers Fastest Growth

By Industry, Banks held the largest share of the ATM Managed Services Market in 2025, driven by the large number of ATMs owned by banks, the high volume of transactions handled by the ATMs, and the increasing need to maintain efficient, secure, and regulated banking operations. While Smart banking’s uses AI and IoT technologies for predictive maintenance, banks are relying on managed services not just to optimize cash handling and downtime, but also to enhance Cost efficiency and experience. At the same time, Retailers represents the fastest-growing end-user segment due to the increasing usage of ATMs in shopping centers, supermarkets, and retail outlets in order to offer easy cash access as well as other value-added services. This is further boosting adoption of ATM by retailers globally, with increasing digital payments and cardless transaction functionality, supporting the growth of this segment worldwide.

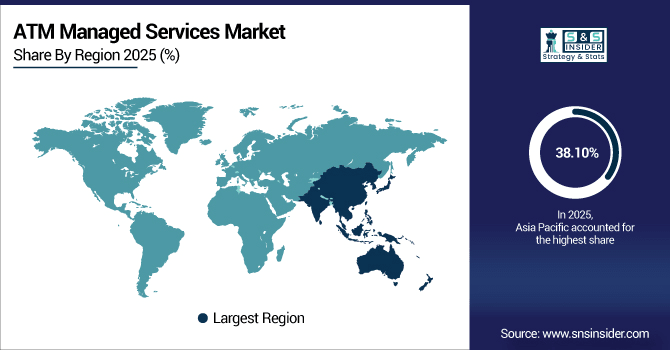

ATM Managed Services Market Regional Analysis:

Asia Pacific ATM Managed Services Market Insights:

The ATM Managed Services Market in Asia Pacific held the largest share 38.10% in 2025, due to growing banking penetration, rising need for easy access to cash, expanding retail and financial infrastructure. Financial institutions are opting for managed services, as they help in cash optimization, greater operational efficiency, reduced downtime through real-time ATM monitoring, and predictive maintenance. The increased adoption and implementation of cloud-based solutions, artificial intelligence, and IoT technologies are other factors boosting market growth. The increasing use of offsite and mobile automated teller machines to enhance customer accessibility experiences also drives demand and makes Asia Pacific region the largest contributor to the ATM managed services market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Propel Rapid Growth in ATM Managed Services Market

China and India propel rapid growth in the ATM Managed Services Market due to increasing ATM deployment, rising banking penetration, adoption of digital solutions, and demand for efficient cash management services.

North America ATM Managed Services Market Insights

In 2025, North America is the fastest-growing region in the ATM Managed Services Market, projected to expand at a CAGR of 9.47%, owing to increasingly adopt advanced technologies like AI, IoT, and cloud-based ATM monitoring solutions. ATM Outsourcing, due to cash management, decreased ATM uptime, security management, and regulatory compliance need has become a growing trend in the region financial institution vertical. Increasing installation of offsite and mobile ATMs with cashless and cardless transaction functionality is further supporting market growth. In addition to this, the region is projected to witness a high growth rate, attributed to the increasing adoption of managed ATM services by banks, credit unions, and retailers, as they prioritize greater operational efficiency while enhancing the customer experience.

U.S. Dominates ATM Managed Services Market with Advanced Technological Adoption

The U.S. dominates the ATM Managed Services Market due to advanced technological adoption, including AI-driven monitoring, predictive maintenance, cloud-based solutions, and enhanced security, ensuring operational efficiency and superior customer experience.

Europe ATM Managed Services Market Insights

The Europe ATM Managed Services Market is increasing with steady growth because of the rise in demand for streamlining cash management, improving the security of ATMs, and optimizing ATM operations among the financial institutions. Lowers Operation Cost, Improves Uptime & Predictive Maintenance With AI-IoT: Banks & Credits Unions utilize managed services to lower operation cost, ensure release-time delivery consistent uptime & employ predictive maintenance based on AI-IoT technology. Cloud-based solutions gain rapid monitoring and centralized control of ATM networks, which plays an important role in ensuring the reliability of services. Besides this, deployment of offsite and mobile ATMs for better customer accessibility, coupled with the introduction of digital as well as cashless transactions capabilities is continuing to drive the regional market growth over the forecast period.

Germany and U.K. Lead ATM Managed Services Market Expansion Across Europe

Germany and the U.K. lead ATM Managed Services Market expansion across Europe due to advanced banking infrastructure, high ATM network density, adoption of managed services, and increasing demand for operational efficiency.

Latin America (LATAM) and Middle East & Africa (MEA) ATM Managed Services Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) ATM Managed Services Market is witnessing moderate growth, owing to the necessity for operational efficiency, cash management, and ATM network optimization. By utilizing managed services banks in such regions are expected to lower the overall operational cost, reduce gaps in uptime and also enable predictive maintenance with the help of managed services using advanced monitoring technologies. Rising implementation of offsite and mobile ATMs and integration of digital and cashless transaction solutions has improved customer reach and convenience. Furthermore, due to the increasing need for security, regulatory compliance, and modernization of banking infrastructure, the growth of the market is facilitated. The combination of these factors makes LATAM and MEA potential high-growth economies for managed ATM services.

ATM Managed Services Market Competitive Landscape

NCR Atleos offers comprehensive ATM management services, including field support, cash replenishment, software updates, and security monitoring. Their solutions aim to ensure optimal performance and minimize downtime, enabling financial institutions to focus on core banking activities.

-

In September 2025, NCR Atleos partnered with Mastercard and ITCARD to introduce a contactless ATM experience, allowing cardholders to withdraw cash using their mobile devices without the need for a PIN.

Fiserv offers flexible ATM managed services that include hardware procurement, software maintenance, cash management, and compliance support. Their solutions aim to keep ATM fleets current, competitive, and compliant, enhancing operational efficiency for financial institutions.

-

In July 2025, Fiserv announced a strategic relationship with TD Bank Group to integrate its innovative merchant product offering, Clover, with TD's business banking solutions.

Hitachi Payment Services provides end-to-end ATM services, including installation, maintenance, cash replenishment, and security monitoring. Their nationwide network aims to optimize costs, maximize revenue, and enhance customer experience for banks and fintechs.

-

April 2024, Hitachi Payment Services Pvt. Ltd, introduced India's first Upgradable ATM, which can be transformed into a high-performance Cash Recycling Machine (CRM) at any point in time. This flexibility enables financial institutions to adapt to evolving customer needs and technological advancements.

ATM Managed Services Market Key Players:

Some of the ATM Managed Services Market Companies are:

-

NCR Corporation

-

Diebold Nixdorf

-

Cardtronics (NCR Atleos)

-

Euronet Worldwide, Inc.

-

Fiserv, Inc.

-

AGS Transact Technologies Ltd

-

Hitachi Payment Services Pvt. Ltd.

-

CMS Info Systems Ltd.

-

Fujitsu

-

Hyosung

-

Electronic Payment and Services (EPS)

-

Vocalink Ltd

-

Cashlink Global Systems Pvt. Ltd

-

QDS, Inc.

-

Automated Transaction Delivery

-

Itautec

-

Brinks Inc.

-

KAL (Korala Associates Limited)

-

Financial Software & Systems Pvt. Ltd.

-

CashTrans LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.24 Billion |

| Market Size by 2033 | USD 16.02 Billion |

| CAGR | CAGR of 8.69 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (ATM Maintenance Services, ATM Monitoring Services, Cash Management Services, Security Services, Others) • By Deployment Mode (Cloud-based, On-premises) • By ATM Location (Offsite ATM, Onsite ATM, Worksite ATM, Mobile ATM) • By End User (Banks, Credit Unions, Retailers, Managed Service Providers (MSPs)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NCR Corporation, Diebold Nixdorf, Cardtronics (NCR Atleos), Euronet Worldwide Inc., Fiserv Inc., AGS Transact Technologies Ltd, Hitachi Payment Services Pvt. Ltd., CMS Info Systems Ltd., Fujitsu, Hyosung, Electronic Payment and Services (EPS), Vocalink Ltd, Cashlink Global Systems Pvt. Ltd., QDS Inc., Automated Transaction Delivery, Itautec, Brinks Inc., KAL (Korala Associates Limited), Financial Software & Systems Pvt. Ltd., CashTrans LLC, and Others. |