Automated Sortation System Market Size & Overview:

Get more information on Automated Sortation System Market - Request Sample Report

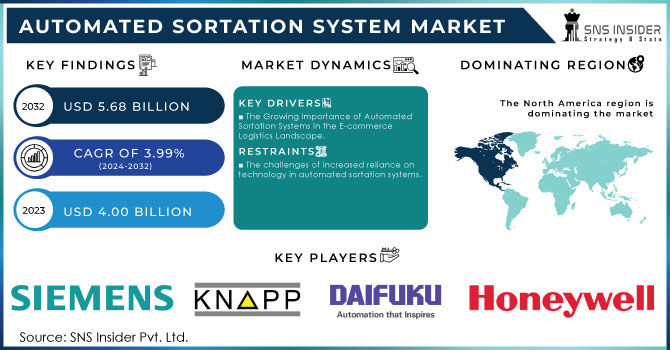

The Automated Sortation System Market Size was valued at USD 4.00 Billion in 2023 and is expected to reach USD 5.68 Billion by 2032 and grow at a CAGR of 3.99% over the forecast period 2024-2032.

The automated sortation systems market is experiencing substantial growth, fueled by the rising need for effective logistics and supply chain operations in different sectors. Automated sorting systems utilize cutting-edge technologies like robotics, artificial intelligence (AI), and machine learning to enhance the efficiency of the goods sorting process, leading to a notable decrease in manual work and an increase in both accuracy and speed. The fast expansion of e-commerce is a key factor in driving the growth of this market. In the United States, the e-commerce sector has seen impressive expansion, with sales surpassing USD 1.03 trillion in 2023. This increase accounts for 14.6% of all retail sales and is expected to surpass USD 1.5 trillion by 2025. 63% of American adults buy things on the Internet every month, and it is predicted that mobile shopping will make up 44% of all online sales, totaling approximately USD 450 billion by 2023. With the increase in online shopping, companies are looking for ways to effectively handle larger quantities of orders. Automated sorting systems help companies to quickly and accurately organize products, leading to faster order processing and enhanced customer contentment. For example, big players in the e-commerce sector have implemented these systems to streamline their distribution centers, ensuring that products are organized and shipped quickly.

In recent years, there has been significant advancement in the technology of automated sortation systems. Different industry needs are met by a variety of systems like conveyor-based sortation systems, AGVs, and robotic sortation systems. Conveyor systems are optimal for operations with large volumes, whereas AGVs provide adaptability when transferring goods between facilities. For example, FlexiMove Solutions focuses on advanced material handling systems that combine conveyor technology with Automated Guided Vehicles (AGVs) to enhance high-volume operations. Their conveyor systems effectively move various products, and AGVs offer the ability to smoothly transport goods between facilities. by incorporating a clever control system that monitors and schedules in real time, we improve workflow efficiency and minimize bottlenecks. Robotic systems, with AI algorithms, are capable of adjusting to varying sorting needs, which makes them appropriate for dynamic settings.

Automated Sortation System Market Dynamics

Drivers

-

The Growing Importance of Automated Sortation Systems in the E-commerce Logistics Landscape.

The rise of e-commerce has drastically increased the need for automated sortation systems. As more and more people use online shopping as the primary source of their purchases, the logistics and supply chain management industry had to adjust to this shift, as such turning into an important source of business for companies of all sizes from all over the world. Automated sortation systems, in their turn, provide an easy and efficient way of sorting products, and do it quickly, which is crucial for the process of meeting customer demands of fast delivery. Combined with the rising desire of e-commerce companies to improve their operational efficiency and reduce delivery times, this accounts for the rising demand for automated sortation systems and other related technologies. Today, the industry growth is expected to continue in the future, too. As such companies sort and differentiate a great number of their products and need to do it in an efficient and fast way, automated sortation systems help them do it by sorting product items and transferring them according to their size, weight, and destination they are supposed to be sent to. Doing this rapidly is essential due to the rise in demand, especially during the peak season. In addition, as the speed of service grows in importance, the logistics companies integrate automated systems to be able to manage and sort the increased amount of orders without the need to have the workforce increase proportionally, which allows them to preserve the profit while enhancing the capacity of the service they offer.

-

The growing importance of automated sortation systems in enhancing business efficiency and reducing costs.

Automated sortation systems allow businesses to reduce costs and increase productivity. Although the initial investment required for their implementation is usually high, their long-term benefits will be generally higher to the extent that the initial investment will not be significant in a broader perspective. Specifically, automated sortation limits the scope for manual labor on a significant scale by performing the function of sorting the products. As such, the businesses’ costs will be reduced as the cost of labor constitutes one of the most significant components of the businesses’ costs. Moreover, automated sortation is more productive than its manual counterpart as it is not affected by periodic interruptions due to requests for work breaks, lunch hours, or sleep hours. Combined with the lesser share of human labor, these factors multiply the output of the automated sortation in comparison to its manual variety. The higher productivity translates into a faster period of order fulfillment, which is likely to become an essential competitive advantage in rapidly developing e-commerce sectors and similar industries. Additionally, the cost of the businesses as well as their costs would be further limited by the lesser frequency of mistakes. Human errors such as mislabeling the boxes may result in high returns, which will be associated with high costs the limited number of these mistakes will reduce the number of such returns and increase the businesses’ profitability. Hence, given the increasing demand for optimal operational efficiency of modern businesses, the demand for automated sortation is likely to meet their demand.

Restraints

-

The challenges of increased reliance on technology in automated sortation systems.

One of the main challenges associated with automated sortation systems is the increasing dependence on technology to conduct sorting operations. Although automated systems are a necessary and justifiable upgrade in the context of large organizations, reliance on technology introduces a vulnerability, particularly in such areas as cybersecurity. Many automated sortation systems rely on technological networks and the internet, in particular, to operate and connect with other systems. Businesses, therefore, face the risk of cyber-attacks, which can compromise data or shut down the sorting process altogether. While such risks existed before the introduction of those systems, it has since escalated with businesses forced to take a range of cybersecurity measures. Another point of weakness, which is not directly related to the use of technology is the risk of technical failures, such as software or hardware issues, which can also shut down the system. In conclusion, most of the challenges associated with the use of automated sortation systems are related to the use of technology for conducting sorting operations. While technological failures are not directly related to cybersecurity, both types of failures are enabled by technology and demand a tailored response. The potential reliance on technology demands that businesses also invest in developing contingency planning, due to the increased susceptibility of such technology to failures. This will likely remain one of the main challenges for the implementation of automated systems, with some businesses opting not to adopt the solutions due to these vulnerabilities.

Automated Sortation System Market Segmentation

by Type

Linear sorting dominated the market with a 65% market share in 2023 because of its ability to effectively manage high capacity in a system that sorts items in a straight line. It is perfect for quickly organizing packages or items that have consistent sizes, commonly seen in sectors like e-commerce, retail, and distribution centers. The ease of scaling and incorporating a linear system into current infrastructure is due to its simplicity. Amazon and Walmart utilize linear sortation systems to optimize operations within their large fulfillment centers. These systems are utilized in expansive postal facilities for sorting mail and packages quickly and efficiently.

Loop sorting is increasing rapidly with the fastest CAGR during 2024-2032 due to its flexibility and ability to manage intricate sorting tasks with multiple destinations in a single cycle. This system, designed for industries with various product sizes like fashion, electronics, and pharmaceuticals, circulates items circularly. Loop sortation is frequently utilized in facilities dealing with a wide range of products, providing flexibility and efficiency in warehouse operations. For instance, Zara and IKEA utilize loop sortation systems to improve their handling and distribution processes, guaranteeing swift and precise sorting for different types of items.

by Applications

The retail & e-commerce sector led the market with a 38% market share in 2023, fueled by the speedy expansion of online shopping and customers' desire for quicker deliveries. Companies like Amazon and Alibaba are utilizing automated sortation systems in their warehouses to streamline their logistics and guarantee fast, precise shipments. With these systems, it is possible to efficiently handle a large number of orders accurately, resulting in improved customer satisfaction. Retailers also depend on sorting technology to efficiently manage returns, further emphasizing its significance. Siemens and Daifuku offer sorting systems designed for retail use, guaranteeing flexibility and adaptability to different sizes of orders and types of products.

The food & beverage sector is to experience the fastest growth rate during 2024-2032 due to increasing consumer demand for fast delivery of fresh and perishable items. Implementing automation in this industry boosts the efficiency of product distribution, especially for perishable items like dairy, meat, and fresh produce, which need to be handled quickly and accurately to ensure their quality is preserved. Companies such as Walmart and Kroger are implementing automated sorting systems to improve their cold chain logistics, decrease product wastage, and increase operational effectiveness.

Automated Sortation System Market Regional Analysis

North America dominated the market with a 44% market share in 2023 because of its advanced technology and strong need for automation in industries like e-commerce, retail, and logistics. The area's strong investment in technology and innovation is leading to the implementation of automated sorting systems to improve efficiency and accuracy in fulfilling orders. Businesses like Amazon and FedEx have greatly incorporated automated sorting systems into their warehouses and distribution centers, enhancing their sorting efficiency to keep up with the increasing need for prompt and precise deliveries.

The APAC region is accounted to become the fastest-growing with rapid CAGR during 2024-2032 due to fast industrialization, urbanization, and growth in the e-commerce sector. Nations such as China and India are experiencing significant investment in automation technologies to improve efficiency in logistics and distribution operations. The growing need for effective sorting systems in warehouses and distribution centers is driven by the surge in e-commerce and the requirement for prompt deliveries. Key players like Alibaba and JD.com are incorporating cutting-edge automated sorting solutions in their processes to efficiently manage large numbers of orders.

Need any customization research on Automated Sortation System Market - Enquiry Now

Key Players

The major key players in the market are:

-

Siemens AG (VarioSort, SIMATIC Sortation Systems)

-

KNAPP AG (OSR Shuttle, KiSoft Sorter)

-

Dematic (Dematic Crossbelt Sorter, Dematic Modular Conveyor System)

-

Bastian Solutions, Inc. (Bastian Conveyor System, Bastian Automated Guided Vehicles)

-

Daifuku Co., Ltd. (Sorting Transfer Vehicle (STV), Daifuku Conveyor Systems)

-

Honeywell Intelligrated (Tilt-tray Sorter, IntelliSort Sliding Shoe Sorter)

-

Interroll Group (Interroll Horizontal Crossbelt Sorter, Interroll Dynamic Storage)

-

Murata Machinery, Ltd. (Shuttle Rack M, Picking Sorter)

-

BEUMER GROUP (BG Line Sorter, Crisplant Tilt-tray Sorter)

-

GW Logistics Group (Automated Parcel Sorting System, Conveyor Belt Sorting System)

-

Vanderlande Industries (Vanderlande Cross-docking System, Airtrax Compact Sorter)

-

Fives Group (GENI-Ant Sorter, SOLI-X Optical Sorter)

-

SSI SCHAEFER (Schäfer Miniload Crane, Schäfer Case Picking)

-

KION Group (via Egemin) (E’gv® Sortation System, E’gv® Pallet Shuttle)

-

MHS Global (MHS Cross-Belt Sorter, MHS High-Speed Shoe Sorter)

-

Okura Yusoki Co., Ltd. (Okura Automated Sorter, Pallet Conveyor System)

-

TGW Logistics Group (Natrix Belt Conveyor, KingDrive® Conveyor System)

-

Swisslog Holding AG (AutoStore, Vectura Automated Warehouse)

-

SICK AG (SICK Identification Solutions, SICK RFID Sortation Systems)

-

Falcon Autotech (AutoD Sortation Conveyor, Falcon Pallet Conveyor)

Recent Development

-

August 2024: Daifuku unveiled a new line of automated sortation systems that utilize AI for real-time decision-making in logistics operations. This launch aims to enhance sorting speed and accuracy for e-commerce applications.

-

January 2024: Dematic released a series of innovative sortation systems incorporating advanced robotics and artificial intelligence. These solutions are aimed at improving operational efficiency for warehouse management and distribution centers.

-

June 2023: Honeywell announced enhancements to its sortation solutions, including advanced algorithms and machine learning capabilities aimed at improving accuracy and throughput. These updates are part of their efforts to meet the increasing demand for automated logistics solutions

-

March 2023: SICK AG launched its SORTER system, designed to optimize the handling of items in logistics operations. This automated sortation solution integrates advanced sensor technology to increase efficiency and reduce operational costs for warehouse environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.00 Billion |

| Market Size by 2032 | USD 5.68 Billion |

| CAGR | CAGR of 3.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Linear Sortation, Loop Sortation) • By Application (Retail & E-Commerce, Post & Parcel, Food & Beverage, Pharmaceuticals & Medical Supply, Large Airports, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, KNAPP AG, Dematic, Bastian Solutions, Inc., Daifuku Co., Ltd., Honeywell Intelligrated, Interroll Group, Murata Machinery, Ltd., BEUMER GROUP, GW Logistics Group, Vanderlande Industries, Fives Group, SSI SCHAEFER, KION Group, MHS Global, Okura Yusoki Co., Ltd., TGW Logistics Group, Swisslog Holding AG, SICK AG, Falcon Autotech. |

| Key Drivers | • The Growing Importance of Automated Sortation Systems in the E-commerce Logistics Landscape. • The growing importance of automated sortation systems in enhancing business efficiency and reducing costs. |

| RESTRAINTS | • The challenges of increased reliance on technology in automated sortation systems. |