Automated Guided Vehicle (AGV) Market Size & Overview:

Get More Information on Automated Guided Vehicle (AGV) Market - Request Sample Report

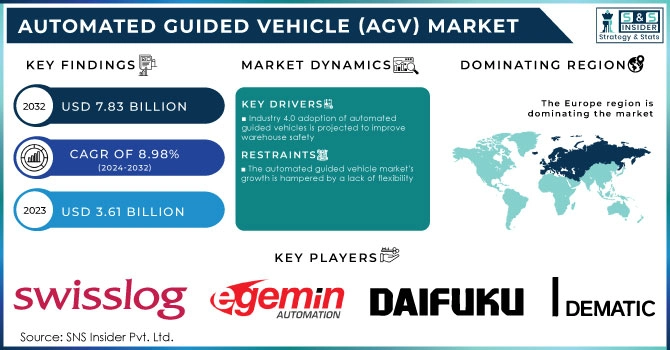

The Automated Guided Vehicle (AGV) Market Size was valued at USD 3.61 billion in 2023 and is expected to reach USD 7.83 billion by 2032 and grow at a CAGR of 8.98% over the forecast period 2024-2032.

Self-guided material handling systems or load carriers are self-guided material handling systems or load carriers that can travel autonomously across distribution centers, warehouses, or industrial facilities with the help of sensors installed aboard. Automation has been seen in supply chain management in the form of automated guided vehicles such as forklifts, automated stackers, tiny rack-carrying robots, and pallet trucks in recent years. Furthermore, these vehicles are configured to accomplish certain duties using machine learning and deep learning, which are the safest options for personnel material handling.

AGVs are widely used due to various advantages, including lower labor costs, less product damage, more production, and scale to assist automation operations. These significant benefits are pushing transportation and logistics companies to use AGVs to improve the efficiency of their operations. It also aids in the transportation of commodities on supply trolleys, ensuring their safety.

Future Demand Landscape:

The future demand landscape of the Automated Guided Vehicle (AGV) market is poised for unprecedented growth as industries increasingly recognize the transformative potential of autonomous material handling. With advancements in technology, AGVs are evolving beyond their traditional roles in manufacturing and logistics, expanding into sectors such as healthcare, retail, and agriculture. The demand surge is driven by a confluence of factors, including the need for efficiency optimization, labor cost reduction, and the imperative to enhance workplace safety. Moreover, the integration of artificial intelligence, machine learning, and sensor technologies is propelling AGVs into new realms of adaptability and intelligence. As companies across diverse sectors embrace the benefits of automation, the AGV market is set to witness robust expansion, paving the way for a future where intelligent robotic systems play a pivotal role in shaping the modern industrial landscape.

MARKET DYNAMICS:

KEY DRIVERS:

-

Industry 4.0 adoption of automated guided vehicles is projected to improve warehouse safety

-

Lower labor costs in organizations encourage market growth

The swift integration of automated guided vehicles (AGVs) in the landscape of Industry 4.0 heralds a transformative era for warehouse safety. As businesses embrace the technological prowess of AGVs, the traditional challenges associated with manual material handling and logistics are poised for a substantial reduction. These intelligent robotic vehicles, equipped with advanced sensors and communication capabilities, navigate through warehouse spaces with unprecedented efficiency, mitigating the risk of human-related errors and accidents. The AGV market's upward trajectory promises not only enhanced operational productivity but a paradigm shift towards a safer working environment.

RESTRAINTS:

-

The automated guided vehicle market's growth is hampered by a lack of flexibility

-

High upfront investment expenditures and installation costs

OPPORTUNITIES:

-

Overall company adoption of Industry 4.0 is minimal.

-

Manufacturers of automated guided vehicles with a focus on incorporating industry 4.0

-

The adoption of Industry 4.0 is expected to open up significant potential prospects for participants

Despite the transformative potential of Industry 4.0, the overall company adoption of Automated Guided Vehicles (AGVs) within this paradigm remains surprisingly minimal. While AGVs promise increased efficiency, streamlined operations, and enhanced productivity through autonomous navigation and data-driven decision-making, many companies seem cautious in embracing this technological shift. Concerns over initial implementation costs, the need for substantial infrastructure changes, and workforce adaptation may be contributing factors to the slower adoption rate.

CHALLENGES:

-

AGVs require routine maintenance and repair from time to time

-

Increased reliance on AGVs can stymie regular operations during maintenance, resulting in losses if not handled properly.

IMPACT OF RUSSIA-UKRAINE WAR:

As geopolitical tensions escalate, the AGV industry faces unprecedented challenges in terms of supply chain disruptions and increased uncertainty. The conflict has the potential to disrupt the production and distribution of AGVs, impacting both manufacturers and end-users. With several key players in the AGV market having operations or suppliers in the affected regions, there is a heightened risk of delays, increased costs, and potential shortages of critical components. The war has underscored the vulnerability of global supply chains, prompting businesses in the AGV sector to reevaluate their strategies and diversify their supply sources to mitigate geopolitical risks and ensure the resilience of the industry in the face of ongoing uncertainties.

IMPACT OF ECONOMIC SLOWDOWN:

As companies across diverse sectors are struggling with financial constraints and reduced production demands, the adoption of AGVs has experienced a nuanced impact. On one hand, cost-conscious organizations are increasingly turning to automation to streamline operations and enhance efficiency, propelling the demand for AGVs as a means of optimizing logistics and material handling. Conversely, some businesses, constrained by budgetary constraints and uncertain market conditions, have deferred or scaled back their investments in AGV technology. This divergence in market dynamics underscores the complex interplay between economic fluctuations and the evolution of automated solutions. Despite short-term challenges, the AGV market is poised for resilience and adaptation, as businesses recognize the long-term benefits of embracing autonomous systems in the post-economic recovery landscape.

Market, By Type:

-

Tow Vehicles

-

Assembly Line Vehicles

-

Pallet Trucks

-

Unit Load Carriers

-

Forklift Vehicles

-

Others

Based on type, the market is divided into five categories: Tow Vehicles, Assembly Line Vehicles, Pallet Trucks, Unit Load Carriers, Forklift Vehicles, and Others. In 2022, the Automated Guided Vehicle (AGV) Market is likely to be dominated by tow trucks. Tow vehicles, sometimes known as tuggers, are used to pull non-powered carts with heavy loads. Because it can move greater loads with several trailers than a single fork truck, this is the most productive type of AGV utilized for towing and tugging.

Market, By Navigation Technology:

-

Laser Guidance

-

Inductive Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Optical Tape Guidance

-

Others

Based on navigation technology, the market is divided into five categories: Laser Guidance, Inductive Guidance, Magnetic Guidance, Vision Guidance, Optical Tape Guidance, and Others. The market for laser-guided AGVs is growing because to the laser guiding technology's versatility, scalability, and accuracy. It also boosts throughput, improves safety, and reduces downtime. Laser guidance is the most versatile and accurate vehicle navigation system available. It permits the trucks to run without the usage of obtrusive barriers in a warehouse.

Market, By Industry:

-

Automotive

-

Food & Beverages

-

Metals & Heavy Machinery

-

Semiconductors & Electronics

-

E-commerce

-

Chemicals

-

Healthcare

-

3PL

-

Aviation

-

Others

Based on the application, the market is divided into eight categories: Automotive, Food & Beverages, Metals & Heavy Machinery, Semiconductors & Electronics, E-commerce, Chemicals, Healthcare, 3PL, Aviation, and Others. Over the projected period, the wholesale and distribution industry is expected to grow at the fastest rate of 12.2%. E-commerce, grocery stores, retail chains/conveyance stores, and hotels & restaurants are all sub-segments of the wholesale & distribution business.

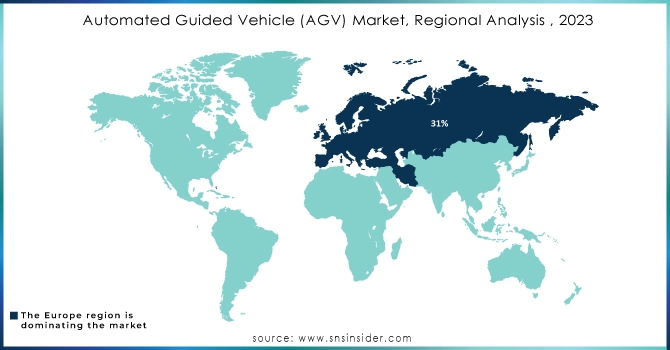

REGIONAL ANALYSIS:

In 2023, the Europe region dominated the market, accounting for almost 31% of total sales. Furthermore, the European regional market is expected to stay dominant throughout the forecast period. The increasing demand for material handling equipment by manufacturing industry incumbents is driving the expansion of the regional market. Additionally, automation in every area has aided the market's expansion in this region.

Over the projected period, the Asia Pacific area is expected to grow at the fastest rate of 11.2%. In the Asia Pacific emerging economies such as China and India, the e-commerce business has been rapidly expanding. As the e-commerce business grows, various e-commerce companies are considering expanding into these regional markets. As industries across the region increasingly embrace Industry 4.0 principles, the AGV market in APAC serves as both a reflection of and a catalyst for the transformative wave reshaping the way goods are moved and managed in the modern era.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players in the automated guided vehicle market are Swisslog Holding AG, Egemin Automation Inc., Inc., Daifuku Co., Ltd., TOYOTA INDUSTRIES CORPORATION, Dematic, JBT, Seegrid Corporation, Bastian Solutions, Hyster-Yale Materials Handling, Inc., BALYO, E&K Automation GmbH, Kollmorgen, KMH Fleet Solutions, ELETTRIC80 S.P.A., Fetch Robotics, Inc., Inc., Locus Robotics, inVia Robotics, Schaefer Systems International, Inc., System Logistics Spa and Transbotics.

RECENT DEVELOPMENT:

-

Companies such as Daifuku Co., Ltd., a global leader in material handling systems, have introduced innovative AGV solutions that seamlessly integrate with smart manufacturing environments, enhancing efficiency and flexibility.

-

Swisslog, a pioneer in robotic and data-driven automation, has unveiled AGV technologies with advanced navigation and obstacle avoidance capabilities, elevating the precision and safety standards of automated logistics.

-

Additionally, KION Group AG, a prominent player in supply chain solutions, has made strides in AGV development by focusing on collaborative and adaptable robotic systems, empowering businesses to optimize their intralogistics operations. These recent advancements underscore the commitment of key industry players to push the boundaries of AGV technology, setting the stage for a more intelligent and responsive era in automated material handling.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.61 Billion |

| Market Size by 2032 | US$ 7.83 Billion |

| CAGR | CAGR of 8.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Tow Vehicles, Assembly Line Vehicles, Pallet Trucks, Unit Load Carriers, Forklift Vehicles, Others) • By Navigation Technology (Laser Guidance, Inductive Guidance, Magnetic Guidance,Vision Guidance, Optical Tape Guidance,Others) • By Industry (Automotive, Food & Beverages, Metals & Heavy Machinery, Semiconductors & Electronics, E-commerce, Chemicals, Healthcare, 3PL, Aviation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Swisslog Holding AG, Egemin Automation Inc., Inc., Daifuku Co., Ltd., TOYOTA INDUSTRIES CORPORATION, Dematic, JBT, Seegrid Corporation, Bastian Solutions, Hyster-Yale Materials Handling, Inc., BALYO, E&K Automation GmbH, Kollmorgen, KMH Fleet Solutions, ELETTRIC80 S.P.A., Fetch Robotics, Inc., Inc., Locus Robotics, inVia Robotics, Schaefer Systems International, Inc., System Logistics Spa and Transbotics. |

| Key Drivers | • Industry 4.0 adoption of automated guided vehicles is projected to improve warehouse safety. • Lower labor costs in organizations encourage market growth. |

| RESTRAINTS | • Industry 4.0 adoption of automated guided vehicles is projected to improve warehouse safety. • Lower labor costs in organizations encourage market growth. |