Automatic Weapons Market Report Scope & Overview:

The Automatic Weapons Market size was USD 8.98 billion in 2023 and is expected to reach USD 16.64 billion by 2032, growing at a CAGR of 7.2% over the forecast period of 2024-2032. The automatic weapons market is being driven by factors such as Increasing demand in emerging countries, advancements in land warfare systems, and ongoing upgrades to combat platforms for interconnected warfare. Recent regional conflicts, such as those between Turkey and Cyprus, India and Pakistan, and Russia and Ukraine, highlight the need for advanced weaponry. Defense spending is increasing, particularly in developing nations, spurring procurement of modern firearms and automation-focused weapon systems. These investments are driven by both external threats and internal conflicts, necessitating the development and purchase of advanced weapons to modernize defense capabilities. The focus is on precision weapon systems to counter terrorism and to address growing regional tensions. The market is growing due to the introduction of high-tech, lightweight automatic weapons and intelligent systems.

Get More Information on Automatic Weapons Market - Request Sample Report

Market Dynamics

Drivers

-

Rising demand for precision weapon systems in emerging countries.

-

Advancement in land warfare systems, leading to increased adoption of automatic weapons.

-

Continuous upgradation of existing combat platforms for Improved performance.

-

Interconnected warfare strategies driving the need for advanced weaponry.

-

Recent regional conflicts emphasize the importance of advanced weapons.

The Growing demand for precision weapon systems in emerging countries signifies a strategic shift towards advanced military capabilities. For instance, according to recent reports, countries such as India and Brazil have significantly increased their procurement of precision-guided munitions. This trend is driven by the need for greater accuracy and efficiency in modern warfare scenarios, with precision weapons offering accuracy rates exceeding 90% compared to conventional munitions. The integration of advanced technologies such as GPS guidance systems and laser targeting has further Drive this demand, as evidenced by the substantial growth in global precision weapon sales, reaching over $32 billion in 2022.

Restraints

-

Stringent regulations and export restrictions on automatic weapons.

-

Ethical concerns and international pressure regarding the proliferation of advanced weaponry.

-

High costs associated with the development and procurement of automatic weapons.

-

Potential risk of misuse or unauthorized access to automatic weapons.

The market growth is hindered by the substantial initial development costs associated with their advanced technology. These firearms incorporate sophisticated fire control and heads-up display technologies aimed at enhancing operational efficiency, especially for long-range targeting. Companies are actively engaged in research and development efforts to create cost-effective solutions for precision firearms, striving to mitigate the financial barrier to entry in this segment.

Opportunities

-

Growing defense spending, particularly in developing countries, creates procurement opportunities.

-

Increasing focus on modernization of defense equipment, driving demand for advanced weapons.

-

Rising incidents of terrorism necessitating precision weapon systems and intelligent weaponry.

-

Technological advancements leading to the development of high-tech, lightweight automatic weapons.

Growing defense spending in developing countries presents significant procurement opportunities in the automatic weapons market. As these nations allocate more resources to bolster their military capabilities, there's a growing demand for advanced weaponry and defense systems. This trend not only reflects a focus on national security but also drives innovation and competition among manufacturers to meet the evolving needs of these markets. The procurement opportunities encompass a wide range of automatic weapons, from rifles to heavy machine guns, as developing countries look to modernize their armed forces and improves their operational capabilities. This surge in defense spending also opens doors for collaboration and partnerships between domestic and international defense firms, facilitating technology transfers and knowledge sharing in the automatic weapons sector.

Challenges

-

Competition among manufacturers to develop and offer Advanced automatic weapons.

-

Addressing concerns related to the reliability and safety of automatic weapons.

-

Adapting to evolving geopolitical dynamics and emerging threats to national security.

Impact of Russia-Ukraine War

During the Russia-Ukraine conflict, the procurement of military weapons is expected to drive market growth significantly. According to the Stockholm International Peace Research Institute (SIPRI), the U.S. remains the largest exporter of conventional weapon systems, accounting for about 40% of major arms exports from 2018 to 2022. In comparison, Russia's share was 16% during the same period. The report indicates a 47% increase in European arms imports amid a 5% global trade decrease. Given the ongoing arms supplies to Ukraine by the U.S. and European nations, it is likely that imports to Europe will further rise, reflecting the growing demand for military equipment in the region.

Economic Downturn

During recent economic downturns, the automatic weapons market has faced challenges, with global arms sales declining by approximately 6% in 2020 due to reduced defense budgets. This downturn results to postponed procurement programs and decreased investments in costly weapon systems. For example, some countries reduced defense spending by up to 10% during this period, impacting market growth. Economic uncertainties also deterred potential customers from making significant investments in advanced weaponry, affecting revenue generation for manufacturers. economic uncertainties can deter potential customers from making substantial investments in costly automatic weapons systems, further impacting market dynamics and revenue generation.

Segmental Analysis

By Type

-

Fully Automatic

-

Semi-Automatic

The largest market share during the forecast period is expected to be held by the Semi-automatic segment, driven by Growing demand from countries Such as Ukraine, India, Pakistan, and Syria seeking to manage regional tensions. The fully automatic segment is anticipated to exhibit a higher CAGR, primarily due to the convenience and accessibility of these weapons in battlefield scenarios.

By Product

-

Automatic Rifles

-

Machine Guns

-

Light Machine Guns (LMG)

-

Medium Machine Guns (MMG)

-

Heavy Machine Guns (HMG)

-

-

Automatic Launchers

-

Grenade Launchers

-

Missile Launchers

-

Mortar Launchers

-

-

Automatic Cannons

-

Gatling Guns

In 2023, The Automatic Rifles Segment Dominates the market, with holding Revenue share of more than 40.5%, driven by Increasing demand from Asian armed forces. The machine gun segment is expected to grow faster from 2024-2031, driven by increased use in naval and border security operations, especially with a shift towards lighter models. The automatic launcher segment, encompassing grenades, missiles, and mortars, is seeing Increasing demand, particularly for integrated 40mm grenade launchers by NATO forces. The investments from major Countries such as the U.S. and Russia to upgrade long-range missile launchers and short-range mortar launchers are anticipated to drive market expansion. Furthermore, lightweight automatic cannons and the expanding use of Gatling guns in combat aircraft and naval vessels are expected to contribute to market growth.

By Caliber

-

Small Caliber

-

5.56mm

-

7.62mm

-

12.7mm

-

14.5mm

-

-

Medium Caliber

-

20mm

-

25mm

-

30mm

-

40mm

-

Others

-

-

Large Caliber

By End Use

-

Land

-

Battle Tanks

-

Armored Fighting Vehicles (AFVS)

-

Light Protected Vehicles (LPVS)

-

-

Naval

-

Destroyers

-

Frigates

-

Corvettes

-

Offshore Patrol Vessels (OPVS)

-

-

Airborne

-

Helicopters

-

Combat Support Aircraft

-

Fighter Aircraft

-

-

Handheld & Stationary

The airborne segment is anticipated to show a significant CAGR, driven by the adoption of advanced combat systems in fighter aircraft, combat support aircraft, and helicopters. The handheld & stationary segment is poised for substantial growth, driven by increased demand from Middle Eastern countries Such as Israel, Saudi Arabia, and Turkey aiming to Improve their defense capabilities.

Regional

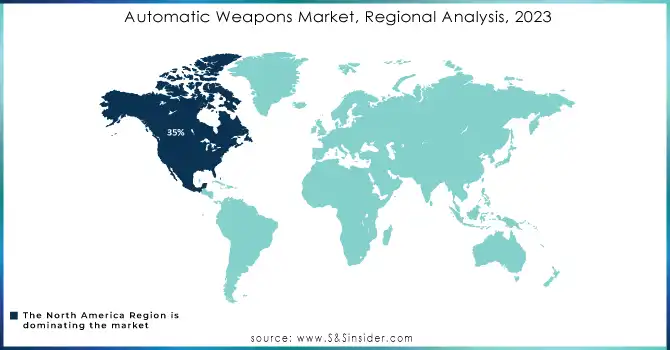

North American Region is dominates market with Contributing revenue share of more than 35%, this growth is attributed to prominent players such as General Dynamics Corporation, Northrop Grumman Corporation, and Colt’s Manufacturing Company LLC in the U.S., where the government is actively strengthening automated weapons and military vehicles. Russia, ranking second globally in arms exports according to SIPRI, contributes to this growth. The Asia-Pacific market is anticipated to grow with significant CAGR, Driven by China and India's growing arms industries and investments from major countries such as China North Industries Corporation (Norinco) and Ordinance Factory Board (India).

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players in market are Northrop Grumman, Rheinmetall AG, ST Engineering, BAE Systems, Denel Land Systems, KBP Instrument Design Bureau, Heckler & Koch AG, Kalashnikov Concern, Israel Weapon Industries & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.98 Billion |

| Market Size by 2032 | US$ 16.64 Billion |

| CAGR | CAGR of 7.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Fully Automatic, Semi-Automatic) • by Product (Automatic Rifle, Machine Gun, Automatic Launchers, Automatic Cannon, Gatling Gun) • by caliber (Small Caliber, Medium Caliber, Large Caliber) • by end-use (Land, Naval, Airborne) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Dynamics Corporation, Northrop Grumman, Rheinmetall AG, ST Engineering, KBP Instrument Design Bureau, Heckler & Koch AG |

| Key Drivers | • Terrorism increases • Armed conflict among countries |

| RESTRAINTS | • Low defense budget • Stringent manufacturing standards |