Automotive Acoustic Engineering Services Market Size:

Get more information on Automotive Acoustic Engineering Services Market - Request Sample Report

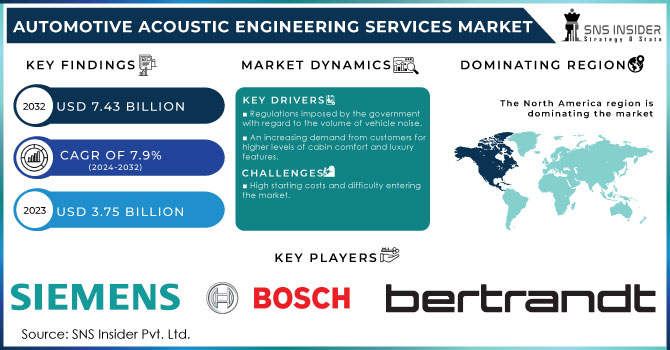

The Automotive Acoustic Engineering Services Market Size was valued at USD 3.75 billion in 2023 and is expected to reach USD 7.43 billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

An essential factor is the increasing need for high-end and luxury cars, leading to a greater focus on improving cabin comfort and reducing noise levels. This is highlighted by a 35% rise in worldwide luxury car sales in the last ten years. At the same time, the growing electric vehicle (EV) sector is having a major impact. Electric vehicles pose distinct sound difficulties because they lack engine noise, requiring creative approaches for interior comfort and pedestrian safety. In reaction, more than 70% of top automotive OEMs have specialized research and development teams focused on electric vehicle acoustics. Additionally, strict government rules regarding noise levels, especially in cities, are forcing car manufacturers to focus on acoustic design. A 20% increase in global noise pollution complaints in major cities has been observed in the past five years.

The trend towards electrification has brought new acoustic challenges despite its many benefits. Roughly 65% of the market's current focus is on dealing with noise, vibration, and harshness (NVH) problems that are unique to electric vehicles, including tire and wind noise. At the same time, there is an increasing focus on improving interior cabin noise levels, with more than 40% of companies dedicated to improving passenger comfort with noise reduction technology. 70% of industry participants are embracing advanced simulation tools and artificial intelligence to enhance acoustic performance, decrease reliance on physical prototypes, and speed up development timelines. Furthermore, due to stricter regulations on noise emissions, automakers are being pushed to invest significantly in acoustic engineering services, which now make up almost 35% of market revenue.

MARKET DYNAMICS:

KEY DRIVERS:

-

Regulations imposed by the government with regard to the volume of vehicle noise.

-

An increasing demand from customers for higher levels of cabin comfort and luxury features.

There is a significant shift happening in the automotive industry as consumers are placing a higher emphasis on comfort and luxury within the cabin. The increasing need for calmer, more sophisticated interiors is noticeable in this transition. A remarkable 85% of new car purchasers consider noise reduction to be a crucial element in their buying choices.

Additionally, there has been a 42% increase in the demand for advanced comfort features like high-end audio systems and noise-cancelling technologies over the last five years. This changing consumer attitude has increased the importance of automotive sound engineering services, as companies aim to provide peaceful and engaging cabin environments.

CHALLENGES:

-

High starting costs and difficulty entering the market.

-

Problems with noise pollution caused by electric vehicles.

The Automotive Acoustic Engineering Services Market presents a formidable landscape characterized by high starting costs and significant barriers to entry, posing challenges for potential market participants. The complexity of acoustic engineering, coupled with the need for specialized knowledge and advanced technologies, contributes to elevated initial investment requirements. Companies aspiring to enter this market face substantial costs associated with research and development, testing, and the acquisition of state-of-the-art equipment. Furthermore, the intricacies involved in designing and implementing effective acoustic solutions for automobiles necessitate a profound understanding of both engineering principles and evolving industry standards.

Automotive Acoustic Engineering Services Market, By Offering:

The global market has been divided into Physical Acoustic Testing, and Virtual Acoustic Testing based on the type segment. Because of the increasing use of virtual testing systems for promptly identifying problems in vehicles, the virtual testing industry currently holds a 49% market share and is expected to rise significantly over the next several years. This is due to the fact that virtual testing systems can detect faults more quickly and accurately than traditional testing methods.

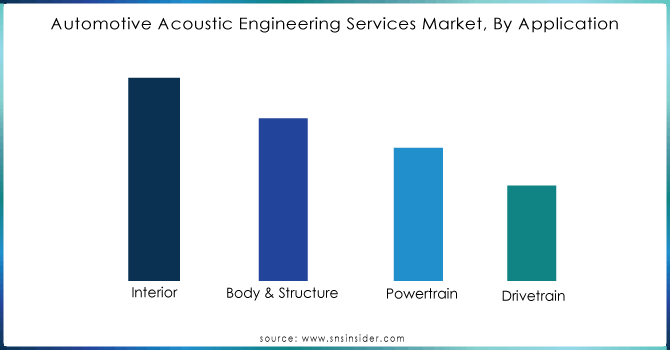

Automotive Acoustic Engineering Services Market, By Application:

The global market has been divided into Interior, Body & Structure, Powertrain, and Drivetrain based on the application segment. As a result of the increased demand for car cabins that are comfortable, secure, and free of noise, the interior category is anticipated to dominate the market during the period covered by the forecast. It is predicted that the powertrain category would be the second-largest market segment over the forecast period. Noise pollution and disruption to drivers are caused by powertrain components.

Get Customized Report as per your Business Requirement - Request For Customized Report

Automotive Acoustic Engineering Services Market, By Vehicle Type:

The global market has been divided into passenger cars and commercial vehicles based on the vehicle type segment. During the projection period, the passenger car category is expected to hold the greatest share of the market. The market for commercial vehicles is likely to develop significantly during the next few years.

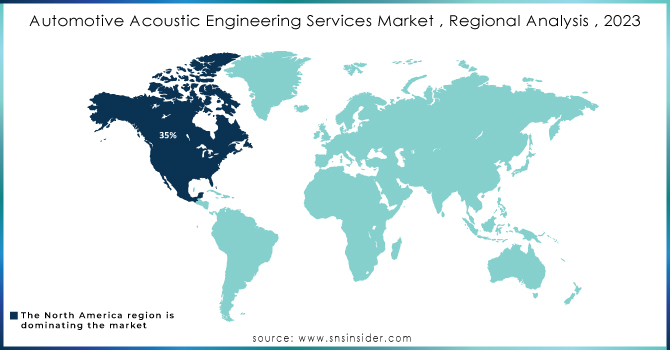

REGIONAL ANALYSIS:

The landscape of the Automotive Acoustic Engineering Services Market displays distinct regional nuances. In 2023, North America, boasting a well-established automotive sector and stringent noise regulations, commanded a substantial market share of approximately 35%. This supremacy is poised to endure, driven by the sustained demand for high-end vehicles and the escalating shift towards electrification, posing novel acoustic challenges. Following closely, Europe secured nearly 30% of the market share, propelled by analogous factors and robust regulations such as the European Union's Noise Emission Standards for Vehicles. Nevertheless, the Asia Pacific region is anticipated to undergo the most rapid growth in the foreseeable future, propelled by a thriving automotive market and increasing disposable incomes, especially in the dynamic markets of China and India. This regional breakdown underscores the importance of tailoring acoustic engineering services to address the unique requirements and growth potentials of each geographical market.

KEY PLAYERS:

Siemens Industry Software Inc., Robert Bosch AVL, Bertrandt AG, Brüel & Kjær, EDAG Engineering GmbH, FEV Group GmbH, HEAD acoustics GmbH, Autoneum, Schaeffler Engineering GmbH, and STS Group AG are some of the affluent competitors with significant market share in the Automotive Acoustic Engineering Services Market.

RECENT DEVELOPMENT:

-

AVL List GmbH, a stalwart in automotive engineering solutions, has introduced cutting-edge acoustic simulation technologies, providing clients with comprehensive tools for noise and vibration analysis.

-

HEAD acoustics GmbH has unveiled advanced sound quality evaluation systems, elevating the benchmark for in-vehicle audio experiences.

-

Siemens PLM Software, a global leader in digital solutions, has pioneered the integration of artificial intelligence in acoustic engineering processes, optimizing efficiency and precision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.75 Billion |

| Market Size by 2032 | US$ 7.43 Billion |

| CAGR | CAGR of 7.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Offering (Physical Acoustic Testing, Virtual Acoustic Testing) • by Application (Interior, Body & Structure, Powertrain, Drivetrain) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Siemens Industry Software Inc., Robert Bosch, AVL, Bertrandt AG, Brüel & Kjær, EDAG Engineering GmbH, FEV Group GmbH, HEAD acoustics GmbH, Autoneum, Schaeffler Engineering GmbH, and STS Group AG |

| Key Drivers | •Regulations imposed by the government with regard to the volume of vehicle noise. •A growing preference among consumers for upgraded levels of cabin comfort and luxury amenities. |

| RESTRAINTS | •The market is hampered by the availability of various testing equipment based on the kind of vehicle. •Enterprises choose to rent acoustic testing equipment, stifling the market. |