Luxury Car Market Size & Overview

Get More Information on Luxury Car Market - Request Sample Report

The Luxury Car Market Size was valued at USD 658.43 billion in 2023, and is expected to reach USD 1210.49 billion by 2032, and grow at a CAGR of 7% over the forecast period 2024-2032. The rising global affluent population with increasing disposable income creates a larger customer base willing to invest in premium vehicles. The Luxury Cars market unit sales in the United States are expected to reach 85.9k vehicles in 2028. The growing desire for individuality and status symbols is driving demand for cars that represent a sense of accomplishment. The advancements in technology are propelling the market forward. For instance, the integration of advanced driver-assistance systems (ADAS) like automatic emergency braking and lane departure warning enhances safety and appeals to a tech-savvy demographic. Additionally, the development of electric and hybrid luxury cars caters to environmentally conscious buyers and aligns with stricter emission regulations.

The ongoing trade tensions and potential disruptions in the global supply chain can create uncertainties and price fluctuations. Stringent government regulations aimed at improving fuel efficiency and safety standards might increase production costs for manufacturers.

Luxury Car Market Dynamics:

KEY DRIVERS:

-

Growing environmental consciousness creates a market for luxury hybrids and electric vehicles.

-

Technological advancements like electric engines and self-driving features attract tech-savvy consumers.

Technological advancements like electric engines and self-driving features are attracting tech-savvy consumers. Electric vehicles cater to environmentally conscious drivers by offering reduced emissions and potential cost savings, while also integrating advanced technology like battery management and remote connectivity. Self-driving features capture the imagination of those interested in automation and artificial intelligence. They promise improved safety through advanced data processing and faster reaction times than human drivers. These features offer convenience by automating tasks like parking and navigation. Thus, these advancements represent a meeting point of innovation, sustainability, and efficiency, appealing to consumers who value a future where technology makes transportation cleaner, safer, and more seamlessly integrated with everyday life.

RESTRAINTS:

-

Intense competition among established luxury brands and new entrants vying for market share can lead to price pressure.

-

Limited availability of charging infrastructure, especially fast-charging stations, can restrict convenience for electric car ownership.

While the technology offers environmental benefits and advanced features, the lack of widespread charging infrastructure, particularly fast-charging stations, creates a significant hurdle for potential buyers. This limited availability disrupts the convenience factor traditionally associated with luxury car ownership. The luxury EV owner has to spend a significant amount of time searching for a charger, especially a fast charger for a quicker turnaround, instead of effortlessly pulling into a gas station for a quick refuel. This disrupts the seamless experience expected by luxury car consumers and can lead to "range anxiety," the fear of running out of power before reaching a charging station.

OPPORTUNITIES:

-

Integration of personalized luxury experiences and advanced connectivity features can differentiate luxury car brands.

-

Collaboration with charging infrastructure providers can create exclusive and convenient charging solutions for luxury car owners.

CHALLENGES:

-

High price tags of electric luxury cars compared to gasoline models can strain buyer budgets.

Luxury Car Market Segmentation:

by Vehicle Type

-

SUV

-

Sedan/Hatchback

-

Sports/Super Luxury Cars

SUVs are the dominating sub-segment in the Luxury Car Market by vehicle type holding around 50% of market share. The SUVs offer a blend of luxury, utility, and ride height that appeals to a growing segment of affluent buyers. They provide a spacious and comfortable interior, perfect for families and those seeking a commanding driving position. Secondly, the practicality of SUVs aligns well with active lifestyles, offering ample cargo space for outdoor adventures or sporting equipment. The increasing popularity of performance SUVs further fuels this dominance, as these vehicles combine luxury features with exhilarating power and handling.

by Propulsion

-

Electric/Hybrid

-

ICE

Electric Vehicles are the dominating sub-segment in the Luxury Car Market by propulsion holding around 60% of market share due to environmental consciousness, government incentives, and advancements in battery technology. However, the internal combustion engine (ICE) segment remains dominant for now. This is primarily due to the aforementioned challenge of limited charging infrastructure, particularly for long-distance travel. The "range anxiety" persists among some buyers who fear running out of power before reaching a charging station. Despite these hurdles, the increasing availability of EVs with impressive range and faster charging times is expected to gradually shift the balance in favour of electric propulsion in the coming years.

by Component

-

Drivetrain

-

Interior

-

Body

-

Electronics

-

Chassis

The drivetrain is the dominating sub-segment in the Luxury Car Market by component as it is undergoing a transformation with the integration of electric motors and hybrid systems, alongside advancements in traditional gasoline engines for improved performance and fuel efficiency. Within the interior segment, luxury carmakers are focusing on features that enhance comfort, safety, and connectivity. This includes advanced driver-assistance systems, high-quality materials, and integration with the latest infotainment technology. The body and chassis segments are also witnessing advancements in lightweight materials and construction techniques that improve handling, safety, and overall driving dynamics. The electronics segment plays a crucial role in integrating all these technologies seamlessly, providing a luxurious and intuitive driving experience.

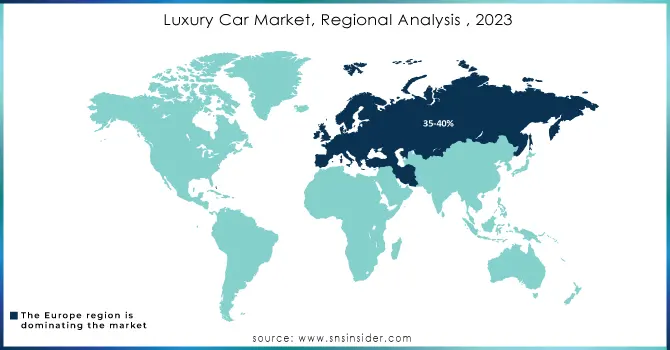

Luxury Car Market Regional Analyses:

Europe is the dominating region in the luxury car market holding around 35-40% of market share. The Europe is home to a rich history of prestigious luxury car brands like BMW, Mercedes-Benz, Audi, and Rolls-Royce. These established players have a strong brand legacy and loyal customer base within the region. Europe benefits from a well-developed automotive industry with a strong infrastructure for manufacturing, research and development, and sales networks for luxury cars.

The Asia-Pacific region is the fastest-growing market for luxury cars, with a Compound Annual Growth Rate (CAGR) projected to be around 8.2%. This rapid growth is fueled by the economic rise in countries like China and India. Rising disposable incomes and a growing affluent class in these regions are creating a significant demand for luxury cars.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Luxury Car Market Key Players

The major key players are Tesla, Inc. (U.S.), BMW (Germany), Denso Corporation (Japan), Daimler AG (Germany), Robert Bosch GmbH (Germany), Delphi Technologies, Inc. (U.K), Audi AG (Germany), Porsche AG (Germany), NXP Semiconductors N.V. (Netherlands), Infineon Technologies AG (Germany), General Motors Company (U.S.), Continental AG (Germany) and other key players.

Luxury Car Market Recent Development

-

In Nov. 2023 - Luxury electric car maker Lotus Technology secured $870 million in funding through PIPE agreements. This injection of capital will support their upcoming merger with L Catterton Asia Acquisition Corp. (LCAA).

-

In June 2023 - Aston Martin partnered with electric vehicle tech leader Lucid Group to develop high-performance electric cars. This deal grants Aston Martin access to Lucid's battery and powertrain technology, accelerating their transition to electric vehicles for future growth.

| Report Attributes | Details |

| Market Size in 2023 | US$ 658.43 Billion |

| Market Size by 2032 | US$ 1210.49 Billion |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle Type (SUV, Sedan/Hatchback, Sports/Super Luxury Cars) • by Propulsion (Electric/Hybrid, ICE) • by Component (Drivetrain, Interior, Body, Electronics, Chassis) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Tesla, Inc. (U.S.), BMW (Germany), Denso Corporation (Japan), Daimler AG (Germany), Robert Bosch GmbH (Germany), Delphi Technologies, Inc. (U.K), Audi AG (Germany), Porsche AG (Germany), NXP Semiconductors N.V. (Netherlands), Infineon Technologies AG (Germany), General Motors Company (U.S.), and Continental AG (Germany). |

| Key Drivers | • The luxury car market is growing due to increase in demand for luxury vehicles. • Increase in the income level of people. • Increased need for a comfortable driving experience boosts the growth of the luxury car market. |

| RESTRAINTS | • The cost of producing cars with luxurious features and various options is higher than the cost of producing cars with similar attributes. • Luxury car sales are quite low, and the majority of the selling price goes to developing and making these cars pricey. |