Automotive Seat Heater Market Report Scope & Overview:

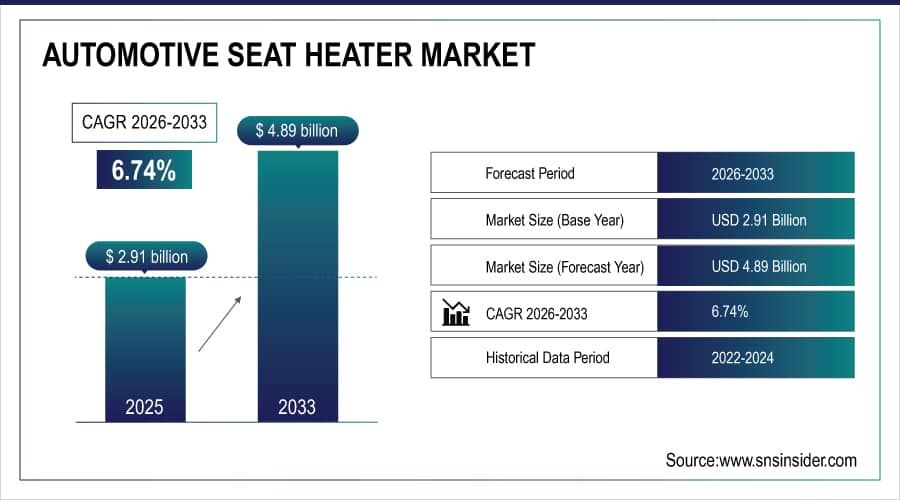

The Automotive Seat Heater Market size is valued at USD 2.91 Billion in 2025E and is projected to reach USD 4.89 Billion by 2033, growing at a CAGR of 6.74% during 2026-2033.

The Automotive Seat Heater Market analysis highlights the increasing consumer preference for more comfort, convenience and luxury along with new innovations. Growing popularity of the electric and luxury cars in several regions is encouraging incorporation of the leading-edge heating solutions including PTC, carbon fiber and film type systems.

On March 17, 2025, Hitachi High-Tech launched a ¥24.5 billion semiconductor facility in Kasado, Japan, featuring digitalized, automated production lines to meet AI and autonomous vehicle demand while promoting carbon neutrality.

Market Size and Forecast:

-

Market Size in 2025E: USD 2.91 Billion

-

Market Size by 2033: USD 4.89 Billion

-

CAGR: 6.74% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Automotive Seat Heater Market - Request Free Sample Report

Automotive Seat Heater Market Trends

-

Rising EV adoption drives integration of energy-efficient seat heaters, enhancing comfort while minimizing battery power consumption in premium vehicles.

-

Growing consumer preference for luxury features in passenger cars and SUVs accelerates demand for advanced PTC and carbon fiber heaters.

-

Expansion of aftermarket seat heater retrofits supports increasing vehicle customization and comfort upgrades across emerging markets.

-

OEMs investing in lightweight, flexible, and modular heating technologies to improve efficiency, reduce installation complexity, and support global production scalability.

-

Regional growth in Asia-Pacific and Europe, coupled with exports of high-performance seat heater modules, strengthens global market expansion opportunities.

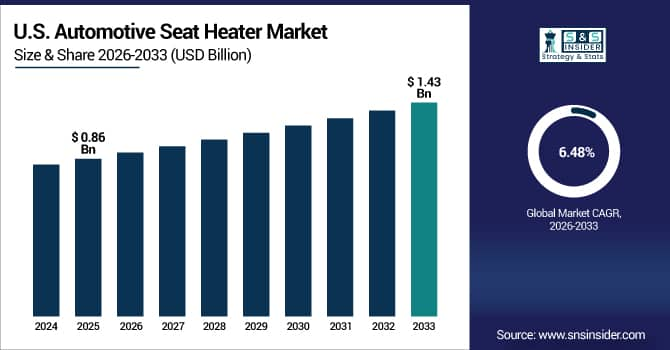

The U.S. Automotive Seat Heater Market size is valued at USD 0.86 Billion in 2025E and is projected to reach USD 1.43 Billion by 2033, growing at a CAGR of 6.48% during 2026-2033. Automotive Seat Heater Market growth is driven by increasing consumer inclination towards comfort features in passenger cars, SUVs, and electric vehicles. Advanced PTC, carbon fiber and film-based heaters are being incorporated in high-end luxury car segments.

Automotive Seat Heater Market Growth Drivers:

-

Growing Consumer Demand for Vehicle Comfort and Luxury Features Accelerates Seat Heater Adoption

Increasing demand for comfort and convenience in passenger cars, SUVs, and EVs is one of the key factors driving the Automotive Seat Heater Market growth. With technologies such as PTC, carbon fiber and film heating that can heat quickly, save energy and be thermal insulation. Seat heaters are being included by OEMs in premier and medium cars to distinguish the product. Aftermarket conversions also extend the reach to legacy vehicles. In 2025, over 6.8 million seat heater units were produced globally, with Asia-Pacific contributing approximately 48% of total production.

In 2025, 80% of new EVs and 65% of SUVs in North America and Europe included seat heaters as standard or optional, driven by cold-climate demand and range-preserving cabin comfort

Automotive Seat Heater Market Restraints:

-

High Production Costs and Energy Consumption Limit Widespread Seat Heater Deployment

High costs associated with manufacture of the advanced heating elements and power draw prevent aggressive integration in mid-end and budget vehicles. Difficult to install and maintain which makes it slower for adoption. Latin America, MEA are price-sensitive markets and hesitant to invest in OEM or aftermarket seat heaters. In addition, the energy-efficiency standards imposed in Europe and North America demand constant design re-optimization at a higher R&D cost. In 2025, approximately 15% of mid-range vehicles skipped seat heaters due to cost and power limitations.

Automotive Seat Heater Market Opportunities:

-

Technological Innovation and Expansion in Electric Vehicle Market Boost Seat Heater Growth

Electric and automated self-driving vehicles offer potential for energy saving lightweight seat heaters. Breakthroughs in carbon fiber, PTC and hybrid heating technology enables quicker power, with less power consumption. Aftermarket add-on opportunities, along with international expansion in Asia-Pacific and Europe, provide additional tailwinds for growth. Strategic OEM partnerships and modular designs allow for broader vehicle integrations. In 2025, EV adoption increased seat heater installations by around 24%, generating over USD 1.1 billion in global trade value.

Advanced seat heaters using carbon fiber and thin-film tech reduced system weight by 40% in 2024, supporting EV range and autonomous vehicle.

Automotive Seat Heater Market Segment Analysis

-

By technology, Wire-Based Heating led the market with a 38.21% share in 2025, while Carbon Fiber Heating was the fastest-growing segment, recording a CAGR of 9.11%.

-

By vehicle type, Passenger Cars dominated with a 52.37% share in 2025, whereas Electric Vehicles (EVs) showed the fastest growth at a CAGR of 6.88%.

-

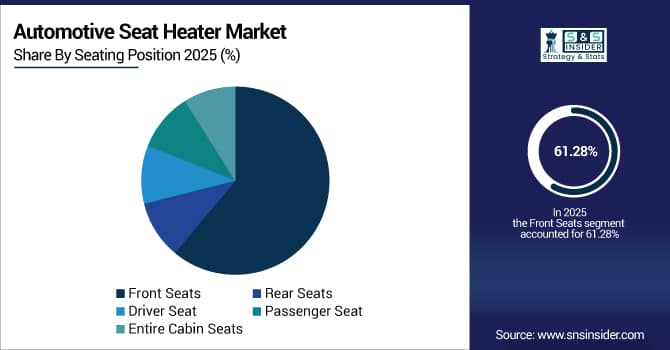

By seating position, Front Seats led with 61.28% of the market in 2025, while Rear Seats experienced the fastest growth, with a CAGR of 7.15%.

-

By sales channel, OEMs (Original Equipment Manufacturers) held 70.12% of the market in 2025, while Aftermarket was the fastest-growing segment, registering a CAGR of 7.64%.

By Technology, Wire-Based Heating Leads Market While Carbon Fiber Heating Registers Fastest Growth

Wire-based seat heaters, dominate the market due to the most common in the industry and used broadly in both passenger cars and SUVs due to its competitive cost, high reliability. They provide stable heating quality and are more easily incorporated into current vehicle design. While, carbon fiber heating fiber has the fastest growth, mainly because of the light weight construction, energy saving heaters and quick warm-up time for being applied to premium & EV vehicles. Constant innovations in PTC and film heaters are also growing applications in luxury and electric cars. Rising world manufacturing will encourage greater use in developing economies. In 2025, wire-based heaters accounted for 38% of global production, while carbon fiber units grew to 1.2 million

By Vehicle Type, Passenger Cars Dominate While Electric Vehicles (EVs) Shows Rapid Growth

Passenger cars continue to be the leading vehicle type, led by the strong uptake of comfort features in mid-priced and high-end models. SUVs also play a large part, especially in North America and Europe. While, Electric vehicles (EVs) are the fastest-growing segment, with more demand for energy-efficient heating systems to work with battery-operated technologies. The move toward luxurious EVs and plug in hybrids further spurs seat heater adoption. The area additions for OEM plants improve availability in key markets. In 2025, passenger cars accounted for 52% of global seat heater installations, while EV adoption drove approximately 820,000 units, up 26% year-on-year.

By Seating Position, Front Seats Lead While Rear Seats Registers Fastest Growth

Front Seats dominate the market due to standard in premium, luxury and EV trims for optimal driver's and front passengers' comfort. Technological advancements like modular heating pads make them easy and cost effective to install. While, rear seat is exploding, particularly for the high-end and executive model cars driven by OEMs adoption of heated rear packages and aftermarket solutions. Growing demand for full heated cabins in cold countries is behind rear what we do are approvement. n 2025, front seats accounted for 61% of total seat heater installations, while rear seat installations grew by 28%, reaching 1.1 million units globally.

By Sales Channel, OEMs (Original Equipment Manufacturers) Lead While Aftermarket Grow Fastest

OEMs segment still hold all the cards as seat heaters are becoming more and more factory fit options in new cars on premium but also mid-range segments. OEM and Aftermarket supplier partnerships ensure product availability. Meanwhile, aftermarket is growing fast, as vehicles are retrofitted especially in places where winter takes a harder toll and vehicle fleets are older. Growing demand for aftermarket across the world due to consumer inclination towards convenience and comfort is driving the global market of automotive seats. Aftermarket penetration is boosted by smart marketing and packaged deals. In 2025, OEM-installed seat heaters represented 70% of global unit consumption, while aftermarket sales grew 27% year-on-year, totaling around 1.3 million units.

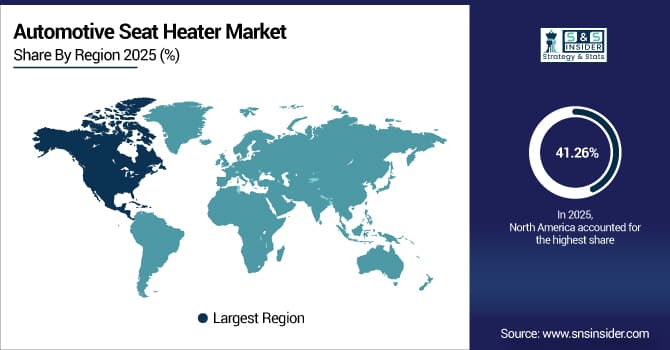

Automotive Seat Heater Market Regional Analysis:

North America Automotive Seat Heater Market Insights

In 2025 North America dominated the Automotive Seat Heater Market and accounted for 41.26% of revenue share, this leadership is due to the automakers concentrate on premium and electric vehicle comfort features. Cold climates are driving up aftermarket add-ons. Local manufacturing players team up with international suppliers and air to expand capacity. Lightweight PTC and film heaters have been more widely deployed. Use of modular PTC heaters simplifies the installation process. In 2025, North America produced about 1.2 million seat heater units.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Automotive Seat Heater Market Insights

The U.S. is primarily driven by increasing penetration of heated seats in passenger vehicle, Sports Utility Vehicle (SUVs), and Electric Vehicles (EVs). The premium and luxury cars are the significant customers for advanced heating systems. Local production by OEMs is increasing, as are aftermarket retrofits. In 2025, U.S. installations reached approximately 820,000 units.

Asia-pacific Automotive Seat Heater Market Insights

Asia-pacific is expected to witness the fastest growth in the Automotive Seat Heater Market over 2026-2033, with a projected CAGR of 7.30% due to high production of vehicles and increasing EV adoption. Advanced PTC, carbon fiber and Film-based heaters are being incorporated in premium to mid-range cars by OEMs. Domestic producers are increasing their output to cater not only for domestic demand but also for export. There are also aftermarket conversions gaining in popularity. It also brings energy saving and comfort to a higher level through new technologies. In 2025, Asia-Pacific produced approximately 6.5 million seat heater units

China Automotive Seat Heater Market Insights

The EV boom and growth in passenger car production result in China forming the largest single-country market while other countries grow at a much slower pace. Wire-based and carbon fiber heaters are now used by both domestic and overseas OEMs. In 2025, China consumed around 2.1 million seat heater units, up 30% year-on-year.

Europe Automotive Seat Heater Market Insights

In 2025, Europe emerged as a promising region in the Automotive Seat Heater Market, due to luxury and premium car production. Germany, France and Italy are the manufacturing-and-exporting heavyweights. High-end carbon fiber, PTC Far-infrared heating technology are used. OEMs prefer energy-saving and modular heating options. The aftermarket is largely made in colder places. The EU puts MAT on the map of innovation for heating systems. In 2025, Europe produced nearly 1.5 million seat heater units.

Germany Automotive Seat Heater Market Insights

Germany is one of the large seat heater manufacturing hub for domestic as well as export OEMs. Growing traction of carbon fiber and PTC heaters in luxury & premium vehicle categories. Local R&D investments help drive innovative designs and energy-efficient modules. In 2025, German output reached around 480,000 seat heater units.

Latin America (LATAM) and Middle East & Africa (MEA) Automotive Seat Heater Market Insights

The Automotive Seat Heater Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the imports of premium and luxury vehicles increase along with retrofits. Urbanization and infrastructure growth encourage use in commercial, passenger vehicles. Demand in the LATAM Aftermarket enhanced by cold climate areas. Local suppliers are increasing production and distribution networks. Adoption is driven by premium car segments in the Middle East. In 2025, LATAM & MEA consumed approximately 210,000 seat heater units.

Automotive Seat Heater Market Competitive Landscape:

Continental AG’s Interior Division develops intelligent seat‑heating systems that integrate sensors, thermal modules and user controls to enhance occupant comfort and energy efficiency. The company leverages its electronics and climate expertise across global OEM programs for passenger cars and EVs. Innovation in lightweight heating elements supports expanding electric vehicle adoption.

-

In June 2024, Continental AG launched next-generation smart seat-heating systems featuring smartphone connectivity and predictive climate control, enhancing comfort and energy efficiency for premium vehicles, while supporting OEM integration and expanding its thermal-comfort technology portfolio globally.

Panasonic Corporation uses its thermal‑analysis and cabin‑climate modelling capabilities to develop advanced seat‑heaters that minimize overall cabin heating load and thus preserve EV range. The company’s innovations support integration of seat and radiation heaters to provide fast warming with reduced power draw. Panasonic collaborates with global vehicle manufacturers on customized heating modules. Panasonic shipped about 620,000 seat‑heater units globally in 2024.

-

In August 2024, Panasonic Corporation unveiled a composite heating-material technology for electric vehicles, enabling direct seat-surface heating with lower power consumption, faster warm-up, and improved energy efficiency, targeting OEMs and aftermarket applications for passenger cars and EVs globally.

Gentherm Inc. specializes in vehicle thermal comfort solutions including seat‑heating, ventilation and neck‑conditioning modules. Its CCS Heat systems feature rapid heat‑up and zonal control, ideal for EV cabins and luxury vehicles. The company continues to expand its portfolio of wire‑, carbon‑ and film‑based heating technologies.

-

In April 2025, Gentherm Incorporated expanded its strategic partnership with Duomed across Europe to enhance distribution of thermal-comfort systems, including seat heaters, focusing on rapid deployment, increased market reach, and strengthening its presence in premium vehicle and EV segments.

Roadwire LLC is a supplier of heating‑element wires and harnesses used in automotive seat‑heater systems. Its high‑reliability wire solutions enable consistent comfort performance across seating positions. The company supports both OEM production and aftermarket retrofit markets globally. Roadwire delivered about 420 km of heating wire harnesses for car seats in 2024.

-

In early 2025, Roadwire LLC launched a high-reliability heating-wire series engineered for electric-vehicle seat applications, offering improved durability, reduced installation footprint, and supporting global OEM and aftermarket demand for energy-efficient and modular thermal-comfort solutions.

Automotive Seat Heater Market Key Players:

Some of the Automotive Seat Heater Market Companies are:

-

Continental AG

-

Panasonic Corporation

-

Gentherm Incorporated

-

II-VI Incorporated

-

Seat Comfort Systems, Inc.

-

Roadwire LLC

-

Rostra Precision Controls Inc.

-

Firsten Automotive Electronics Co., Ltd.

-

Lear Corporation

-

Guangzhou Tachibana Electronic Co., Ltd.

-

SINOMAS

-

Changchun SET Electronics Co., Ltd.

-

Champion Auto Systems

-

AUNDE Group SE

-

Check Corporation

-

Adient PLC

-

Faurecia SE

-

Brose Fahrzeugteile GmbH & Co. KG

-

Toyota Boshoku Corporation

-

Magna International Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.91 Billion |

| Market Size by 2033 | USD 4.89 Billion |

| CAGR | CAGR of 6.74% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Carbon Fiber Heating, Wire-Based Heating, PTC Heating, Ceramic Heating, Film Heating) • By Vehicle Type (Passenger Cars, SUVs, Commercial Vehicles, Electric Vehicles (EVs), Luxury Vehicles) • By Seating Position (Front Seats, Rear Seats, Driver Seat, Passenger Seat, Entire Cabin Seats) • By Sales Channel (OEMs (Original Equipment Manufacturers), Aftermarket, Distributors, Specialty Automotive Retailers, Online Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Continental AG, Panasonic Corporation, Gentherm Incorporated, II-VI Incorporated, Seat Comfort Systems, Inc., Roadwire LLC, Rostra Precision Controls Inc., Firsten Automotive Electronics Co., Ltd., Lear Corporation, Guangzhou Tachibana Electronic Co., Ltd., SINOMAS, Changchun SET Electronics Co., Ltd., Champion Auto Systems, AUNDE Group SE, Check Corporation, Adient PLC, Faurecia SE, Brose Fahrzeugteile GmbH & Co. KG, Toyota Boshoku Corporation, Magna International Inc. |