Automotive Dyno Market Report Scope & Overview:

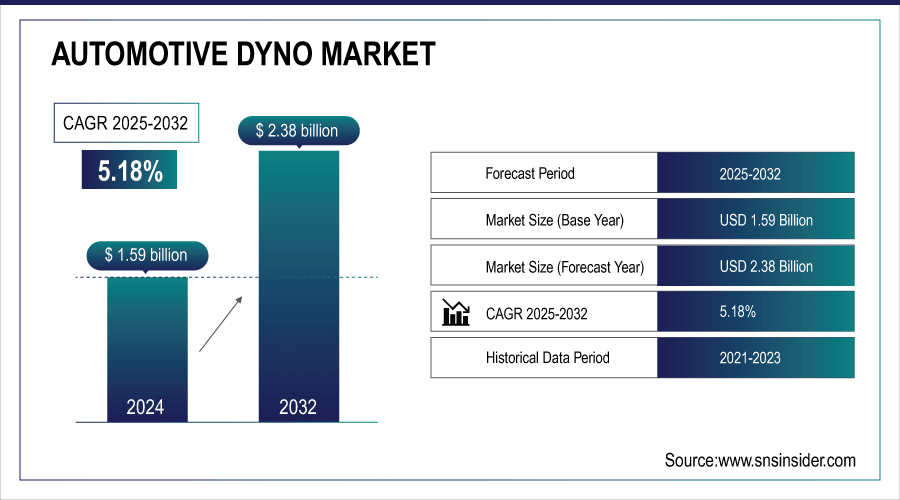

The Automotive Dyno Market size was valued at USD 1.59 Billion in 2024 and is projected to reach USD 2.38 Billion by 2032, growing at a CAGR of 5.18% during 2025–2032.

The Automotive Dyno Market is experiencing significant growth driven by innovations in compact and versatile dynamometers. Advancements such as adjustable mounts, enhanced multi-motor drive systems, and the integration of USB-C and battery-powered options are improving efficiency and user convenience. Growing interest in dynamic testing solutions, especially for scale-model and miniature vehicles, is expanding the market scope among hobbyists, researchers, and collectors. The ability to simulate speed and aerodynamics in controlled environments is further fueling adoption. These developments highlight the market’s focus on cost-effective, portable, and high-performance solutions for enhanced vehicle testing and performance analysis.

July 24, 2025 – Runsible Dynamometer Brings Mini Cars to Life in Wind Tunnel TestsFun Tech Labs has launched the Runsible dynamometer for 1:64-scale cars, featuring adjustable mounts, a four-motor drive system, and USB-C or battery power, priced at $39.90. It fits inside the Windsible wind tunnel, allowing miniature cars to spin their wheels and run through fog streams for a dynamic, fun testing experience.

To Get More Information On Automotive Dyno Market - Request Free Sample Report

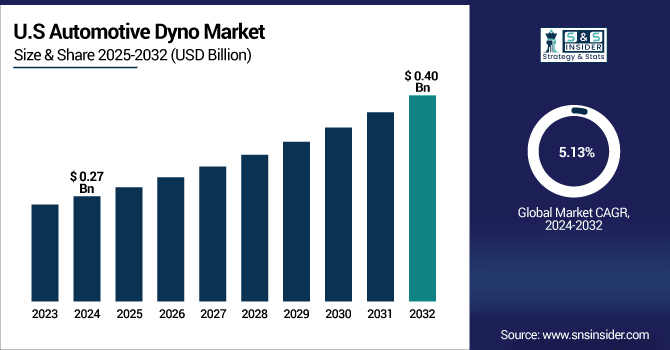

The U.S. Automotive Dyno Market size was valued at USD 0.27 Billion in 2024 and is projected to reach USD 0.40 Billion by 2032, growing at a CAGR of 5.13% during 2025 – 2032, driven by rising demand for advanced vehicle testing solutions, increasing focus on emission regulations, and growing adoption of performance optimization technologies. Innovations in portable and high-precision dynamometers further support market expansion, catering to automotive manufacturers, research facilities, and hobbyist segments.

Automotive Dyno Market Highlights:

-

Growing need for precise measurement of real-world vehicle performance is driving demand for advanced dynamometers.

-

High-power performance vehicles and rising consumer expectations increase adoption of high-precision chassis dynos.

-

High initial costs, technical complexities, and specialized expertise requirements restrain widespread implementation.

-

Space constraints in urban facilities and regulatory hurdles limit market expansion.

-

Rapid EV and autonomous vehicle growth is fueling demand for hub and steerable dynamometers.

-

Integration of hardware-in-the-loop, torque vectoring, and intelligent software platforms enhances testing capabilities and market innovation.

Automotive Dyno Market Drivers:

-

Power Discrepancies Drive Demand for High-Precision Chassis Dynamometers

The growing need for accurate measurement of real-world vehicle performance is driving demand for advanced chassis dynamometers. As performance vehicles become more powerful, manufacturers, tuners, and testing facilities require precise tools to validate horsepower and torque outputs, ensuring transparency and compliance with industry standards. This demand is fueled by increasing consumer expectations for verified performance data, the rise of high-output engines, and the push for enhanced tuning and optimization. High-precision dynos capable of handling elevated power levels and reducing measurement inaccuracies are becoming essential for both OEMs and aftermarket performance sectors.

June 25, 2025 – Chassis Dyno Reveals Chevrolet C8 ZR1 Packs More Power Than Claimed

Paragon Performance’s dyno test showed the C8 Corvette ZR1 delivering 1,028.6 horsepower and 839.5 lb-ft of torque at the wheels, exceeding GM’s official 1,064 hp flywheel claim after accounting for drivetrain losses.

Automotive Dyno Market Restraints:

-

High Costs and Technical Complexities Restrain Automotive Dyno Market Expansion

The Automotive Dyno Market faces restraints primarily due to high initial investment costs and ongoing maintenance expenses associated with advanced dynamometer systems. Technical complexities in calibration and operation further limit adoption, particularly among small-scale manufacturers and testing facilities with constrained budgets. Additionally, the requirement for specialized expertise to manage high-performance testing setups increases operational challenges. Space constraints in urban facilities and regulatory hurdles related to emissions testing equipment also pose barriers. These factors collectively slow down widespread implementation, affecting market growth despite rising demand for accurate vehicle performance measurement and emissions compliance solutions.

Automotive Dyno Market Opportunities:

-

EV and Autonomous Growth Drives Demand for Advanced Dynamometer Systems

The rapid advancement of electric and autonomous vehicles is driving the need for next-generation dynamometer systems that enable precise simulation of real-world driving scenarios. Growing requirements for hardware-in-the-loop testing, torque vectoring, and advanced load handling capabilities are pushing manufacturers to adopt hub and steerable dynos. These systems allow efficient validation of autonomous driving functions, enhanced drivetrain performance, and reduced reliance on physical proving grounds. As the automotive industry moves toward connected and zero-emission mobility, the integration of intelligent software and flexible testing platforms is expected to accelerate market adoption and innovation.

February 24, 2025 – Ascential Technologies Unveils Hub and Steerable Dynos for EV and Autonomous Vehicle Testing

Ascential Technologies introduced new hub and steerable dynamometers designed for precise simulation of electric and autonomous vehicles, featuring advanced torque vectoring, hardware-in-the-loop integration, and enhanced load handling for comprehensive vehicle testing and validation.

Automotive Dyno Market Segment Highlights:

-

By Type – Dominating: Engine Dynamometers (51.13% in 2024), Fastest: Transmission Dynamometers (8.0% CAGR)

-

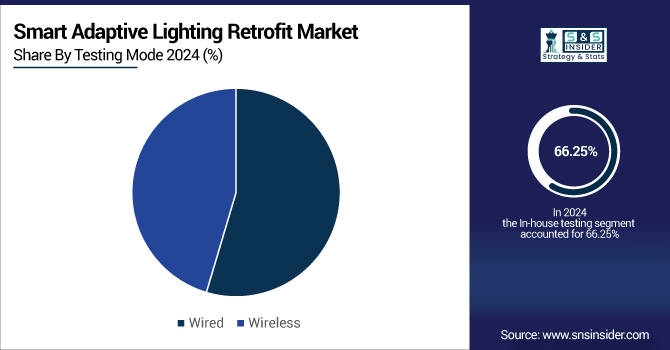

By Testing Mode – Dominating: In-house Testing (66.25% in 2024), Fastest: Outsourced Testing (6.82% CAGR)

-

By Vehicle – Dominating: Passenger Vehicles (58.25% in 2024), Fastest: Commercial Vehicles (6.52% CAGR)

-

By End Use – Dominating: Automotive OEMs (54.38% in 2024), Fastest: Aftermarket Service Providers (6.66%CAGR)

By Testing, Mode In-house Testing Leads While Outsourced Testing Shows Rapid Growth

In-house testing dominates the market due to its greater control over testing processes and seamless integration with internal operations. However, outsourced testing is growing at the fastest pace, driven by cost efficiency, access to specialized expertise, and increasing reliance on third-party testing facilities for advanced vehicle validation.

By Type, Engine Dynamometers Lead While Transmission Dynamometers Fastest Growth

Engine dynamometers dominate the market, driven by their widespread use in powertrain testing and emission compliance validation. Transmission dynamometers are witnessing the fastest growth, fueled by increasing demand for advanced drivetrain testing and their expanding role in electric and hybrid vehicle development.

By Vehicle, Passenger Vehicles Lead While Commercial Vehicles Gain Momentum

Passenger vehicles dominate the market, supported by their extensive production volumes and consistent demand for performance and emissions testing. However, commercial vehicles are experiencing the fastest growth, driven by the rising focus on fleet efficiency, stricter regulatory standards, and increasing adoption of advanced testing solutions for heavy-duty applications.

By End Use, Automotive OEMs Lead While Aftermarket Service Providers Grow Fastest

Automotive OEMs dominate the market due to their large-scale production and consistent need for vehicle testing and validation. Meanwhile, aftermarket service providers are growing the fastest, driven by increasing vehicle customization, performance upgrades, and the rising demand for reliable testing solutions in the aftermarket and service sectors.

Automotive Dyno Market Regional Highlights:

-

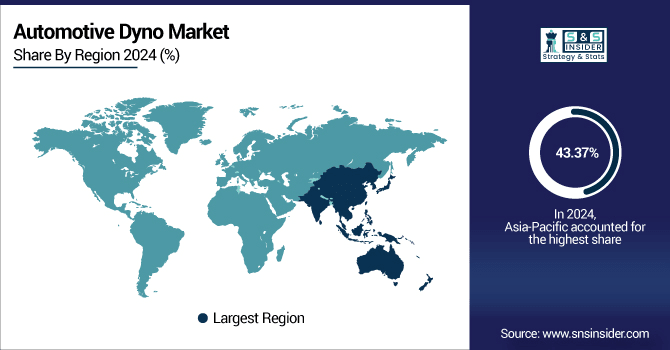

By Region – Dominating: Asia-Pacific (43.37% in 2024), Fastest: North America (25.25% in 2024 → 27.66% in 2032, CAGR 6.37%)

-

Europe: 20.25% → 21.78% (CAGR 6.14%)

-

South America: 6.13% → 5.14% (CAGR 2.88%, declining)

-

Middle East & Africa: 5.00% → 4.13% (CAGR 2.65%, declining)

Automotive Dyno Market Regional Analysis:

Asia-Pacific Automotive Dyno Market Insights:

The Asia-Pacific Automotive Dyno Market dominates globally due to high vehicle production, expanding automotive R&D, and increasing adoption of advanced testing solutions. Strong growth in passenger and commercial vehicle segments, along with government support for emissions compliance and performance optimization, is driving demand for both engine and chassis dynamometers across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

China Automotive Dyno Market Insights

China leads the Asia-Pacific Automotive Dyno market, driven by high vehicle production, growing R&D activities, and increased adoption of advanced testing solutions.

North America Automotive Dyno Market Insights:

North America is the fastest-growing Automotive Dyno market, fueled by advanced automotive infrastructure, increasing electric and hybrid vehicle adoption, and rising demand for accurate performance testing. Strong investments in R&D, stringent emission regulations, and growing focus on drivetrain optimization are accelerating the adoption of engine, chassis, and transmission dynamometers.

-

U.S. Automotive Dyno Market Insights

The U.S. Automotive Dyno market is growing rapidly due to advanced vehicle testing, performance optimization, and increasing EV and hybrid adoption.

Europe Automotive Dyno Market Insights:

The Europe Automotive Dyno market is witnessing steady growth, driven by increasing vehicle production, stringent emission regulations, and rising demand for performance testing. Investments in R&D, adoption of advanced dynamometer technologies, and growing focus on electric and hybrid vehicle validation are supporting market expansion across key European countries.

-

Germany Automotive Dyno Market Insights

Germany dominates the European Automotive Dyno market, driven by its strong automotive manufacturing base, advanced R&D infrastructure, and high adoption of vehicle testing and validation technologies.

Latin America Automotive Dyno Market Insights:

The Latin America Automotive Dyno market is expanding steadily, supported by growing automotive production, increasing demand for performance and emissions testing, and gradual adoption of advanced dynamometer technologies. Emerging markets in Brazil and Mexico are driving growth, while investments in vehicle R&D and testing infrastructure continue to rise across the region.

-

Brazil Automotive Dyno Market Insights

Brazil leads the Latin America Automotive Dyno, driven by its large automotive manufacturing industry, growing vehicle production, and increasing adoption of advanced testing and validation solutions.

Middle East & Africa Automotive Dyno Market Insights:

The Middle East & Africa Automotive Dyno market is growing steadily, supported by increasing automotive production, rising demand for performance and emissions testing, and gradual adoption of advanced dynamometer technologies. Key markets like the UAE and South Africa are driving growth, with ongoing investments in vehicle R&D and testing infrastructure.

-

United Arab Emirates (UAE) Automotive Dyno Market Insights

United Arab Emirates (UAE) is dominating the Middle East & Africa Automotive Dyno market, driven by its advanced automotive infrastructure, high adoption of testing technologies, and growing investments in vehicle performance and validation solutions.

Automotive Dyno Market Competitive Landscape:

Established in 1975, Mustang Dynamometer is a U.S.-based leader in designing and manufacturing high-precision testing equipment, including chassis, engine, and transmission dynamometers. The company serves automotive OEMs, aftermarket providers, and motorsport teams, offering innovative solutions, calibration services, and advanced ADAS testing systems to ensure accurate and reliable vehicle performance validation.

-

In Aug 2025 Mustang releases 2025 catalogs, introduces a revolutionary ADAS testing system, and offers calibration services to ensure precise and repeatable dynamometer testing.

Rototest International AB, founded in January 1988, is a Swedish technology company specializing in high-dynamic, hub-coupled dynamometers for automotive testing. Initially developed to commercialize a Swedish-patented dynamometer, it has since become a global leader in powertrain testing solutions. In late 2023, Rototest was acquired by TOYO Corporation, a Japanese provider of advanced measurement solutions, to enhance its global presence and innovation capabilities.

-

In Jun 2024 – Rototest Showcases Advanced Powertrain Dynos Rototest exhibited its latest dynamometer range at a European expo, highlighting high-performance models for ADAS testing and educational applications, including the Energy a62 4WD for dynamic braking and the cost-efficient Energy u14 4WD for universities.

Automotive Dyno Market Key Players:

-

AVL List GmbH

-

Dynojet Research

-

HORIBA Automotive

-

Magtrol Inc.

-

MAHA Maschinenbau Haldenwang GmbH

-

Meidensha Corporation

-

Mustang Dynamometer

-

Power Test

-

Rototest

-

SuperFlow Technologies

-

Dynotech Research Inc.

-

Dynotronics

-

Flh Dyno Technologies

-

Ardic

-

Dynametric Dyne Systems

-

Mainline Dyno

-

Taylor Dynamometer

-

Phoenix Dynamometer Technologies LLC

-

Com-Ten Industries

-

Dynapack USA

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.59 Billion |

| Market Size by 2032 | USD 2.38 Billion |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Engine Dynamometers, Chassis Dynamometers, Transmission Dynamometers) • By Testing Mode (In-house Testing, Outsourced Testing) • By Vehicle (Passenger Vehicles, Commercial Vehicles) • By End Use (Automotive OEMs, Aftermarket Service Providers, Motorsport Teams) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AVL List GmbH, Dynojet Research, HORIBA Automotive, Magtrol Inc., MAHA Maschinenbau Haldenwang GmbH, Meidensha Corporation, Mustang Dynamometer, Power Test, Rototest, SuperFlow Technologies, Dynotech Research Inc., Dynotronics, Flh Dyno Technologies, Ardic, Dynametric Dyne Systems, Mainline Dyno, Taylor Dynamometer, Phoenix Dynamometer Technologies LLC, Com-Ten Industries, and Dynapack USA. |