Micro-Mobility Market Report Scope & Overview

Get More Information on Micro-Mobility Market - Request Sample Report

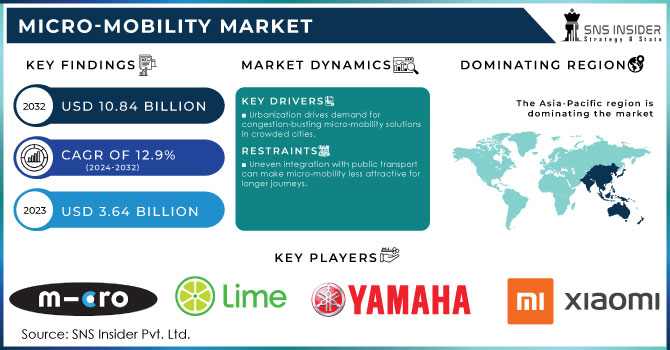

The Micro-Mobility Market size was valued at USD 3.64 billion in 2023 and will reach USD 10.84 billion by 2032 and grow at a CAGR of 12.9% by 2024-2032

Urban living and traffic jams are a big reason for the growth of the Micro-Mobility Market. As cities get more crowded, streets become clogged with cars. Micro-mobility solutions, like electric scooters and bikes, offer a convenient and nimble escape from traffic, making commutes faster and easing congestion. The rising environmental concerns make micro-mobility a more sustainable alternative to traditional vehicles. The growing government support, including subsidies and infrastructure development for cycling lanes and docking stations, incentivizes micro-mobility use.

The growth is further accelerated by advancements in the sector. For instance, the introduction of lightweight, high-performance batteries extends the range of micro-mobility vehicles, making them more practical for longer commutes. Additionally, the development of dockless rental systems using smartphone apps allows for easy on-the-go access to micro-mobility options. Safety concerns, particularly for riders navigating alongside cars and other vehicles, can deter some users. The limited infrastructure for dedicated lanes and parking can restrict the smooth operation of micro-mobility solutions in certain cities.

Micro-Mobility Market Dynamics:

KEY DRIVERS:

-

Urbanization drives demand for congestion-busting micro-mobility solutions in crowded cities.

-

Technological advancements in batteries extend range and improve performance of micro-mobility vehicles.

Micro-mobility vehicles like electric scooters and bikes are getting a major boost due to advancements in battery technology. These advancements focus on packing more power into the same size battery. This translates to riders going further on a single charge, making micro-mobility a more practical option. Better batteries also mean these vehicles can accelerate faster, handle hills with ease, and deliver a smoother ride. Safety improvements come along for the ride too, with smarter battery management systems reducing the risk of overheating or quick drain. As a result, micro-mobility is becoming a more attractive and realistic option for eco-conscious city dwellers. It offers a convenient and sustainable way to get around, reducing traffic congestion and emissions. With continued battery innovation on the horizon, the future of micro-mobility looks even brighter, promising even further improvements in range, performance, and overall user experience.

RESTRAINTS:

-

Uneven integration with public transport can make micro-mobility less attractive for longer journeys.

-

Limited infrastructure for dedicated lanes and parking restricts smooth operation in certain cities.

The dedicated lanes and parking areas for micro-mobility in older cities presents a unique challenge. These cities, shaped by history, often lack the space for such expansions. Narrow streets, tightly packed buildings, and established property lines make carving out new space difficult and disruptive. Even if space could be found, the cost is significant. These projects compete for funding with other crucial needs like schools, hospitals, and police services. Limited budgets might force compromises in design and functionality, leading to less-than-ideal infrastructure. The parking areas might be inconveniently located or offer limited capacity.

OPPORTUNITIES:

-

Collaboration with city planners can lead to the development of dedicated infrastructure for micro-mobility.

-

Focus on safety features like improved lighting and braking systems can enhance rider confidence.

CHALLENGES:

-

Limited integration with existing public transportation systems discourages riders from using micro-mobility for longer journeys.

Micro-Mobility Market Segmentation:

by Type

-

E-bikes

-

E-kick scooters

-

Others

E-bikes is the dominating sub-segment in the Micro-Mobility Market by type holding around 80-85% of market share. This dominance can be attributed to several factors. The e-bikes offer a perfect balance between affordability and performance compared to electric scooters. They provide a more comfortable riding experience, especially for longer distances, and the ability to pedal alongside electric assist caters to riders seeking exercise or those with range anxiety. The government subsidies in some regions specifically target e-bikes, making them even more accessible and promoting their adoption as a sustainable alternative to traditional transportation.

by Battery Type

-

Sealed Lead Acid

-

NiMH

-

Li-ion

Li-ion batteries are the dominating sub-segment in the Micro-Mobility Market by battery type holding around 35-40% of market share. This dominance stems from their superior performance compared to older battery technologies like Sealed Lead Acid (SLA) and Nickel-Metal Hydride (NiMH). Li-ion batteries offer a lighter weight for the same energy storage capacity, translating to a longer range for micro-mobility vehicles. Additionally, they boast faster charging times and a longer lifespan, reducing downtime and maintenance costs. While Li-ion batteries might have a slightly higher initial cost compared to older options, their overall efficiency and performance make them the more attractive choice for both manufacturers and consumers.

by Voltage

-

Below 24V

-

36V

-

48V

-

Greater than 48V

36V and 48V are the dominating sub-segment in the Micro-Mobility Market by voltage. This voltage range strikes a balance between power, efficiency, and affordability. Lower voltage options (below 24V) might struggle to provide adequate power for steeper inclines or heavier riders. Conversely, voltages exceeding 48V, while offering more power, often come with a significant increase in cost and weight. The 36V and 48V range offers sufficient power for most urban commutes without sacrificing affordability or adding unnecessary weight to the vehicle. This balance makes them the most popular choice for manufacturers and aligns well with the typical needs of micro-mobility users.

by Speed

-

Up To 25 kmph

-

25-45 kmph

by Propulsion

-

Human Powered

-

Electrically Powered

by Sharing Type

-

Docked

-

Dock-less

by Ownership

-

Business-to-Business

-

Business-to-Consumer

by Data Service

-

Navigation

-

Payment

-

Other Data Services

by Travel Range

-

Up to 3 Miles

-

3-6 Miles

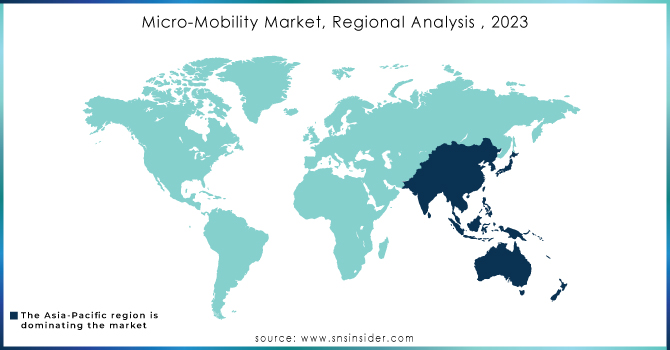

Micro-Mobility Market Regional Analysis

The Asia-Pacific is the dominating region in the Micro-Mobility market, holding around 45% of market share. This dominance is fueled by the rapid urbanization creating a need for convenient transportation, a large and growing affluent population, and government support through subsidies and infrastructure development.

North America is the second highest region in this market, driven by its strong technological infrastructure that fosters innovation, a growing environmentally conscious population embracing sustainable options, and the presence of major micro-mobility companies headquartered there.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Micro-Mobility Market Key Players

The major key players are Yellow Scooters (US), YAMAHA MOTOR CO., Lime Scooter (US), Micro Mobility Systems AG (Switzerland), Mobike (China), Yadea Technology Group Co., Ltd.; Jiangsu Xingri E-vehicle CO., LTD.; Xiaomi; SEGWAY INC.; Boosted USA; Air wheel Holding Limited; LTD.; Accell Group, Bird Rides, Inc. (US), Motivate (Lyft) (US), SWAGTRON, Pride Mobility Products Corp. (US), EV RIDER LLC (US), ofo Inc. (China), Golden Technologies (US), Merits Co. Ltd (Taiwan), Invacare Corporation (US) and other key players.

Micro-Mobility Market Recent Development

-

In March 2022: Segway-Ninebot addressed the evolving demands of modern transportation with their new GT-series, P-series, and E110A electric vehicles. These eco-friendly and reliable options prioritize rider comfort and style, making them a sleek and sustainable transportation solution.

-

In June 2022: Porsche is revving up its e-bike business through a German partnership. They've joined forces with a local e-bike manufacturer to develop, produce, and sell a new line of high-end Porsche electric bicycles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.64 Billion |

| Market Size by 2032 | US$10.84 Billion |

| CAGR | CAGR of 12.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle Type (Electric Kick Scooters, Electric Skateboards, Electric Bicycles) • by Battery Type (Sealed Lead Acid, NiMH, Li-ion) • by Voltage (Below 24V, 36V, 48V, Greater than 48V) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Yellow Scooters (US), YAMAHA MOTOR CO., Lime Scooter (US), Micro Mobility Systems AG (Switzerland), Mobike (China), Yadea Technology Group Co., Ltd.; Jiangsu Xingri E-vehicle CO., LTD.; Xiaomi; SEGWAY INC.; Boosted USA; Air wheel Holding Limited; LTD.; Accell Group, Bird Rides, Inc. (US), Motivate (Lyft) (US), SWAGTRON, Pride Mobility Products Corp. (US), EV RIDER LLC (US), ofo Inc. (China), Golden Technologies (US), Merits Co. Ltd (Taiwan), Invacare Corporation (US) |

| Key Drivers | •Due to geopolitical tensions, the demand for Micro-Mobility systems is on the rise. •These automobiles are low-emission and low-cost. |

| RESTRAINTS | •In order to implement the Micro-Mobility System, it is extremely difficult to build the infrastructure. •A micro-mobile vehicle's development and production are incredibly time-consuming. |