Automotive Navigation Systems Market Report Scope & Overview

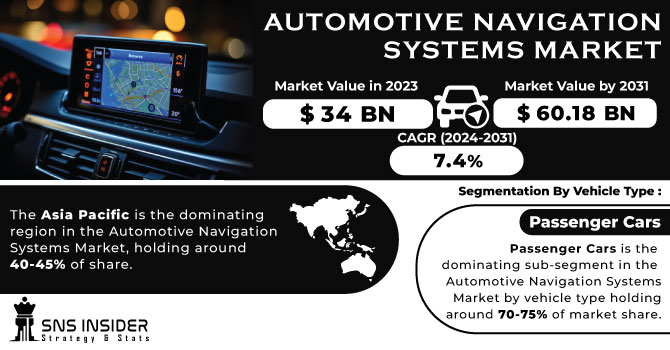

The Automotive Navigation Systems Market Size was valued at USD 34 billion in 2023 and is expected to reach USD 60.18 billion by 2031 and grow at a CAGR of 7.4% over the forecast period 2024-2031.

The Automotive Navigation Systems Market provides in-vehicle technology to guide drivers using satellite navigation, maps, and real-time traffic data. This market is fueled by a growing desire for convenient features that enhance the driving experience.

Get More Information on MEMS Gyroscopes Market - Request Free Sample Report

The navigation systems are primarily embedded within the car's dashboard but can also be accessed through smartphone integration. With increasing traffic congestion, especially in urban areas, navigation systems offer valuable assistance. The market is driven by the desire for a connected car experience, with features like real-time traffic updates and integration with points of interest. Opportunities lie in developing more user-friendly interfaces, advanced features like augmented reality overlays, and even personalization options for the navigation experience. This market caters not just to private car owners but also to fleet management companies and professional drivers seeking optimized routes and improved efficiency.

MARKET DYNAMICS:

KEY DRIVERS:

-

Real-time Traffic Data and Infrastructure Development Drive Automotive Navigation Systems Market Growth

The automotive navigation systems market thrives on drivers' desire to beat traffic. Real-time data from car GPS systems helps them avoid congestion and navigate more efficiently. This, combined with increased government investment in improved roads and infrastructure, is driving market growth. However, some challenges remain. Smartphone navigation offers a cheaper alternative, and some drivers might find in-dash systems less user-friendly or expensive. Despite these hurdles, the future looks bright as navigation systems become more sophisticated, seamlessly integrating with the driving experience.

-

Growing Demand for Logistics, Rising Middle Class in Emerging Economies, and Increased Investment Fuel Automotive Navigation Systems Market

RESTRAINTS:

-

High-tech navigation systems can make cars more expensive, potentially deterring budget-minded buyers especially in developing countries.

The advanced navigation systems provide a clear advantage but their high cost can be a barrier. This is especially true in developing nations, where price sensitivity is high. Advanced features can significantly increase a car's initial price tag, potentially deterring budget-conscious buyers from opting for vehicles with navigation systems. This creates a problem for the market to fully penetrate these regions, as affordability becomes a key factor for consumers.

-

Satellite Signal Obstructions Limit Navigation Accuracy in Dense Urban Areas and Remote Locations

OPPORTUNITIES:

-

Navigation systems can connect with parking apps, charging station locators, and traffic management systems for a seamless driving experience.

-

Navigation data can be used to power ADAS features like lane departure warnings and adaptive cruise control.

CHALLENGES:

-

Advanced navigation systems can significantly increase a car's price tag, limiting adoption in budget-conscious markets.

-

Dense urban areas and remote locations with weak satellite signals can disrupt navigation accuracy.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has disrupted the Automotive Navigation Systems Market, impacting both supply and demand. Disruptions in the supply chain, particularly due to the importance of neon gas and palladium from the region in chip production, have limited the number of navigation systems reaching manufacturers. This has coincided with a decrease in overall car production due to rising costs and economic uncertainty. The is a decline in global navigation system market share by around 5-7%. The war has also indirectly impacted consumer demand. With rising fuel prices and inflation, consumers are generally spending less on discretionary purchases, which could include new cars with navigation systems.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown significantly impacts the Automotive Navigation Systems Market. The economic downturn translates to limited consumer budgets, leading to a decline in new car purchases. This directly impacts in-dash navigation systems, typically bundled with new vehicles, potentially dropping their market share by around 10-15%. The Existing car owners might postpone upgrading their navigation systems with features like real-time traffic or voice assistance. This could cause a stagnation or decline in 5-7% in the aftermarket segment. During economic downturns consumers might opt for cheaper alternatives like free smartphone navigation apps, further eroding market share, particularly for portable devices, which could see a decline of 8-12%.

KEY MARKET SEGMENTS:

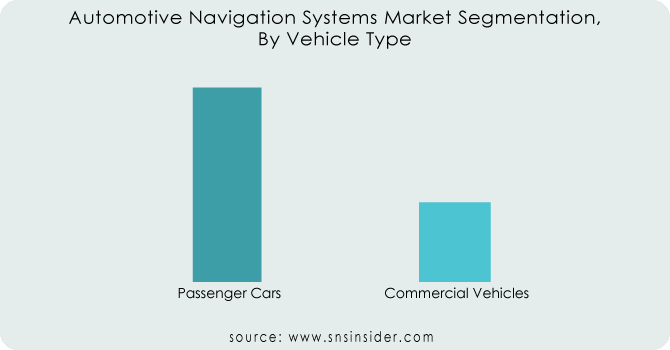

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

Passenger Cars is the dominating sub-segment in the Automotive Navigation Systems Market by vehicle type holding around 70-75% of market share. Passenger cars account for a larger share of global vehicle sales compared to commercial vehicles. Consumers prioritizing comfort and convenience features like navigation systems are more likely to purchase them for personal use in passenger cars.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Sales Channel

-

Original Equipment Manufacturers (OEMs)

-

Aftermarket

Original Equipment Manufacturers (OEMs) is the dominating sub-segment in the Automotive Navigation Systems Market by sales channel holding around 60-65% of market share. OEMs pre-install navigation systems in new vehicles, offering seamless integration with the car's overall electronics and user interface. This convenience is a major factor driving consumer preference for OEM-installed systems.

By Screen Size

-

Less than 6 Inches

-

6-10 Inches

-

More than 10 Inches

6-10 Inches is the dominating sub-segment in the Automotive Navigation Systems Market by screen size holding around 55-60% of market share. This screen size offers a good balance between providing clear visibility of maps and information while maintaining a sleek and ergonomic design for the car's dashboard. Smaller screens can be difficult to see, while larger ones can overwhelm the driver and take up valuable dashboard space.

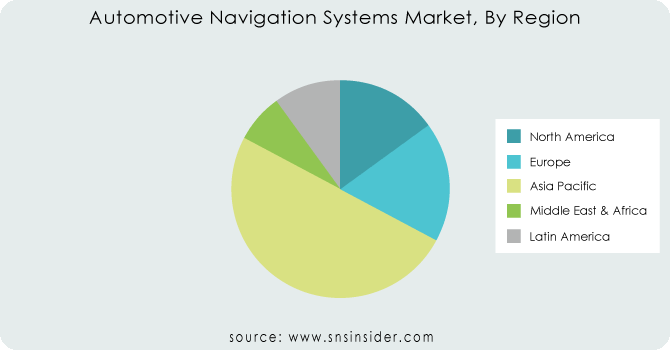

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Automotive Navigation Systems Market, holding around 40-45% of share. This dominance is fueled by a booming car ownership trend, particularly in giants like China and India. Rising disposable incomes and a growing desire for in-vehicle features further propel the market in this region.

Europe is the second highest region in this market leveraging its established automotive industry's focus on safety and technology. Regulations mandating navigation systems in some European countries solidify its strong market position.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Clarion Corporation (US)-Company Financial Analysis

KEY PLAYERS

The major key players are Robert Bosch GmbH (Germany), Clarion Corporation (US), Continental AG (Germany), Delphi Technologies (UK), AISIN SEIKI Co., Ltd (Japan), Denso Corporation (Japan), Garmin Ltd (US), Pioneer Corporation (US), Harman International Industries, Inc. (the US), HERE Technologies (US), JVC Kenwood Corporation (Japan), Telenav, Inc. (the US), TomTom N.V. (US), NNG Software Developing and Commercial Llc. (Hungary), Alpine Electronics, Inc., (Japan) and other key players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34 Billion |

| Market Size by 2031 | US$ 60.18 Billion |

| CAGR | CAGR of 7.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Cars, Commercial Vehicles) • By Sales Channel (Original Equipment Manufacturers, Aftermarket) • By Screen Size (Less than 6 Inches, 6-10 Inches, More than 10 Inches) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Robert Bosch GmbH (Germany), Clarion Corporation (US), Continental AG (Germany), Delphi Technologies (UK), AISIN SEIKI Co., Ltd (Japan), Denso Corporation (Japan), Garmin Ltd (US), Pioneer Corporation (US), Harman International Industries, Inc. (the US), HERE Technologies (US), JVC Kenwood Corporation (Japan), Telenav, Inc. (the US), TomTom N.V. (US), NNG Software Developing and Commercial Llc. (Hungary), and Alpine Electronics, Inc., (Japan) |

| Key Drivers | • Smartphone integration with IVS is driving growth in the automotive navigation systems market. • Increased demand for wireless connectivity and smartphones and tablets will boost connected car sales. |

| RESTRAINTS | • Navigating system costs are prohibitive. • Low-cost alternatives, such as portable GPS systems, may restrain the market's expansion. |