Automotive Filters Market Report Scope & Overview:

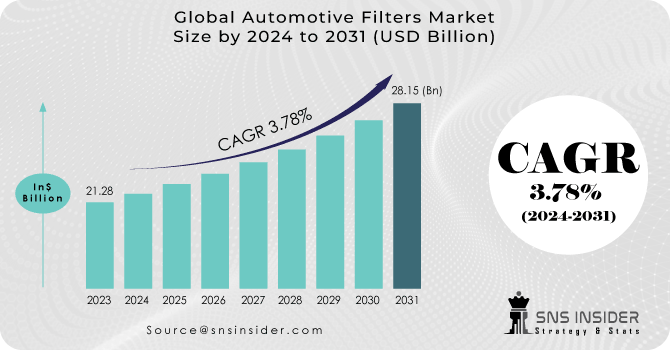

Automotive Filters Market size was valued at USD 21.28 billion in 2023 and is expected to reach USD 28.15 billion by 2031 and grow at a CAGR of 3.78% over the forecast period 2024-2031.

The future path of automotive filters unfolds against the backdrop of two distinct engine technologies: traditional combustion engines and electric vehicles (EVs). While the increasing prominence of EVs might initially suggest a downturn in demand for filters, the reality is more complex.

Get More Information on Automotive Filters Market - Request Sample Report

For conventional vehicles, the tightening of emission standards will propel advancements in filter technology, with a particular emphasis on capturing ultra-fine particulate matter. China's recent adoption of the China VI emission standard, mirroring Euro 6, is expected to significantly drive demand for advanced filters in this segment. Conversely, the EV revolution presents a unique opportunity. Although EVs eliminate the need for oil filters, they require high-efficiency air filters to safeguard delicate battery components and cabin air filters for passenger comfort. Governments worldwide are actively incentivizing this shift, as seen in India's FAME II scheme offering subsidies for EV adoption. Additionally, the projected $60 billion global investment in EV battery production by 2030 underscores the substantial growth prospects for specialized EV filters. In summary, the automotive filter market is on the edge of transformation, fueled by stringent regulations and the ascent of EVs. While demand for traditional filters may stabilize, the pursuit of innovations in pollutant capture and tailored solutions for EVs heralds promising avenues for growth.

MARKET DYNAMICS:

KEY DRIVERS:

- Government Regulatory Laws Against Emissions

The vehicle filter keeps dirt particles like pollen, exhaust fumes, bacteria, and other contaminants out of the carburetor and engine.. This reduces the amount of air pollution released by automobiles, lowers maintenance costs, and extends the vehicle's service life. The government and emission authorities have enacted strict emission regulations for automobiles that generate dangerous gases such as hydrocarbons (HC), nitrogen oxide (NOx), carbon monoxide (CO), and others. In the United States,

Protection Agency (EPA) has updated regulations such as the national program for greenhouse gas emissions (GHG) and fuel economy criteria for light-duty vehicles (passenger cars and trucks). Similarly, German cities are permitted by European law to prohibit the use of obsolete diesel automobiles. Union rules to reduce air pollution. These reasons are projected to drive the worldwide automotive filter market's overall growth.

RESTRAINTS:

-

Increase in Battery Electric Vehicle (BEV) Adoption

Due to the fact that battery electric/plug-in vehicles do not utilize fuels such as petrol, diesel, and gasoline, consumers' preferences have evolved in recent years. Furthermore, reduced maintenance costs lower overall costs, increasing demand for battery electric vehicles, which stimulates the growth of the automotive filter market.

Sales of battery electric vehicles increased by approx. 62%, while sales of typical non-plug-in hybrids increased by 40% in the year 2023, more than previous year. Because these electric vehicles do not utilize any type of fuel or oil, the necessity for oil and fuel filters is gone, which is predicted to impede the growth of the oil and fuel filter market.

-

Filters that cannot be replaced would be detrimental to the expansion of the market.

-

The market's growth will be slowed by the increase in use of electric vehicles.

OPPORTUNITIES:

-

As the general population grows, so does the demand for private autos..

The demand for private autos is increasing in tandem with the general population's growth. This development has a direct impact on the Automotive Filters Market, as rising vehicle ownership leads to increased filter demand. These fundamental components are critical in preserving engine efficiency and air purity, making the Automotive Filters Market a critical participant in guaranteeing optimal vehicle performance and environmental requirements in the face of expanding population automotive needs.

-

In the coming years, advances in filter media or technology will benefit vehicle filter makers.

-

New entrants will have an advantage in the automobile filter market due to raising public awareness and demand.

CHALLENGES:

-

Market expansion may be hampered by a lack of organization in the aftermarket..

The growth potential of the Automotive Filters Market may be hampered by insufficient organization within the Aftermarket segment. A lack of optimized systems and coordination may limit efficient filter distribution and service. Addressing these organizational problems is critical for the market's long-term growth, as well as assuring the seamless availability and maintenance of filters for vehicle owners.

-

Manufacturers have a significant hurdle in the form of product counterfeiting.

IMPACT OF ECONOMIC SLOWDOWN:

Singapore's distillate stocks are reaching multi-year lows, with -2.5 million barrels (-24% or -1.27 standard deviations) less than the ten-year average. After two years of severe depletion, China's restart of diesel exports and a slowdown in the global business cycle relieved some of the shortage in diesel supplies and stabilized stocks in the second half of 2022. However, the impending US and EU penalties on Russian exports, a boost to China's industry following repeated lockdowns in 2021, and the return of China's passenger aviation all threaten to tighten supplies again in 2023.Without a recession or at least a large mid-cycle downturn to restrict demand, distillate inventories are unlikely to be refilled.

IMPACT OF RUSSIA OR UKRAINE WAR:

As pandemic restrictions loosened around the world, oil prices and demand began to recover WTI prices rose from a low of less than $17 per barrel in the spring of 2020 to more than $80 per barrel by October 2021. When Russia invaded Ukraine in February 2022, oil prices skyrocketed, with WTI reaching more than $115 per barrel by June. The market expressed concerns about the stability of oil supply. As OPEC+'s second-largest supplier, Iran engaged in a violent fight with its neighbor, inflaming ties with the US and Europe. This factors are likely going to affect the market growth during the upcoming recession.

Market, By Filter Type:

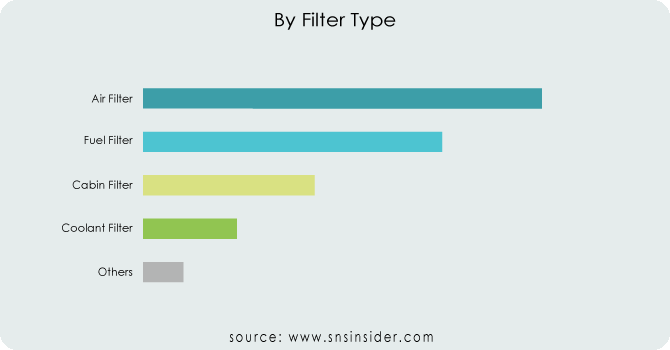

An analysis of filter sales by type uncovers intriguing customer preferences. Air filters, likely due to their regular replacement cycle, consistently dominate the market, comprising around 45% of total sales. Following closely are fuel filters, crucial for engine health, accounting for approximately 30% of sales. Cabin filters, vital for passenger comfort, maintain a steady share of around 15%. Coolant filters, though critical, represent a smaller portion at 5%, given their less frequent replacement needs. The remaining 5% encompasses various specialty filters, underscoring niche market demands. Understanding the constant demand for air filters suggests promoting bulk purchases, while raising awareness about the significance of coolant filters can stimulate sales, given their infrequent replacement frequency. This breakdown informs targeted marketing strategies to better serve customer needs.

Market, By Media Type:

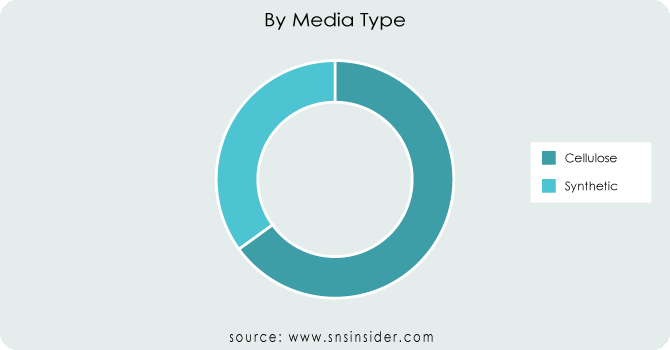

There is anticipated to be a notable contrast in their respective shares. Cellulose filters, primarily crafted from paper, are projected to capture approximately 65% of the market. This predominance can be ascribed to their cost-effectiveness and eco-friendly nature, rendering them suitable for one-time use scenarios. Conversely, synthetic filters are expected to constitute the remaining 35%. These could encompass advanced variants manufactured from materials like nylon or polyester, prized for their durability and heightened filtration efficacy, particularly in demanding contexts. An examination based on filter categories provides valuable perspectives on consumer preferences and shifts within the industry landscape.

Market, By Vehicle Type:

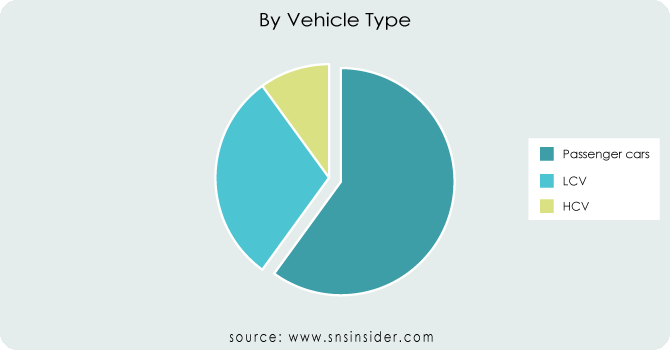

Breaking down our dataset by vehicle type reveals distinct customer profiles. Passenger cars, likely the most prevalent segment (60-70% according to industry reports), typically exhibit frequent short-distance trips and emphasize fuel efficiency. Light Commercial Vehicles (LCVs), potentially constituting 20-25% of the dataset, may indicate deliveries or small business operations, balancing payload capacity with fuel economy. Heavy Commercial Vehicles (HCVs), estimated at 5-10% of the dataset, likely engage in long-distance haulage, prioritizing durability and engine power. Delving deeper into these segments enables us to customize marketing strategies, optimize maintenance schedules, and design tailored service packages for each vehicle category.

Get Customized Report as per Your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By Filter Type:

-

Air Filter

-

Fuel Filter

-

Cabin Filter

-

Coolant Filter

-

Others

By Media Type:

-

Cellulose

-

Synthetic

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

REGIONAL ANALYSIS:

The global automotive filters market presents a dynamic landscape shaped by regional dynamics. APAC emerges as the dominant force, poised to seize over half of the market share by 2031. This ascent is propelled by a burgeoning middle class enjoying increased disposable income and a surge in vehicle production. The region is forecasted to experience a remarkable Compound Annual Growth Rate (CAGR) exceeding 4.6%, driven by rapid urbanization and a rising demand for personal transportation.

NA maintains a robust position, attributed in part to stringent government regulations targeting vehicle emissions. Here, the market is expected to demonstrate a solid CAGR of approximately 3.5%, fueled by a growing preference for high-performance filters and an emphasis on maintaining older vehicles. In Europe, a mature market characterized by a high replacement rate for automotive filters, growth is projected to be steady, with a CAGR of around 2.98%. Factors such as stringent environmental regulations and the flourishing electric vehicle segment, necessitating specialized filtration systems, contribute to this trajectory. While APAC leads in market share, each region—APAC, North America, and Europe—presents promising opportunities for automotive filter manufacturers, driven by distinct growth catalysts and market dynamics.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

Rest of Latin America

KEY PLAYERS:

Robert Bosch GmbH (Germany), Mahle GmbH (Germany), Mann+Hummel, Clarcor Inc. (Germany), ALCO filters (Germany), Lydall Inc. (Japan), Toyota Boshoku Corporation (Japan), ACDelco Inc. (U.S.), Cummins Inc. (U.S.), Denso Corporation (Japan), Hollingsworth & Vose Co. Inc. (U.S.), Donaldson Company Inc (U.S.) are some of the affluent competitors with significant market share in the Automotive Filters Market.

RECENT DEVELOPMENTS:

-

Mann+Hummel has been actively broadening its product range through acquisitions and partnerships. Notably, in 2019, they acquired Tri-Dim Filter Corporation's air filtration business, strengthening their position in HVAC and IAQ products. Additionally, the company has been investing in research and development, introducing advanced cabin air filters aimed at enhancing air quality and combating allergens and harmful particles.

-

Bosch has been at the forefront of developing next-generation filtration technologies tailored to the automotive sector. Their efforts are concentrated on improving filter efficiency and performance while simultaneously reducing emissions. Furthermore, Bosch is pioneering smart filters embedded with sensors and IoT capabilities, enabling real-time monitoring of filter status and facilitating predictive maintenance for vehicles.

-

Donaldson Company, Inc. has been prioritizing product innovation to meet the growing demand for cleaner air in automotive applications. They have introduced cutting-edge filtration solutions aimed at optimizing engine performance, fuel efficiency, and emission control. Through strategic partnerships and acquisitions, such as the acquisition of an engine air filtration business in India in 2018, Donaldson has been expanding its global presence, particularly in the Asia-Pacific region.

Clarcor Inc. (Germany)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.28 Billion |

| Market Size by 2031 | US$ 28.15 Billion |

| CAGR | CAGR of 3.78% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Filter Type (Air Filter, Fuel Filter, Cabin Filter, Coolant Filter, Others) • By Media Type (Cellulose, Synthetic) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Mahle GmbH (Germany), Mann+Hummel, Clarcor Inc. (Germany), ALCO filters (Germany), Lydall Inc. (Japan), Toyota Boshoku Corporation (Japan), ACDelco Inc. (U.S.), Cummins Inc. (U.S.), Denso Corporation (Japan), Hollingsworth & Vose Co. Inc. (U.S.), Donaldson Company Inc (U.S.) |

| Key Drivers | • The market's expansion will be driven by an increase in vehicle manufacturing. • An increase in the sale and purchasing of automotive filters. • As a result of technological advancements in filter media types |

| Restraints | • Filters that cannot be replaced would be detrimental to the expansion of the market. • The market's growth will be slowed by the increasing use of electric vehicles. • The market's expansion will be slowed if original products cannot be found. |