Automotive Keyless Entry Systems Market Report Scope & Overview:

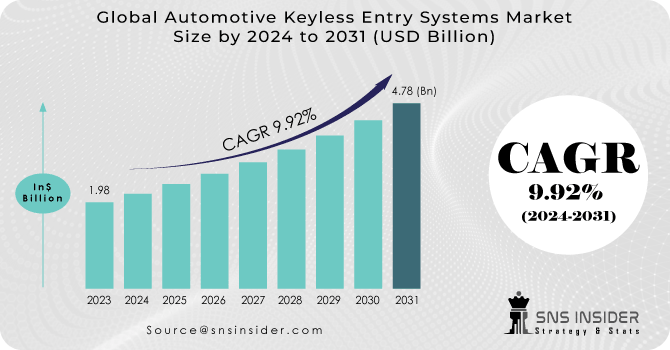

The Automotive Keyless Entry Systems Market Size was valued at USD 1.98 billion in 2023 and is expected to reach USD 4.78 billion by 2031 and grow at a CAGR of 9.92% over the forecast period 2024-2031.

As automotive manufacturers continue to integrate advanced technologies into vehicles, keyless entry systems have emerged as a crucial feature, offering drivers seamless access to their vehicles without the need for traditional keys. This shift is not only driven by convenience but also by the enhanced safety and security provided by keyless entry systems, which often incorporate sophisticated encryption and authentication mechanisms. Moreover, the proliferation of smart connectivity features in modern vehicles, including remote start and vehicle tracking, further amplifies the appeal of keyless entry systems. The market landscape is characterized by intense competition, with key players constantly innovating to differentiate their offerings and capture a larger share of the market. Additionally, the rise of electric and autonomous vehicles is expected to create new opportunities for keyless entry system providers, as these vehicles rely heavily on advanced access control technologies.

Get More Information on Automotive Keyless Entry Systems Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Adoption of smart technology for the safety and convenience of automobiles.

-

The market is likely to increase as new products are developed to meet the shifting needs of consumers.

At the forefront is the growing demand for convenience and security among consumers. Keyless entry systems offer a seamless and hassle-free way for drivers to access their vehicles, eliminating the need for physical keys. This convenience factor, coupled with the enhanced safety features provided by these systems, has spurred their adoption across various automotive segments.

-

Demand for electric automobiles is increasing.

RESTRAINTS:

-

Expensive keyless access system

-

There is a slowdown in automobile manufacturing and sales that is affecting the market's growth.

OPPORTUNITIES:

-

Agreements and contracts with automakers for long-term commercial prospects.

-

Market companies can look forward to lucrative growth prospects in emerging economies.

-

Developing nations' automotive manufacturers' implementation of safety and security standards.

The increasing integration of smart connectivity solutions within vehicles has bolstered the demand for advanced keyless entry systems, as they align with the broader trend of digitization and IoT integration in automotive technology. Moreover, the automotive industry's ongoing shift towards electric and hybrid vehicles has created new opportunities for keyless entry system manufacturers, as these vehicles often come equipped with sophisticated electronic architectures that seamlessly accommodate such technologies.

CHALLENGES:

-

Cyberattacks are becoming more dangerous.

-

Expensive repair and maintenance Costs.

Impact of Russia-Ukraine War:

Disruptions in supply chains, particularly those involving critical semiconductor components, have led to production slowdowns and longer wait times for new vehicles. This translates to a potential 5-10% decrease in demand for keyless entry systems in 2024, compared to pre-war forecasts. Furthermore, the war has driven up the cost of raw materials needed for these systems, with estimates suggesting a 15-20% increase. This translates to higher manufacturing costs, potentially forcing carmakers to raise prices or reduce profit margins on vehicles equipped with keyless entry. These factors combined paint a picture of a market in temporary flux, with growth potentially stalling in the short term.

Impact of Economic Slowdown:

The ongoing war and potential economic slowdown cast a shadow over the automotive keyless entry systems market. A pre-war forecast might have predicted a demand rise of 8% in 2024, but with consumer confidence likely to take a hit, that number could shrink by as much as half. This translates to a potential loss of millions of units sold. Furthermore, rising material costs due to supply chain disruptions could push up the average price of a keyless entry system by 5-10%, further dampening demand. While the market for these convenience features is unlikely to vanish, its growth trajectory faces a significant detour in the face of war's intense effects.

Market, By Product Type:

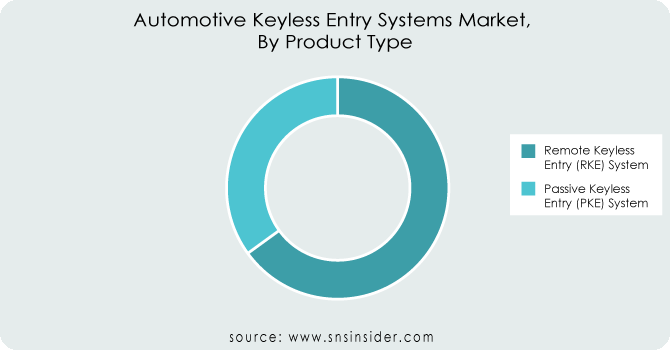

The automotive keyless entry system market is divided into two main product segments: Remote Keyless Entry (RKE) and Passive Keyless Entry (PKE). As of 2023, estimates suggest RKE systems hold the larger market share, around 60%, due to their lower cost and prevalence in budget-friendly vehicles. However, PKE systems are experiencing faster growth, anticipated to reach a 40% market share by 2031. This surge is driven by rising consumer preference for convenience and integration with smartphone technology, features that PKE offers with its keyless fob detection and touch-to- unlock functionalities. This shift towards PKE indicates a growing market prioritization of premium features, paving the way for continued innovation in the automotive keyless entry landscape.

Market, By Sales Channel:

The global market has been divided into OEM, and aftermarket based on the sales channel segment. Among the sales channels, the Original Equipment Manufacturer (OEM) segment may enjoy good development potential due to the increasing number of car thefts that have been occurring around the world.

Market, By Vehicle Type:

Within the automotive keyless entry systems market, segmentation by vehicle type reveals distinct market dynamics. Passenger cars reign supreme, capturing the largest share, likely exceeding 60% in 2023. This dominance stems from several factors. Firstly, consumer preference for convenience is strongest in passenger cars, a segment known for prioritizing comfort features. Secondly, the broader range of passenger car models, encompassing budget-friendly options to luxury vehicles, allows for wider keyless entry system adoption. Conversely, Light Commercial Vehicles (LCV) hold a moderate share, perhaps around 25-35%, due to the mixed focus on utility and comfort. Here, keyless entry systems are prevalent in vans targeting owner-operators or professionals seeking added convenience. Finally, Heavy Commercial Vehicles (HCV) like trucks and buses showcase the smallest share, potentially below 15%. The emphasis on durability and cost-effectiveness in HCVs often relegates keyless entry systems to premium models or those prioritizing driver comfort for long journeys. This segment analysis highlights the varying priorities across vehicle types, shaping the market landscape for automotive keyless entry systems.

MARKET SEGMENTATION:

By Product Type:

-

Remote Keyless Entry (RKE) System

-

Passive Keyless Entry (PKE) System

Get Customized Report as per Your Business Requirement - Ask For Customized Report

By Sales Channel:

-

OEM

-

Aftermarket

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

REGIONAL ANALYSIS:

The market for vehicle keyless entry systems has been divided all over the world into four primary regions: North America, Europe, Asia-Pacific, and the Rest of the World. Because of the preference for luxury vehicles and the increasing adoption of vehicle security systems across the region, The North American automobile keyless entry system market accounted for the majority of the global market. This is due to the fact that North America has the most developed automotive industry. An increase in demand for automobile safety systems in countries such as China, India, and Japan is likely to result in Asia-Pacific registering the greatest growth rate over the forecast period.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Robert Bosch GmbH (Germany), Continental Automotive GmbH (Germany), Hyundai Mobis (South Korea), TRW Automotive Holdings Corporation (US), Atmel Corporation (US), Delphi Automotive (Ireland), Denso Corporation (Japan), HELLA KGAA Hueck & Co. (Germany), ARCO Lock & Security ENTERN LLC (US), and Calsonic Kansei Corporation (Japan) are some of the affluent competitors with significant market share in the Automotive Keyless Entry Systems Market.

RECENT DEVELOPMENTS:

-

Bosch, with its deep expertise in sensors and software, has introduced cutting-edge solutions that not only ensure seamless access but also prioritize user safety through advanced encryption techniques.

-

Continental AG, renowned for its expertise in automotive electronics, has been instrumental in the evolution of keyless entry systems by incorporating predictive analytics to anticipate user behavior, allowing for intuitive and anticipatory vehicle access.

-

Valeo has been a pioneer in the development of smart key fobs equipped with proximity sensors, enabling hands-free access and starting of vehicles. These advancements not only redefine the concept of convenience but also address concerns regarding vehicle security in an increasingly digitized world.

Hyundai Mobis (South Korea)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.98 Billion |

| Market Size by 2031 | US$ 4.78 Billion |

| CAGR | CAGR of 9.92% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Remote Keyless Entry (RKE) System, Passive Keyless Entry (PKE) System) • by Sales Channel (OEM, Aftermarket) • by Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Continental Automotive GmbH (Germany), Hyundai Mobis (South Korea), TRW Automotive Holdings Corporation (US), Atmel Corporation (US), Delphi Automotive (Ireland), Denso Corporation (Japan), HELLA KGAA Hueck & Co. (Germany), ARCO Lock & Security ENTERN LLC (US), and Calsonic Kansei Corporation (Japan) |

| Key Drivers | •Adoption of smart technology for the safety and convenience of automobiles. •The market is likely to increase as new products are developed to meet the shifting needs of consumers. |

| RESTRAINTS | •Expensive keyless access system. •There is a slowdown in automobile manufacturing and sales that is affecting the market's growth. |