Automatic High Beam Control Market Report Scope & Overview:

Get More Information on Automatic High Beam Control Market - Request Sample Report

The Automatic High Beam Control Market Size was valued at USD 10.68 billion in 2023 and is expected to reach USD 18.82 billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

The expanding advancements in automotive technology continue to propel the Automatic High Beam Control (AHBC) market into a trajectory of strong growth, anticipating an unprecedented increase in future demand. As vehicular safety and driver assistance systems become increasingly important, AHBC stands out as a imperative component in enhancing nighttime driving experiences. The rising demand for vehicles equipped with smart sensing and adaptive lighting solutions, coupled with a growing awareness of road safety, is expected to be a driving force behind the sustained expansion of the AHBC market. Also, the integration of artificial intelligence and machine learning algorithms in automotive systems is poised to elevate the precision and efficiency of automatic high beam control, reinforcing its appeal among discerning consumers.

Manufacturers, cognizant of the evolving consumer preferences and stringent safety norms, are likely to invest significantly in research and development to offer cutting-edge AHBC solutions, ensuring their market relevance in the dynamically evolving automotive landscape.

MARKET DYNAMICS:

KEY DRIVERS:

-

Automobiles with automated headlights are becoming increasingly popular

-

Road accidents are increasing in number

-

Boosting the sales of high-end automobiles

-

Requirements for driving and lighting a vehicle that is very strict

-

The need for auto high-beam automatic controllers is increasing

As vehicular technology advances, drivers seek not only enhanced safety but also an elevated driving experience. Auto high-beam controllers address this need by intelligently adapting to varying road conditions and oncoming traffic, optimizing visibility without causing discomfort to fellow drivers. This surge in demand is further fueled by the growing emphasis on road safety and the integration of sophisticated sensors and artificial intelligence in modern vehicles. The Auto High Beam Control Market is poised for expansion as these controllers become indispensable components, aligning seamlessly with the evolving preferences and expectations of discerning motorists.

RESTRAINTS:

-

Operators are lacking in expertise

-

LED lights cost a lot of money

-

Obstacles impeding market expansion are the modern lighting system's low compactness

OPPORTUNITIES:

-

Developing countries' economies are opening up new growth prospects

-

Improvements in automobile HBS systems technology

-

Using artificial intelligence & image processing in a versatile camera also presents growth potential

Recent developments in HBC technology have focused on enhancing precision and adaptability, ensuring optimal visibility without causing discomfort to oncoming drivers. Cutting-edge sensors and cameras integrated into these systems enable real-time analysis of the surrounding environment, allowing for seamless transitions between high and low beams based on traffic conditions. Moreover, machine learning algorithms have been intricately employed to refine the decision-making process, learning from diverse driving scenarios to deliver unparalleled performance.

CHALLENGES:

-

Concerns relating to the safety of passengers and drivers

-

There is still a lot of unpredictability in this sector

-

Affects the automotive supply chain, production, and R&D operations

IMPACT OF RUSSIA-UKRAINE WAR:

The Russia-Ukraine war has had a discernible impact on the Automatic High Beam Control (AHBC) market, introducing a complex set of challenges and opportunities for industry stakeholders. The geopolitical tensions have led to disruptions in the global supply chain, affecting the procurement of essential components required for AHBC systems. Escalating uncertainties and economic sanctions have contributed to increased production costs and hindered the smooth flow of goods and services. Additionally, fluctuating exchange rates and geopolitical instability have created an atmosphere of uncertainty, influencing consumer purchasing behavior and potentially slowing down the adoption of advanced automotive technologies, such as AHBC. As the conflict unfolds, industry players are compelled to navigate through these geopolitical dynamics, adapt to market fluctuations, and devise strategic responses to mitigate potential setbacks while remaining vigilant to emerging market trends and regulatory changes.

IMPACT OF ECONOMIC SLOWDOWN:

The economic slowdown tends to influence purchasing priorities, with consumers potentially deferring discretionary spending on premium automotive features. However, amidst this challenge lies an opportunity for market players to recalibrate strategies, emphasizing the cost-effectiveness and long-term value proposition of Automatic High Beam Control systems. Adapting to evolving consumer sentiments and aligning marketing strategies with economic realities will be crucial for stakeholders navigating the market during periods of economic deceleration.

Market, By Propulsion:

Based on the propulsion segment, the global market has been divided into the internal combustion engine (ICE), and electric vehicle (EV) propulsion. Plug-in electric vehicles, battery electric vehicles, and hybrid electric vehicles are the three primary sub-categories that make up the electric vehicle propulsion system. Manufacturers are increasingly focusing on the integration of advanced propulsion mechanisms, such as electric and hybrid powertrains, to synergize with AHBC functionalities. This intersection of propulsion and AHBC not only enhances the overall driving experience but also contributes significantly to the broader automotive industry's pursuit of sustainability and technological advancement. As the market continues to evolve, stakeholders are poised to witness a compelling interplay between propulsion technologies and Automatic High Beam Control, ultimately shaping the future of automotive illumination and energy efficiency.

Market, By Vehicle Type:

The global market has been divided into Passenger cars and commercial vehicles based on the vehicle type segment. The market is dominated by the passenger automobile sector, which accounts for a large share of total sales. The growing market for luxury and premium automobiles has been beneficial. This is because many luxury vehicles already come standard with high beam controller options. The passenger vehicles segment emerges as a pivotal domain, embodying technological advancements that redefine nighttime driving experiences. Witnessing a ideal shift in automotive safety and illumination systems, this segment demonstrates a growing demand for innovative AHBC solutions. The integration of sophisticated sensors, adaptive algorithms, and precision optics within passenger vehicles exemplifies a commitment to enhancing both driver safety and overall road visibility.

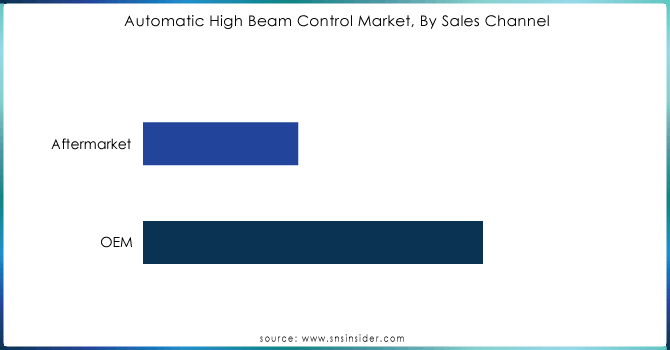

Market, By Sales Channel:

Get Customized Report as per your Business Requirement - Request For Customized Report

The global market has been divided into OEM, and aftermarket based on the sales channel segment. When it comes to providing passenger vehicles with ventilated seating systems of higher quality, original equipment manufacturers (OEMs) are also providing stiff competition. Automobile manufacturers are making substantial investments in the development of advanced technologies in order to produce the most practical and pleasant seating arrangements for their products. As automotive enthusiasts increasingly seek to enhance the safety and convenience of their vehicles, the aftermarket AHBC segment has witnessed a surge in interest. This demand surge can be attributed to a growing awareness among vehicle owners about the tangible benefits of AHBC systems, such as improved visibility and reduced glare for both drivers and oncoming traffic.

MARKET SEGMENTATION:

By Propulsion:

-

Internal Combustion Engine (ICE)

-

Electric Vehicle (EV) Propulsion

By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

By Sales Channel:

-

OEM

-

Aftermarket

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

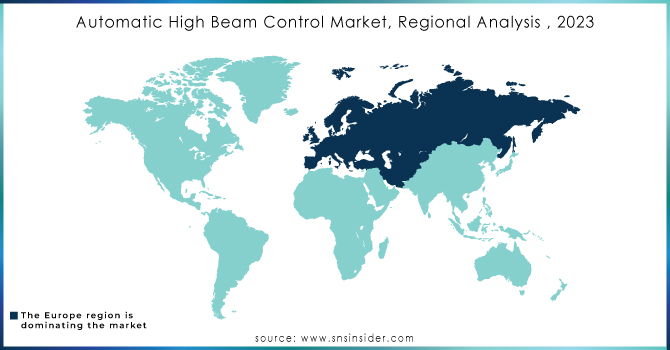

REGIONAL ANALYSIS:

The Automatic High Beam Control (AHBC) market is expected to witness a surge in growth, with regional variations creating a dynamic landscape. Developed economies like North America and Europe, with their established automotive industries and focus on road safety, currently hold the largest market share, driven by significant investments estimated at around USD 2 billion annually in advanced driver-assistance systems (ADAS) that often include AHBC. However, the Asia-Pacific (APAC) region is poised for explosive growth due to its rapidly increasing vehicle production, rising disposable incomes, and growing government regulations promoting car safety features. Here, China is expected to be a major market leader, with its massive domestic car market and supportive government policies attracting substantial investments in AHBC technology development and integration. This regional shift highlights the potential for AHBC to become a standard feature, not just a premium offering, across the global automotive industry.

KEY PLAYERS:

Robert Bosch GmbH (Germany), Hella KGaA Hueck & Co. (Germany), OSRAM Licht AG (Germany), Gentex Corporation, Valeo (France), Continental AG (Germany), Magneti Marelli S.p.A. (Italy), Koninklijke Philips N.V. (Netherlands), Hyundai Mobis (South Korea), Denso Corporation (Japan), Renesas Electronics Corporation (Japan), Aptiv Plc (Netherlands), Lear Corporation (US), North American Lighting (US), NXP Semiconductors N.V. (Netherlands), Federal-Mogul (US), Gentex Corporation (US), Stanley Electric Co., Ltd. (Japan), Flex-N-Gate Corporation (US), and NXP Semiconductors N.V. (Netherlands) are some of the affluent competitors with significant market share in the Automatic High Beam Control Market.

RECENT DEVELOPMENTS:

-

Bosch, has introduced an enhanced AHBC system that leverages cutting-edge sensors for real-time analysis of road conditions, ensuring seamless transitions between high and low beams.

-

Valeo, has focused on refining adaptive driving beam (ADB) technology, enhancing visibility without causing glare to oncoming vehicles.

-

Hella, renowned for its automotive lighting solutions, has pioneered an intelligent AHBC system that incorporates artificial intelligence algorithms to optimize beam control based on diverse driving scenarios.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.68 Billion |

| Market Size by 2032 | US$ 18.82 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Operating System (QNX, LINUX, Microsoft, Others) • by Technology (Multimedia Player, Navigation Systems) • by End-use (OEM, Aftermarkets) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alpine Electronics, Inc. (Japan), Pioneer Electronics (US), Continental AG (Germany), Harman International (US), Panasonic Corporation (Japan), Denso Corporation (Japan), Garmin Ltd (Switzerland), Delphi Automotive PLC (UK), KENWOOD Corporation (Japan), VOXX Electronics Corp. (US), and Visteon Corporation (US) |

| Key Drivers | •Automobiles with automated headlights are becoming increasingly popular. •Road accidents are increasing in number |

| RESTRAINTS | •Automobiles with automated headlights are becoming increasingly popular. •Road accidents are increasing in number |