Used Car Market Size & Overview:

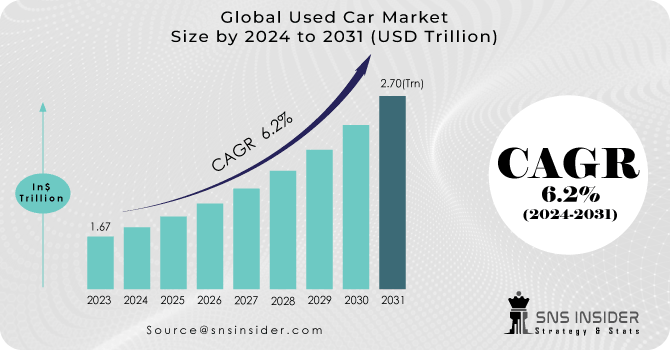

The Used Car Market Size was valued at USD 1.67 trillion in 2023 and is expected to reach USD 2.70 trillion by 2031 and grow at a CAGR of 6.2% over the forecast period 2024-2031. A used car is a secondhand or previously owned vehicle that has been reconditioned and resold. Identifying problems in an old car, fixing and restoring it to functional condition, and marketing it for sale are all steps in the process of selling an old vehicle. Used automobiles are sold through a variety of venues, including franchise and independent car dealers, car rental companies, auctions, and leasing offices. Hatchbacks, sedans, and sports utility vehicles are some of the most popular used cars. They are typically sold through disorganized or organized channels, such as walk-in used-car stores, independent automobile dealerships, and internet platforms. Dealing in used automobiles helps to reduce the vehicle's depreciation, gives a complete guarantee and warranty, and makes the vehicle more affordable and cost-effective for the customer.

Get More Information on Used Car Market - Request Sample Report

Furthermore, the importance of internet sales has become a major industry growth component. Consumers have benefited greatly from one-click access provided by auto marketplace websites. A combination of these factors resulted in a large increase in demand for used cars. Automobile manufacturers and dealers have mostly focused on their new vehicle business, with used cars, which are frequently regarded as a byproduct, being overlooked.

MARKET DYNAMICS:

KEY DRIVERS:

-

High cost of new automobiles.

-

Concerns about accessibility.

-

The increased demand for off-lease vehicles.

-

Subscription services provided by franchises and vehicle dealers have been found to help the market flourish.

RESTRAINTS:

-

Used automobile sales that aren't well-organized.

-

The global market's expansion is hampered by a lack of regularization.

-

The used vehicle market is completely reliant on others which generates a great deal of unpredictability.

OPPORTUNITIES:

-

The introduction of e-commerce and internet technology.

-

In emerging countries, organized/semi-organized sales have been steadily increasing.

-

Electric vehicle sales are on the rise all around the world.

-

The growing demand for car-sharing services is likely to provide profitable opportunities for the used automobile sector.

CHALLENGES:

-

The passenger automobile segment's price increase is a hint of affordability issues in the new market.

-

Used cars have a high cost of servicing and maintenance.

-

The threat of reliability of used cars.

IMPACT OF COVID-19:

Due to the global COVID-19 pandemic, countries had to temporarily reduce demand for both old and new cars. Furthermore, the global economic crisis has had an effect on customers, resulting in a decrease in automobile sales. However, because of the risk of infection and the desire to preserve social distance, individuals all over the world have begun to avoid public transportation. Furthermore, the vast majority of people around the world want to purchase automobiles following the lockdown. Despite the fact that some automotive industries are struggling as a result of the pandemic, the used car market has seen a significant increase in sales in several nations due to social distancing, which is predicted to benefit the used car industry throughout the COVID-19 outbreak.

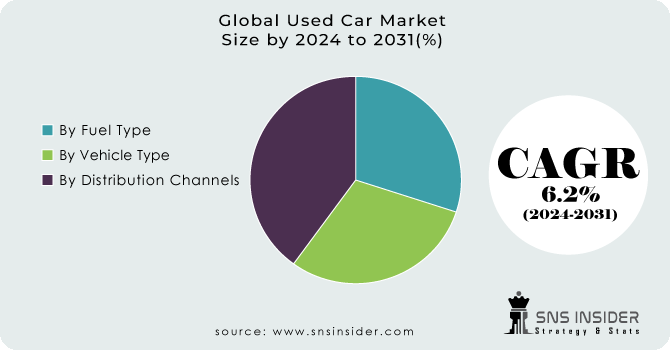

Market, By Fuel Type:

The global market is divided into petrol, diesel, and others based on the fuel type segment. In 2023, the petrol segment had the biggest volume share, accounting for nearly 40.0 percent. This is due to the government's prohibition on the acquisition of secondhand diesel automobiles, which has resulted in a decrease in the use of diesel vehicles. Over the forecast period, the others segment is expected to increase significantly.

Market, By Vehicle Type:

According to the vehicle type segment, the global market is divided into the hatchback, sedan, and SUV. They are typically sold through disorganized or organized channels, such as walk-in used-car stores, independent automobile dealerships, and internet platforms. In the projection period, the SUV subsegment is expected to rise due to the growing adoption of SUVs and the rising disposable income of the people.

Market, by Distribution Channels:

Based on the distribution channels segment, the global market has been divided into the franchised dealers, independent dealers & Others. In the global market, the independent dealer sub-segment is expected to have a dominant position. Independent dealers have a significant supply of used cars and a diverse selection of used cars in terms of age.

MARKET SEGMENTATION:

By Fuel Type:

-

Petrol

-

Diesel

-

Others

By Vehicle Type:

-

Hatchback

-

Sedan

-

SUV

By Distribution Channels:

-

Franchised dealer

-

Independent dealer

-

Others

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

The Asia Pacific had the greatest share of about 35.0 percent in 2023, owing primarily to the rapid growth of demand for used vehicles in China. Over the forecast period, Asia Pacific is expected to grow at the fastest rate. This is due to an increase in used car sales in China, India, and other Asian countries. Because of the recent decline in growth, the North American region retained a significant market share in 2023 and is likely to rise steadily in the years ahead. Unorganized companies have historically dominated the secondhand car industry in nations like Mexico, India, China, and Brazil.

Unlike the unorganized companies in emerging markets, organized players offer free servicing and towing at their dealerships, as well as expanding their used vehicle industry. These services assist dealerships to attract clients and develop confidence between buyers and sellers. Furthermore, due to the necessity for pollution control systems and the implementation of severe emission standards, there is a growth in demand for electric vehicles.

REGIONAL COVERAGE:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

Alibaba.com; Cox Automotive; eBay Inc.; Scout24 AG; Asbury Automotive Group, Inc., AutoNation, Inc., Lithia Motors, Inc., Big boy Toyz Ltd, LLC, Cars24 services private limited, Group1 Automotive Inc., Hendrick automotive group, CarMax Business Services, Mahindra First Choice Wheels Ltd., and TrueCar, Inc. are some of the affluent competitors with significant market share in the Used Car Market.

Cox Automotive-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.67 Trillion |

| Market Size by 2031 | US$ 2.70Trillion |

| CAGR | CAGR of 6.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Fuel Type (Petrol, Diesel, Others) • by Vehicle Type (Hatchback, Sedan, SUV) • by Distribution Channels (Franchised dealer, independent dealer, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Alibaba.com; Cox Automotive; eBay Inc.; Scout24 AG; Asbury Automotive Group, Inc., AutoNation, Inc., Lithia Motors, Inc., Big boy Toyz Ltd, LLC, Cars24 services private limited, Group1 Automotive Inc., Hendrick automotive group, CarMax Business Services, Mahindra First Choice Wheels Ltd., and TrueCar, Inc |

| Key Drivers | •High cost of new automobiles. •Concerns about accessibility. •The increased demand for off-lease vehicles. |

| RESTRAINTS | •Used automobile sales that aren't well-organized. •The global market's expansion is hampered by a lack of regularization. |