Recreational Boats Market Report Scope & Overview:

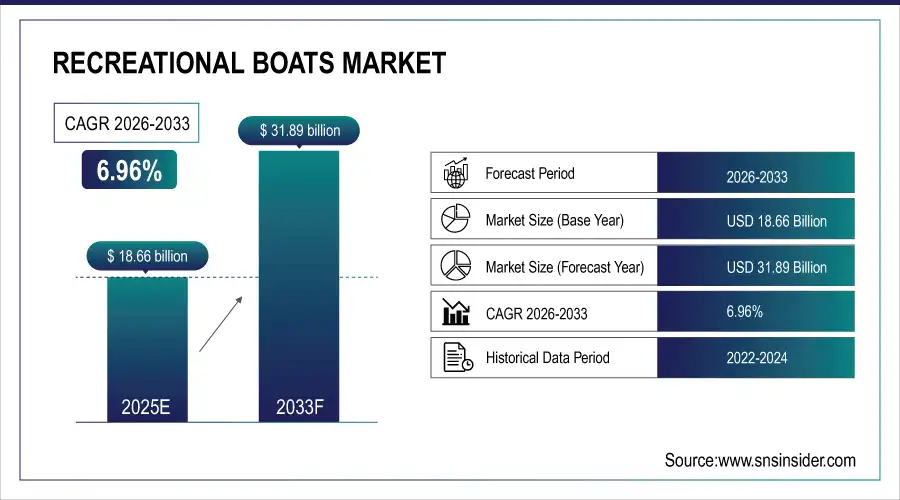

The Recreational Boats Market size is valued at USD 18.66 Billion in 2025E and is projected to reach USD 31.89 Billion by 2033, growing at a CAGR of 6.96% during the forecast period 2026–2033.

The Recreational Boats Market analysis report provides a detailed overview of industry developments, highlighting increasing leisure activities, tourism, and water sports. Rising disposable incomes, recreational spending, and demand for luxury and eco-friendly boats are expected to drive market growth during the forecast period.

Recreational Boat sales reached 320,000 units in 2025, driven by rising leisure activities and growing demand for luxury and eco-friendly boats.

Market Size and Forecast:

-

Market Size in 2025: USD 18.66 Billion

-

Market Size by 2033: USD 31.89 Billion

-

CAGR: 6.96% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Recreational Boats Market - Request Free Sample Report

Recreational Boats Market Trends:

-

Growing leisure and tourism activities are driving demand for recreational boats, particularly motorboats, yachts, and sailboats.

-

Increasing disposable incomes and rising interest in water sports are expanding the market across urban and coastal regions.

-

Demand for eco-friendly and electric/hybrid propulsion boats is gaining traction among environmentally conscious consumers.

-

Online sales platforms and specialty dealerships are improving accessibility and boosting market penetration.

-

Shorter, easily manageable boats and modular designs are becoming popular for first-time buyers and casual users.

-

Customization, luxury features, and smart onboard technology are trending, reflecting lifestyle and experiential preferences of affluent consumers.

U.S. Recreational Boats Market Insights:

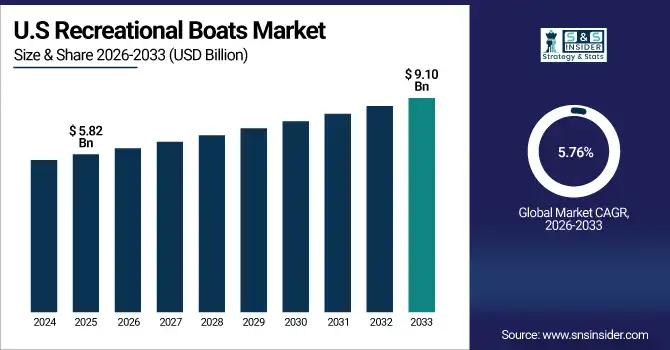

The U.S. Recreational Boats Market is projected to grow from USD 5.82 Billion in 2025E to USD 9.10 Billion by 2033, at a CAGR of 5.76%. Market growth is driven by rising leisure spending, tourism activities, demand for motorboats and yachts, and increased interest in premium and eco-friendly recreational boating experiences.

Recreational Boats Market Growth Drivers:

-

Rising leisure spending and tourism activities driving demand for recreational and luxury boats.

Rising leisure spending and tourism activities are key drivers of Recreational Boats Market growth. With increasing disposable incomes and a focus on lifestyle experiences, consumers are seeking boats for recreation, water sports, and luxury travel. Demand is growing for motorboats, yachts, and eco-friendly propulsion options, while short-term rentals and personalized boating experiences are becoming popular. This shift toward experiential recreation is influencing consumer preferences and expanding market penetration across regions.

Recreational Boat sales grew 7.5% in 2025, driven by rising leisure spending, tourism activities, and demand for luxury and eco-friendly boats.

Recreational Boats Market Restraints:

-

High purchase costs, maintenance expenses, and regulatory restrictions are limiting widespread adoption of recreational boats.

High purchase costs, ongoing maintenance expenses, and stringent regulatory requirements pose significant restraints for the Recreational Boats Market. Luxury and large-sized boats require substantial investment, making ownership unaffordable for many consumers. Compliance with safety, environmental, and licensing regulations adds complexity and limits market expansion. High operational costs, including fuel and docking fees, further discourage widespread adoption. These challenges restrict market penetration, slow first-time buyer uptake, and act as barriers for new entrants aiming to offer premium or eco-friendly boating solutions.

Recreational Boats Market Opportunities:

-

Growing interest in eco-friendly, electric, and hybrid boats creates strong opportunities for sustainable and innovative designs.

Growing interest in eco-friendly, electric, and hybrid boats presents a significant opportunity for the Recreational Boats Market. Consumers increasingly prefer sustainable propulsion options and low-emission vessels for leisure, water sports, and tourism activities. Manufacturers are innovating with electric motors, hybrid systems, and energy-efficient designs to meet this demand. This shift toward environmentally conscious boating helps differentiate brands, expand market appeal, and create new product categories, driving sustained growth in the recreational boating industry.

Eco-friendly and electric/hybrid boats accounted for 18% of new recreational boat launches in 2025, driven by rising consumer demand for sustainable and low-emission vessels.

Recreational Boats Market Segmentation Analysis:

-

By Type, Motorboats held the largest market share of 34.25% in 2025, while Yachts are expected to grow at the fastest CAGR of 12.78% during 2026–2033.

-

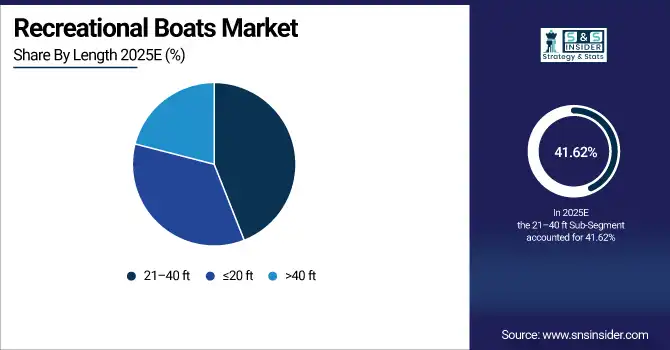

By Length, 21–40 ft accounted for the highest market share of 41.62% in 2025, while >40 ft is projected to expand at the fastest CAGR of 9.56% during the forecast period.

-

By Propulsion Type, Outboard dominated with a 38.44% share in 2025, while Electric/Hybrid is anticipated to record the fastest CAGR of 15.12% through 2026–2033.

-

By Application, Leisure & Recreation held the largest share of 46.31% in 2025, while Tourism & Rentals are expected to grow at the fastest CAGR of 11.87% during 2026–2033.

-

By Distribution Channel, Dealerships accounted for the largest share of 52.14% in 2025, while Online Sales are forecasted to register the fastest CAGR of 14.45% during 2026–2033.

By Type, Motorboats Dominate While Yachts Expand Rapidly:

Motorboats segment dominated the market due to their versatility, ease of use, and popularity among recreational boating enthusiasts for leisure, short trips, and water sports. Consumers favor motorboats for both family activities and adventure experiences. In 2025, motorboat sales surpassed 110,000 units.

Yachts are the fastest-growing segment, reflecting rising disposable incomes, luxury lifestyles, and interest in premium recreational experiences. High-net-worth individuals increasingly invest in yachts for leisure, tourism, and water-based events, with sales reaching approximately 39,000 units in 2025.

By Length, 21–40 ft Dominates While >40 ft Expands Rapidly:

21–40 ft segment dominated the market, offering the ideal balance between size, performance, and affordability for recreational users. Their suitability for family trips, water sports, and coastal cruising has made them the most popular choice. In 2025, sales of 21–40 ft boats exceeded 130,000 units.

>40 ft is the fastest-growing segment, driven by luxury consumers seeking large yachts and premium vessels for leisure and tourism. Rising charter services and exclusive coastal resorts further boost demand. Rising investments in long-range cruising and private charters pushed demand to 27,000 units in 2025.

By Propulsion Type, Outboard Dominates While Electric/Hybrid Expands Rapidly:

Outboard segment dominated the market due to their cost-effectiveness, easy maintenance, and compatibility with small to mid-sized recreational boats. These boats are widely used for fishing, leisure, and water sports, with sales reaching 120,000 units in 2025.

Electric/Hybrid are the fastest-growing segment, reflecting increasing consumer interest in eco-friendly and low-emission technologies. Rising environmental awareness and government incentives for sustainable boating solutions pushed demand to 22,000 units in 2025.

By Application, Leisure & Recreation Dominates While Tourism & Rentals Expands Rapidly:

Leisure and Recreation segment dominated the market, as private boat ownership for family trips, water sports, and personal entertainment continues to rise. This segment accounted for over 150,000 boats in 2025, highlighting the popularity of recreational boating among affluent and middle-class consumers.

Tourism and Rental are the fastest-growing segment, driven by rising adventure tourism, yacht charter services, and short-term recreational rentals. Growth in coastal tourism and water-based leisure experiences pushed fleet utilization in this segment to 35,000 boats in 2025.

By Distribution Channel, Dealerships Dominate While Online Sales Expands Rapidly:

Dealerships segment dominated the market due to established networks, after-sales services, and brand trust, making them the primary choice for purchasing recreational boats. In 2025, dealership sales surpassed 170,000 units, covering various boat types and sizes.

Online Sales are the fastest-growing segment, as digital platforms expand accessibility, convenience, and customization options for buyers. Rising e-commerce adoption and virtual showrooms helped online recreational boat sales reach 28,000 units in 2025, particularly for small to mid-sized boats.

Recreational Boats Market Regional Analysis:

North America Recreational Boats Market Insights:

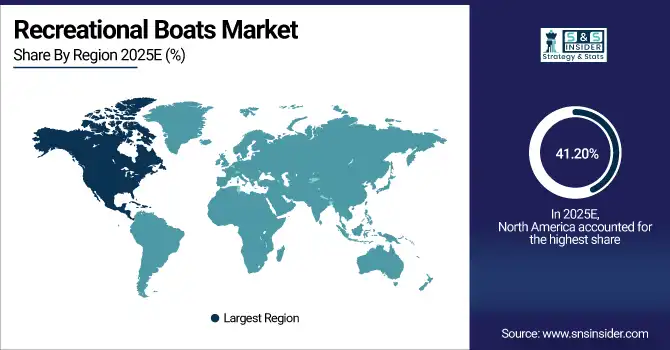

North America dominated the Recreational Boats Market with a 41.20% share in 2025. High disposable incomes, growing leisure and tourism activities, and rising interest in water sports have strengthened the region’s position. Consumers increasingly prefer motorboats, yachts, and mid-sized vessels for recreational use. Well-established dealership networks, advanced infrastructure, and strong after-sales services further support market dominance. These factors make North America a key hub for product launches, innovations, and premium boating experiences.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Recreational Boats Market Insights:

The U.S. Recreational Boats Market is driven by growing leisure and tourism activities, rising disposable incomes, and expanding water sports participation. Increasing demand for luxury yachts, motorboats, and eco-friendly propulsion systems, combined with strong dealership networks and innovations in boat design, fuels the country’s dominance in the North American boating market.

Asia-Pacific Recreational Boats Market Insights:

The Asia-Pacific Recreational Boats Market is the fastest-growing, projected at a CAGR of 9.56% during 2026–2033. Growth is driven by rising disposable incomes, expanding tourism, and increasing interest in leisure activities across China, Japan, Australia, and India. Growing demand for motorboats, yachts, and eco-friendly propulsion systems, along with investments in coastal infrastructure and marina facilities, positions Asia-Pacific as a key region for new product launches, boating innovations, and market expansion.

China Recreational Boats Market Insights:

China’s Recreational Boats Market is driven by rising disposable incomes, growing leisure and tourism activities, and increasing interest in water sports. Expansion of coastal infrastructure, marinas, and yacht clubs, along with rising demand for luxury and eco-friendly boats, positions China as one of the dominant growth contributors in the Asia-Pacific boating market.

Europe Recreational Boats Market Insights:

The Europe Recreational Boats Market is growing due to rising disposable incomes, increasing leisure and tourism activities, and growing participation in water sports. Germany, the UK, France, and Italy are leading contributors, supported by strong coastal infrastructure, yacht clubs, and advanced boating facilities. Demand for luxury motorboats, yachts, and eco-friendly vessels, combined with innovative designs and marine services, underpins Europe’s position as a key growth market in the recreational boating industry.

Germany Recreational Boats Market Insights:

Germany is a key Recreational Boats market driven by strong leisure culture, rising disposable incomes, and growing participation in water sports. Increasing demand for luxury motorboats and yachts, combined with advanced marina infrastructure, eco-friendly propulsion systems, and innovative boating services, further strengthens Germany’s position within the European recreational boating market.

Latin America Recreational Boats Market Insights:

The Latin America Recreational Boats Market is anticipated to grow with rising leisure spending, tourism activities, and water sports participation across Brazil, Mexico, and Argentina. Increasing demand for motorboats, yachts, and rental services, along with expanding coastal infrastructure and marine facilities, is expected to drive regional market growth.

Middle East and Africa Recreational Boats Market Insights:

The Middle East & Africa Recreational Boats Market is expanding with rising leisure spending, tourism growth, and increasing water sports participation. Growing demand for luxury yachts, motorboats, and eco-friendly vessels in Saudi Arabia, UAE, and South Africa, along with expanding marina infrastructure, is contributing to regional market development and adoption.

Recreational Boats Market Competitive Landscape:

Brunswick Corporation, headquartered in the U.S., is a leader in recreational marine products, specializing in boats, propulsion systems, parts, and accessories. Operating over 60 brands, including Mercury Marine, Sea Ray, Bayliner, and Boston Whaler, it serves a wide range of boating segments from leisure to luxury. Brunswick dominates the market through strong R&D, innovative propulsion technologies, digital boating solutions, and an extensive dealer network. Its focus on product quality, customer experience, and expansion has cemented its leadership in the recreational boating industry.

-

In January 2025, Brunswick Corporation unveiled its AI-powered Boating Intelligence systems at CES 2025, featuring autonomous docking, co-captain navigation assistance, and immersive simulators, enhancing boating safety, digital innovation, and smart recreational boating experiences across marine brands.

Groupe Beneteau, founded in 1884 in France, is a historic leader in sailboats, motorboats, multihulls, and catamarans. Operating nine key brands such as Beneteau, Jeanneau, Lagoon, and Prestige, Groupe Beneteau combines heritage craftsmanship with modern innovations. It dominates Europe and markets through its 16 production sites, wide model range, and extensive distribution network. By catering to diverse boating needs, investing in design, technology, and sustainability, the company maintains market leadership in both recreational and luxury boating segments.

-

In October 2025, Groupe Beneteau launched new models including the Gran Turismo 50 and Sea Loft 480 hybrid at the Paris Nautic Show and Cannes Yachting Festival, expanding its sustainable, high-performance sailboats and motorboats portfolio for leisure and luxury markets.

Azimut Benetti Group, based in Italy, is a premier manufacturer of luxury yachts and megayachts. With its flagship brands Azimut and Benetti, Azimut Benetti Group combines Italian craftsmanship, innovative design, and advanced marine technology to deliver high-end vessels. Its dominance stems from continuous R&D, sustainable practices, and a network spanning over 80 countries. By offering customized luxury boating experiences and maintaining strong brand prestige, the company has positioned itself as a leader in the luxury yacht and megayacht market.

-

In September 2025, Azimut Benetti Group introduced the Grande 30M and Fly 82 yachts at the Cannes Yachting Festival, featuring eco-friendly propulsion, reduced emissions, and luxury design innovations, strengthening its leadership in high-end recreational and megayacht segments.

Recreational Boats Market Key Players:

Some of the Recreational Boats Market Companies are:

-

Groupe Beneteau

-

Azimut Benetti Group

-

Ferretti Group

-

MasterCraft Boat Holdings, Inc.

-

Yamaha Motor Co. Ltd.

-

Marine Products Corporation

-

Polaris Inc.

-

Sunseeker International Ltd

-

Bavaria Yachtbau GmbH

-

White River Marine Group

-

Catalina Yachts

-

Princess Yachts

-

Hobie Cat Company

-

Tracker Boats

-

Bennington Marine LLC

-

Ranger Boats

-

Godfrey Pontoon Group

-

Chaparral Boats, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 18.66 Billion |

| Market Size by 2033 | USD 31.89 Billion |

| CAGR | CAGR of 6.96% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Motorboats, Sailboats, Yachts, Pontoon Boats, Kayaks & Canoes, Others) • By Length (≤20 ft, 21–40 ft, >40 ft) • By Propulsion Type (Inboard, Outboard, Sterndrive, Electric/Hybrid) • By Application (Leisure & Recreation, Sports & Racing, Tourism & Rentals, Fishing, Others) • By Distribution Channel (Dealerships, Online Sales, Specialty Retailers, Rental Services, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Brunswick Corporation, Groupe Beneteau, Azimut Benetti Group, Ferretti Group, Malibu Boats, Inc., MasterCraft Boat Holdings, Inc., Yamaha Motor Co. Ltd., Marine Products Corporation, Polaris Inc., Sunseeker International Ltd, Bavaria Yachtbau GmbH, White River Marine Group, Catalina Yachts, Princess Yachts, Hobie Cat Company, Tracker Boats, Bennington Marine LLC, Ranger Boats, Godfrey Pontoon Group, Chaparral Boats, Inc. |