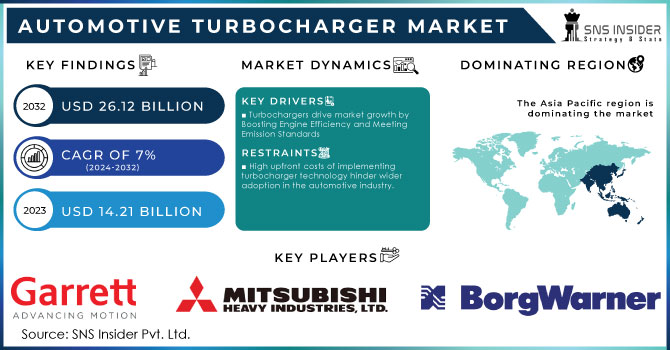

Automotive Turbocharger Market Size :

The Automotive Turbocharger Market size was valued at USD 14.21 billion in 2023 & will reach USD 26.12 billion by 2032 and grow at a CAGR of 7% by 2024-2032

In modern engines, turbochargers boost efficiency by using exhaust gas to compress incoming air. This compressed air allows for more efficient fuel burning, resulting in both increased power and improved fuel economy. New technologies are driving growth in the global automotive turbocharger market. Electric turbochargers, designed for better fuel economy and reduced emissions, represent a significant advancement.

Get More Information on Automotive Turbocharger Market - Request Sample Report

This focus on efficiency and sustainability aligns with the increasing demand for environmentally friendly cars. Traditionally, diesel engine vehicles, particularly in the commercial sector, have driven demand for turbochargers due to their superior fuel efficiency and power. This trend reflects a wider industrial focus on balancing performance with environmental standards. The growing demand for turbochargers in off-highway equipment like tractors highlights the technology's potential beyond cars.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Fuel Type (New Energy Engine, Diesel, Alternate Fuel/CNG, Gasoline) • by Vehilce Type (Passenger Vehicles, Commercial Cars, Construction Equipment) • by Material (Cast Iron, Aluminium, Others), By Turbo Type (VGT/VNT, Wastegate, Twin-Turbo, Others) • by Component (Turbine, Compressor, Housing) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Garrett Motion Inc., Continental AG, Mitsubishi Heavy Industries, BorgWarner Inc., IHI Corporation, Fengcheng Xindongli Turbocharger Co. Ltd, Precision Turbo and Engine, Bullseye Power LLC, Bosch Mahle, Cummins Inc., Continental AG, IHI Corporation, Mitsubishi Heavy Industries Ltd, BorgWarner Inc., Honeywell International Inc. |

MARKET DYNAMICS:

KEY DRIVERS:

-

Turbochargers drive market growth by Boosting Engine Efficiency and Meeting Emission Standards

The growing popularity of automotive turbochargers is a major driver in the market's expansion. These devices improve fuel efficiency by enabling more air intake into the engine, leading to increased power and better combustion. The turbochargers has the ability to deliver high engine power without needing a larger piston displacement, making them both efficient and environmentally friendly. Thus, factors like optimal resource utilization, minimal waste production, and overall efficiency gains are significantly contributing to market growth. Stricter government regulations on fuel emissions are also playing a role.

RESTRAINTS:

-

High upfront costs of implementing turbocharger technology hinder wider adoption in the automotive industry.

A major obstacle for the automotive turbocharger market is the significant cost of implementing this technology in vehicles. While turbochargers offer clear benefits in performance and efficiency, the added cost of installation can be a burden for both manufacturers and consumers. The complex design and production processes involved in making turbochargers contribute to their high price tag. This creates the barrier for automakers who want to balance the advantages of turbochargers with the need to produce affordable vehicles.

OPPORTUNITIES:

-

Rising demand for eco-friendly vehicles creates an opportunity for electric turbochargers with their focus on fuel efficiency and emissions reduction.

-

Growing agricultural productivity worldwide creates an opportunity for turbocharger use in off-highway equipment like tractors for increased power and efficiency.

CHALLENGES:

-

Maintaining and repairing turbochargers can be more expensive than traditional systems.

-

The technology may not be suitable for all vehicle types or driving styles.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has significantly disrupted the automotive turbocharger market. The supply chains are facing a major hurdle. Russia and Ukraine are key players in the metals and minerals market, including those vital for turbocharger production. Sanctions and disrupted trade routes have made obtaining these materials difficult, leading to shortages and a potential 10-15% increase in material costs for turbochargers. The automakers worldwide are experiencing production slowdowns due to a lack of various parts, including turbochargers. This stems from both the former supply chain issues and the wider disruption to global manufacturing caused by the war. The war's impact isn't limited to production, however. High energy prices are pushing consumers towards more fuel-efficient vehicles. This could lead to a short-term boost in demand for smaller engines, which often rely on turbochargers for power.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown impacts the automotive turbocharger market in several ways. Consumer spending often limits during downturns, with car purchases, an optional expense, being directly affected. This could lead to a potential 7-10% decline in new vehicle demand, impacting the market for new turbochargers. Existing car owners might also limit their budget and postpone upgrading to turbocharged vehicles, potentially causing a decrease in aftermarket demand for replacement turbochargers. The affordability might become the key driver for consumers, leading them towards smaller, less powerful vehicles that don't require turbochargers. This could shift the auto industry's sales mix, potentially reducing the overall market share of turbocharged vehicles. Thus, automakers facing declining sales might resort to cost-cutting measures that could impact turbocharger adoption. This might involve using cheaper, non-turbocharged engines in some models or delaying the introduction of new turbocharged options.

KEY MARKET SEGMENTS:

By Vehicle Type

-

Passenger cars

-

LCVs

-

Trucks

-

Buses

Passenger Cars is the dominating sub-segment in the Automotive Turbocharger Market by vehicle type holding around 55-60% of market share due to their widespread use for personal transportation. This high volume translates to a significant demand for turbochargers in passenger cars, particularly for smaller engines seeking a performance boost without sacrificing fuel efficiency.

By Fuel Type

-

Gasoline

-

Diesel

-

Alternate fuel/CNG

Gasoline is the dominating sub-segment in the Automotive Turbocharger Market by fuel type holding more than 65% of market share. Stringent emission regulations, particularly in developed countries, are pushing car manufacturers towards cleaner burning gasoline engines. These engines often utilize turbochargers to maintain power output while meeting stricter emission standards. Thus, the rising popularity of smaller, fuel-efficient gasoline vehicles further fuels the demand for gasoline turbochargers.

By Turbo Type

-

Diesel Turbochargers

-

VGT

-

Wastegate

-

E-Turbocharger

-

-

Gasoline Turbochargers

-

VGT

-

Wastegate

-

E-Turbocharger

-

Wastegate Turbochargers (for both Gasoline and Diesel) are the dominating sub-segment in the Automotive Turbocharger Market by turbo type. Wastegate turbochargers offer a simple and reliable design at a relatively lower cost compared to Variable Geometry Turbochargers (VGT) and Electric Turbochargers (E-Turbochargers). This makes them a more attractive option for budget-conscious manufacturers, especially for high-volume production vehicles.

By Material

-

Cast Iron

-

Aluminium

-

Others

Cast Iron is the dominating sub-segment in the Automotive Turbocharger Market by material. Cast iron is a traditional and cost-effective material for turbocharger housings due to its high durability, strength, and ability to withstand extreme temperatures. However, the use of other materials like steel or composites remains limited due to cost or performance considerations.

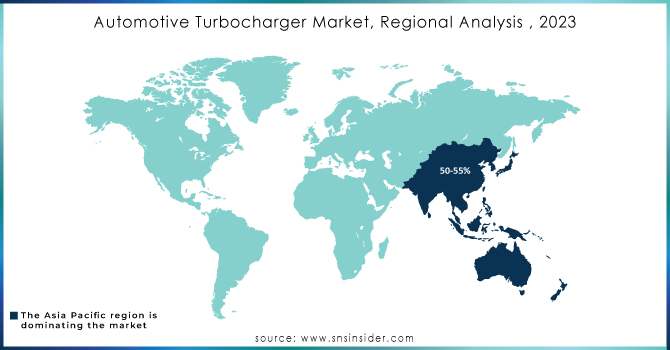

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Automotive Turbocharger Market holding around market share of 50-55%. This dominance is fueled by region’s massive car and light commercial vehicle production, along with a preference for fuel-efficient yet powerful engines. Growing environmental regulations also push manufacturers towards turbocharged engines, further propelling market growth in this region.

Europe is the second highest region in this market with its long history of automotive innovation and strict emission standards. The gasoline turbochargers are widely adopted to meet emission norms. Thus, Europe offers potential for growth in replacement and performance turbochargers.

North America is the fastest-growing region in this market. This is driven by the shift towards smaller, fuel-efficient turbocharged gasoline engines and the popularity of performance vehicles. However, its overall market size is smaller compared to the leaders.

Need any customization research on Automotive Turbocharger Market - Enquiry Now

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Garrett Motion Inc. (US), Continental AG (Germany), Mitsubishi Heavy Industries (Japan), BorgWarner Inc. (US), IHI Corporation (Japan), Fengcheng Xindongli Turbocharger Co. Ltd (China), Precision Turbo and Engine (US), Bullseye Power LLC (US), Bosch Mahle (Germany), Cummins Inc. (the US), Honeywell International Inc. (US) and other key players.

RECENT DEVELOPMENT

-

In June 2023: Garrett Motion has expanded its Wuhan factory, adding a high-speed production line for advanced variable nozzle turbochargers used in passenger vehicles. This signifies a commitment to innovation in fuel-efficient engine technology.

-

In April 2023: Garrett Motion showcased its advanced turbochargers and e-mobility tech at Auto Shanghai 2023. Their new E-turbos boost power and fuel economy, allowing smaller engines to deliver performance previously requiring much larger ones.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.21 Bn |

| Market Size by 2032 | US$ 26.12 Bn |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Petrol engines are migrating from naturally aspirated to turbocharged engines faster than ever before. • Turbochargers are increasingly being employed in diesel engines to improve fuel efficiency and engine performance. |

| Challenges | • Turbo lag is a big issue. The time it takes a turbocharger to develop positive pressure is known as turbo lag. • It takes time for a turbocharger to generate adequate pressure to suck the air in because of frictional and thermal losses. |