Automotive Oil Filter Market Report Scope & Overview:

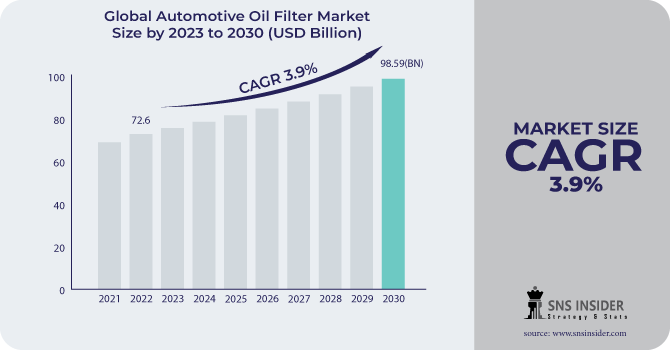

The Automotive Oil Filter Market size was valued at USD 75.43 Bn in 2023 and is expected to reach USD 106.43 Bn by 2032, and grow at a GAGR of 3.9% over the forecast period of 2024-2032.

One dominant trend that can be identified is the growth of green products. This is because consumers require auto-part products to be eco-friendly. Primarily, consumers need oil filters that consist of recyclable or biodegradable material. The companies then attempt to produce products in favour of alternative fuel types, such as biodiesel. This reflects the overall demand of the automotive market for sustainability. Further, the improvement of oil filter technology has increased the performance and efficiency of oil filters. The advancements of nanotechnology and advanced materials are being utilized for improving filtration capacity and durability; claims and reports indicate that new improvements can make filtration more efficient up to 30% and the service interval up to 25%.

This innovation is significant in protecting a vehicle's engine better and improving overall performance within vehicles. In addition, there's growing attention towards vehicle maintenance, which is that 70-75% of vehicle owners are aware of the necessity of periodic maintenance to ensure maximum efficiency from their engine. It is driving more investment in high-quality oil filters, which in turn, drives premium product demand that should ensure optimal filtration and performance of the engines.

Automotive Oil Filter Market Dynamics

Drivers:

-

Regularly changing the automotive oil filter as per the manufacturer's guidelines is essential for maintaining optimal engine performance, enhancing fuel efficiency, and extending engine life by preventing contaminants from causing wear and tear.

An automotive oil filter plays a vital role in keeping the engine oil free from contaminants like dirt, metal particles, and sludge, which can cause severe engine damage. By replacing the oil filter regularly—typically every 5,000 to 10,000 miles depending on the vehicle and driving conditions—engine longevity can be extended by up to 25-30%, while fuel economy can improve by around 3-5%. Neglecting to change the oil filter increases the risk of particles entering the engine, which can lead to a 10-15% decrease in overall engine efficiency and a potential increase in repair costs by up to 20%. Using the correct oil filter, as recommended by the manufacturer, ensures proper filtration, which prevents clogging and supports effective oil flow. This maintenance task is one of the most cost-effective ways to ensure that the engine operates smoothly, reducing the risk of costly breakdowns and maintaining optimal engine performance.

Restrains:

-

The growing demand for eco-friendly and sustainable automated parts is putting pressure on manufacturers to develop oil filters that are environmentally friendly both in terms of the fuel types they support and their disposal at the end of their useful lives.

In recent years, consumer preference for environmentally sustainable products has led to increased demand for eco-friendly car parts, including oil filters. Approximately 60-65% of consumers express a preference for automated components that are more sustainable, which adds pressure on manufacturers to innovate. This includes designing oil filters that are compatible with alternative fuels, such as biodiesel and electric hybrids, and ensuring the materials used are either biodegradable or easily recyclable. Furthermore, proper disposal remains a critical issue, as traditional oil filters are often made with materials that are not environmentally friendly, contributing to increased landfill waste. The push for greener solutions is encouraging the adoption of materials like cellulose or metal-free filter media, which can reduce environmental impact by up to 20-25%. This shift, while beneficial for the environment, presents a challenge for manufacturers who must invest in new technologies to meet these demands without significantly raising production costs or compromising filter performance.

Automotive Oil Filter Market Segmentation Overview

By Filter Type:

The Automotive oil filter market can be segmented by filter type and by vehicle type, providing a comprehensive view of industry dynamics. Under filter type, the key segments include Fuel Filters, Engine Oil Filters, Hydraulic Filters, and Others. Among these, engine oil filters hold the largest share, accounting for approximately 40-45% of the overall demand. This dominance can be attributed to their critical role in maintaining engine health by filtering out contaminants that can lead to wear and tear. Regular replacement of engine oil filters is essential to ensure the longevity of the engine and to maintain optimal performance, driving a consistent demand in this segment. Fuel filters also contribute significantly to the market, making up about 25-30% of the total demand.

They ensure clean fuel delivery to the engine, which is crucial for efficient operation and fuel economy. As fuel quality varies across regions, the importance of effective fuel filtration is heightened, making this segment increasingly relevant. Additionally, hydraulic filters, which are typically found in heavy machinery and specialized vehicles, represent about 10-15% of the market. These filters are vital for preventing contamination in hydraulic systems, and their demand is driven by industries that rely heavily on equipment performance and uptime.

By Vehicle Type:

In terms of vehicle type, the market is segmented into Passenger Vehicles and Commercial Vehicles. Passenger vehicles dominate the demand for automotive filters, capturing around 60-65% of the total market share. The growing global fleet of passenger vehicles, combined with increased consumer emphasis on regular maintenance for enhanced fuel efficiency and performance, significantly boosts this segment. With more consumers becoming aware of the importance of timely oil and filter changes, the market for passenger vehicle filters continues to thrive.

Commercial vehicles accounted for approximately 35-40% of the market. This segment is characterized by a higher replacement rate of filters, as these vehicles operate in more demanding environments and have longer operating hours compared to passenger vehicles. The rigorous operating conditions lead to increased wear and tear on filters, resulting in more frequent maintenance and replacement requirements. As a result, the commercial vehicle segment remains a crucial component of the overall automotive oil filter market, highlighting the need for durable and efficient filtration solutions to meet the operational demands of various industries.

.png)

Automotive Oil Filter Market Regional Analysis:

The automotive oil filter market in North America is quite large. The main factors propelling the growth of the automotive oil filter market in North America are the rising use of automobiles and the rise in investment in developing nations like Mexico and the United States. The demand for oil filters is influenced by the region's huge fleet of vehicles, stringent emission laws, and consumer awareness of preventive maintenance.

High-performance oil filters that can prolong engine life and offer superior engine protection are becoming more and more in demand from consumers. Compared to conventional oil filters, synthetic oil filters are more effective at capturing contaminants and have a longer lifespan. As a result, there is an increasing need for synthetic oil filters in the North America market.

Several of the biggest automakers in the world, including Toyota, Honda, and Hyundai, have their headquarters in the APAC region. To keep up with the region's rising demand for automobiles, these manufacturers are raising their output. There are more cars on the road as a result of the fast urbanization that is occurring in the APAC region. Growing disposable incomes: Consumers in the APAC region is becoming more affluent, which is driving up the cost of cars and auto maintenance. Growing consumer awareness of the value of preventive maintenance: In the Asia-Pacific area, consumers are realizing the value of routine maintenance procedures like oil changes. As a result, there is a growing need for car oil filters.

Key Players in Automotive Oil Filter Market

Some of the major automotive oil filter market key players are:

-

FRAM: FRAM Extra Guard Oil Filters, FRAM Tough Guard Oil Filters, FRAM Ultra Synthetic Oil Filters.

-

Sogefi: Purflux Oil Filters, Fram Eco Filters, CoopersFiaam Oil Filters.

-

Hengst: Hengst Blue.tronic, Hengst E630H, Hengst H17W06 Oil Filters.

-

Robert Bosch GmbH: Bosch Premium Oil Filters, Bosch DistancePlus Oil Filters, Bosch Workshop Oil Filters.

-

K&N Engineering: K&N High:Flow Oil Filters, K&N Performance Gold Oil Filters, K&N Heavy:Duty Oil Filters.

-

UFI Filters: UFI EcoFilters, UFI Pro Filters, UFI Standard Oil Filters.

-

Champion Laboratories: Champ XL Oil Filters, Champ High Efficiency Filters, Champ Luber:Finer Filters.

-

Donaldson Company, Inc.: Donaldson Endurance Oil Filters, Donaldson P-Series, Donaldson Blue Oil Filters.

-

Cummins Filtration: Fleetguard Oil Filters, Cummins Direct Flow, Cummins NanoNet Filters.

-

Freudenberg Filtration Technologies: micronAir Blue Oil Filters, micronAir Flexline, micronAir ProTex.

-

Mann+Hummel: Mann:Filter HU 816, Mann:Filter W 719, Mann:Filter HU 7006 z Oil Filters.

-

ACDelco: ACDelco Professional Oil Filters, ACDelco Duraguard, ACDelco Classic Gold Oil Filters.

-

Parker Hannifin Corporation: Parker Racor Spin:on Filters, Parker ParFit Elements, Parker Lubrication Oil Filters.

-

WIX Filters (MANN+HUMMEL Group): WIX XP Oil Filters, WIX Heavy:Duty Oil Filters, WIX ECO Oil Filters.

-

Mahle GmbH: Mahle OX Oil Filters, Mahle Knecht Oil Filters, Mahle Metal:Free Oil Filters.

| Report Attributes | Details |

| Market Size in 2022 | US$ 75.43 Billion |

| Market Size by 2032 | US$ 106.43 Billion |

| CAGR | CAGR of 3.9% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (Gasoline, Diesel, Alternative Fuels), • By Filter Type (Fuel Filter, Engine Oil Filter, Hydraulic Filter, Others), • By Vehicle Type (PV, CV) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | FRAM, Sogefi, Hengst, Robert Bosch, K&N Engineering, UFI Filters, Champion Laboratories, Donaldson Company, Cummins Freudenberg |

| Key Drivers | The benefits associated with oil filter. |

| Market Restraints | oil filters must adhere to tight rules and specifications regarding emissions, |