Smart Fleet Management Market Report Scope & Overview:

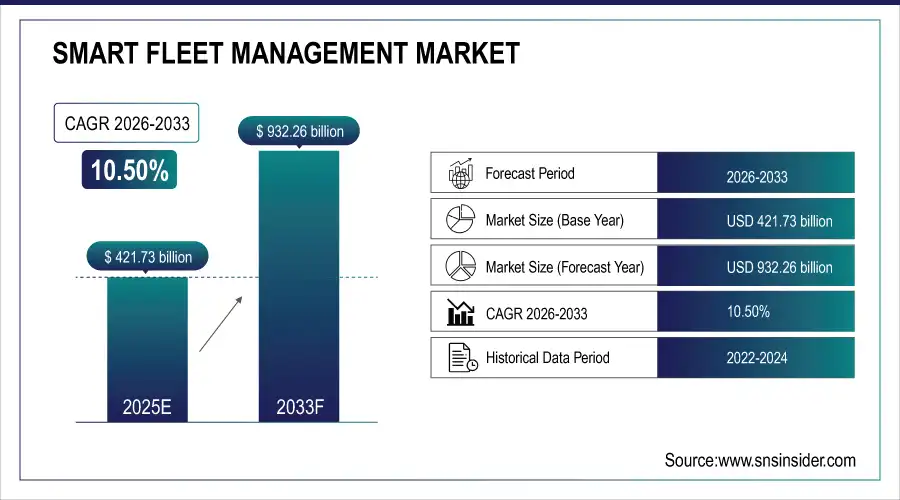

The Smart Fleet Management Market was valued at USD 421.73 billion in 2025E and is expected to reach USD 932.26 billion by 2032, growing at a CAGR of 10.50% from 2026-2033.

The Smart Fleet Management Market is growing due to rising adoption of connected vehicles, telematics, and IoT-based solutions across logistics, transportation, and e-commerce sectors. Increasing demand for real-time vehicle tracking, route optimization, fuel efficiency, and predictive maintenance is driving market expansion. Businesses are leveraging AI and cloud-based platforms to enhance operational efficiency, reduce costs, ensure regulatory compliance, and improve driver safety, collectively supporting robust growth in the global Smart Fleet Management Market.

To Get more information on Smart Fleet Management Market - Request Free Sample Report

AI-Powered Safety Systems: Powerfleet launched an Automated AI Risk Intervention Module that utilizes edge and cloud-based AI to detect risky driving patterns, such as fatigue and distraction, and triggers real-time escalation workflows to enhance driver safety.

Generative AI in Fleet Management: Verizon Connect reports that over 30% of fleet managers plan to implement generative AI within a year, aiming to enhance data analysis and operational efficiency through AI-powered interfaces.

Market Size and Forecast

-

Market Size in 2025: USD 421.73 Billion

-

Market Size by 2033: USD 932.26 Billion

-

CAGR: 10.50% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Smart Fleet Management Market Trends

-

Rising demand for operational efficiency and cost reduction is driving the smart fleet management market.

-

Integration of IoT, GPS tracking, telematics, and AI analytics is enhancing route optimization and predictive maintenance.

-

Growing adoption across logistics, transportation, and delivery services is boosting market growth.

-

Expansion of electric and connected vehicles is fueling technology deployment.

-

Focus on safety, fuel efficiency, and regulatory compliance is shaping adoption trends.

-

Advancements in cloud-based platforms and mobile applications are improving fleet monitoring and decision-making.

-

Collaborations between fleet operators, technology providers, and automotive OEMs are accelerating innovation and market penetration.

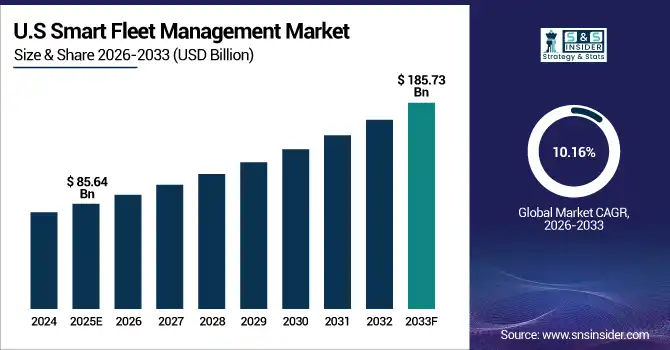

U.S. Smart Fleet Management Market was valued at USD 85.64 billion in 2025E and is expected to reach USD 185.73 billion by 2032, growing at a CAGR of 10.16% from 2026-2033.

The U.S. Smart Fleet Management Market is growing due to increasing adoption of telematics, IoT, and AI-driven fleet solutions, rising demand for route optimization, fuel efficiency, predictive maintenance, and enhanced operational efficiency across transportation and logistics sectors.

Smart Fleet Management Market Growth Drivers:

-

Rising adoption of connected vehicle technologies and telematics systems driving growth in Smart Fleet Management Market globally

The increasing integration of telematics, IoT, and AI in fleet operations is enhancing real-time tracking, predictive maintenance, and route optimization. Businesses are leveraging data-driven insights to reduce fuel consumption, improve driver safety, and increase operational efficiency. Adoption of cloud-based fleet platforms allows seamless communication between vehicles and fleet managers, enhancing decision-making capabilities. Rising demand from logistics, e-commerce, and transportation sectors for efficient fleet management solutions is accelerating deployment, ensuring cost savings and improved service reliability.

|

Initiative / Update |

Details |

|

GSA Fleet Telematics (U.S. Government) |

GSA requires all leased vehicles to use integrated, FedRAMP-approved telematics for real-time tracking, fuel reporting, driver monitoring, and compliance. |

|

Defense Logistics Agency (U.S.) |

DLA equips 82% of government vehicles with telematics by March 2025, tracking diagnostics, idle time, fuel use, and driver behavior. |

|

Teletrac Navman TN360 (2025) |

Teletrac Navman integrates TN360 with OEM telematics, cutting costs and streamlining connected fleet management for logistics and transport. |

|

Powerfleet + MTN Business Partnership |

Powerfleet partners with MTN Business to deliver AIoT fleet insights, predictive maintenance, logistics optimization, and supply chain visibility. |

|

Lytx Fatigue Detection (2025) |

23,000+ fleet vehicles adopt Lytx fatigue detection, achieving 90% accuracy in spotting drowsy driving, improving safety and reducing accidents. |

|

NYC Fleet Telematics Mandate |

NYC mandates telematics across municipal fleets, enabling monitoring of speeding, braking, and seatbelt use to reduce crashes and improve safety. |

|

Platform Science Acquisition (2025) |

Platform Science acquires Trimble’s global telematics division, expanding connected vehicle, in-cab platforms, and digital fleet management globally. |

|

Telematics & Insurance Expansion |

Survey shows 51% of fleets expanding telematics in 12 months, while 70% of insurers grow usage-based insurance with telematics. |

Smart Fleet Management Market Restraints:

-

Limited digital infrastructure and inconsistent network coverage may hinder Smart Fleet Management Market growth

Smart Fleet Management heavily relies on reliable internet connectivity, cloud platforms, and GPS tracking systems. Regions with poor network coverage or unstable digital infrastructure face difficulties in deploying these solutions effectively. Inconsistent connectivity can lead to inaccurate tracking, delayed reporting, and reduced operational efficiency. Rural and remote areas with limited IoT and telematics support may experience challenges in real-time monitoring. Fleet operators must invest in additional network infrastructure or alternative solutions to ensure seamless management. Such infrastructural limitations restrict market penetration and slow adoption, particularly in developing regions, posing a restraint to overall growth.

Smart Fleet Management Market Opportunities:

-

Increasing demand for AI-enabled predictive analytics presents opportunities for Smart Fleet Management growth globally

Integration of AI and machine learning in fleet management is opening opportunities to optimize routes, predict maintenance, and enhance fuel efficiency. Predictive analytics allows fleet managers to anticipate vehicle failures, minimize downtime, and schedule timely repairs. Advanced algorithms analyze driver behavior, traffic patterns, and vehicle conditions to enhance operational efficiency. Growing adoption of connected vehicles and telematics systems enables real-time data collection, feeding into AI models for continuous optimization. As businesses seek cost reduction, operational efficiency, and safety improvements, AI-powered Smart Fleet Management solutions are gaining significant traction, creating a lucrative growth opportunity worldwide.

|

Organization / Company |

Key Impact |

AI-Powered Fleet Focus |

|

U.S. Department of Energy – Vehicle Technologies Office |

Cuts fuel consumption by 10–15% and reduces unplanned maintenance downtime. |

Predictive analytics in connected vehicles |

|

Volvo Group |

Reduces unplanned stops by up to 80%, improving uptime and safety. |

AI-enabled predictive maintenance |

|

Geotab |

Analyzes 4M+ vehicles worldwide, optimizing fuel efficiency, driver behavior, and vehicle health. |

AI-based predictive analytics platform |

|

Continental |

Extends tire life by up to 30%, reducing operational costs and improving safety. |

ContiConnect predictive tire analytics |

|

U.S. General Services Administration (GSA) |

Requires predictive telematics by 2025, enhancing monitoring, maintenance scheduling, and safety compliance. |

AI in fleet telematics (federal mandate) |

|

Scania |

Reduces service costs and downtime through predictive scheduling. |

AI-powered predictive maintenance service |

Smart Fleet Management Market Segment Highlights

-

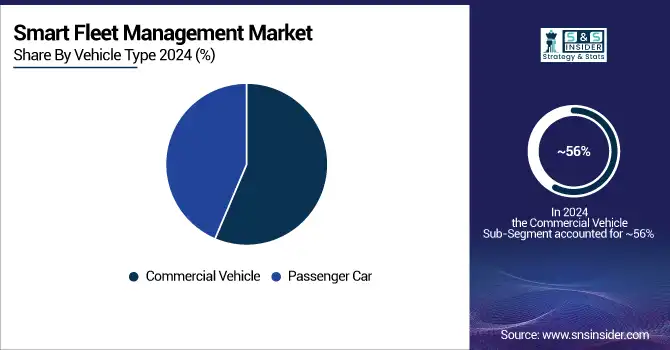

By Vehicle Type, Commercial Vehicle dominated with ~56% share in 2025; Passenger Car fastest growing (CAGR)

-

By Transportation, Automotive dominated with ~68% share in 2025; Rolling Stock fastest growing (CAGR)

-

By Hardware, Tracking dominated with ~37% share in 2025; ADAS fastest growing (CAGR)

-

By End User, Retail & E-commerce dominated with ~59% share in 2025; fastest growing (CAGR)

-

By Connectivity, Cloud dominated with ~59% share in 2025; fastest growing (CAGR)

Smart Fleet Management Market Segment Analysis

By Vehicle Type, Commercial vehicles dominated in 2025; passenger cars expected fastest growth 2026–2033

Commercial Vehicle segment dominated the Smart Fleet Management Market in 2025 due to large-scale adoption by logistics, transport, and freight companies. High demand for route optimization, fuel efficiency, and regulatory compliance drives fleet operators to implement smart management solutions, ensuring operational efficiency, reduced costs, and enhanced visibility across commercial transportation networks.

Passenger Car segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising personal vehicle ownership, increasing demand for connected car technologies, and growing awareness of safety and efficiency features. Integration of telematics, navigation, and monitoring solutions in passenger cars is fueling rapid adoption and market expansion in this segment.

By Transportation, Automotive led in 2025; rolling stock projected fastest growth 2026–2033

Automotive segment dominated the Smart Fleet Management Market in 2025 as most fleet deployments are concentrated in road transport and commercial vehicles. Established infrastructure, high investment in telematics, and widespread adoption of digital fleet management solutions by automotive companies ensure consistent demand, driving the segment’s leadership in market revenue.

Rolling Stock segment is expected to grow at the fastest CAGR from 2026-2033 due to modernization initiatives in rail transport, increasing adoption of digital monitoring solutions, and government support for smart rail infrastructure. Enhanced efficiency, safety, and predictive maintenance requirements are driving accelerated implementation of fleet management technologies in this segment.

By Hardware, Tracking systems dominated in 2025; ADAS expected fastest growth 2026–2033 with focus on safety and autonomous features.

Tracking segment dominated the Smart Fleet Management Market in 2025 as it forms the core of fleet monitoring solutions. Companies prioritize real-time vehicle location, route tracking, and operational efficiency, making tracking systems essential. Their integration with analytics platforms ensures cost savings and improved decision-making, maintaining dominance in fleet management technologies.

ADAS segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing focus on vehicle safety, autonomous driving features, and advanced driver assistance systems. Growing regulatory emphasis on accident prevention and enhanced user experience is driving fleet operators and manufacturers to adopt ADAS-enabled smart fleet management solutions rapidly.

By End User, Retail & e-commerce led in 2025; fastest growth 2026–2033

Retail & E-commerce segment dominated the Smart Fleet Management Market in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to the surge in online shopping and demand for timely deliveries. Companies are increasingly implementing smart fleet solutions for real-time tracking, route optimization, and efficient last-mile delivery. Rising consumer expectations for faster shipping, coupled with the expansion of e-commerce platforms and logistics networks, are driving both the segment’s dominance and accelerated growth during the forecast period.

By Connectivity, Cloud solutions dominated in 2025; projected fastest growth 2026–2033

Cloud segment dominated the Smart Fleet Management Market in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to its scalability, cost-efficiency, and ease of integration with existing fleet operations. Cloud-based solutions enable real-time data access, advanced analytics, and centralized monitoring, improving operational efficiency. Growing adoption of IoT-enabled devices, remote fleet management needs, and demand for flexible, secure, and upgradable platforms are driving both the segment’s current dominance and its rapid growth during the forecast period.

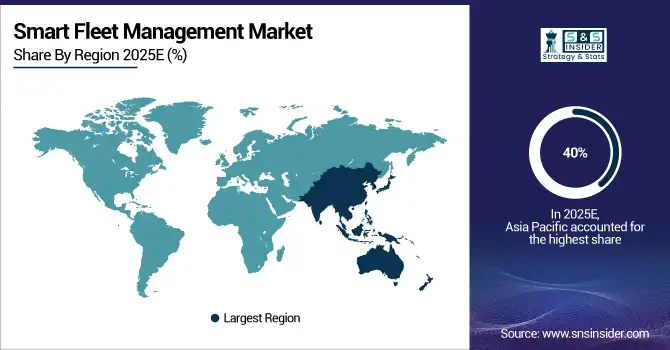

Smart Fleet Management Market Regional Analysis

Asia Pacific Smart Fleet Management Market Insights

Asia Pacific dominated the Smart Fleet Management Market with about 40% revenue share in 2025 due to rapid urbanization, expanding logistics and e-commerce sectors, and growing adoption of connected vehicles. Strong government initiatives for smart transportation, rising demand for fleet efficiency, and increased investment in IoT and telematics solutions further enhance operational management, route optimization, and predictive maintenance, supporting consistent market dominance and revenue growth across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Smart Fleet Management Market Insights

North America held a significant share in the Smart Fleet Management Market in 2025 due to advanced technological infrastructure, widespread adoption of connected vehicles, and strong presence of key market players. Growing demand for fleet optimization, real-time tracking, and predictive maintenance in logistics, transportation, and e-commerce sectors, coupled with supportive government regulations and investment in telematics solutions, drives operational efficiency and consistent revenue growth across the region.

Europe Smart Fleet Management Market Insights

Europe accounted for a significant share in the Smart Fleet Management Market in 2025 due to increasing adoption of telematics, connected vehicles, and advanced fleet tracking solutions. Rising demand for operational efficiency, fuel optimization, and regulatory compliance in logistics and transportation sectors, along with growing investments in IoT, AI, and cloud-based fleet management platforms, supports enhanced productivity, cost savings, and steady market growth across the region.

Middle East & Africa and Latin America Smart Fleet Management Market Insights

Middle East & Africa and Latin America are witnessing steady growth in the Smart Fleet Management Market due to expanding logistics and transportation sectors, increasing adoption of connected vehicle technologies, and rising demand for efficient fleet operations. Investments in telematics, IoT-based tracking systems, and cloud solutions, along with improving road infrastructure and growing e-commerce activities, are enhancing operational efficiency, reducing costs, and driving revenue growth across these regions.

Smart Fleet Management Market Competitive Landscape:

Geotab

Geotab is a global leader in telematics and fleet management solutions, providing AI-driven insights to optimize fleet operations, enhance safety, and improve sustainability. The company integrates advanced analytics, IoT devices, and automation to deliver actionable intelligence for fleets of all sizes. Geotab’s solutions support vehicle tracking, driver behavior monitoring, predictive maintenance, and regulatory compliance, helping organizations reduce costs, improve efficiency, and make data-driven decisions across global fleet operations.

-

2024: Introduced Geotab Ace, an AI-driven fleet management solution at Geotab Connect 2024.

-

May 2024: Recognized in Fleet News Reader Recommended awards for excellence in telematics, fleet management, safety, and sustainability.

Samsara

Samsara provides IoT-based fleet management, safety, and industrial automation solutions, leveraging AI to enhance operational efficiency. The company’s cloud-connected devices deliver real-time monitoring, predictive analytics, and automated workflows, enabling organizations to optimize fleet performance and safety. Samsara emphasizes customer-centric solutions, ensuring high satisfaction and loyalty through robust technology, responsive support, and innovative offerings that integrate seamlessly into enterprise operations.

-

September 23, 2025: Unveiled an expanded AI-powered safety platform for real-time driver monitoring and predictive maintenance.

Powerfleet

Powerfleet, formerly Fleet Complete, is a global provider of IoT and enterprise fleet intelligence solutions. The company delivers connected vehicle platforms, real-time monitoring, and predictive analytics for fleet operations, enhancing safety, efficiency, and asset utilization. Powerfleet focuses on software innovation and operational consolidation to provide comprehensive fleet management solutions, enabling organizations to streamline maintenance, reduce costs, and make data-driven decisions across large, distributed fleets.

-

October 2024: Acquired Fleet Complete, consolidating its presence in the fleet management industry.

-

December 2024: Announced software enhancements for Unity, Inspect, VisionAI Hub, and Unity mobile to improve fleet operations and maintenance.

Teletrac Navman

Teletrac Navman is a global provider of GPS fleet tracking, telematics, and AI-enabled safety solutions. The company delivers real-time fleet visibility, predictive analytics, and actionable insights to optimize operations, enhance driver safety, and reduce environmental impact. Teletrac Navman emphasizes technological innovation, partnering with key organizations to expand its presence and improve operational efficiency for fleets worldwide.

-

July 22, 2025: Launched Multi IQ, an AI-powered camera providing 360° visibility and enhanced safety insights.

-

September 17, 2024: Secured sole telematics partner status with Readypower Group in the UK, expanding European presence.

Omnitracs

Omnitracs provides fleet management, routing, telematics, and compliance solutions across North America. The company integrates IoT and analytics to enhance operational efficiency, driver safety, and regulatory compliance for commercial fleets. Omnitracs focuses on acquisitions, software integration, and technology upgrades to broaden its capabilities in fleet tracking, electronic logging, and predictive maintenance, serving diverse transportation and logistics sectors.

-

December 9, 2024: Completed the acquisition of Shaw Tracking, expanding North American fleet management capabilities.

-

August 15, 2023: Integrated Solera’s Electronic Logging Devices to meet Canadian ELD mandates.

Zonar Systems

Zonar Systems provides IoT-based fleet management solutions, specializing in GPS tracking, vehicle diagnostics, and operational intelligence. The company’s platforms enhance fleet safety, efficiency, and sustainability, supporting enterprise-level logistics and transportation operations. Zonar focuses on strategic mergers and acquisitions to expand capabilities and deliver integrated solutions that streamline fleet operations while reducing operational costs and improving asset utilization.

-

December 3, 2024: Merged with GPS Trackit to enhance fleet management offerings.

-

December 3, 2024: Continental sold Zonar to GPS Trackit, focusing on core operations.

Key Players

Some of the Smart Fleet Management Market Companies

-

Geotab

-

Samsara

-

Verizon Connect

-

Fleet Complete

-

Teletrac Navman

-

Omnitracs

-

Zonar Systems

-

Motive

-

PowerFleet

-

MiX Telematics

-

Fleetio

-

Trimble

-

Continental AG

-

Bosch IoT Fleet Services

-

TomTom Telematics

-

Inseego Corp.

-

Sierra Wireless

-

AT&T Fleet Complete

-

IBM Maximo Fleet

-

Bridgestone

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 421.73 Billion |

| Market Size by 2033 | USD 932.26 Billion |

| CAGR | CAGR of 10.50% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Car, Commercial Vehicle) • By Transportation (Automotive, Rolling Stock, Marine) • By End User (Retail & E-commerce, Car Rental, Oil & Gas, Others) • By Hardware (Tracking, Optimization, ADAS, Remote Diagnostics) • By Connectivity (Short Range Communication, Long Range Communication, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Geotab, Samsara, Verizon Connect, Fleet Complete, Teletrac Navman, Omnitracs, Zonar Systems, Motive, PowerFleet, MiX Telematics, Fleetio, Trimble, Continental AG, Bosch IoT Fleet Services, TomTom Telematics, Inseego Corp., Sierra Wireless, AT&T Fleet Complete, IBM Maximo Fleet, Bridgestone |