Compact Wheel Loaders Market Report Scope & Overview:

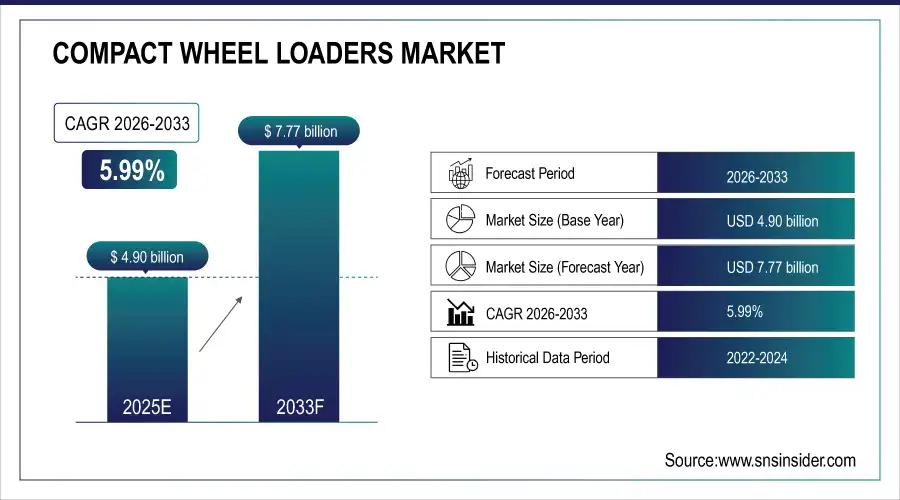

The Compact Wheel Loaders Market size was valued at USD 4.90 Billion in 2025E and is projected to reach USD 7.77 Billion by 2033, growing at a CAGR of 5.99% during 2026-2033.

The Compact Wheel Loaders Market is growing due to increasing demand for versatile, fuel-efficient, and manoeuvrable equipment in construction, agriculture, and landscaping applications. Urbanization, infrastructure projects, and the expansion of rental services are driving adoption. Technological advancements such as hybrid engines, operator-assist features, and telematics integration further enhance productivity, safety, and sustainability, fueling steady market growth globally.

To Get more information on Compact Wheel Loaders Market - Request Free Sample Report

The U.S. government allocated USD 1.2 trillion under the Infrastructure Investment and Jobs Act, significantly boosting demand for compact construction equipment

Key Compact Wheel Loaders Market Trends

-

Rapid urbanization and large-scale infrastructure projects driving demand for compact, versatile machinery.

-

Increased adoption of telematics, automation, and operator-assist systems to boost efficiency and safety.

-

Growing environmental awareness prompting development of hybrid and electric compact wheel loaders.

-

Expansion of equipment rental services in emerging economies to reduce ownership costs.

-

Rising investments in smart cities and mechanized agriculture fostering innovation and market growth.

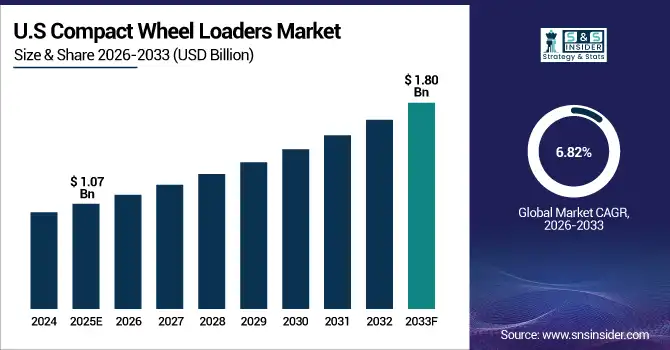

The U.S. Compact Wheel Loaders Market size was valued at USD 1.07 Billion in 2025E and is projected to reach USD 1.80 Billion by 2033, growing at a CAGR of 6.82% during 2026-2033. The U.S. compact wheel loader market is driven by urbanization, infrastructure expansion, and increased demand for versatile, fuel-efficient equipment in confined spaces. Technological advancements, such as telematics and automation, enhance productivity and safety, while sustainability trends promote the adoption of eco-friendly machines. Additionally, the growth of rental services and mechanization in agriculture further contribute to market expansion.

Compact Wheel Loaders Market Growth Drivers:

-

Urbanization Infrastructure Growth and Technological Innovation Drive Demand in Global Compact Wheel Loader Market

The global Compact Wheel Loaders Market is primarily driven by rapid urbanization, infrastructure expansion, and rising demand for versatile, fuel-efficient, and maneuverable machinery. Growth in construction, landscaping, and agricultural projects worldwide fuels the need for compact loaders capable of operating in confined spaces. Technological advancements such as telematics, automation, and operator-assist systems are enhancing productivity, reducing operating costs, and improving safety. Additionally, growing environmental awareness is prompting manufacturers to introduce hybrid and electric compact loaders, aligning with global sustainability trends.

Volvo CE introduced mid-size electric wheel loader machines in North America in 2024, offering enhanced operational efficiency and sustainability. These launches reflect the industry's focus on adopting innovative, eco-friendly machinery to support evolving construction requirements.

Compact Wheel Loaders Market Restraints:

-

High Costs Regulatory Hurdles and Technological Challenges Restrain Growth in Compact Wheel Loader Market

The Compact Wheel Loaders (CCA) market faces challenges such as high development and integration costs, complex regulatory approvals, and interoperability issues between manned and unmanned systems. Technological limitations in AI reliability, cybersecurity risks, and communication link vulnerabilities also hinder rapid deployment. Additionally, geopolitical tensions and export restrictions may slow global adoption and collaborative defense projects.

Compact Wheel Loaders Market Opportunities:

-

Expanding Rental Services IoT Adoption and Smart Investments Drive Global Compact Wheel Loader Market Opportunities

Opportunities in the global market lie in expanding equipment rental services, especially in emerging economies where high upfront costs deter ownership. Adoption of IoT-enabled fleet management systems offers opportunities to improve efficiency and machine utilization. Furthermore, rising investments in smart cities and mechanized agriculture present long-term growth prospects, while innovation in lightweight, high-performance compact loaders opens avenues for market differentiation and competitive advantage.

Bobcat introduced the L95 compact wheel loader, boasting a 3,981-pound rated operating capacity and a 1.2-yard bucket capacity. With a travel speed of up to 24 mph, this model combines lightweight design with high performance, catering to industries requiring efficient and agile equipment.

Compact Wheel Loaders Market Segment Analysis

-

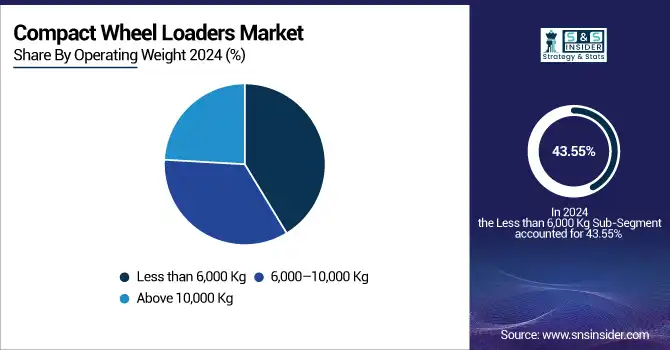

By Operating Weight, Less than 6,000 Kg dominated with 43.55% in 2025E, and Above 10,000 Kg is expected to grow at the fastest CAGR of 6.64% from 2026 to 2033.

-

By Engine Power, Less than 50 HP dominated with 39.63% in 2025E, while Above 100 HP is expected to grow at the fastest CAGR of 6.93% from 2026 to 2033.

-

By Application, Construction dominated with 46.74% in 2025E, while Industrial is expected to grow at the fastest CAGR of 7.65% from 2026 to 2033.

-

By End User, Construction Companies dominated with 44.45% in 2025E, and Rental Service Providers is expected to grow at the fastest CAGR of 7.03% from 2026 to 2033.

By Operating Weight, Lightweight Loaders Dominate 2025 Market While Heavyweight Loaders Drive Fastest Growth Through 2033

In 2025E, compact wheel loaders with operating weights less than 6,000 kg are expected to dominate the market. These machines are favoured for their versatility, manoeuvrability, and suitability for urban construction, landscaping, and agriculture. Their compact size allows them to operate efficiently in confined spaces, making them ideal for tasks in congested areas. Loaders with operating weights above 10,000 kg are projected to experience the fastest growth from 2026 to 2033. This segment's expansion is driven by increasing demand in heavy-duty applications such as large-scale construction, mining, and infrastructure development. Their higher capacity and power make them suitable for handling more demanding tasks, contributing to their anticipated growth in the coming years.

By Engine Power, Low Power Loaders Dominate 2025 Market While High Power Loaders Drive Rapid Growth Through 2033

In 2025E, compact wheel loaders with engine power less than 50 HP are expected to dominate the market, particularly in applications requiring manoeuvrability and efficiency in confined spaces. These loaders are well-suited for tasks in urban construction, landscaping, and agriculture, where space constraints and fuel efficiency are paramount. From 2026 to 2033, loaders with engine power above 100 HP are projected to experience the fastest growth in the market. This growth is driven by increasing demand in heavy-duty applications such as large-scale construction, mining, and infrastructure development. Their higher capacity and power make them suitable for handling more demanding tasks, contributing to their anticipated growth in the coming years.

By Application, Construction Dominates 2025 Compact Wheel Loader Market Industrial Sector Drives Fastest Growth Through 2033

In 2025E, the Construction sector is projected to dominate the compact wheel loader market, driven by escalating urbanization and infrastructure development. These loaders are essential for tasks like excavation, material handling, and site preparation in construction projects. Their compact size and versatility make them ideal for navigating confined spaces and urban environments. From 2026 to 2033, the Industrial sector is expected to experience the fastest growth in the compact wheel loader market. This growth is fueled by increasing demand for material handling, waste management, and logistics operations across various industries. Compact wheel loaders offer efficiency and manoeuvrability in industrial settings, enhancing productivity and reducing operational costs.

By End User, Construction Companies Lead Market Growth While Rental Services Drive Future Compact Wheel Loader Demand

In 2025E, Construction Companies are projected to dominate the compact wheel loader market, driven by increasing urbanization and infrastructure development. These loaders are essential for tasks like excavation, material handling, and site preparation in construction projects. Their compact size and versatility make them ideal for navigating confined spaces and urban environments. From 2026 to 2033, Rental Service Providers are expected to experience the fastest growth in the market. This growth is fueled by increasing demand for flexible, cost-effective equipment solutions across various industries. Rental services offer businesses access to high-quality compact wheel loaders without the upfront investment, making them an attractive option for short-term projects and fluctuating workloads.

Compact Wheel Loaders Market Report Analysis

Asia Pacific Compact Wheel Loaders Market Insights

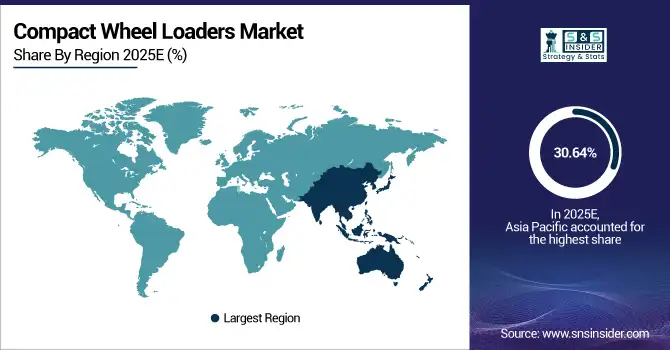

The Asia Pacific region is expected to dominate the Compact Wheel Loaders Market with 30.64% in 2025E due to rapid urbanization, large-scale infrastructure projects, and growing demand for efficient construction equipment. Expansion in industrial and agricultural activities is boosting loader adoption. Additionally, rising mechanization, technological advancements, and increasing investment in sustainable and compact machinery are driving strong growth, positioning the region as a key market leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Compact Wheel Loaders Market Insights

In the Asia Pacific region, China is expected to dominate the compact wheel loader market in 2025E. This dominance is driven by rapid urbanization, extensive infrastructure development, and significant investments in construction and mining sectors. China's large-scale projects and industrial activities contribute to the high demand for compact wheel loaders. Additionally, the government's initiatives to modernize infrastructure further bolster the market's growth in the country

North America Compact Wheel Loaders Market Insights

North America is expected to grow at the fastest CAGR of 7.01% from 2026–2033 due to increasing investments in infrastructure, urban development, and industrial projects. Rising demand for advanced, fuel-efficient, and technologically enhanced compact wheel loaders, along with growth in rental services and sustainability initiatives, is driving expansion. Adoption of automation and telematics further boosts efficiency, productivity, and market growth in the region.

U.S. Compact Wheel Loaders Market Insights

In North America, the U.S. dominates the compact wheel loader market due to extensive infrastructure development, strong construction activity, advanced technology adoption, and a mature rental equipment sector, which together drive high demand for versatile and efficient compact loaders.

Europe Compact Wheel Loaders Market Insights

Europe holds a 21.45% market share in the Compact Wheel Loaders Market, driven by strong demand in construction, landscaping, and industrial sectors. Growth is supported by investments in urban infrastructure, sustainability initiatives, and adoption of advanced, fuel-efficient machinery. Technological innovations, strict environmental regulations, and the increasing preference for compact, versatile equipment for confined spaces further strengthen market growth, positioning Europe as a key contributor to the global market.

Germany Compact Wheel Loaders Market Insights

In Europe, Germany dominates the compact wheel loader market due to its advanced construction and manufacturing sectors, strong infrastructure investments, high adoption of innovative machinery, and stringent environmental regulations that drive demand for efficient, versatile, and eco-friendly equipment.

Latin America (LATAM) and Middle East & Africa (MEA) Compact Wheel Loaders Market Insights

Latin America (LATAM) and Middle East & Africa (MEA) markets for compact wheel loaders are growing steadily, driven by expanding infrastructure projects, industrial development, and increasing mechanization. Rising urbanization and investments in construction and mining sectors boost demand. Adoption of versatile, efficient, and durable machinery tailored to challenging environments supports sustained growth in both regions.

Competitive Landscape for Compact Wheel Loaders Market:

Caterpillar Inc. is a leading global manufacturer of construction and mining equipment, including compact wheel loaders. The company offers a diverse range of loaders, such as the 191-horsepower 938 model, designed for versatility in various applications like construction, landscaping, and agriculture. Caterpillar's commitment to innovation and quality positions it as a key player in the compact wheel loader market.

- In November 2024, Caterpillar introduced the Cat 903 compact wheel loader, featuring an all-new Cat C1.7 engine that provides 17% more horsepower than its predecessor, the Cat 903D. This enhancement aims to improve performance and efficiency for various applications.

Volvo Construction Equipment (Volvo CE) is a leading manufacturer of compact wheel loaders, offering models like the L25H, L30G, and L35G. These machines are designed for versatility in applications such as construction, landscaping, and agriculture. Volvo CE emphasizes innovation, sustainability, and operator comfort in its equipment design. The company has been expanding its electric vehicle lineup, including the L25 Electric model, to meet growing demand for eco-friendly construction equipment. Additionally, Volvo CE is enhancing its manufacturing capabilities to better serve global markets.

- In April 2025, Volvo CE introduced a new generation of wheel loaders, including models L150 to L260. These loaders feature enhanced productivity, operator comfort, and safety, incorporating innovative technologies for improved performance.

Compact Wheel Loaders Market Key Players:

Some of the Compact Wheel Loaders Market Companies

- Caterpillar Inc.

- Volvo Construction Equipment

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- JCB Ltd.

- Doosan Infracore (Develon)

- CNH Industrial N.V. (CASE Construction)

- Hyundai Construction Equipment Co., Ltd.

- Yanmar Co., Ltd.

- Kubota Corporation

- Wacker Neuson SE

- Manitou Group

- Mecalac Group

- SDLG (Shandong Lingong Construction Machinery)

- Xuzhou Construction Machinery Group (XCMG)

- Sany Group

- Takeuchi Mfg. Co., Ltd.

- Mustang by Manitou

- Avant Tecno Oy

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.90 Billion |

| Market Size by 2033 | USD 7.77 Billion |

| CAGR | CAGR of 5.99% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operating Weight (Less than 6,000 Kg, 6,000–10,000 Kg, and Above 10,000 Kg) • By Engine Power (Less than 50 HP, 50–100 HP, and Above 100 HP) • By Application (Construction, Agriculture, Landscaping, and Industrial) • By End User (Construction Companies, Agricultural Enterprises, Municipalities, and Rental Service Providers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Caterpillar, Volvo CE, Komatsu, Hitachi Construction Machinery, Liebherr, JCB, Doosan Infracore (Develon), CNH Industrial (CASE), Hyundai CE, Yanmar, Kubota, Wacker Neuson, Manitou, Mecalac, SDLG, XCMG, Sany, Takeuchi, Mustang by Manitou, and Avant Tecno. |