Baby Drinks Market Report Scope & Overview:

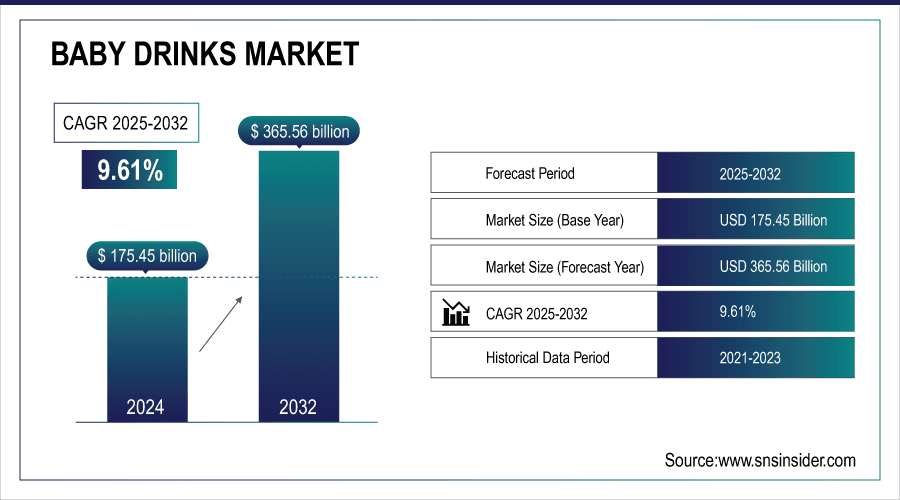

The Baby Drinks Market Size was valued at USD 175.45 billion in 2024 and is expected to reach USD 365.56 billion by 2032, growing at a CAGR of 9.61% over the forecast period of 2025-2032.

The growth of the Baby Drinks Market is facilitated by the rising focus of parents on infant nutrition, increasing demand for organic and fortified baby drinks, and the milestone trend of babies, as well as the demand for on-the-go formats. The growth of e-commerce channels, urbanization, and premiumization has also fueled market growth, while innovation in formulations can increase consumers’ confidence and preference.

In 2022, U.S. House Democrats introduced the “Infant Formula Supplemental Appropriations Act,” which authorized the FDA to spend USD 28 million. This helped to facilitate more inspections and staffing to combat the national formula shortage.

To Get More Information On Baby Drinks Market - Request Free Sample Report

Key Baby Drinks Market Trends

-

Shift toward organic & clean-label baby drinks

-

Growing demand for plant-based & lactose-free alternatives

-

Premiumization with fortified functional ingredients

-

Expansion of e-commerce & subscription models

-

Stricter government & regulatory compliance

-

Rising focus on eco-friendly packaging solutions

-

Strong growth in emerging markets (APAC, LATAM, Africa)

-

Technological innovations in formulation & formats

Baby Drinks Market Growth Drivers

-

Rising Health Consciousness Among Parents Drives the Market Growth

This driver is the result of increasingly health-aware parents who are aware of the nutritional content of baby drinks. Today, parents are seeking more than just taste; they want products that are organic, free from hazardous chemicals, rich in essential nutrients, and suitable for infants. This is very strong in countries where disposable incomes are on the rise and people are educated about child nutrition.

Else Nutrition's launch shows this movement in action. With its allergen-free, plant-based infant formulas, the company is targeting health-conscious parents from all walks of life who seek natural products. Their U.S. and Canada expansion is also good evidence of how companies are capitalising on the health fad by making these products more accessible.

Baby Drinks Market Restraints

-

Stringent Regulatory Standards May Hamper the Market Growth

Infant nutrition products are subject to stringent regulations by government and regulatory authorities, and they must be safe, provide the necessary nutrients for infant development, and be free from contamination worldwide. These are important laws to ensure consumer safety, but can hinder product development and raise costs, as manufacturers have to test, certify, and ensure compliance.

Europe’s tough safety schemes, enforced by the EFSA, serve as a reminder. Any new baby drink will have to be thoroughly tested before it can come to the market. This may slow down launches and generate increased compliance cost, creating a hindrance for OEMs that want to grow rapidly.

Baby Drinks Market Opportunities

-

Growing Demand for Bio-based and Eco-friendly Baby Drinks Creates an Opportunity for the Market

In developing countries, such as China, India, and certain parts of Southeast Asia, there is an increase in incomes, urbanization, and a rising awareness of child nutrition. This brings more dynamics to the baby drinks consumer base, especially in products that offer additional nutrition, convenience, and high-quality ingredients. Firms can capitalize on market growth on a large scale by entering these markets.

The story of Nestlé in China and India epitomizes this opportunity. They are making bets on infant-nutrition products specific to these markets – for example, formulas with HMO, a type of sugar found in breast milk that is not found in formulas from cow's milk. This upward spiral targets more and more newborns and health-conscious parents, an example of how companies can profit from the growth potential in the developing world.

Baby Drinks Market Segment Highlights:

-

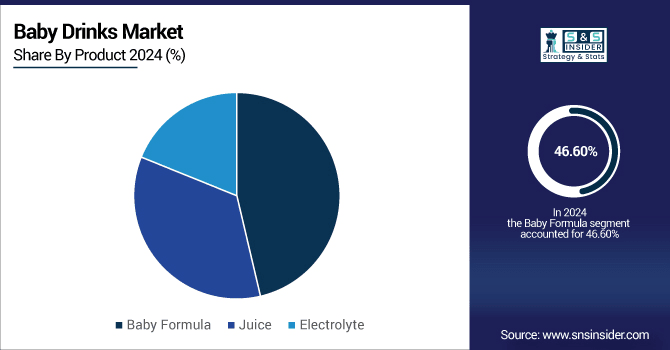

By Product: Dominating – Baby Formula 46.6%, Fastest-growing – Baby Juice 35%

-

By Distribution Channel: Dominating – Hypermarket & Supermarket 45%, Fastest-growing – Online 20%

Baby Drinks Market Segment Analysis:

By Product

Baby Formula market dominated the baby drinks market with a 46.6% share in 2024, closely followed by the growing prominence of it as the preferred alternative for breastfeeding, particularly amongst working women, with rising awareness across developed and developing markets. Parents are still choosing formula for its convenience, nutrients, and because it is supported by the pediatric community. On the other hand, the Baby Juice market is the fastest-growing segment, representing approximately 35% of the market, driven by the growing demand for natural juices fortified with vitamins and minerals. This trend is being driven by the convenience of ready-to-drink, and the increased demand for organic, clean-label juices from health-conscious consumers and parents.

By Distribution Channel

Hypermarkets & Supermarkets had a 45% share of the market in 2024, due to their large retail networks, product variety, and regular promotional discounts to encourage parents to buy in quantity. It’s also the visibility in store of premium brands that makes are more powerful. But Online Retail represents the fastest pace of growth and is approximately 20% of the sales mix, as parents continue to favor e-commerce for convenience, home delivery, and subscription offerings. And with a spike in digital uptake post-pandemic, thanks to exclusive online offers and access to niche brands, this growth has been expedited.

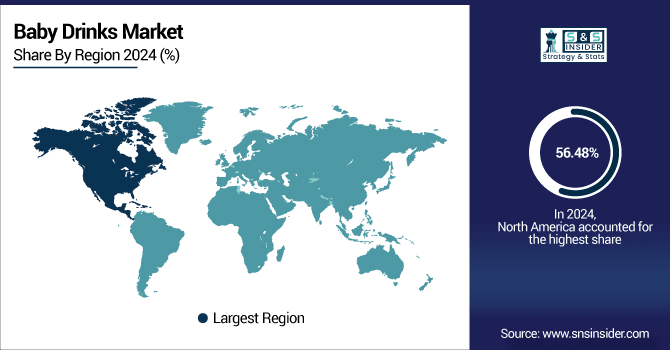

Baby Drinks Market Regional Analysis

North America Baby Drinks Market Insights

The Baby Drinks industry for North America had a largest baby drinks market share of 56.48% in 2024. It is a result of high disposable income levels, increased consciousness about infant nutrition, and the presence of a well-developed healthcare infrastructure. In the U.S. and Canada, parents frequently choose nutritionally fortified baby formulas that provide complete nutrition to babies. With globally trusted brands such as Enfamil, Similac, and Nestlé, consumer confidence is further secured. Furthermore, a lifestyle focuses on convenience and the rising number of working parents raises demand for on-the baby drinks market trends-go baby drinks. At the retail chains of hypermarkets, pharmacies) A broad selection of products is available.

Get Customized Report as Per Your Business Requirement - Enquiry Now

For Instance, in 2023, a few of the U.S. companies, such as The Organic Starter Co., have increased their offerings of organic and plant-based infant formulations to cater to increasing consumer need for natural products, which is consistent with the trend of health-conscious and allergen-free infant nutrition.

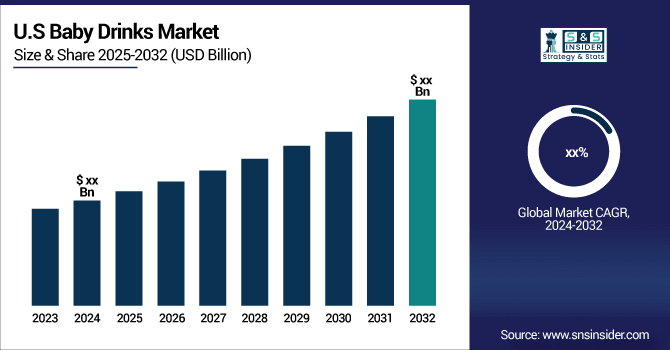

U.S. Baby Drinks Market Insights

The United States dominates North America owing Strong awareness of child health & nutrition, and well-maintained retail infrastructure in the U.S. keeps it in the forefront in the marketplace. Baby Formula reigns supreme due to ease, fortified, and trust of the brand. Parents are more likely to select products that include DHA, ARA, and probiotics to aid in the healthy development of their baby.

In 2024, the FDA released new fortification regulations for baby formulas that included more nutrients for cognitive and immune system development. This action has prompted manufacturers to introduce reformulated offers to comply with regulations and changing parental desires.

Asia Pacific Baby Drinks Market Insights

Asia Pacific is the fast-growing market for baby drinks, due to urbanisation, rise in disposable income, and an expanding middle class. The formula category has gone gangbusters in China and India, where mums work and want easier feeding options without dropping breastfeeding. Greater understanding of nutrition among parents in the area is driving growth in demand for fortified and specialist formulas. Further, local authorities and clinics conduct infant nutrition health education programs.

In 2023, multinational companies expanded production facilities in China to cater to high demand, to avoid the hassle of distance purchasing, and to comply with policies, which helps to faster delivery of baby nutrition and expand the market.

Europe Baby Drinks Market Analysis

Baby Formula leads the baby drinks market in Europe, with stringent regulations, high levels of parental awareness, and good entitlement to healthcare. Those countries with higher birth rates and maturing healthcare systems, such as France, the U.K., and the Netherlands, show relatively consistent demand. Quality, traceability, and organic certifications are central to consumer demands.

In 2023, the EU tightened its labeling and marketing rules for baby formula to make them more transparent and prevent misleading claims. Manufacturers are now required by law to offer specific nutrient data, which has encouraged consumer confidence and better food choices.

Germany Baby Drinks Market Insights

The German Market Germany is one of the largest baby drinks industries in Europe, with Baby Formula taking the majority of the shares. This market dominance is supported by high nutritional standards, a well-developed healthcare system, and the preference of parents for certified and fortified products. This is also consistent with a German consumer preference for premium and organic options, which would speak to safety and infant health.

The German government implemented low-income family subsidies for infant formula access in 2023 to create equal nutrition for all infants, with market growth supported as these subsidies make formula more affordable and accessible.

Latin America (LATAM) and Middle East & Africa (MEA) Baby Drinks Market Insights

The baby drinks sector in Latin America is growing at a healthy rate, led by the Baby Formula category. Urbanization, the rise of a middle class, and working mothers have all contributed to increased dependence on formula feeding. Initiatives to raise awareness about baby nutrition and bettering healthcare infrastructure also spur market acceptance. Recent Development: In 2023, Brazil and Mexico implemented public health campaigns to educate parents about breastfeeding and the efficiency of formula feeding. These initiatives work to restore culture-cantered breastfeeding while also incorporating the use of formulas, resulting in better infant feeding for all income groups.

Competitive Landscape for Baby Drinks Market:

Nestlé S.A.

Nestlé S.A. is one of the largest players in the baby nutrition industry, with a wide portfolio covering infant formula, follow-on formula, and ready-to-drink (RTD) juices. The company emphasizes innovation in premium and specialty nutrition products.

-

In March 2024, Nestlé expanded its Illuma formula production facility in Ireland to meet the growing global demand for premium infant nutrition, especially in Europe and Asia.

Danone S.A.

Danone S.A. is a leading global food and beverage company with a strong presence in baby nutrition, offering specialized infant formulas and juices under brands such as Aptamil and Nutricia. The company invests in affordability and accessibility.

-

In May 2024, Danone collaborated with the UK Competition and Markets Authority to introduce more affordable formula packs in the U.K. market, addressing consumer concerns over rising infant nutrition costs.

Abbott Laboratories

Abbott Laboratories has a well-established baby nutrition portfolio under its Similac brand, focusing on specialized nutrition solutions for infants with diverse dietary needs. The company continues to invest in innovation and R&D.

-

In April 2024, Abbott announced the expansion of its infant formula manufacturing capacity in the U.S. to ensure supply chain resilience after recent shortages, backed by a multimillion-dollar investment.

Reckitt Benckiser Group (Mead Johnson Nutrition)

Reckitt, through its Mead Johnson Nutrition brand, is a key player in the global baby drinks market, known for its Enfamil range of infant formulas. The company is expanding into organic and allergen-free nutrition.

-

In June 2024, Reckitt launched a new organic Enfamil formula in North America to meet growing demand for natural, non-GMO baby nutrition.

Baby Drinks Market Key Players

Some of the Baby Drinks Companies

-

Nestlé S.A.

-

Danone S.A.

-

Abbott Laboratories

-

Mead Johnson Nutrition Company (Reckitt)

-

The Kraft Heinz Company

-

FrieslandCampina

-

HiPP GmbH & Co.

-

Arla Foods

-

Bellamy’s Organic

-

Hain Celestial Group

-

Perrigo Company plc

-

Ausnutria Dairy Corporation Ltd.

-

Meiji Holdings Co., Ltd.

-

Yili Group

-

Mengniu Dairy

-

Hero Group

-

Holle Baby Food GmbH

-

Beingmate Baby & Child Food Co., Ltd.

-

Synutra International, Inc.

-

Ella’s Kitchen

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 175.45 Billion |

| Market Size by 2032 | USD 365.56 Billion |

| CAGR | CAGR of9.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Baby Formula, Juice (RTD, Concentrate), and Electrolyte) • By Distribution Channel (Hypermarket & Supermarket, Pharmacies, and Online) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company (Reckitt), The Kraft Heinz Company, FrieslandCampina, HiPP GmbH & Co., Arla Foods, Bellamy’s Organic, Hain Celestial Group, Perrigo Company plc, Ausnutria Dairy Corporation Ltd., Meiji Holdings Co., Ltd., Yili Group, Mengniu Dairy, Hero Group, Holle Baby Food GmbH, Beingmate Baby & Child Food Co., Ltd., Synutra International, Inc., Ella’s Kitchenical Corporation |