Baby Food and Infant Formula Market Report Scope & Overview:

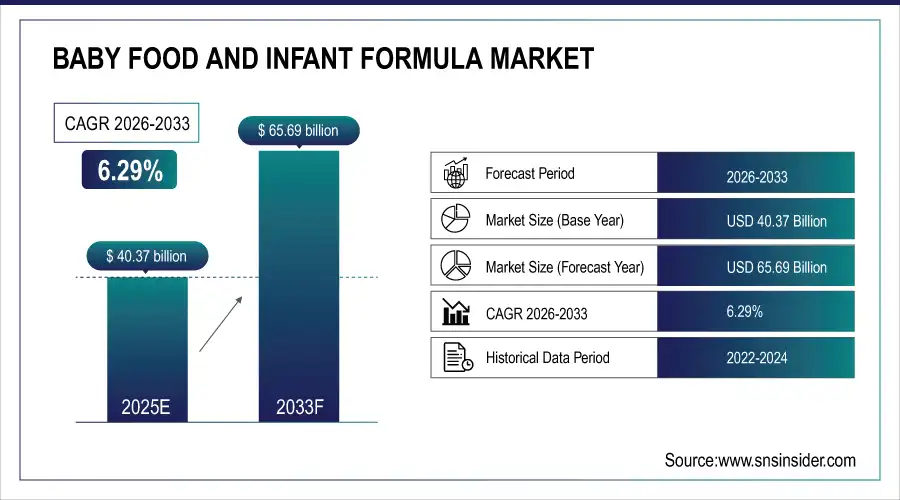

The Baby Food and Infant Formula Market size is valued at USD 40.37 Billion in 2025E and is projected to reach USD 65.69 Billion by 2033, growing at a CAGR of 6.29% during 2026-2033.

The Baby Food and Infant Formula Market analysis highlights the surge in the demand for easily accessible, wholesome, and safe infant nutrition products. Rising urbanization, the proportional increment of female participation in the workforce, and awareness about infant well-being rapidly expand the market.

Online sales of infant formula and baby food rose by 38% in 2024, with subscription models and same-day delivery boosting access for busy urban families

Market Size and Forecast:

-

Market Size in 2025E: USD 40.37 Billion

-

Market Size by 2033: USD 65.69 Billion

-

CAGR: 6.29% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Baby Food and Infant Formula Market - Request Free Sample Report

Baby Food and Infant Formula Market Trends

-

Increasing consumer preference for organic, additive-free, and natural baby food options ensures safer infant nutrition.

-

Demand for dairy-free and plant-based alternatives grows as parents seek allergen-free and sustainable nutrition sources.

-

Parents are choosing premium products fortified with DHA, probiotics, and essential nutrients for enhanced infant development.

-

Online platforms simplify access to specialized baby formulas, boosting sales through convenience and brand variety.

-

Growing environmental awareness drives manufacturers to adopt recyclable, biodegradable, and minimal-plastic packaging solutions.

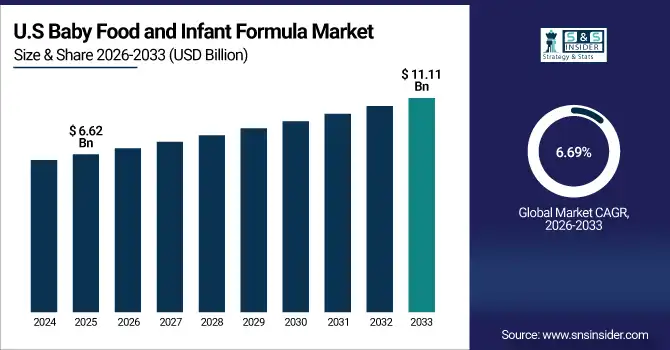

The U.S. Baby Food and Infant Formula Market size is valued at USD 6.62 Billion in 2025E and is projected to reach USD 11.11 Billion by 2033, growing at a CAGR of 6.69% during 2026-2033. Baby Food and Infant Formula Market growth is driven by escalating infant nutrition consciousness and high-grade produce necessity. More mothers working and living more hectic lifestyles also contribute to growth in pre-made, easy pourable feed alternatives.

Baby Food and Infant Formula Market Growth Drivers:

-

Rising Awareness of Infant Nutrition and Demand for Convenient Feeding Solutions

The sector’s development is propelled by parents being more conscious about their infants’ health and proper nutrition. Increased urbanization and the increasing number of working women are leading to a rise in the demand for formulated nutrition and ready-to-consume products. Organic, non-GMO, and probiotic-enriched formulations are being developed by the majority of manufacturers who have understood the importance of safety and health in modern-day parenting.

In 2025, 78% of parents globally actively sought infant formulas fortified with DHA, iron, and vitamins, citing brain development and immunity as top priorities

Baby Food and Infant Formula Market Restraints:

-

Stringent Regulations and Safety Concerns Regarding Infant Formula Ingredients

Another factor to blame is the consumers’ concern and skepticism. Governments impose rigorous regulatory requirements, which result in delayed product acceptance for novel nourishment offerings. Few other examples include recalls for contaminated and impure inputs, which produce widespread negative press. Finally, the growing protest against artificial formulas and the resulting societal backlash contribute to decreasing client acceptance in several locales, particularly the developing planet.

Baby Food and Infant Formula Market Opportunities:

-

Growing Demand for Organic, Plant-Based, and Specialized Infant Nutrition Products

The promise for organic, plant-based, and distinctive nutrition, which provides a major growth opportunity for producers. The rising trend for organic and plant-based consumption and the intolerance to lactose and allergies among infants have created a history of specialty formula and hypoallergenic demand. Brands that focus on the entire infant nutrition value network, ranging from sourcing to formulation to personalization, will capture the sophisticated customer segments and charge higher fees globally.

38% of global baby food launches featured organic or plant-based claims, with oat, almond, and pea protein bases growing rapidly in response to dairy concerns

Baby Food and Infant Formula Market Segment Analysis

-

By Ingredients, carbohydrates led the Baby Food and Infant Formula Market with a 36.50% share in 2025, while proteins emerged as the fastest-growing segment, registering a CAGR of 7.80%.

-

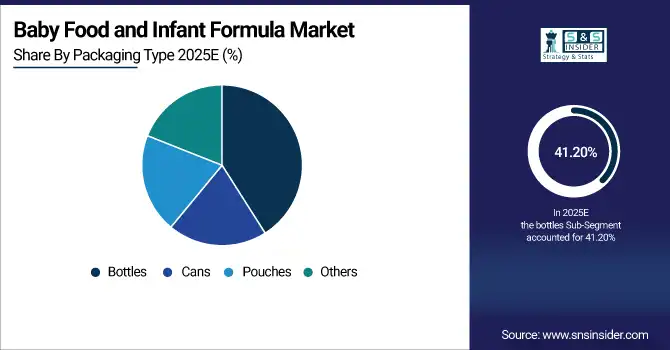

By Packaging Type, bottles dominated the market with a 41.20% share in 2025, whereas pouches are projected to be the fastest-growing segment, expanding at a CAGR of 8.60%.

-

By Type, infant milk accounted for the largest market share of 44.70% in 2025, while specialty baby milk is anticipated to grow fastest, recording a CAGR of 8.70%.

-

By Distribution Channel, supermarkets held the highest share at 46.90% in 2025, while online stores are expected to register the fastest growth with a CAGR of 10.50%.

By Ingredients, Carbohydrate Leads Market While Protein Registers Fastest Growth

Carbohydrates are leading in the baby food and infant formula market since they are the basic source of energy that is vital for an infant’s growth. Apart from promoting digestibility and providing balanced nutrition, carbohydrates are incorporated in nearly all formulations. While, protein-based products are growing fastest, and they are supported by increasing awareness of muscle and tissue development benefits. Further, specialized protein-enhanced and lactose-free formulas are seeking to meet the growing demand, particularly among health-conscious parents and infants with dietary intolerances, to reinforce the nutritional products segment’s growth worldwide.

By Packaging Type, Bottles Dominate While Pouches Shows Rapid Growth

Bottles are dominating the packaging type in the baby food and infant formula due to they are convenient, safe to use and handle, and ensure proper hygiene. They are a perfect container for liquid and powdered nutritional roll outs due to the extended shelf life that requires safe consumption. Meanwhile, pouches are the most rapidly growing segment due to increased awareness of promoting on-the-go, mess-free, and easy to use packaging solutions. Its single-serve and lightweight design and structure are more attractive to portable goods consumers, causing changes and trends in the global baby food and toddler packaging market.

By Type, Infant Milk Lead While Specialty Baby Milk Registers Fastest Growth

Infant milk continues to lead the market with wide acceptance as the best alternative to breast milk because it is suitable for newborn nutritional needs comprising balanced nutrients, vitamins, and minerals. While, specialty baby milk is growing fastest due to infants have developed lactose intolerance, allergies, and specific health conditions. Therefore, the manufacturers are creating formulations incorporating probiotics, DHA, and hypoallergenic proteins to meet these specific needs, leading to diversification and premiumization of the global baby formula segment.

By Distribution channel, Super Markets Lead While Online Stores Grow Fastest

In 2025, the supermarkets dominate the baby food and infant formula markets due to the wide availability of products in one place, brand visibility, and trust by parents that physical shopping guarantees quality and promotional benefits. However, online stores record the highest growth due to digitalization or e-commerce trends that are transforming peoples’ lifestyles and purchasing behaviours towards convenience. Moreover, the digital platform offers various brands, lists shopping options, subscriptions, and door-step delivery attracting mainly the tech-savvy parents. Additionally, online reviews, price comparison, and discounts offer evident opportunities for manufacturers anywhere in the world.

Baby Food and Infant Formula Market Regional Analysis:

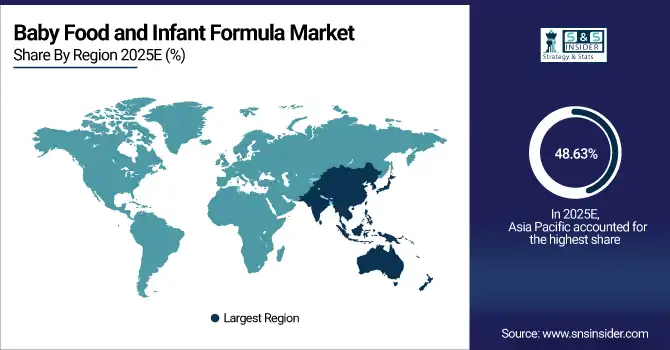

Asia-pacific Baby Food and Infant Formula Market Insights

In 2025 Asia-Pacific dominated the Baby Food and Infant Formula Market and accounted for 48.63% of revenue share, this leadership is due to the higher infant count, rising disposable income and urbanization drive product demand, and increased knowledge about infant nutrition. India, Japan, and Australia are some of the major consumers. The demand for premium products and organics is on the rise. E-commerce and retail expansions provide more convenient access across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Baby Food and Infant Formula Market Insights

China dominates the APAC market; a huge infant base and changing eating habits contribute to its market share. Rising urbanization leads women’s employment or confidence in formula-based nutrition to consistently open demand trends. The two-child policy of the federal government increased market volume.

North America Baby Food and Infant Formula Market Insights

North America is expected to witness the fastest growth in the Baby Food and Infant Formula Market over 2026-2033, with a projected CAGR of 7.02% due to skewed towards higher spending, better awareness of infant health, and parent are inclined towards organic, clean-label, and allergen-free foods. Strong regulatory supervision enables better product knowledge and certainty. Functional formulations like DHA and probiotics are a current trend. e-commerce adoption is increasing, providing transcendent access to the product and strong brand participation.

U.S. Baby Food and Infant Formula Market Insights

The U.S. is growing the fastest on account of additional factors, rising working mothers, urbanization, and nutritious nutrition. Organic and non-GMO infant formulae are rapidly gaining market share. The FDA has established such stringent standards for baby food and supplements, having built up trust in the eyes of consumers.

Europe Baby Food and Infant Formula Market Insights

In 2025, Europe emerged as a promising region in the Baby Food and Infant Formula Market, due to stringent safety standards and a mature consumer base. Parents favor organic, traceable, and sustainably sourced products. Demand for lactose-free and hypoallergenic formulas promotes niche market growth. In Western Europe, premium baby nutrition rules the sales chart.

Germany Baby Food and Infant Formula Market Insights

Germany is one of the leading European markets, with considerable demand for organic and bio-certified baby food. Brands with transparent sourcing and natural ingredients ownership are preferred among health-conscious parents. The government initiatives to raise awareness of infant nutrition also support the consumption boost.

Latin America (LATAM) and Middle East & Africa (MEA) Baby Food and Infant Formula Market Insights

The Baby Food and Infant Formula Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the improving birth rates and urbanization. The growing populations’ increased awareness of infant nutrition and middle-class income drives consumption up. Brazil, Mexico, South Africa, and the UAE lead in this regard. Import dependence on global brands due to limited local production supports growth. Increased retail penetration and e-commerce ubiquity enhance the market’s accessibility across the regions.

Baby Food and Infant Formula Market Competitive Landscape:

Abbott is one of the key global players in the baby food and infant formula market with the highly regarded Similac variety. Based on science-based nutrition, the business offers essential vitamin-enriched nutrition with DHA and probiotics for the parents’ safe infant expansion. At the same time, Abbott is strengthening the scientific basis of its innovation, based on clinical research and product safety across the industrial countries and developing markets.

-

In August 2024, Abbott expanded its “Pure Bliss by Similac” line to include new organic offerings, such as Irish-milk-sourced formula and USDA-certified ready-to-feed liquid, catering to consumer demand for premium infant nutrition.

Nestlé S.A. is one of the dominant players on the baby food and infant formula scene, Nestlé S.A. produces the Gerber, Nan, and Lactogen brands. Featuring universally high-quality formulations, the company’s products are all backed by science and suitable for infants’ diverse development stages. Nestlé invests in organic, plant-based, and hypoallergenic products as consumer preferences shift. They also have strong global distribution and presence, leading market shares in developed and developing countries.

-

In January 2025, Nestlé launched its “NAN Sinergity” ultra-premium infant formula combining six human milk oligosaccharides (HMOs) and probiotic Bifidobacterium infantis, targeting immunity and microbiome development in infants.

Danone S.A. is another major innovator in the baby food and infant formula segment, with popular products like Aptamil and Nutricia. The company’s focus on early-life nutrition and product safety ensures high nutritional value. It also invests in organic and plant-based nutrition to reflect the rising health concerns of consumers. Commitment to sustainable packaging and carbon neutrality efforts also burnish its reputation.

-

In May 2025, Danone acquired a majority stake in California-based Kate Farms, bolstering its plant-based and organic infant-formula portfolio to address rising demand for specialized, sustainable nutrition.

Mead Johnson & Company is one of the leaders in the production of infant formulas and is owned by Reckitt. The Enfamil brand is recognized globally for scientifically formulated nutrition to promote brain and immune system development in infants. The company invests considerably in specialized formulas, including hypoallergenic and preterm nutrition. Their reach is expanding through the use of e-commerce and cooperation agreements with healthcare providers.

-

In November 2024, in Hong Kong, Mead Johnson partnered with online retailer HKTVmall and World Green Organisation to launch “We CAN Protect the Future” formula-can recycling program across 36 collection stations until Feb 2025.

Baby Food and Infant Formula Market Key Players:

Some of the Baby Food and Infant Formula Market Companies are:

-

Abbott

-

Nestlé S.A.

-

Danone S.A.

-

Mead Johnson & Company, LLC

-

The Kraft Heinz Company

-

HiPP GmbH & Co. Vertrieb KG

-

ASAHI GROUP HOLDINGS Ltd.

-

Hero Group

-

Yashili International Holdings Ltd.

-

Kendamil

-

Ausnutria

-

ByHeart

-

Bobbie

-

Hain Celestial Group

-

Lactalis

-

Nutricia

-

Hipp Holding AG

-

Plasmon

-

Kabrita

-

Gerber

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 40.37 Billion |

| Market Size by 2033 | USD 65.69 Billion |

| CAGR | CAGR of 6.29% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Ingredients (Carbohydrate, Fat, Protein, Minerals, Vitamins, and Others) • By Packaging Type (Bottles, Cans, Pouches, and Others) • By Type (Infant Milk, Follow-on Milk, Specialty Baby Milk, and Growing-up Milk) • By Distribution Channel (Supermarkets, Hypermarkets, Small Grocery Retailers, Hard Discount Stores, Convenience Stores, Online Stores, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Abbott, Nestlé S.A., Danone S.A., Mead Johnson & Company, LLC, The Kraft Heinz Company, HiPP GmbH & Co. Vertrieb KG, ASAHI GROUP HOLDINGS Ltd., Hero Group, Yashili International Holdings Ltd., Kendamil, Ausnutria, ByHeart, Bobbie, Hain Celestial Group, Lactalis, Nutricia, Hipp Holding AG, Plasmon, Kabrita, Gerber. |